But wait - that was just an XRP ruling…

So, what exactly does the ruling mean for ADA?

Long story short, tokens like ADA, explicitly targeted by the SEC, have rallied.

However, it seems that market participants may be getting ahead of themselves.

Did the market overreact? Well, probably.

So, what happens next?

Let’s find out!

TLDR 📃

- The XRP ruling is a positive signal for altcoins like ADA but doesn't guarantee a similar outcome for them.

- Despite significant Total Value Locked (TVL) growth, ADA remains overpriced compared to its on-chain utility.

- Charles Hoskinson's proposal of Cardano sidechains could potentially boost activity on the Cardano network.

- While the SEC ruling is encouraging, ADA's future performance is uncertain and dependent on ecosystem growth and potential partnerships.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

The SEC ruling is bullish but not a slam-dunk ✴️

It is no longer news that Ripple has won against the SEC; XRP is not a security in the eyes of the US legal system.Many altcoins have been held hostage by the SEC over the last couple of months since filing lawsuits against Binance and Coinbase. BTC had been rallying for the last few weeks; alts, not so much.

So, the market reaction that followed the ruling was like an elastic band releasing tension. Ripple’s win triggered a massive shift in direction and momentum for the market. It also sets a precedent for future lawsuits, making it more difficult SEC to score a win.

But is this the end of the matter?

As bullish as the news is, the truth is that, technically, the ruling only applies to XRP.

Nowhere did the court state that other cryptocurrencies are off the hook.

However, the ruling has challenged the SEC’s shotgun approach of framing crypto assets as “guilty (of being a security) until proven innocent”.

Ripple’s win now provides more context on what is and isn’t a security.

And Cardano, for all its failings in terms of slow development and relatively low usage, still fits the criteria of being a commodity rather than a security.

Signs of life as Cardano's TVL grows 🌳

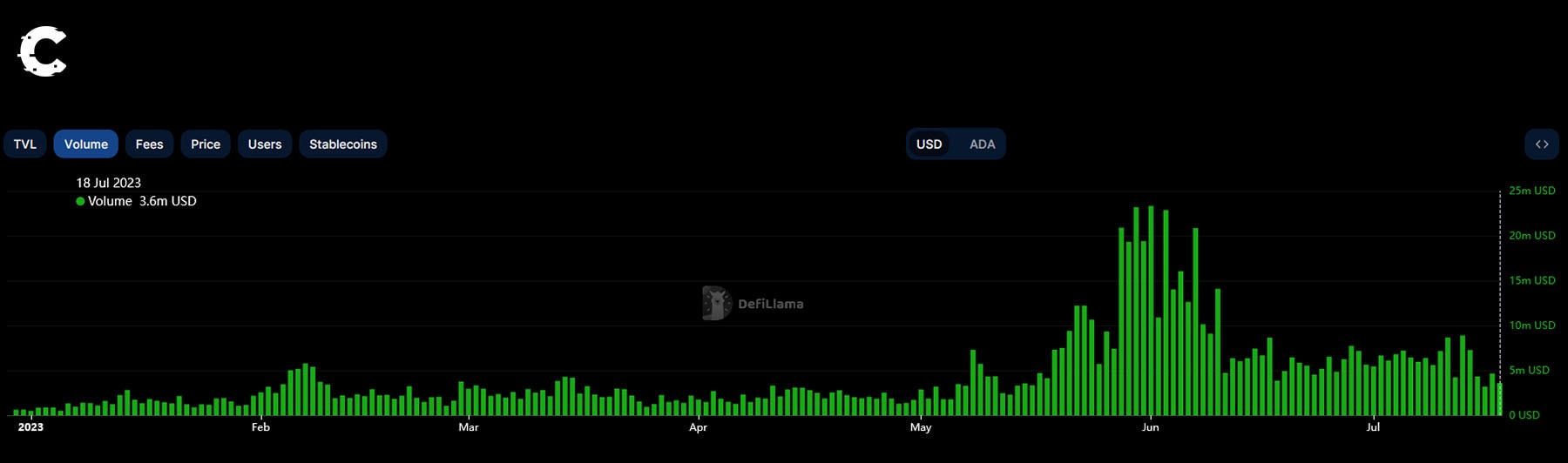

Even before the SEC’s attack, ADA had mostly been stuck in limbo. But Despite the relative underperformance of ADA compared to its peers, Cardano’s TVL has seen significant growth over the last month, up almost 53% since June.Cardano DEX volumes have also seen a significant uptick, with MuesliSwap as the top gainer by %. Although peaking in June, DEX volumes have remained significantly higher than any other period throughout 2023.

DEX volumes averaged around $2.5 million in April, $11 million in May-June, and have remained elevated throughout July at around $6 million.

As we’re aware, DEXs are the lifeblood of DeFi, so it is encouraging to see positive figures and sustained growth in DEX volumes.

The overall trend in terms of Cardano DeFi remains positive, with sustained overall TVL growth. Cardano TVL has grown from $64.85 million to $221.1 million through 2023, a YTD increase of 241%.

Despite these promising figures, ADA’s price has largely ignored its ecosystem’s gains. The TVL to market cap ratio remains disparate, suggesting that Cardano is still overpriced compared to actual on-chain utility.

But there may be a way to improve price perfomance…

Sidechains may be the way forward for the Cardano ecosystem 🛣

Charles Hoskinson, the creator of Cardano, recently had an interesting interaction in which he suggested that Algorand consider becoming a Cardano sidechain.For some context, a sidechain is a blockchain that runs parallel to the main chain and uses the main chain for security. Examples are Ethereum and its L2s or Avalanche and its subnets.

The Algorand community immediately began clowning on Charles. Understandable because nobody wants their chain to lose independence, even if it technically might be the best option. This sentiment is especially valid after the shutdown of AlgoFi earlier this month.

Yet, the idea of Cardano attracting projects to launch as sidechains is feasible. Our views on Cardano aside, it has one of the most marketable brands in crypto. And, with the SEC becoming less of a threat, it might be prudent for other protocols that are less likely to win against regulators to “seek shelter” under the umbrella of the Cardano ecosystem.

Smaller protocols could also be attracted by the network effects, financial support, and the large community that Cardano could provide. So, although Algorand is an unlikely candidate, Cardano could still get other chains to become its sidechain.

Price analysis 📊

Last week, ADA saw one hell of a pump, rising over 30% in just two days. Of course, this was a direct result of XRP winning its case. As stated above, since XRP managed to win, then ADA will have fewer issues going forward, hence the increase in demand.

Most of that volatility has settled down, and ADA now ranges above its $0.30 support level. The deal is simple - holding $0.30 keeps the door open for $0.40 - $0.45, our next resistance area.

An invalidation for this scenario occurs if the asset closes a weekly candle under $0.30.

Cryptonary’s take 🧠

Despite the generally positive vibes in the market after the SEC case, we remain cautious around Cardano and ADA. The SEC still has an arsenal of weapons it could unleash against protocols, and even for Ripple, the ruling was far from decisive.Cardano is one of the more centralised protocols, so it is still in the crosshairs of the SEC.

Aside from the SEC drama, the Cardano ecosystem shows promising signs of growth. However, the critical issue is that none of this ecosystem growth has translated to gains for the ADA token.

You can attribute this mismatch partially to ADA's colossal market capitalisation, around $11 billion.

To summarise, we expect nothing big from ADA in the coming months. But we will be paying attention to the ecosystem tokens and potential partnerships – perhaps something will pop out of those to move the needle for ADA.

As always, thanks for reading! 🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms