As the world races towards a crypto-powered future, the question looms: Will the US risk being left behind? The answer is probably "yes." And that's becoming obvious.

However, what many people don't know is that the stage is being set DeFi to score big wins as crypto regulations become clearer.

So where do we stand?

TLDR 📃

- The UK is taking the lead in embracing (DeFi) by outlining new recommendations for regulating crypto assets.

- The UK's proposals could legitimise most DeFi applications, allowing for using crypto as collateral and confirming on-chain transactions as valid business transactions.

- France is also trying to regulate DeFi but leans more toward controlling it rather than fostering innovation.

- Central banks may explore using Curve Finance for on-chain liquidity pools to replace current foreign exchange (FX) trading practices.

- While these developments are still exploratory and not yet signed into law, the future of DeFi appears promising.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

The UK takes the initiative 🇬🇧

The UK Law Commission has outlined new recommendations on how to regulate crypto. We won't bore you with the specifics of the recommendations.

- The key thing is that the UK agrees that some digital assets are neither "things in possession” like a gold bar nor “things in action” like a debt.

- There's a proposal for a third category of rights to address the unclear status of some crypto assets.

The proposal also sets the stage for using crypto as collateral, and it confirms blockchain transactions as valid business transactions. If adopted and executed by the UK government, these proposals legitimise most DeFi applications.

Now, this is where it gets interesting.

With this proposal, DeFi applications are in a prime position to compete with TradFi products. We won't be surprised if we see tokenised securities issued directly by companies like Shell or BP trading on decentralised exchanges like UNISwap or Orca. We could even see some of them on derivatives exchanges like DYDX – again, this is pure speculation.

And, as we've stated in previous reports the centralised derivatives market is huge. If these reforms are passed, the door is open for institutions to participate.

And they'll be using the UK as a gateway.

France joins the fray 🇫🇷

France has a similar stance, but it is not quite as open as what we've seen in the UK.

The country is focused on a global approach to try and unify regulation. So we see Paris being more aligned with the EU in its attempt to control DeFi rather than actively fostering innovation.

It is noteworthy that the French financial authority, AMF, recognises that DeFi is cross-border, so harmonising regulation is the best way to handle the “situation.”

That is a losing battle - there is no single point or person/entity to hold accountable for compliance.

And that's why we still prefer the UK's approach - if you can't beat them, join them.

Now the big win: CBDCs x Curve🥇

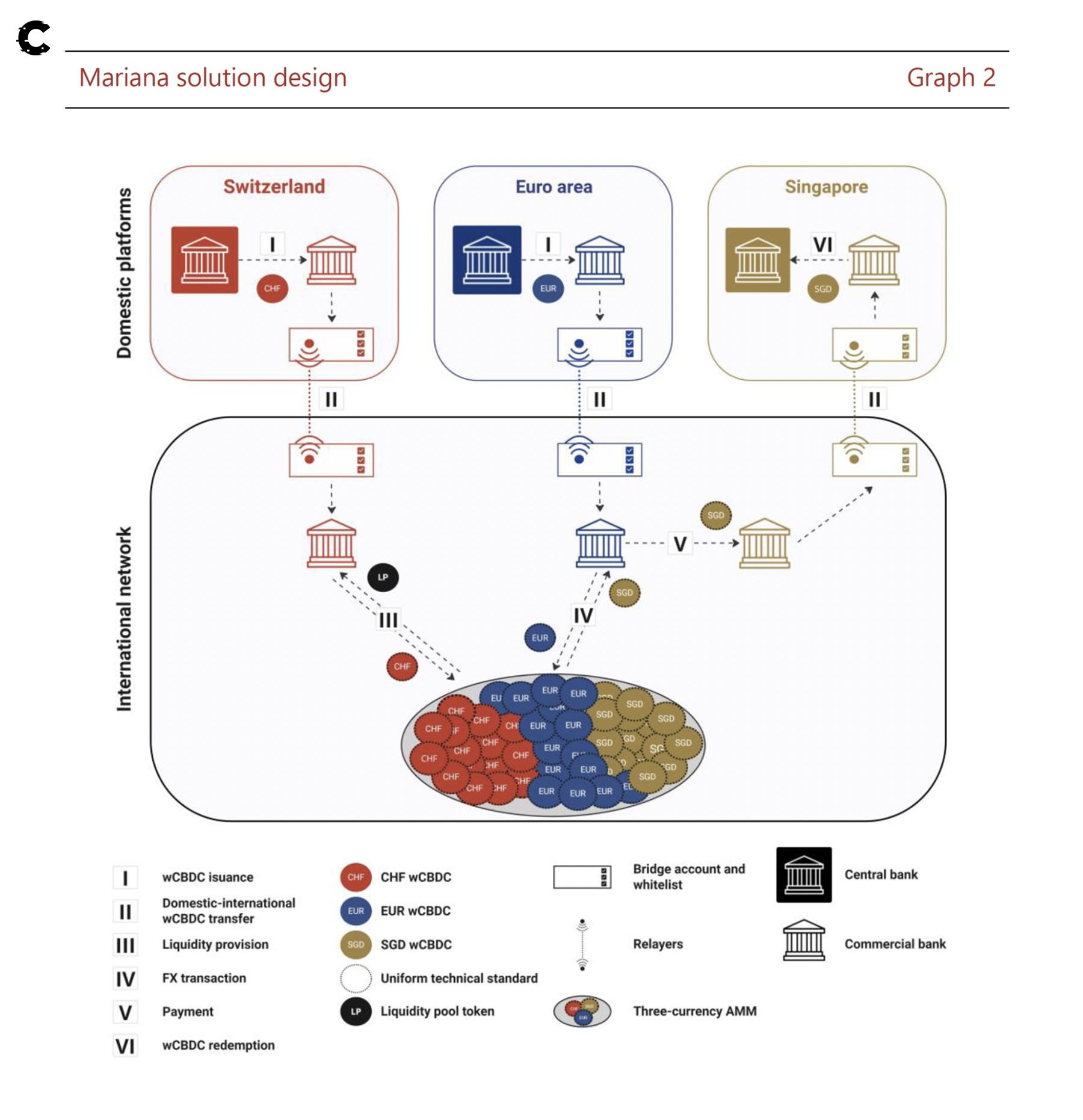

What if there was a way to incorporate existing DeFi protocols into the future of CBDCs?

Just to be clear. We think CBDCs are a gross overreach of government influence and control. We will never support any attempt to impose that oversight on anyone.

But what if there's the possibility of using government-issued pseudo-cryptocurrencies in protocols outside of government control?

"Well, that's a lot of "what ifs”.

Yet, authorities like the BIS Innovation Hub, the Monetary Authority of Singapore, and the Swiss National Bank, are exploring how to use Curve Finance for on-chain wholesale CBDC pools.

The study found advantages in using a protocol like Curve to remove barriers to conventional FX trading.

The report proves that protocols like CRV are building the future of finance, and central banks know and acknowledge it. The FOREX market is worth over $6.5 trillion in trading volume per day.

Curve is on to a winner.

The study also found that utilising liquidity pools filled with CBDCs is much more efficient than current FX trading practices. We've been saying this for years. Especially the liquidity pool/AMM model of transacting *hint*.

The government/central banks would control bridges to and from TradFi to DeFi. However, once on-chain, users, traders, banks - anyone - would be free to use those funds as necessary.

All of these are still exploratory, but it highlights how some governments are shifting towards a “dip our toes” attitude towards DeFi.

Cryptonary's take 🧠

Regulation is inevitable - the challenge is that governments are known for over-regulating

The UK seems to have its acts together, especially when compared to the SEC, which is hellbent on regulating crypto under 100-year-old laws.

Coupled with the study outlining the utility of Curve, it's clear that the innovation happening in DeFi finally appears to be gaining attention.

It's important to note that it has not been signed into law - yet.

But the information is there, and governments are under pressure to act.

The best time to bet on the future of DeFi was yesterday; the next best time to place your bets is now.

For those just joining us - welcome to the party.🎉

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms