So, what’s happened recently?

There’s been some big news from the Polygon camp. A date has been announced for the zkEVM mainnet. zkEVM (zero-knowledge Ethereum Virtual Machine) is a zero-knowledge (ZK) blockchain that’s compatible with Ethereum dApps. It could potentially be a front-runner in the ZK blockchain sector, which Vitalik himself has stated is the future!

Let’s dive in!

TLDR

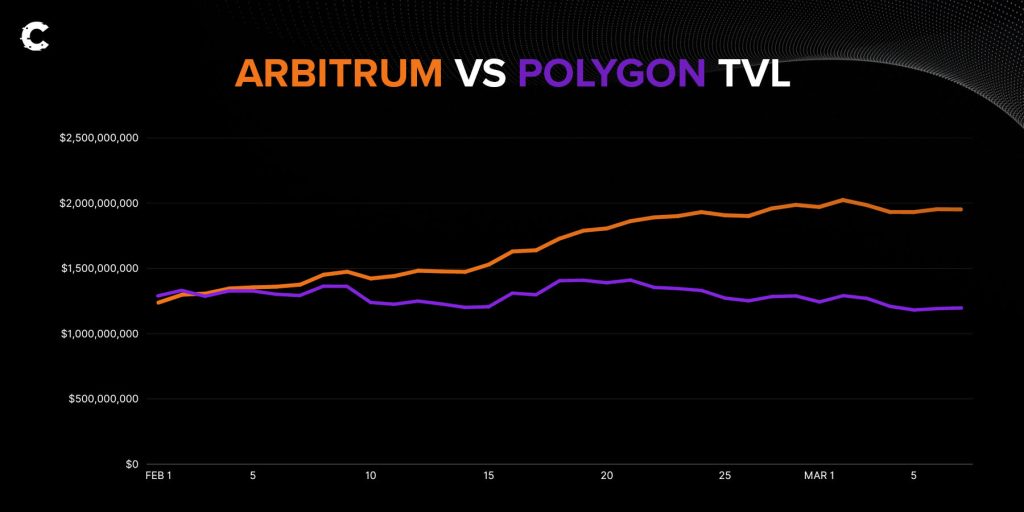

- Polygon PoS is being outcompeted by Arbitrum and Optimism. Polygon’s TVL (Total Value Locked) is down 4%, while the others are up 57% and 37% respectively. Whilst the chain is not dead, it’s certainly losing market share.

- zkEVM is set to launch on March 27. This could be the answer to the increasing competition Polygon is facing, especially as ZK technology is seen as the future of blockchains. This will add value to the $MATIC token, as it must be locked by transaction sequencers.

- With considerable funding, expert teams, and an established ecosystem, Polygon has the potential to incubate a leading zkEVM blockchain!

- Polygon ID is live, allowing KYC (Know Your Customer) and proving users’ identities without actually sharing personal information.

Disclaimer: This is not investment nor investment advice. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

Is Polygon PoS Dying?

Launched in 2020, Polygon’s PoS chain is currently live and in use.The PoS chain has seen $2.52B in transactions, with an average cost of $0.017, from over 223M unique wallets.

TVL on Polygon sits at $1.12B, down 4% ($46M) since the start of February.

This change isn’t massive, but Polygon is far behind Arbitrum and Optimism (up 57% and 37% respectively).

This backs up the widespread narrative that Layer 2s are superior to sidechains (Polygon PoS is a sidechain).

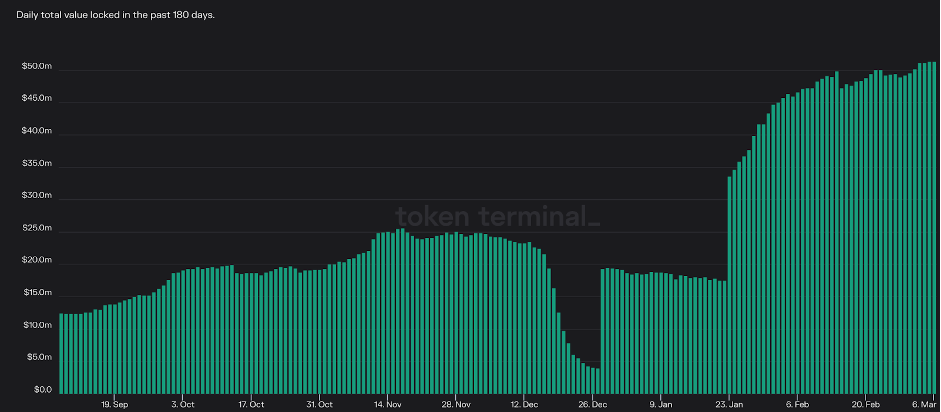

Gains Network is a great example. It’s been live on Polygon since January 2022, but since launching on Arbitrum (Layer 2) on December 30, trading volumes have increased by 300% (as seen below). Arbitrum now sees 70% of all trading volume on Gains.

When it comes to data, there are more signs that capital is rotating to other chains…

Major DEXs (decentralised exchanges) are seeing capital outflows, with Curve and Uniswap’s TVL -11% ($7.6M) and -8% ($8.8M) respectively.

So, is Polygon PoS dead?

No.But it’s definitely losing market share.

And unless something changes, it’s on a path to its end.

Luckily, there’s a new dog in the Polygon ecosystem…

The Future is zkEVMs

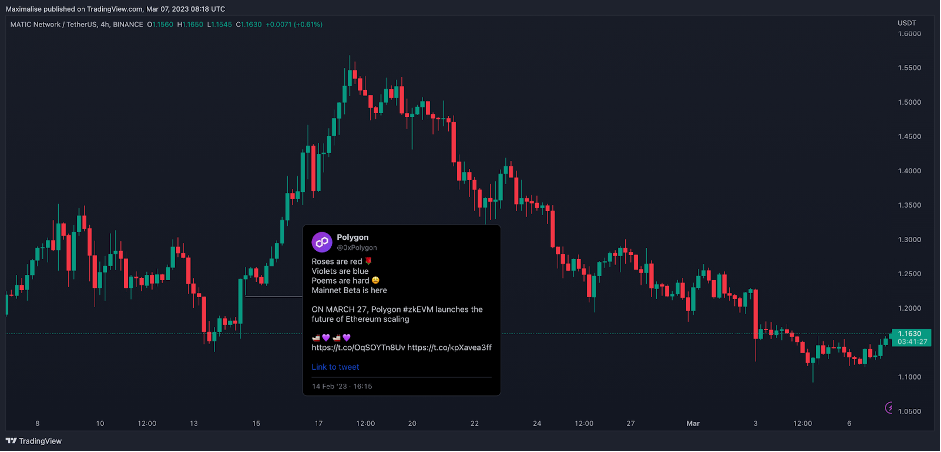

ZK technology is the most well-known Layer 2 solution. And after a lovely Valentine’s gift, it appears Polygon has become a front-runner in the sector and is in a position to seriously compete for market share.

Transaction costs considered, it’s clear Polygon could be taking on all blockchains and Layer 2s, not just ZK Layer 2s.

Polygon stated that the cost to send an ERC-20 token (a standard transaction, sending a token from one wallet to another) on their zkEVM will be $0.0001! For comparison, Arbitrum currently costs between $0.05 and $0.15 per transaction.

What does this mean for $MATIC’s price?

While transaction fees themselves will be paid in $ETH, $MATIC (Polygon’s token) will benefit from the new chain.Sequencers (who order transactions in blocks) must lock $MATIC tokens. This adds value - if $MATIC is locked up while buying pressure remains the same or increases, the price will rise.

The news has had a clear impact on $MATIC price, but the excitement was short-lived.

As the announcement was merely a date, the 35% pump wasn’t sustainable in these macro conditions.

When the mainnet is released, any pump will have more legs…

$MATIC Price Analysis (Weekly)

Recently, $MATIC lost $1.30 as support on the weekly timeframe.

This opens the door for a test of $0.75 as support in the coming weeks, unless it can close a weekly candle back above $1.30.

$MATIC’s weekly market structure is bullish (higher highs and higher lows), which suggests it will likely continue to perform well in the next few months, or at least until the market structure is broken.

An important thing to note is that Bitcoin will be the "guy at the wheel" (the one to influence $MATIC's price action). If you want to know more, we dive into Bitcoin's monthly timeframe and our expectations for Q2 here.

Other News

- Polygon ID is live. This decentralised solution leverages ZK to protect users' privacy and makes it possible to prove identity without revealing it. It will likely be integrated with Polygon PoS and zkEVM in the future.

- Robinhood Wallet will support Polygon alongside Ethereum at launch. This surprising move could open the doors to a host of users, with Robinhood’s hooks in the retail market, and Polygon’s cheaper transactions (compared to Ethereum).

- DFX Finance rewards went live, resulting in a 340% increase in TVL since the start of February. The protocol now has over $1M TVL.

- Dopex launched on Polygon, bringing their options and vaults to the blockchain.

- Azuro, a betting markets protocol, launched on Polygon on February 16.

- Kilma DAO ON SET #2 | Leveraging Digital Carbon event live on Tuesday 7, 4pm.

- Aavegotchi Forge went live on February 22, allowing enthusiasts to “forge” and “smelt” NFT wearables.

Cryptonary’s Take | Conclusion

Polygon PoS is a well-established ecosystem, but Layer 2s have taken over in both TVL and hype. This was proven when launching on Arbitrum pumped the Gains Network token’s price, volume and TVL. The same can’t be said for Polygon…Whilst the chain isn’t dead, it's consistently being outcompeted by Arbitrum and Optimism.

Polygon zkEVM could be the answer to this problem.

The ZK blockchain and Layer 2 ecosystem are early. However, Polygon has considerable funding, expert teams, and an established ecosystem.

They’re in the perfect position to take advantage of the hype surrounding ZK and establish themselves as a major player. If they do, this will add considerable value to the $MATIC token.

zkEVM mainnet is due March 27, and we’re very excited to give it a go!

As always, thank you for reading.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms