TLDR 📃

- BTC's hold on the market is starting to loosen, opening up doors of growth for altcoins and DeFi.

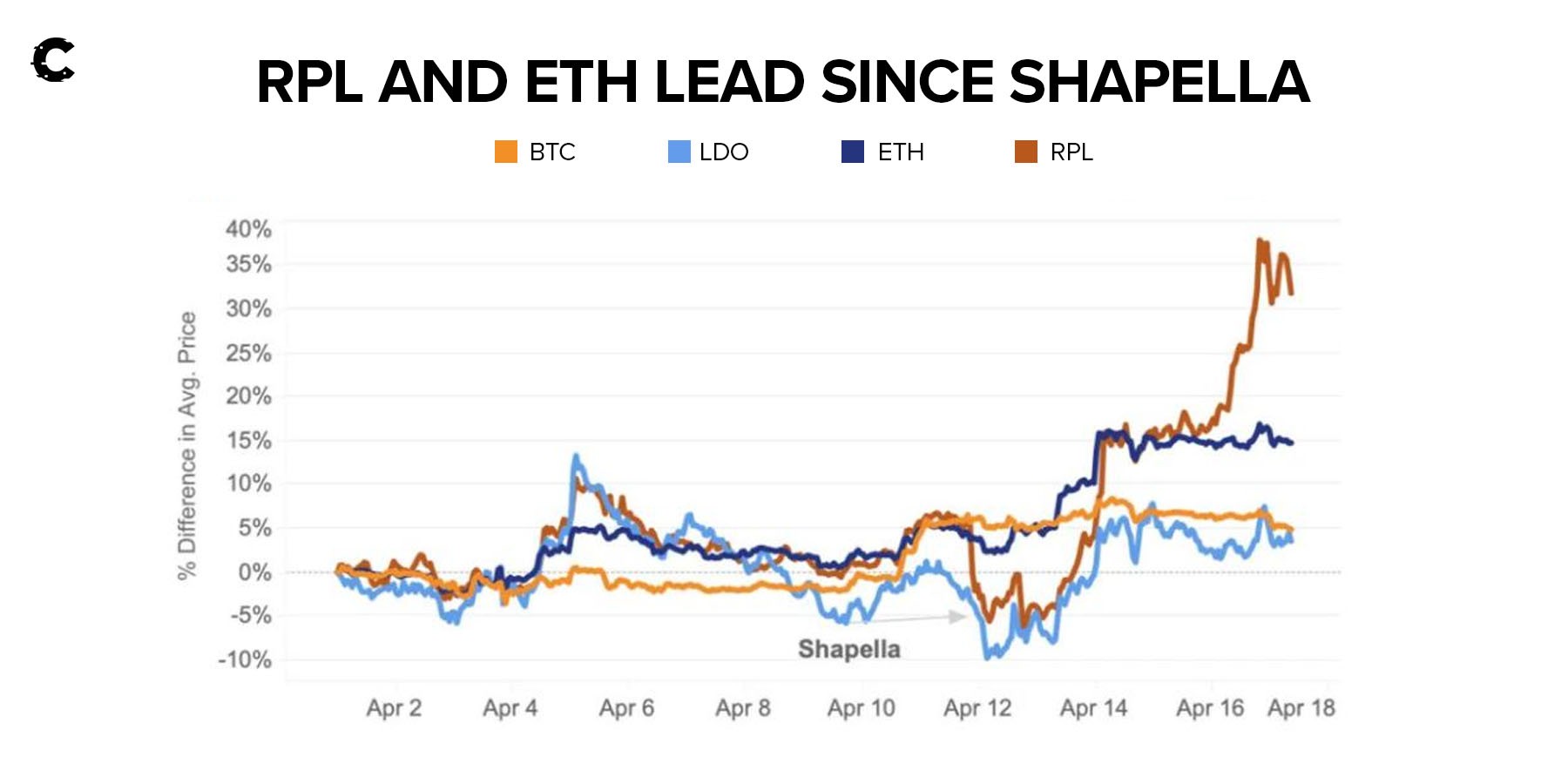

- RocketPool's RPL is crushing it, outpacing its rivals after the Shanghai upgrade – pretty impressive!

- Premia's gone and re-vested 22M tokens, which means less selling pressure and a smaller circulating supply – talk about good news for their bulls.

- SEC Chair Gary Gensler got an earful from Congress, putting the spotlight on how messy crypto regulations are right now. They're even thinking about swapping Gensler for a whole board of directors – now that's a shake-up!

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

DeFi overview 👀

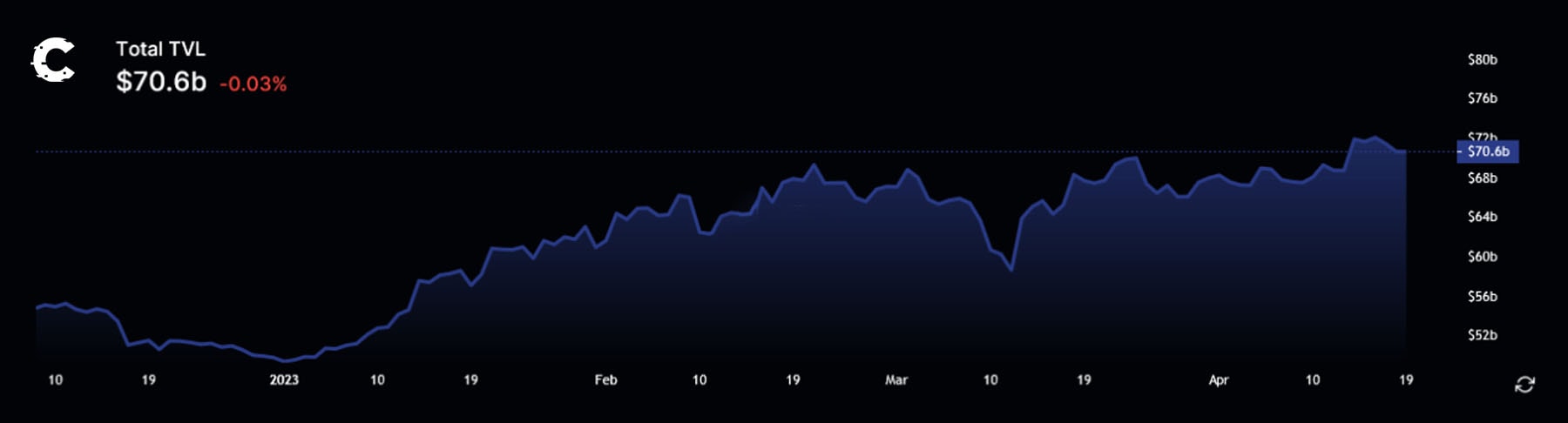

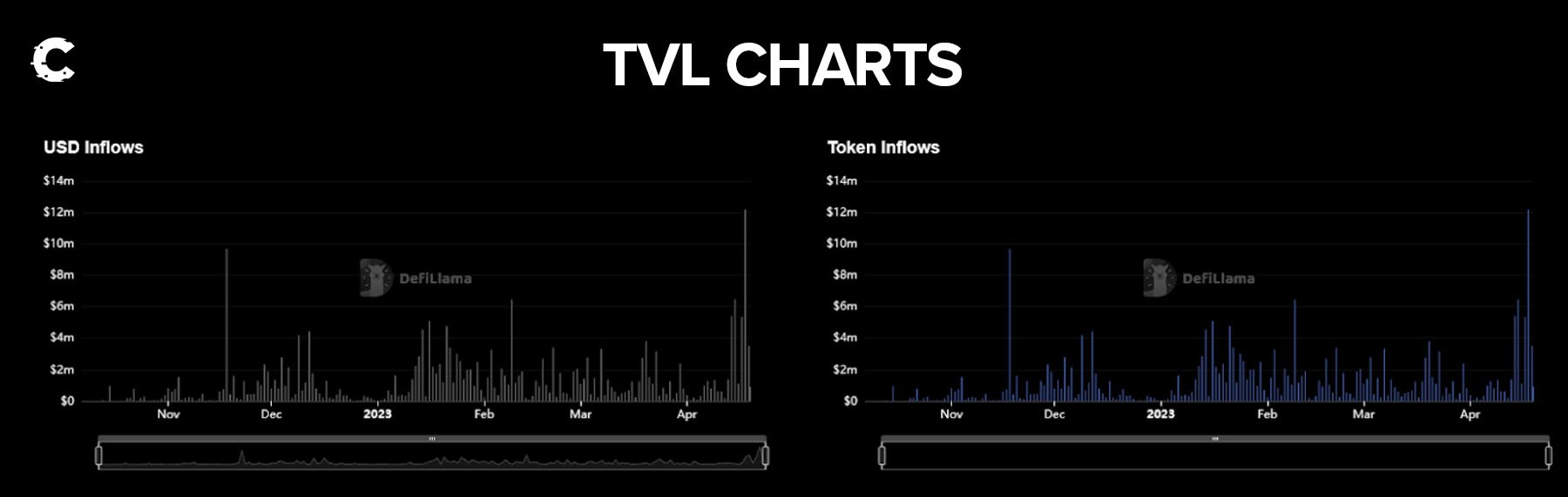

DeFi's TVL is on fire this week, smashing through the $70 billion mark for the first time this year! Guess who's leading the pack? Arbitrum, Solana, Kava, and Cardano, that's who! And all this excitement is happening even though BTC's been going through a bit of a rough patch lately.

After a solid Q1, its dominance seems to be getting a bit shaky. Are altcoins staging a coup? With all the chatter lately, it sure feels like it! We're betting on BTC's dominance dipping as altcoins gobble up more market share.

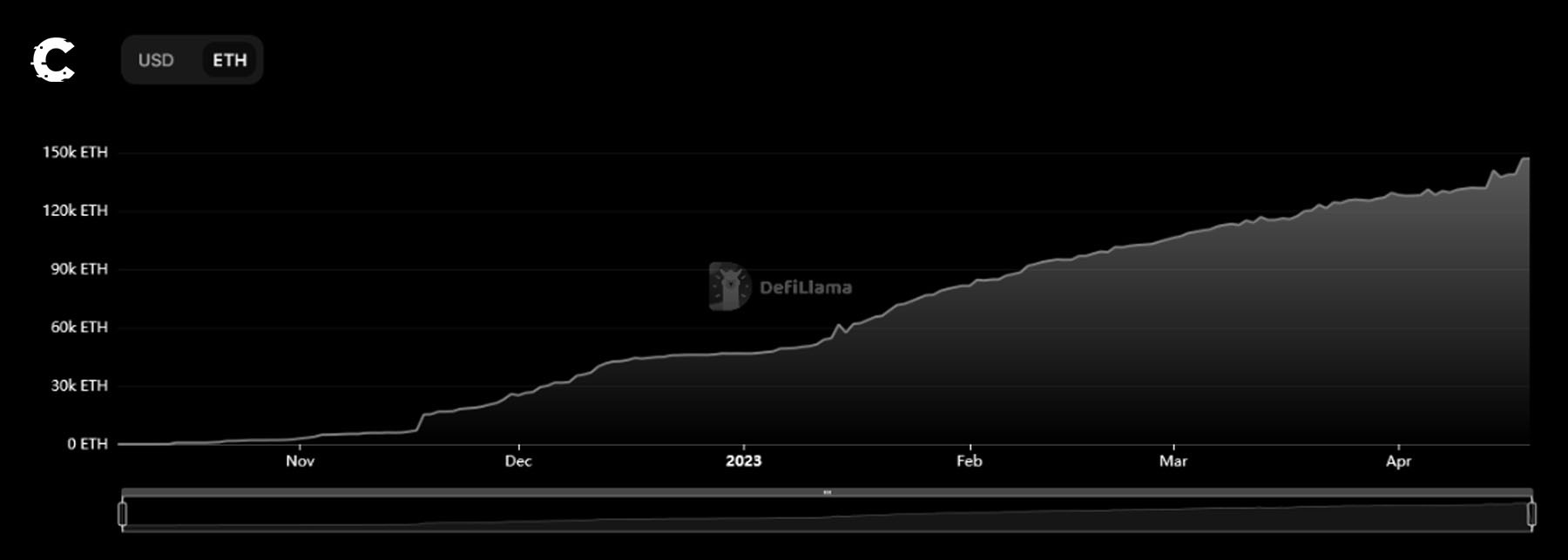

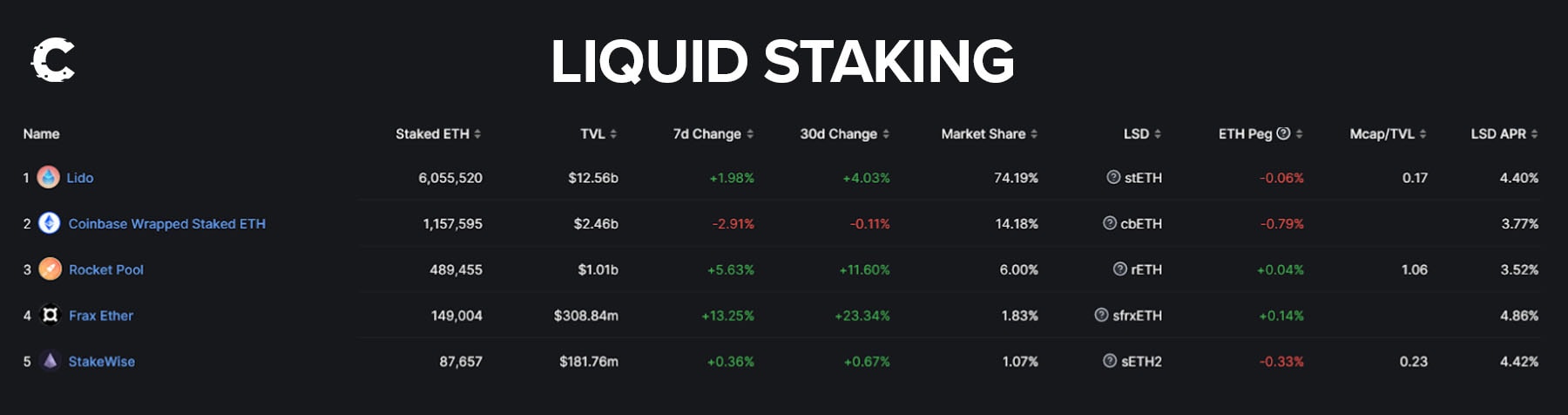

Ethereum Liquid Staking, anyone? Frax Finance is making waves with a noticeable increase in total ETH staked. They're offering some sweet staking rewards, boosted by CRV pools. No wonder they've been turning heads since the April 12th Shanghai upgrade!

Now, Frax might be a bit of an underdog in the liquid staking scene. But, as we've mentioned in our recent analysis, we think staked ETH will play musical chairs between providers as more options pop up. Keep your eyes peeled for Lido unlocking staked ETH sometime in May.

That's when the real test begins - can the smaller players hold onto their higher yields? For now, Lido is still king of the hill.

Key developments 🔑

- Premia revests 22M tokens: Premia's doing something big! They're revesting 22 million PREMIA tokens that were once unlocked. Talk about a confidence boost in their protocol! The Premia community is buzzing with excitement, as this move eases selling pressure and slashes the PREMIA float by up to 30%.

- The SEC says Algorand (ALGO) is a security: Get a load of this – the SEC declares Algorand (ALGO) as a security. What's wild is that SEC Chair Gary Gensler was once an ALGO fan, but now he's backing the decision. People are starting to doubt the SEC's crypto regulation chops, especially with their relentless crackdown on DeFi.

Hot narratives 🔥

Gensler in trouble?

It's been pretty crazy week in the US, with Congress coming down hard on Gensler and the SEC. Representative Tom Emmer called Gensler an "incompetent cop on the beat" and accused the SEC of putting regular folks in danger. The hearing was pretty wild - you should check out the video clips, they’re pure theater.JUST IN: 🇺🇸 US Congressman introduces bill to restructure the SEC and fire Chairman Gary Gensler. pic.twitter.com/7jceXJBkfR

— Watcher.Guru (@WatcherGuru) April 18, 2023

Why all the drama? Gensler's been pushing for the SEC to start regulating crypto as securities (especially DeFi governance tokens), but when he was asked whether ETH was a security or a commodity, he got visibly flustered and couldn't answer. It's kind of wild that the head of the SEC wouldn't be better prepared. This clip that shows just how embarrassing it got:

Gary Gensler getting grilled on whether he thinks ETH is a security or commodity

Enjoy pic.twitter.com/vrFVn3Ap63— sassal.eth 🦇🔊 (@sassal0x) April 18, 2023

There's a lot of confusion around crypto regulation in the US. Even finance bigwigs aren't sure how to classify ETH. And while Gensler and the SEC seem to be attacking protocols left and right, there's still a lot of unanswered questions around how they're going to regulate things.

Congress is starting to wonder if Gensler and the SEC are the problem. Some lawmakers are calling for Gensler to be replaced with a board of directors. And honestly, a lot of people in the crypto world are cheering them on. It's clear that the SEC hasn't been doing a great job.

We welcome the change. US legislators are finally realizing what the average crypto enthusiast has known all along: The SEC has not been protecting the interests of US citizens. It has stifled Web3 growth and dealt the US a competitive disadvantage, pushing investments away from the US and into the arms of competitors like China.

At this point, it's pretty embarrassing for the SEC. Gensler's never even used crypto, despite teaching courses on it in the past.

Chair Gensler just testified that he taught multiple courses on crypto but has never owned or used it. How can you teach a course about something you've never owned or used? @MIT pic.twitter.com/EqDbZaIb28

— Justin Slaughter (@JBSDC) April 18, 2023

With all the incompetence, inflexibility, and haphazard enforcement we've seen from the SEC lately, it's not surprising that people are starting to question whether they're the right folks to be regulating crypto. All in all, it's been a pretty humiliating week for US DeFi regulation.

RocketPool's great performance

Ethereum staking has seen an uptick since last week’s Shapella/Shanghai upgrade. And a newish liquid staking protocol called RocketPool, has been doing really well - it’s outperformed market leaders and competitors in terms of token price.

One reason: The protocol’s upcoming Atlas upgrade will reduce ETH requirements for launching a node from 32 to 16.

Even though RocketPool only has a 6% market share in Ethereum LSD (liquid staking derivatives), we're standing by what we said in February: When Lido enables withdrawals in May, the following reshuffling of staked ETH will favour RocketPool.

RocketPool's TVL has gone up by about 40% since the start of the year. That's another reason its token performance has been so strong. Everyone's keeping a close eye on those Lido unlocks, since they're going to be the next big thing in ETH liquid staking.

Crypto investment corner 📈

- a16z, one of the largest funds in crypto, is working on a new Optimistic rollup client, Magi.

- Karate Combat, a blockchain-based martial arts/gaming project, has raised $18 million. The token is set to launch on the 10th of May.

- Yoz Labs, a Web3 notification system for sending instant messages to users on-chain, has raised $3.5 million to build the infrastructure.

Other news 🔔

- SushiSwap posts a post-mortem on its recent exploit.

- Coinbase to launch offshore derivatives exchange.

- yCRV depegs as much as 85%.

- Hong Kong declares crypto assets are property, not currency, and can be held in trust.

- Another $1.2 million of USDT is blacklisted.

Cryptonary’s take 🧠

DeFi TVL topped $70 billion for the first time this year as altcoins swiped a bit of market share from BTC. Look for BTC dominance to continue to slide.We're keeping a close eye on Frax Finance, which has been on fire since the Ethereum's Shanghai upgrade. Can Frax emerge as king of liquid staking on Ethereum? Can they stave off a challenge from RocketPool? We won't know for sure before Lido shakes things up by unlocking staked ETH in May.

Gary Gensler’s pitiful performance in Congress is a win for DeFi because it's becoming more and more clear that the SEC has no idea what they're doing. Under Gensler's leadership, investments in Web3 are getting pushed away from the US thanks to incompetent, inconsistent regulation. The SEC is limiting DeFi access to US financial markets without giving any clear or consistent reasons. They're not doing a great job of protecting US citizens, that's for sure.

But it's not just the US that's having problems. Regulators all over the world are failing to provide clarity on DeFi and blockchain technology. And while the average crypto user may not be too worried about it, it's a huge deal for corporations and businesses. For DeFi and Web3 to really reach their potential, institutional capital must be able to flow freely. That means regulators all over the globe need to give the thumbs-up - or at least refrain from creating laws and regulations that are skewed toward destroying the industry.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms