So, what’s happening this week?

Binance whales are working to push prices up, Arbitrum continues to trend higher across multiple metrics, and NFT volumes are on the rise.

TLDR

- The Shanghai Upgrade is likely to be pushed back by a month to April.

- $ETH’s price continues to trade sideways, but multiple factors indicate higher prices are on the way.

- Layer 1 TVL (total value locked) is down while Layer 2 TVL continues to rise.

- Arbitrum is winning the L2 race and remains miles ahead.

- Ethereum NFT volumes shot up and stayed there after the $BLUR airdrop.

- Share this report with your family and friends.

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your responsibility and yours only.

The Ethereum hard fork is on the way!

You’ve probably been hearing “Shanghai Upgrade” being discussed in your crypto circle but remain confused about what it is, its timelines, and its market effects. Let us bring you up to speed!

- First, and most importantly, what is it? Think of it as the last step in Ethereum’s transition from proof-of-work to proof-of-stake. Even though Ethereum now uses PoS, the model is not complete because users cannot withdraw staked $ETH or any staking rewards. The Shanghai Upgrade makes both of these possible.

- And what’s the timeline?

- Goerli Testnet Implementation: March 14, 2023.

- Ethereum Mainnet Implementation: 3-4 weeks afterwards.

- Market effects:

- 14.5% of the $ETH supply is staked, and many fear that enabling withdrawals will cause widespread selling of this staked supply. However, that is unrealistic. In fact, $ETH stakers are (on average) currently at a -26% loss in USD terms when comparing the price of $ETH at the time of staking with today’s levels.

- The unlocks will happen gradually, with only 1,800 stakers able to withdraw per day (out of over 90,000).

- We believe there are two key factors to consider:

- First, the upgrade will make ETH staking a fully functional activity, and the percentage of ETH staked will increase closer to 35%, roughly the level at where other PoS blockchain stakes sit.

- Second, there has been ~1M in accumulated ETH staking rewards, and these are at risk of being market sold.

How much can you make by staking $ETH?

The more $ETH gets staked, the smaller the reward becomes for each staker. You can visualize this with the blue line above. What we can note is that the rate seems to be stabilizing at around 4% per annum.

Let’s assume you start with 10 $ETH. What will your reward be over 1, 2, 3, 5, or 10 years? Let’s do the math:

- 1 Year: 10 ETH → 10.4 $ETH (0.4 $ETH profit)

- 2 Years: 10 ETH → 10.816 $ETH (0.816 $ETH profit)

- 3 Years: 10 ETH → 11.248 $ETH (1.248 $ETH profit)

- 5 Years: 10 ETH → 12.167 $ETH (2.167 $ETH profit)

- 10 Years: 10 ETH → 14.802 $ETH (4.802 $ETH profit)

Is this lucrative? The answer lies in you and where you believe $ETH trades ten years down the line.

Analyzing $ETH’s price action

Price chart

$ETH’s price has been incredibly confusing over the past six weeks. Nonetheless, we like keeping it simple. As long as the market structure remains bullish, meaning price is setting higher highs and higher lows, then we will maintain our target at $2,200. Make sure you join our free Discord portal for daily $ETH analysis and updates (join here).

Smart money

We always dive deep for information, and in our latest plunge into the murk, we found out something quite interesting about the smart money flows🧐.

The above chart represents the $ETH order book on Binance, filtered to show orders only of >4,000 $ETH in size ($6M+).

- Why do we care? Because this chart tells us what whales are doing to $ETH’s price.

- How should we interpret this chart?

- Horizontal line above price: These are sell orders placed by whales, and as you can see, their recent sell orders kept the price from moving up.

- Horizontal line under price: These are buy orders placed by whales. On the previous dump down, you can clearly see how they blocked the price from moving any lower.

After today’s dump in price, the whales moved up their buy orders from $1,410 to $1,481.25. Unless they pull those orders, the price is likely to bottom above that level.

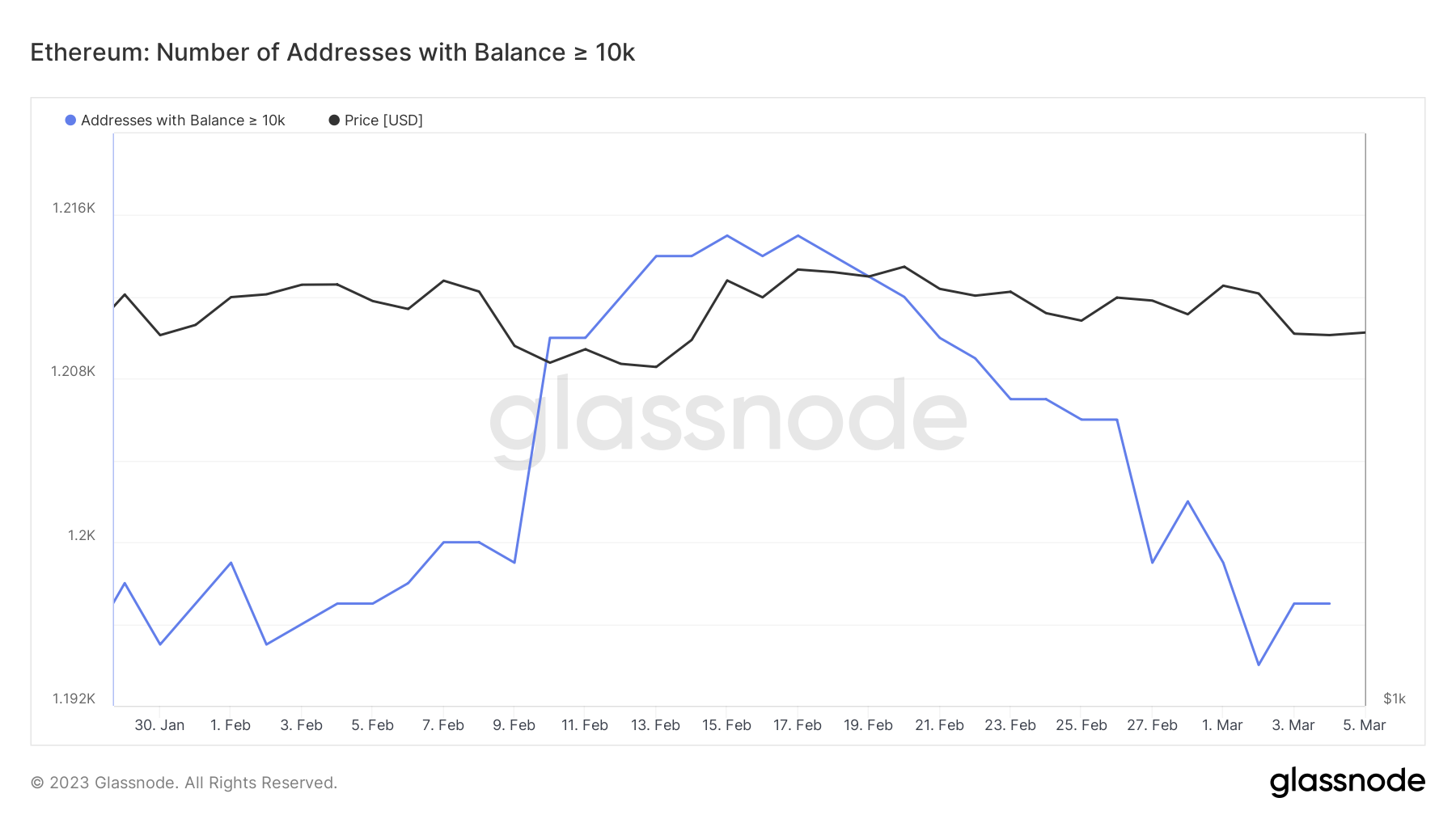

We also dove into $ETH whale wallets to see who’s selling/buying.

16 out of the 1,200 “10,000+ $ETH Whales” have sold some of their stakes. This number is very small and negligible as of today, but it is important to keep an eye on it.

Ethereum’s ecosystem

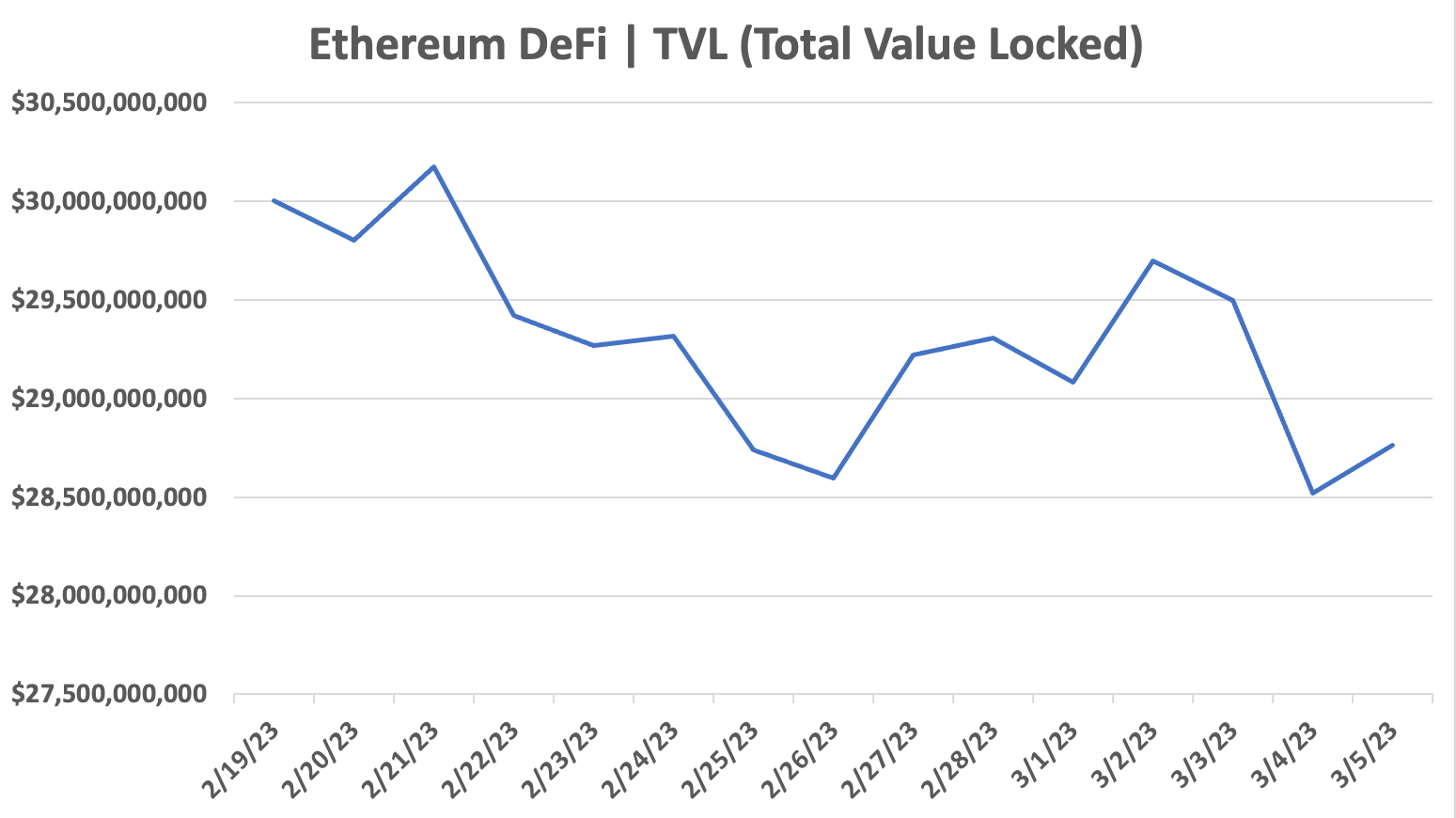

DeFi (Decentralized Finance)

[caption id="attachment_263389" align="aligncenter" width="1549"] Source: DeFiLlama[/caption]

Source: DeFiLlama[/caption]

Ethereum’s DeFi TVL is down by $1.24B (-4.1%) since the last digest. With that said, two DeFi protocols were notable outliers as they continued to trend higher:

- Lido Finance: Lido’s TVL grew by $320M (+3.6%) despite the overall loss in DeFi TVL. Lido’s a liquid staking platform that makes $ETH staking very simple for the average user.

- Solidly V2: Solidly’s TVL grew by $88M (+151.2%). This is a type of DEX (decentralized exchange) that allows protocols to bribe others to increase their token’s liquidity. Solidly has had a great many forks that managed to attract $100M TVLs very quickly. Some examples are Velodrome on Optimism, Thena on BNB Chain, and SolidLizard on Arbitrum.

We feel a responsibility to tell you that if you do decide to ape into Solidly or one of its forks, be careful as they are a game of musical chairs, and you must sell before the music stops or you’ll get rugged.

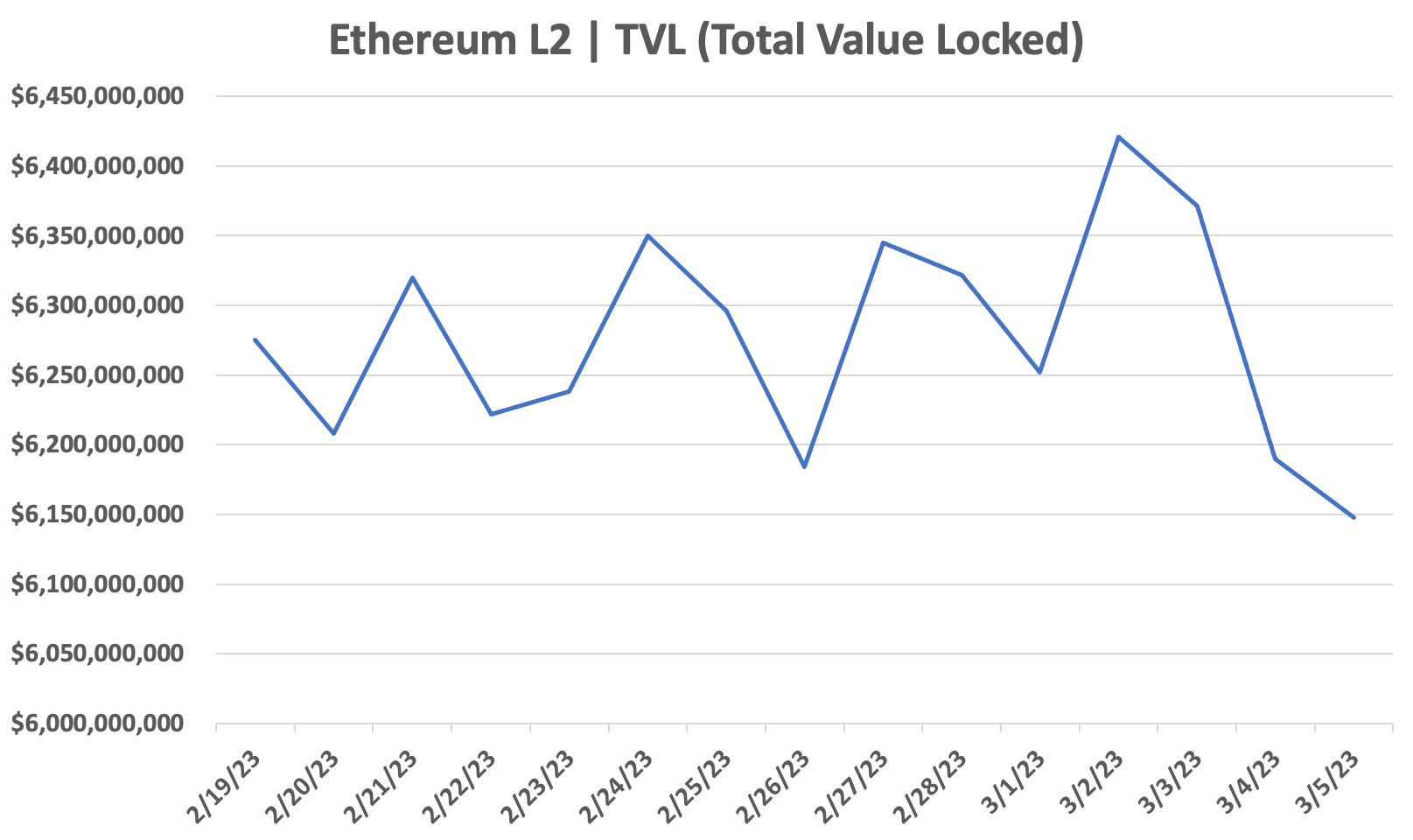

Layer-2s

[caption id="attachment_263391" align="aligncenter" width="1615"] Source: L2Beat[/caption]

Source: L2Beat[/caption]

Layer-2s also saw a decrease in TVL of $125,000,000 (-1.9%) from the time of our last digest. That’s decent because the decrease was half as bad as the Ethereum L1, but let’s dig deeper by looking at the specific changes with the two largest L2s.

Optimism[caption id="attachment_263386" align="aligncenter" width="2204"] Optimism Daily Active Users (DAUs) | Source: TokenTerminal[/caption]

Optimism Daily Active Users (DAUs) | Source: TokenTerminal[/caption]

Optimism had the news of the year to help boost it. This came with Coinbase announcing their own L2 powered by Optimism. This led to a huge increase in active users on Feb. 24 (when the news broke) only to be followed by a -69% drop back to its 30k DAU baseline.

What’s more, Optimism’s TVL actually decreased by $138,000,000 (-6.9%); much higher than the overall L2 TVL fall.

These stats speak negatively about Optimism’s fundamentals these days.

Arbitrum[caption id="attachment_263387" align="aligncenter" width="2205"] Arbitrum Daily Active Users (DAUs) | Source: TokenTerminal[/caption]

Arbitrum Daily Active Users (DAUs) | Source: TokenTerminal[/caption]

On the other hand, Arbitrum’s TVL actually shot up by $104,000,000 (+3.2%). Its DAUs have fallen but by an "okay" amount towards 85k (-28%) to where it was when the previous digest dropped.

These are very decent numbers, and they speak well about Arbitrum’s fundamentals. We remain strong on our bias that “Arbitrum is the mid-term L2 winner” (by mid-term, we mean for at least two years).

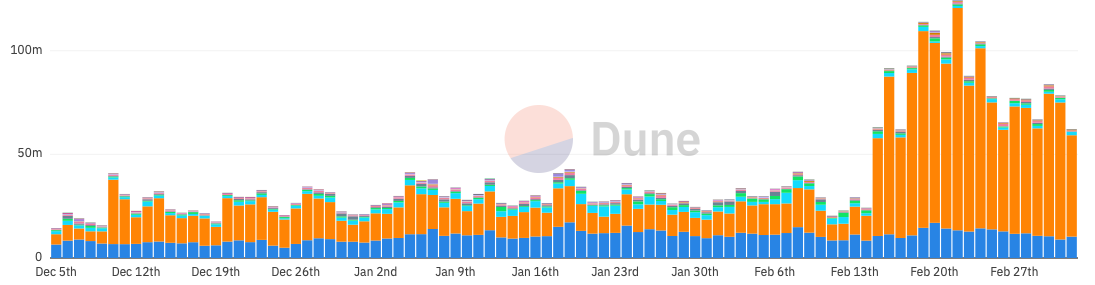

Ethereum NFTs

The Ethereum NFT market has seen a significant surge in volumes. The majority of this, though, is being traded on Blur following the $BLUR airdrop. We speculate that this spike in volume is not sustainable given that it is attached to a specific catalyst rather than overall organic demand.

The interesting NFT movements, at the moment, seem to be “very surprisingly” happening on Bitcoin (read more here).

Cryptonary’s Take | Conclusion

This digest isn't all positive. There are some potential negative factors to consider, such as an upcoming (potential) sale of 1M+ ETH on the market in April, artificially inflated NFT volumes, and a rise of DeFi projects based solely on hype rather than strong fundamentals.

Nonetheless, the negative points are outweighed by positives as whales continue to protect ETH’s price from further downside, the market structure remaining bullish, and Layer 2s (specifically Arbitrum) continuing to hit record levels of adoption.

The fight between bulls and bears is clear. This is what’s causing this boring stagnation in prices. For the time being, though, we continue to bet that the bulls will ultimately be able to prevail andtake ETH’s price to $2,200. We’re going to be monitoring this closely, so stay tuned for the next digest!

And, as always, thank you for reading 🙏

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms