Let’s dive in…

TLDR

- DeFi trends higher but lags behind BTC performance. The altcoin market and DeFi tokens are likely to catch up, assuming favorable BTC performance.

- The Euler Finance hacker returns the entire $197 million, bringing the exploit to a favorable conclusion.

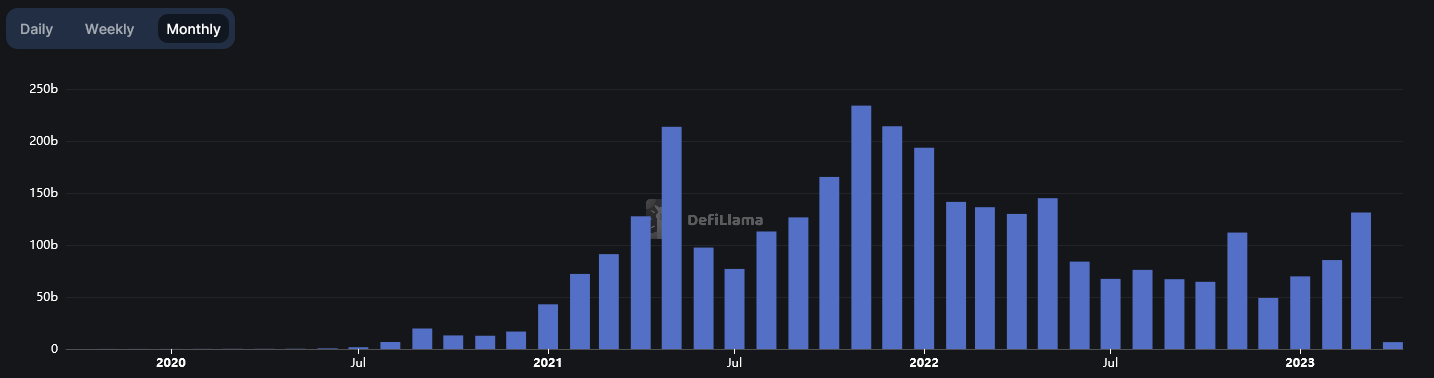

- DEX volumes have been trending up since the start of the year. DEXs are the heart of DeFi, and data shows that DeFi use may be rebounding - even accelerating.

- THORChain was halted after a vulnerability was found, exposing assets in the liquidity pools to potential theft. The chain has been restarted; however, better communication is key going forward.

- On-chain data shows 1inch has facilitated trillions of dollars of swap volume on key Ethereum DEXs to date.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

DeFi Overview

DeFi TVL is grinding up again after three to four weeks of slow growth. Registering a ~5% gain since last week. This comes as BTC continues to range at local highs. However, DeFi is losing market share to Bitcoin overall, a trend that has been in effect since the beginning of 2023.

This is consistent with the overall underperformance of altcoins compared to BTC. Capital is simply not flowing to other areas of the market - yet. This suggests that most DeFi assets are still in an accumulation phase. Depending on the direction of BTC, the DeFi dominance chart implies that DeFi has some catching up to do.

Now, let’s dive into the news.

Key Developments

- Euler Finance exploiter returns the remaining $31 million after a $197 million exploit. After a tumultuous few weeks, the Euler exploit has reached a favorable conclusion. With all funds returned, the Euler exploit can be considered a rare event. Very few hacks have ended with all funds returned, and so for many, a huge sigh of relief is in order.

- Astar Network will launch a virtual machine. Astar has confirmed that its multi-language virtual machine is near. Developers from many backgrounds can now code Astar smart contracts in their native language. As this key functionality is realized, the developer pool available to Astar will be huge. Whether they will migrate to Astar remains to be seen. However, with Astar making big moves in Asia, the ecosystem's growth will likely accelerate.

Hot Narratives

DEX Volume Makes a Comeback

Decentralized exchange volume registered the third straight month of gains in March – and the rate of usage is accelerating. This welcome news indicates there is still strong demand for on-chain, decentralized services. 2022 was a graveyard year for many centralized entities, and customers have been left with gaping holes in their portfolios after key CEXs and other services collapsed.

As the controversy surrounding CEXs continues this year with the CFTC lawsuit, the need for a decentralized option has never been clearer. The data suggests that users are once again turning to DEXs to fill orders.

Speaking of DEXs…

THORChain Halted

THORChain was halted last week after an unspecified vulnerability was found. Developers explained that the exploit would have required a malicious node operator. Assets within the liquidity pools could have been at risk. THORChain was restarted the same day and resumed operations as normal. A patch has been implemented.

This comes after a largely successful 12 months for THORChain. From integration with TrustWallet to the launch of savers vaults, the THORChain ecosystem has seen more than a few welcome developments. Still, the exploits of 2021 are still fresh on the minds of the THORChain developers. They have taken an aggressive stance on potential vulnerabilities.

This is not the first time THORChain has been halted, and it is unlikely to be the last. However, communication around the circumstances of the halt is key to avoiding the confusion and FUD that circulated this time. Still, taking a proactive stance on vulnerabilities is infinitely better than reacting after an exploit has occurred.

1inch Moving Trillys’

On-chain data shows that the Ethereum DEX aggregator 1inch has directed trillions of dollars of volume through key DEXs. Token DEX Uniswap and stablecoin hub Curve have been the biggest beneficiaries. These figures demonstrate the integral and essential service that DEX aggregators provide to both users and protocols. Users benefit from cheaper swaps, and protocols benefit from higher transactions and swap counts.

This data is consistent with the overall trend of increased DEX usage. 1inch is not the only Ethereum DEX aggregator, it is by far the most widely used.

Crypto Investment Corner

Delphi Labs raises $13.5 million for new incubator program.The new incubator program is set to help Web3 startups. Each project within the program will receive a $200k grant and access to Delphi’s expansive VC contact list. The goal is to foster Web3 innovation and provide a roadmap for project development and funding.

Manifold secures 25,000 ETH in huge deal with Cream Finance.

Manifold Finance will build a new multi-chain liquid staking platform. In a recent announcement in conjunction with Cream Finance, Manifold will acquire Cream’s validator set. This means about 25,000 ETH will be ported to the new protocol. The new derivative token mevETH will be a multi-chain token through the LayerZero infrastructure.

Other News

- Safemoon subject to $8.9 million hack.

- Sentiment Finance, a liquidity market, exploited for $1 million.

- Prominent crypto twitter user Cobie causes a ruckus in the markets.

- Twitter updates logo to DOGE.

Cryptonary’s Take

Overall, it’s been a solid week for DeFi. It continues to lage behind BTC, but we have no reason to believe that situation will continue for long. As always, the direction of all things crypto is tied to BTC. If BTC continues to range, confidence will grow and capital should begin to flow back to the altcoin market. DeFi will be a key beneficiary in that event.The decentralized exchange uptick is evidence of this. With large volumes returning and usage trending higher, DEXs represent the core of DeFi, so the recent data is likely an early indicator of renewed DeFi activity.

We expect the trend in DEX volumes to continue higher as centralized exchange FUD continues to grow. Although CZ and Binance are no strangers to controversy, it’s better to be careful than sorry. As cliche as it sounds - not your keys, not your coins!

Another interesting week in DeFi! Stay tuned for next week’s update.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms