The dollar is on the verge of collapse: Here's what you need to know

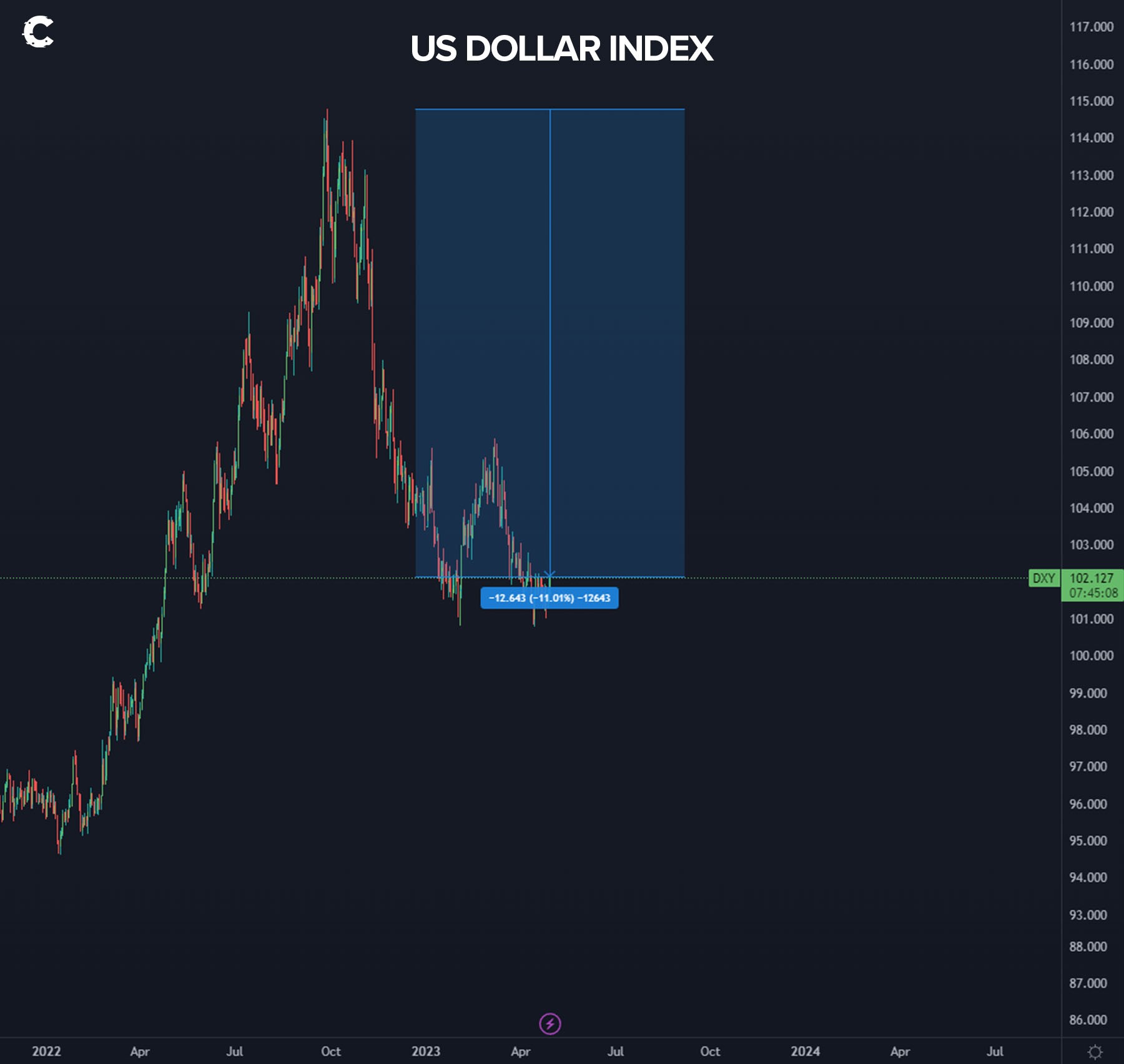

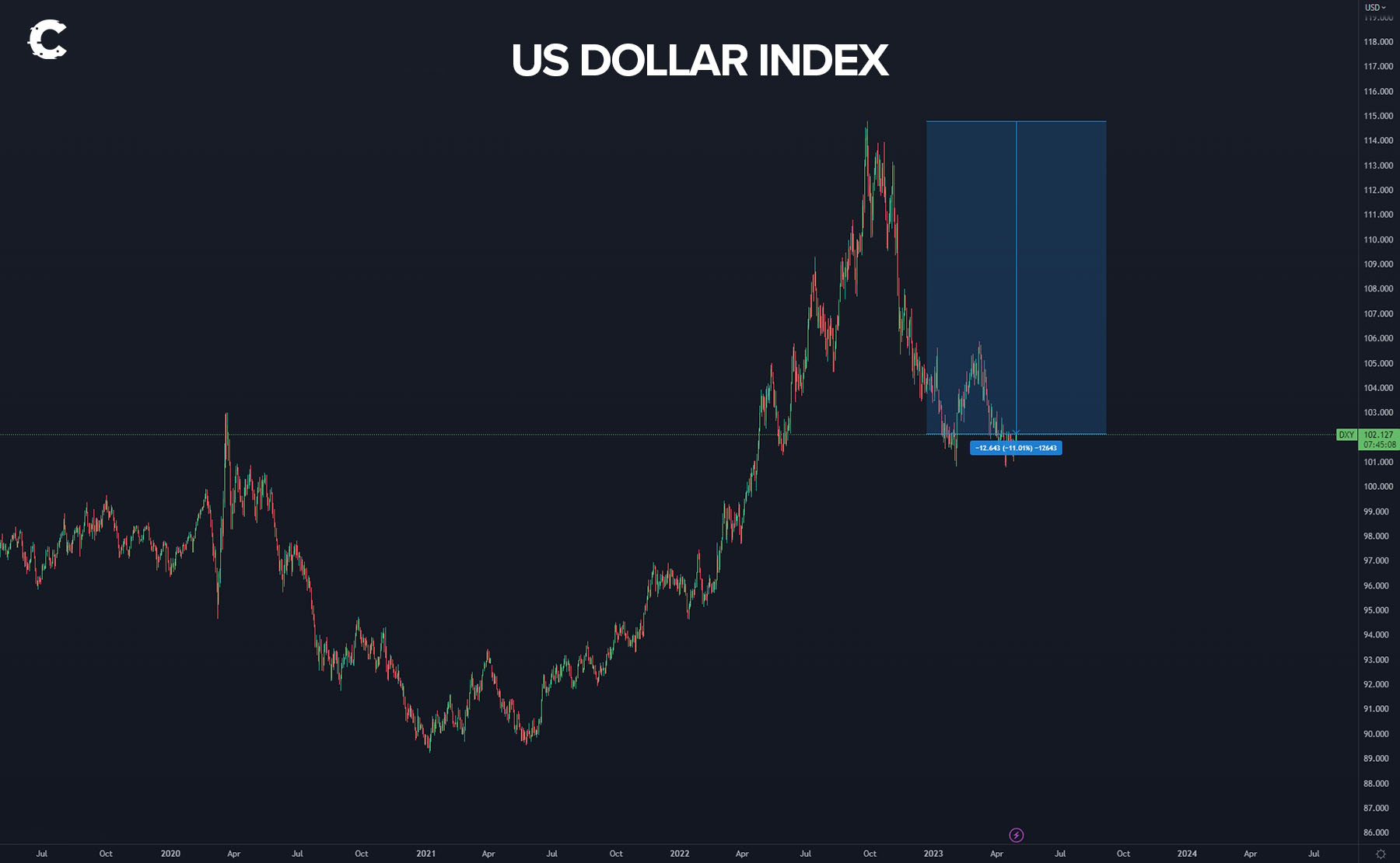

The dollar continues to lose strength around the world, dropping more than 10% since the peak. BRICS countries – Brazil, Russia, India, China, and South Africa – are among the nations considering a move away from the dollar as the settlement currency for international trade. Brazil has already agreed with China to ditch the dollar for trade between the two nations. They will settle transactions in Chinese Yuan.

TLDR 📃

- Brazil and China have agreed to use the Chinese yuan instead of the dollar as trade settlement currency.

- They're the first, but not the last: More countries are considering dumping the dollar.

- First Republic Bank is the latest casualty in US banking.

- The banking crisis is concentrating US economic power in the hands of fewer and fewer banks.

- US GDP growth for Q1 2023 came in lower than expected.

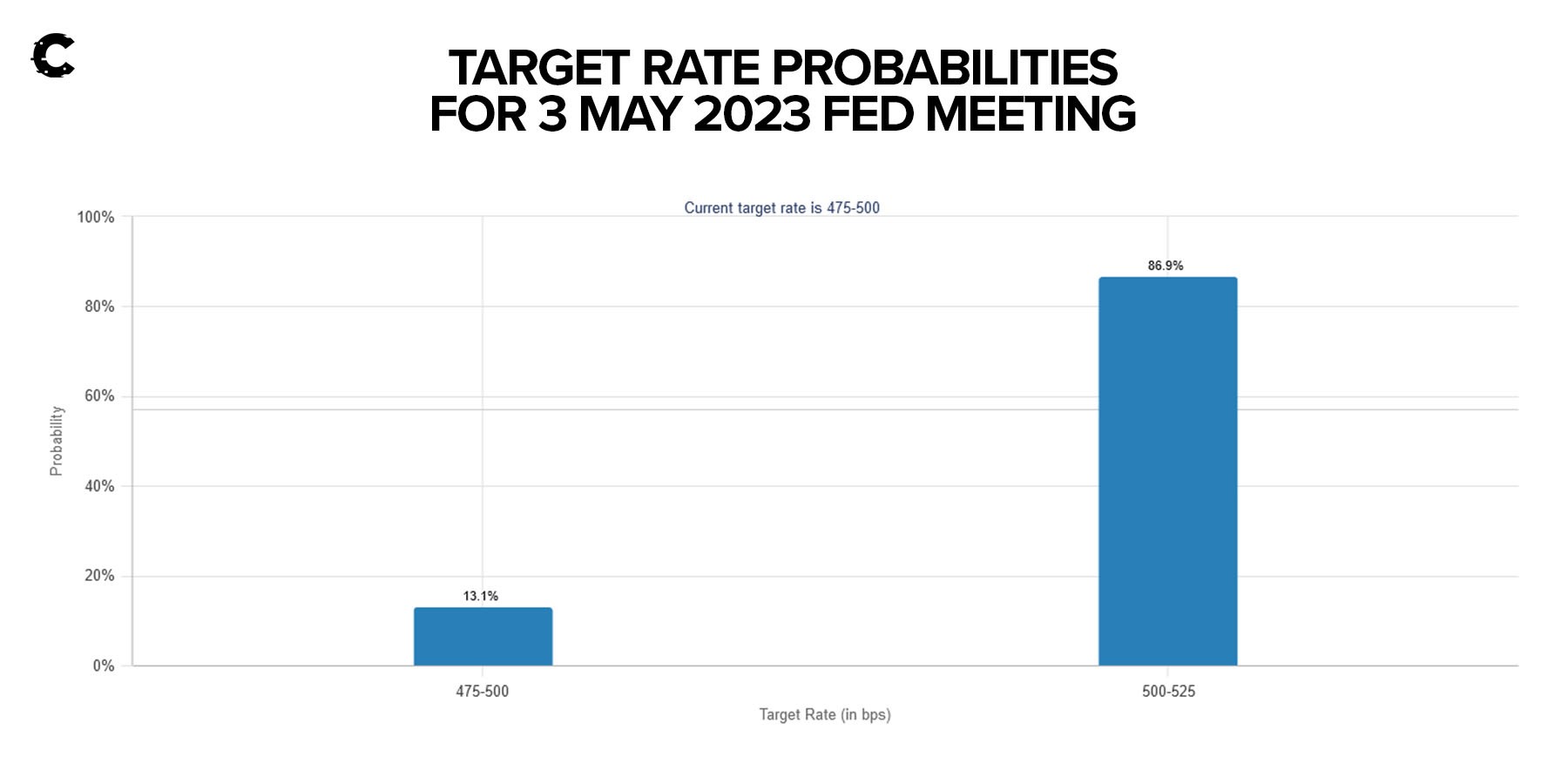

- The Feds meeting on Wednesday is expected to produce a hike of 25 basis points.

- It's the 9th straight hike in interest rates.

Macro news 👀

- Euro trades lower against the dollar as US economic data increases fears of a banking crisis. The punch line here is that the IMF managing director downplayed de-dollarisation risks – at the same time countries are openly making alternative international trade arrangements. If this goes on, look for stablecoins pegged to a wider variety of fiat currencies.

- Layoffs likely to continue in tech startups. Startups in America are paying the price as rising interest rates make borrowing more expensive. Layoffs are likely to continue through the end of the year. Look for weaker DeFi apps to fade away.

- OPEC's decision not a move against the US after all. Many saw OPEC’s recent production cuts as an economic move against the US at a crucial period in the fight against inflation. But recent oil prices suggest OPEC was just being smart. Weak demand sent oil prices dropping to $75 in April from an $83 peak. Still, US inflation rates make crypto an attractive alternative to a dollar that is declining in value and usefulness.

Key developments 🔑

Has world de-dollarisation begun?

This is bad for the US – really bad. The United States enjoys a privileged position in international markets because the dollar is the main settlement currency for cross-border transactions. Losing that advantage would be extremely detrimental to the US’s position as the leading global economic power.

Why the sudden interest in moving away from the dollar? It’s the speed and effectiveness of US sanctions on Russia. Settling trade in dollars gives the US leverage in imposing its political will on other countries.

A shift away from the dollar is long overdue. But we are against replacing the dollar with another national fiat currency. The same problems will arise. Passing the mantle from one central bank to another is not the solution. The future is decentralised.

State of the US economy

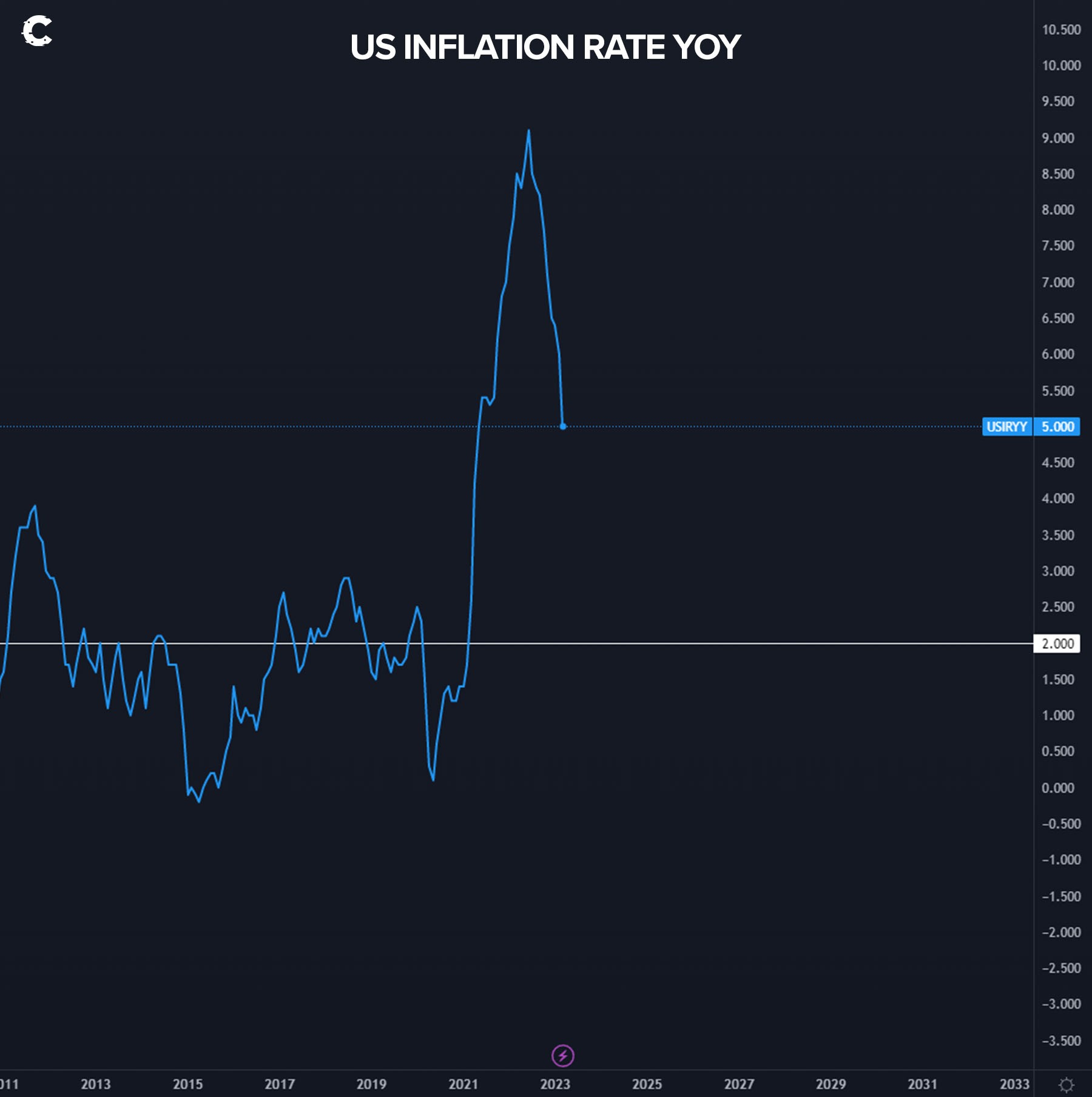

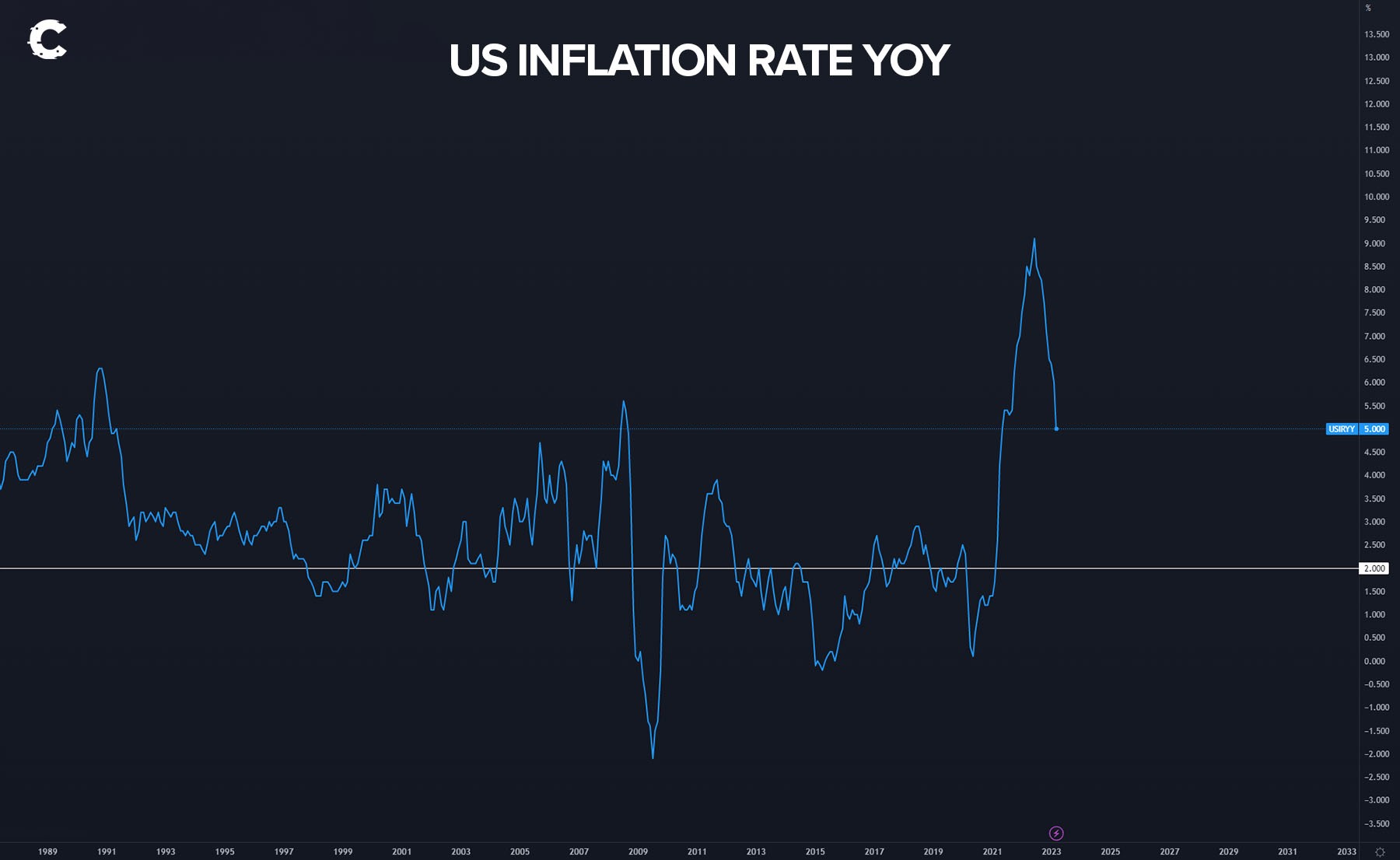

March 2023 headline inflation came in at 5%. Headline inflation includes food and energy, which tend to be volatile, so lower oil prices have affected the rate.

This is good progress, but US finance officials shouldn’t waste a lot of energy patting themselves on the back. The main reason for the apparent decline is that year-over-year figures don’t include the rise in food and energy prices caused by the Russia-Ukraine conflict in February and March of this year.

This is concerning because core inflation, which excludes food and energy, has seen a significantly slower rate of decline.

Core CPI dropped only about 0.2%. That’s a reduction of about 1.5% from the peak. Inflation is stickier than anticipated.

If core inflation continues to decline by only 0.2% every month, it will take more than a year to get the number back down to the target of 2%. With US GDP taking a hit and the banking sector in crisis, the Fed has some tough decisions ahead.

Hot narratives 🔥

1. Banking crisis?

Fears of a US banking crisis continue to grow. Under the “sky is falling” theory, Silicon Valley Bank was only the first domino. A series of banking failures followed, and now First Republic Bank has fallen. It was scooped up at auction by JPMorgan Chase for $10.6B. With assets under management of $230B, this is the second-largest bank failure in US history.In Acquiring First Republic Bank, JP Morgan Has:

1. Bypassed laws against acquiring bank while controlling 10%+ of US deposits2. Shared $13 billion in losses with the FDIC

3. Received a $50 billion loan from the FDIC

4. Effectively bought back its own deposits

5. Expects to…

— The Kobeissi Letter (@KobeissiLetter) May 1, 2023

The panic is largely overblown. Large banks like JPMorgan Chase are actually profiting from the crisis. This is nothing like 2008. The banking sector is essentially saving itself this time – and in the process, becoming more centralised and more monopolistic. Classic TradFi banking.

The US government appears to have waived a key rule by allowing JPMorgan’s acquisition of FRB. Regulations say no bank can hold more than 10% of total US deposits. It appears that regulators have allowed the acquisition to eliminate the need for direct government involvement. The last thing the administration needs is headlines saying it is bailing out banks for the second time in less than 20 years.

2. Federal Reserve meeting

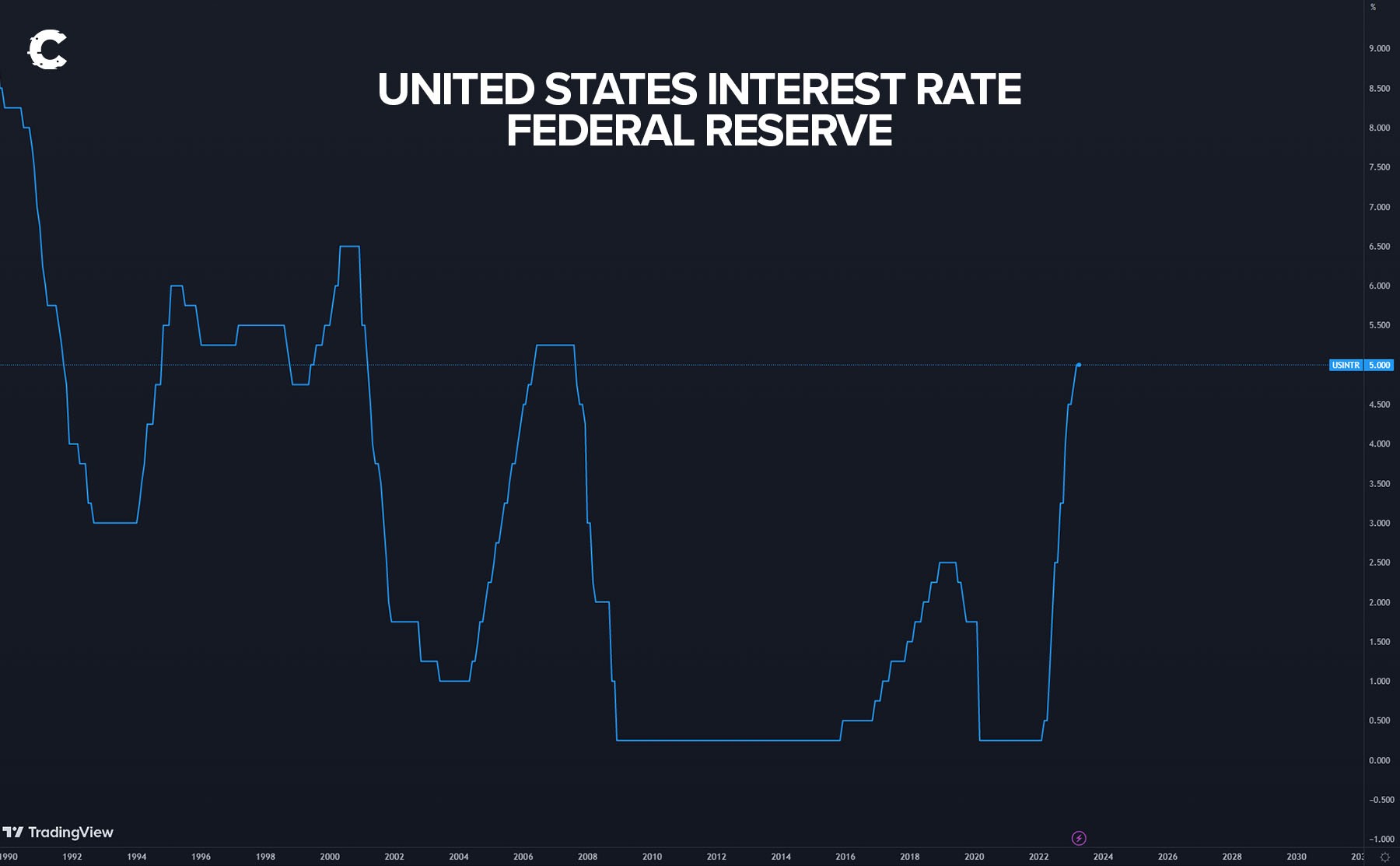

The US Federal Reserve’s Open Markets Committee will meet on the 3rd of May. Fed Chair Jerome Powell is expected to announce a rate hike of 25 basis points – the ninth straight hike. This would take the US federal funds rate to 5% - the highest in 17 years.

The chart reveals the sharpness of the rate hikes. This is essentially what is causing chaos in the US economy. Close to 0% rates for the better part of two decades, then BOOM – all of a sudden, rates rise to 5% in a little over 16 months.

It’s shocking – but it is also helping check US inflation rates.

It is this balancing act that Powell and the Fed are trying to play. Essentially, it’s a game of “How much damage can we do to the US economy without breaking it?” The goal is to reduce consumer spending and allow supply to catch up with demand.

How’s it going? Let’s put it into perspective:

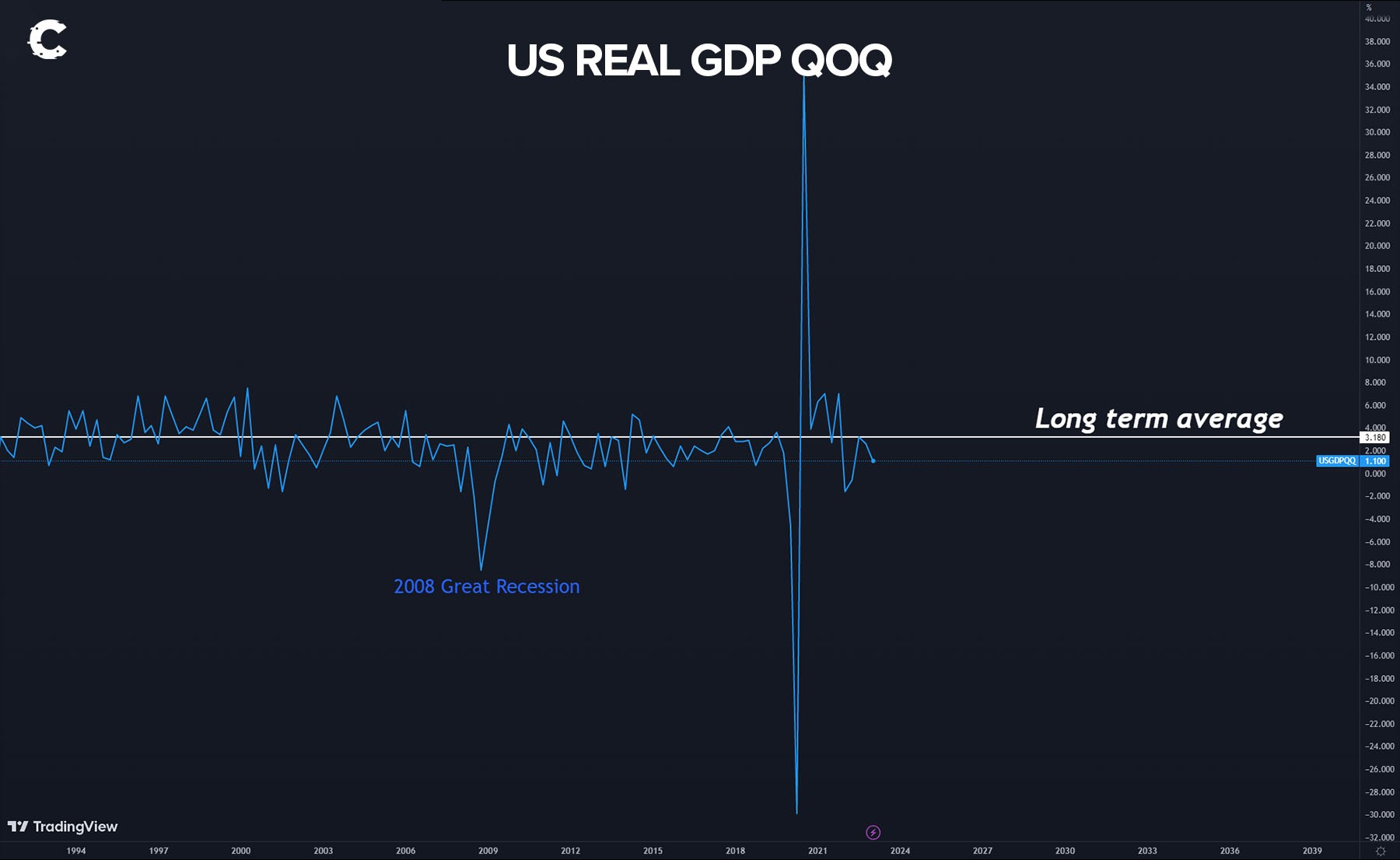

GDP growth for Q1 2023 was way lower than the expected 2%, coming in at 1.1%. We believe a recession is unavoidable. With the Fed hiking rates to 5 - 5.25% this week, we expect slow GDP growth to settle in for a while.

Cryptonary’s take 🧠

What will come down first – inflation or the US economy? With three banks failing in four months, we see the US economy as vulnerable.We believe the Fed is trying to engineer some form of recession: not quite enough to cause mass panic, but enough to slow consumer demand to sink inflation to 2%.

Don’t believe us? Here it is from Powell’s own mouth:

MUST WATCH:

Jerome Powell was prank called by Russians pretending to be Zelenksky.In the call, the Fed Chair admitted that a US recession is likely. “This is what it takes to get inflation down.” pic.twitter.com/t61gZGqw16

— Stephen Geiger (@Stephen_Geiger) April 27, 2023

This is important because crypto is a risk-on asset. The crypto market has followed risk-on assets like the stock market closely for the last two to three years. Risk-on assets typically do not perform well during recessions. If the US does enter a recessionary period, we can expect markets across the board to dump assets initially.

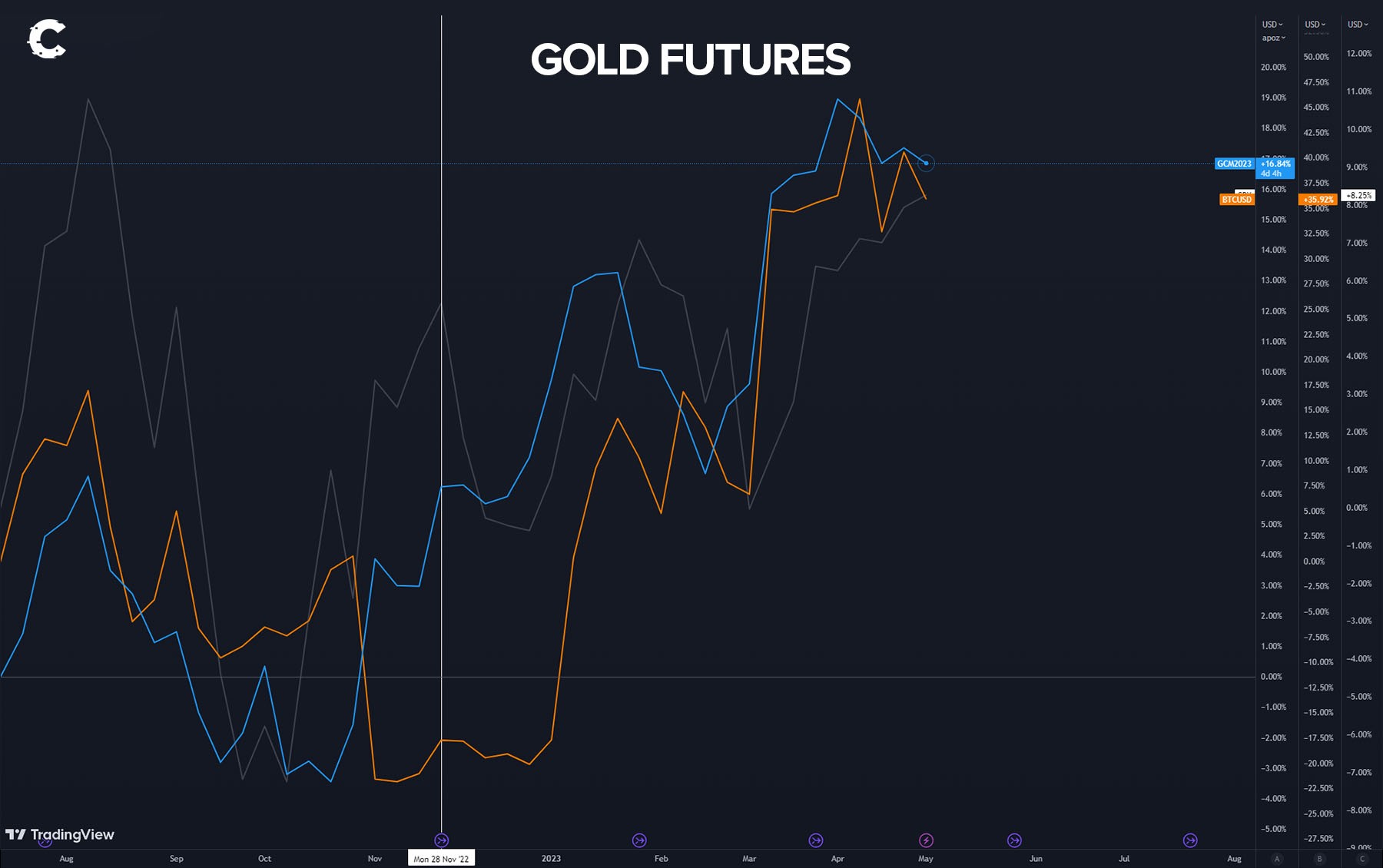

We don’t think the crypto market will be affected as badly as the stock market. Here’s why:

Gold is the TradFi go-to asset during recessionary periods. BTC – shown here in orange – has been tracking the general market structure of gold (the blue line) this year (except for the FTX turmoil in November to January). If this trend continues, then it is likely that BTC will react more like gold if and when a recession hits.

Markets pay close attention to Powell, who (usually) chooses his words carefully. If he states that the Fed has reached its target rate, expect a pump – this would be the pause that everyone’s waiting for. But he is unlikely to come right out and say it. So listen closely:

- If there is no sign of the usual “we anticipate continued rate increases to be appropriate” then a pause at the next meeting is unlikely. Bearish.

- The exclusion of remarks like that increases the odds of a pause at the next meeting. Bullish.

- Powell could begin talking more openly about a recession. Powell has said that a recession may be unavoidable, and he will certainly be asked questions about his statements in the clip that appeared on Twitter. Bearish.

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms