L2 Digest: Follow the incentives | April 5

Welcome to Cryptonary’s L2 Digest, your one-stop shop for everything related to the Layer 2 ecosystem.

So, what’s happening this week?

First, on our list, we're thrilled to report that zkSync Era has surpassed $100M in total value locked (TVL). We'll dive deeper into the reasons behind its success and what this means for the future of zkSync.

Next, we'll discuss the recent governance drama surrounding Arbitrum, which made headlines over the weekend. We'll explore what happened and why it might not be as big of a concern as many feared.

Finally, we'll look at the potential comeback of Metis, a layer 2 solution that’s been off the radar for some time.

Let’s dive in…

TLDR

- Arbitrum reversed a key governance proposal, following concerns raised over the weekend about its decentralisation.

- Despite experiencing an outage, zkSync Era saw a significant increase in TVL.

- As the $ARB airdrop is received by Arbitrum protocols, We believe that Arbitrum will witness an increase in TVL and usage as a result of $ARB incentives.

- Metis will soon see the launch of Aave V3, which may allow the network to attract more liquidity.

- ConsenSys opened the testnet for its zero-knowledge rollup to developers and users.

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your responsibility and yours only.

Layer 2 overview

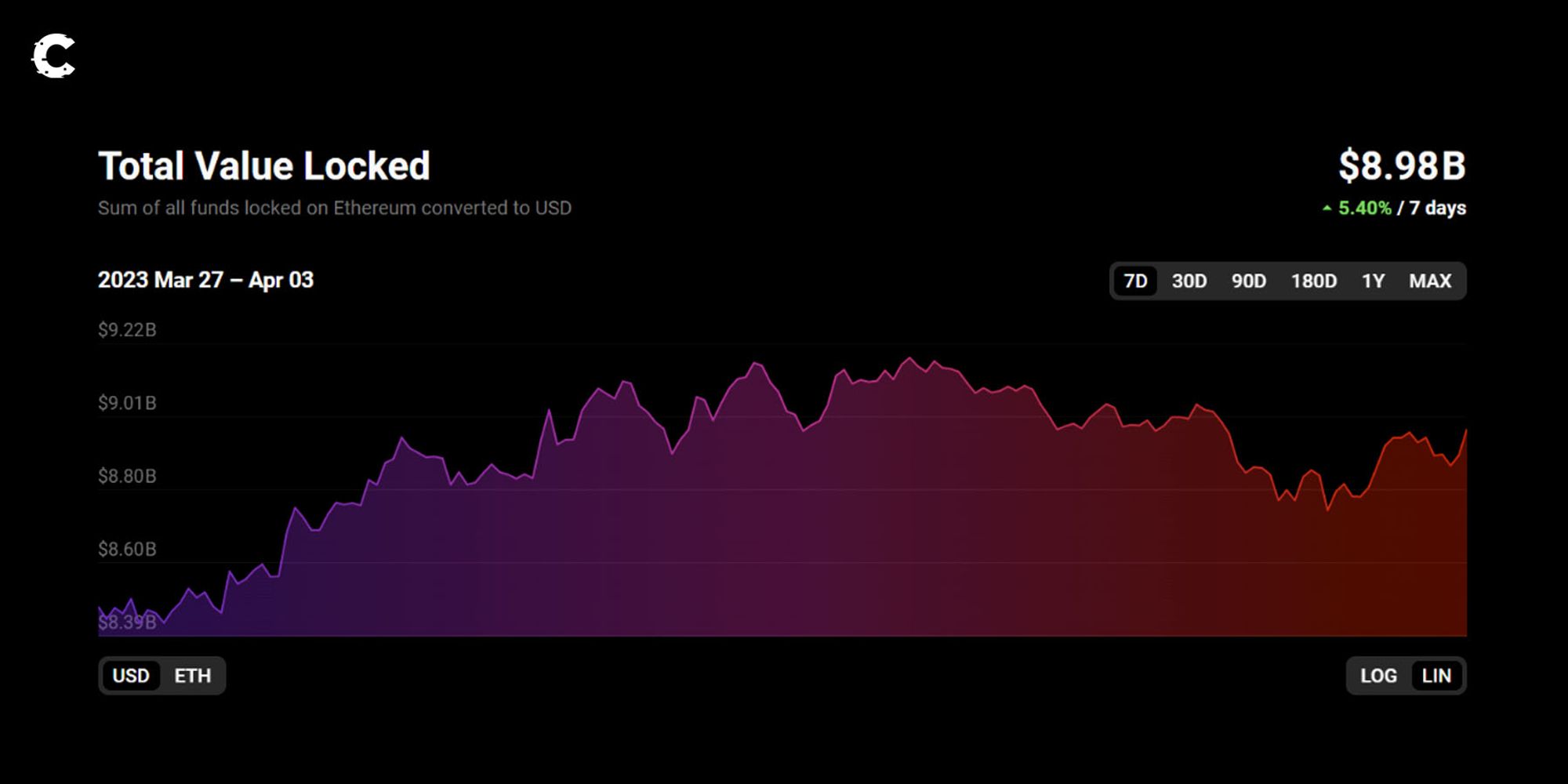

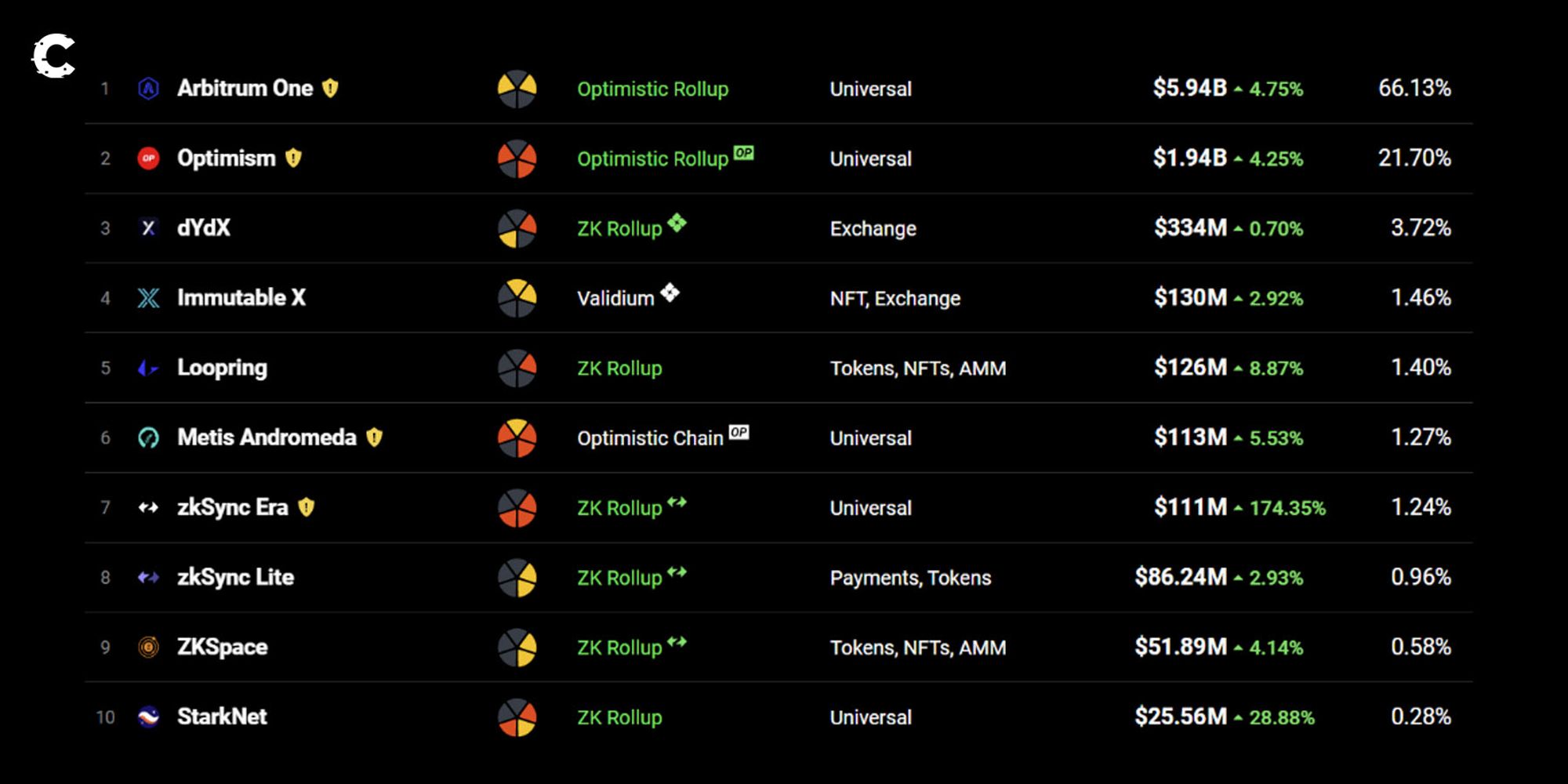

Layer 2 TVL is up 5.40% this week to $8.9B. This demonstrates that the ecosystem's growth pattern is still intact. As TVL rises sluggishly in other segments, layer 2s have continued to grow robustly this year.

Nevertheless, the level of growth varies, depending on each layer 2 network. zkSync Era is clearly stealing the show with a 174% gain reaching $100M in TVL just two weeks after its launch. But overall, each network has experienced some TVL growth this week.

Key developments

- Arbitrum Foundation makes U-turn on proposal following a communication slip-up: Arbitrum reversed a key governance proposal following concerns raised over the weekend about its decentralisation. The proposal, which would have given the Arbitrum Foundation nearly $1B in $ARB tokens, will now be broken up and voted on again.

- zkSync Era resumes block production after a brief outage: Just over a week after its launch, zkSync Era faced a block failure that was resolved five minutes later. In response, the team introduced alerts and other solutions while acknowledging that decentralising the platform is the ultimate answer.

- Polygon released its zkEVM beta to the public: Polygon's zkEVM Mainnet Beta successfully launched on March 27, almost six months after its public testnet. For now, the launch has gone as expected. The launch was followed by Aave announcing plans to launch on Polygon's zkEVM.

zkSync Era sees a surge in TVL

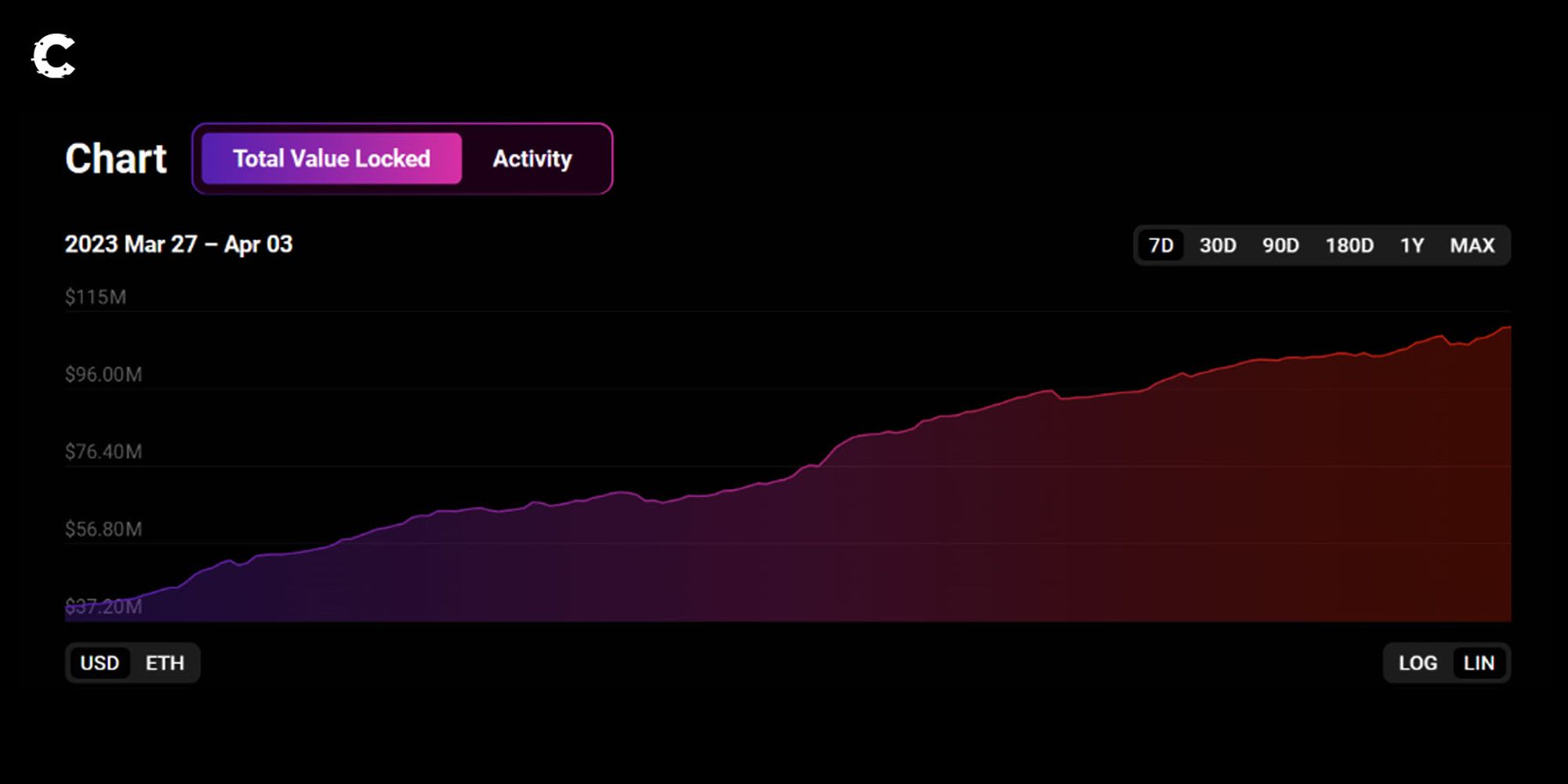

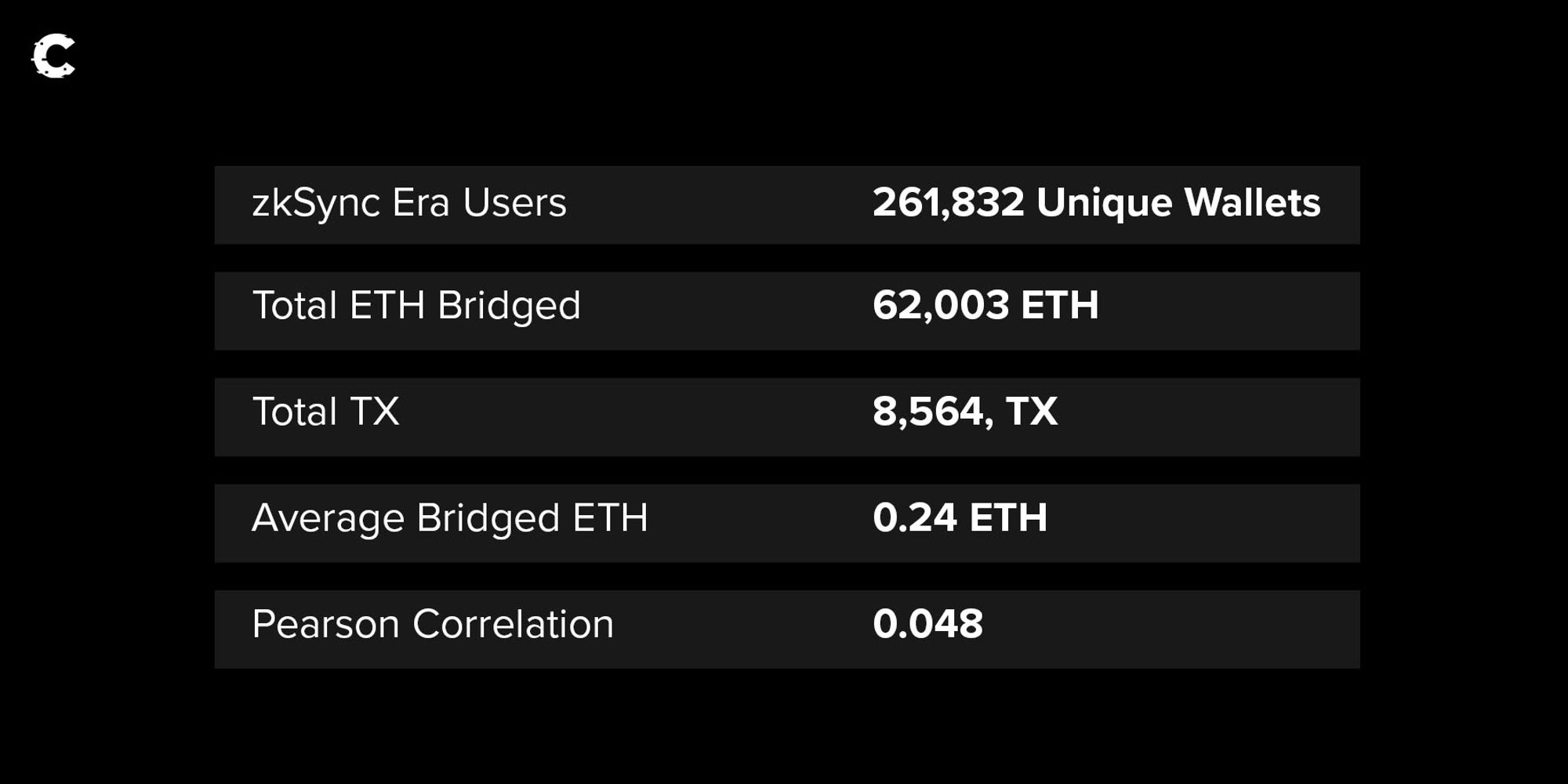

It's time to take a closer look at the zkSync Era and its meteoric rise. Despite a minor hiccup with a four-hour outage over this past weekend, zkSync Era dominated the scene this week. Its TVL surpassed an impressive $100M just two weeks after launch.

According to the data, over 250K distinct wallets have bridged to the ecosystem, with an average of 0.24 ETH ($428) bridged per unique wallet.

The TVL growth on zkSync is likely driven by airdrop farming, with many users bridging to the ecosystem in anticipation of a potential reward for early adoption. As the network moves towards decentralization, We believe that it will eventually follow the examples of Arbitrum and Optimism by offering an airdrop to early adopters.

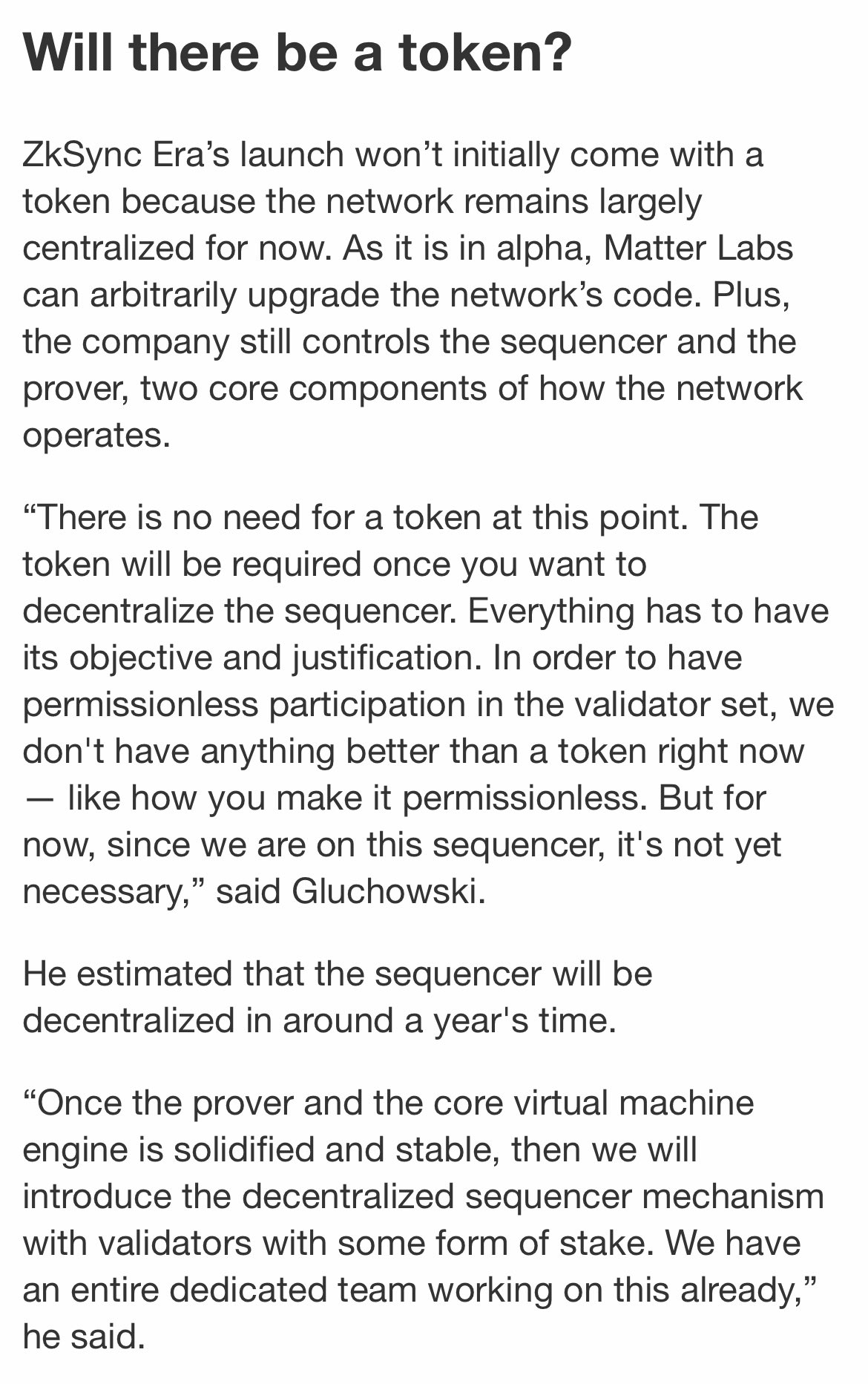

In an interview, Alex Gluchowski, Co-Founder of Matter Labs, the company behind ZkSync, offered his ideas on the potential of a token, which you can see here.

ZKSync’s new layer 2 ecosystem presents a fresh opportunity for investors, much like Arbitrum and Optimism did in 2021 and 2022.

To begin your journey into zkSync Era, here’s a list of DeFi protocols to explore:

- Syncswap: The leading decentralised exchange (DEX) on zkSync Era with $23.69M in TVL.

- Nexon Finance: The leading lending protocol on zkSync Era, with a current TVL of $600K. It allows users to borrow $USDC using $ETH as collateral.

- UniDex Exchange: The largest perpetual exchange on zkSync right now, allowing users to trade with leverage. However, the user experience is not yet as good as similar protocols on Arbitrum like Gains Network or GMX.

Why Arbitrum’s governance drama won't matter: Follow the incentives

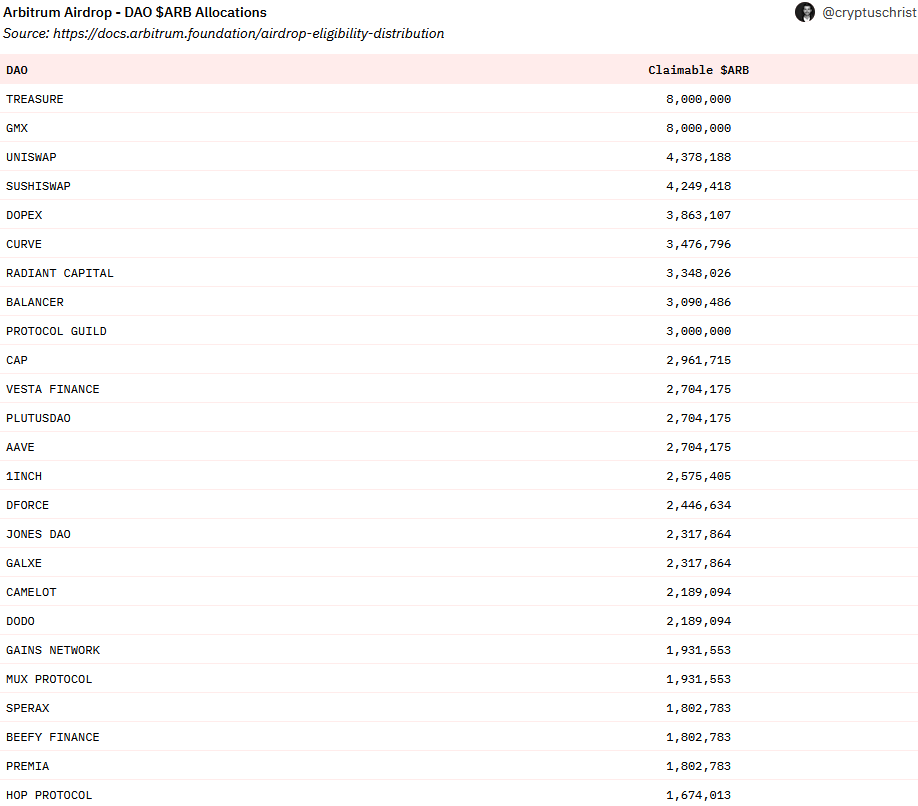

Arbitrum's governance came under scrutiny last weekend when The Arbitrum Foundation proposed to allocate 750M $ARB tokens in its first governance proposal named AIP-1. The proposal has since been broken up and will be voted on again.The governance drama may have caused some concern, but it is unlikely to have any long-term consequences. In the current state of the market, token incentives (rewards granted for performing a specific behaviour that helps the network) ultimately drive adoption. And, Arbitrum will be airdropping 112.834M $ARB to a long list of DAOs (Decentralised Autonomous Organisations), as seen in the image below.

When these DAOs receive the tokens, it's expected they will be a major catalyst for TVL growth in Arbitrum's DeFi ecosystem. Many of these protocols will likely use the tokens to enhance the yield they offer, by distributing the tokens to their users.

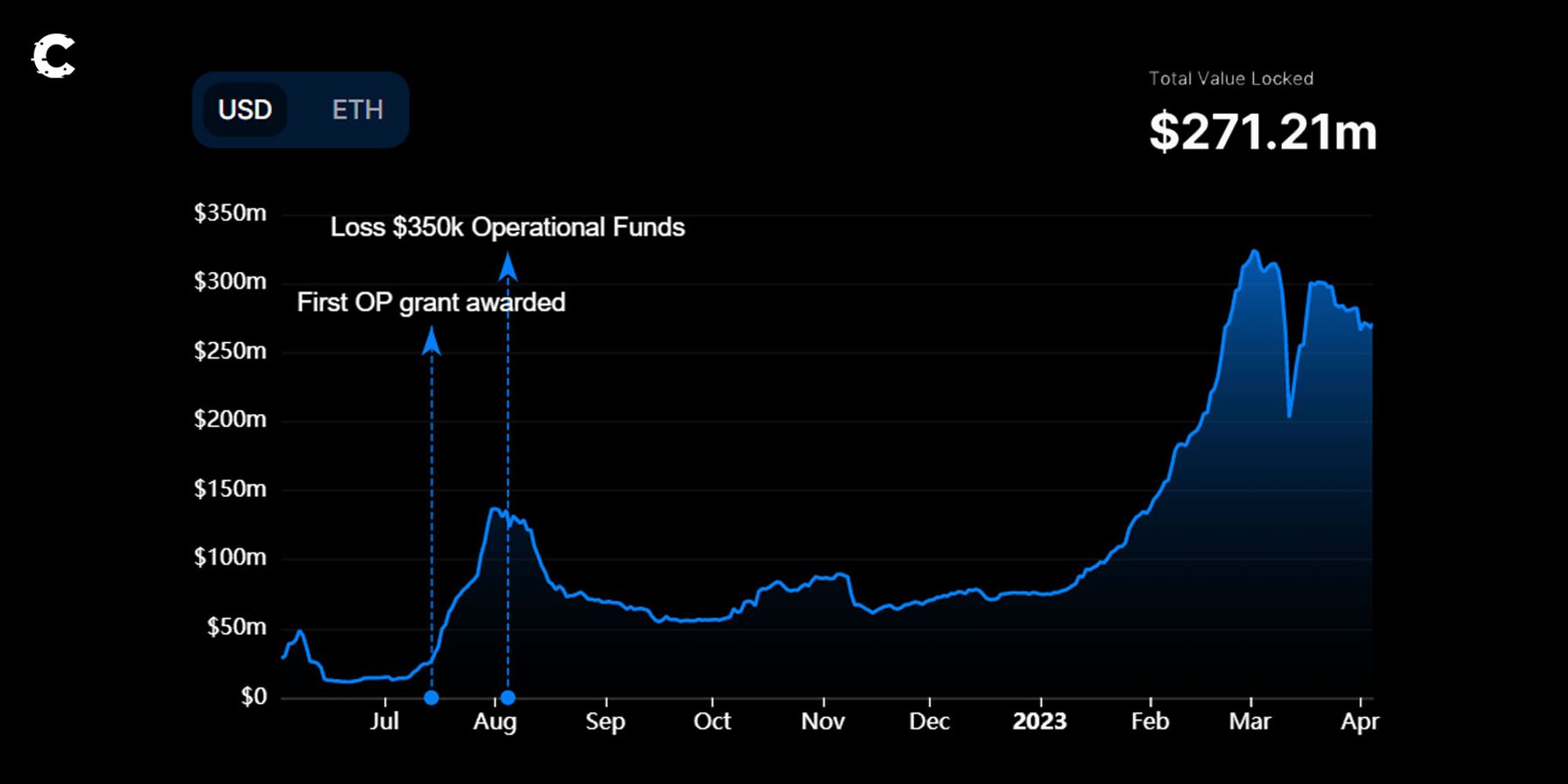

We can get a good sense of the impact by looking at what happened after Velodrome (an Optimism-native DEX) launched its $OP incentives. They used incentives incredibly well to drive the early growth of their protocol when they won their first $OP grant of $1.5M in 2022.

In a world where yield reigns supreme, profit-seeking investors are sure to flock to Arbitrum's DeFi ecosystem, enticed by the promise of higher yields when lending or providing liquidity. And let's face it, when there's money to be made, governance drama takes a backseat.

Metis: Poised for a comeback?

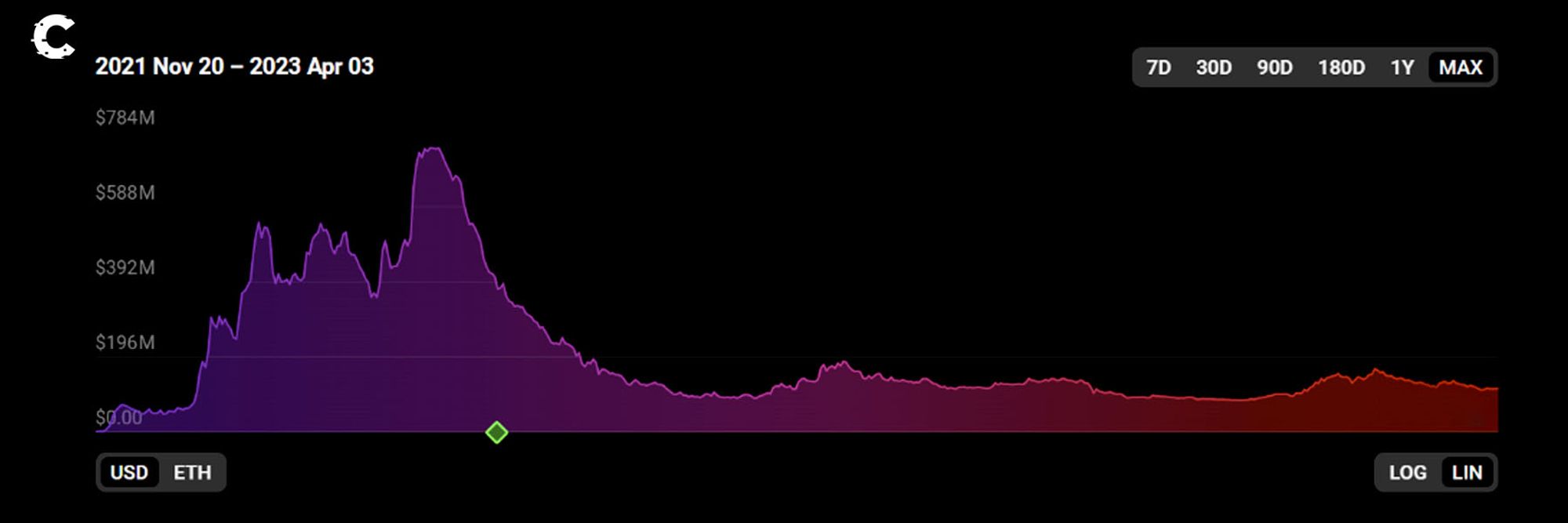

Metis, a layer 2 network that hasn’t received as much attention as giants like Arbitrum, Optimism, and zkSync, is back in the spotlight thanks to the announcement that Aave V3 will soon be launched on its network.As illustrated in the graph, Metis' TVL suffered significantly as competing layer 2s like Arbitrum and Optimism gained traction. Meanwhile, issues such as exploits and rug pulls drove users away from the DeFi ecosystem on Metis’ chain.

Metis plans to offer 100K of its native $METIS token as liquidity mining incentives for Aave users on the network over the next six months.

The launch of Aave appears to have the potential to revive Metis after a long period of decline. We believe that with so much competition, it is a toss-up whether Metis can stand out in this incredibly competitive layer 2 market, but with the launch of Aave, there is surely a reason for people to bridge part of their assets back to Metis to take advantage of the incentives.

If you believe the launch of Aave on Metis will bring some liquidity back to the ecosystem, here are some protocols to explore in preparation for its comeback:

- Hermes Protocol: Metis' leading DEX and the main place for users to exchange volatile assets. It’s currently the protocol with the most TVL ($10M) on Metis Finance.

- Hummus Exchange: Like Curve Finance, Hummus is a decentralised exchange for trading stablecoins on Metis. The protocol also created a governance proposal for the launch of a "friendly fork" of Balancer, one of the most popular automated market makers to launch on Metis.

- Tethys Finance: A Metis-based perpetual exchange that allows users to trade with leverage. In January, it released its V2 version.

Other news

- ConsenSys’ zkEVM Linea is now live on testnet for all users. ConsenSys, the blockchain software company behind the popular MetaMask crypto wallet, has opened the testnet for its zero-knowledge rollup to developers and users.

- Conduit, built on the Optimism stack launches infrastructure to easily launch a rollup. The infrastructure will make it easier for projects to launch app-specific rollups.

- Optimism announces results of the latest retroactive public goods funding. 195 people and projects received funding in $OP tokens for their creations and efforts to help grow the Optimism ecosystem.

- Starknet alpha v0.11.0 has been successfully propagated to the mainnet.

Cryptonary’s take

Much is happening in the layer 2 ecosystem, and we don't expect the activity to subside anytime soon, as all of these networks are actively competing for market share. Polygon and zkSync now have live zkEVMs, and Arbitrum and Optimism already have tokens.Currently, the two most important factors driving usage will be airdrop farming of new layer 2s without tokens, and token incentive programs.

This competition for liquidity is similar to what we saw in the rise of alternative layer 1s. We believe that Arbitrum is currently in the strongest position as the largest layer 2 network.

Additionally, with the upcoming launch of $ARB incentives offered by DAOs, Arbitrum is set to become even more attractive to users compared to other networks that can’t offer similar incentives.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms