We discussed dYdX's DeFi expansion plans, the potential impact of the V4 upgrade on the dYdX token, and the implications for holders.

But we get it; your time is valuable. So, we've condensed all that conversation, including our insights on the dYdX token price, into a quick and easy read.

Get up to speed in just a few minutes. 👇

TLDR📃

- dYdX is the largest decentralised exchange (DEX) in DeFi, known for perpetual futures contract trading with a trading volume of $858.06 million.

- dYdX aims to onboard users from centralised exchanges into DeFi

- The V4 upgrade involves a significant shift that includes creating a chain on Cosmos for scalability and decentralisation.

- The dYdX token will transition from solely being a governance token to a Layer 1 token.

Disclaimer: This is not financial or investment advice. Any capital-related decisions you make are your full responsibility and yours only. The information made available in this report is NOT for replication. The purpose is to share the thought process behind our decision-making for entertainment purposes only.

What, Who, Why, Where, When?🤔

What is dYdX today?

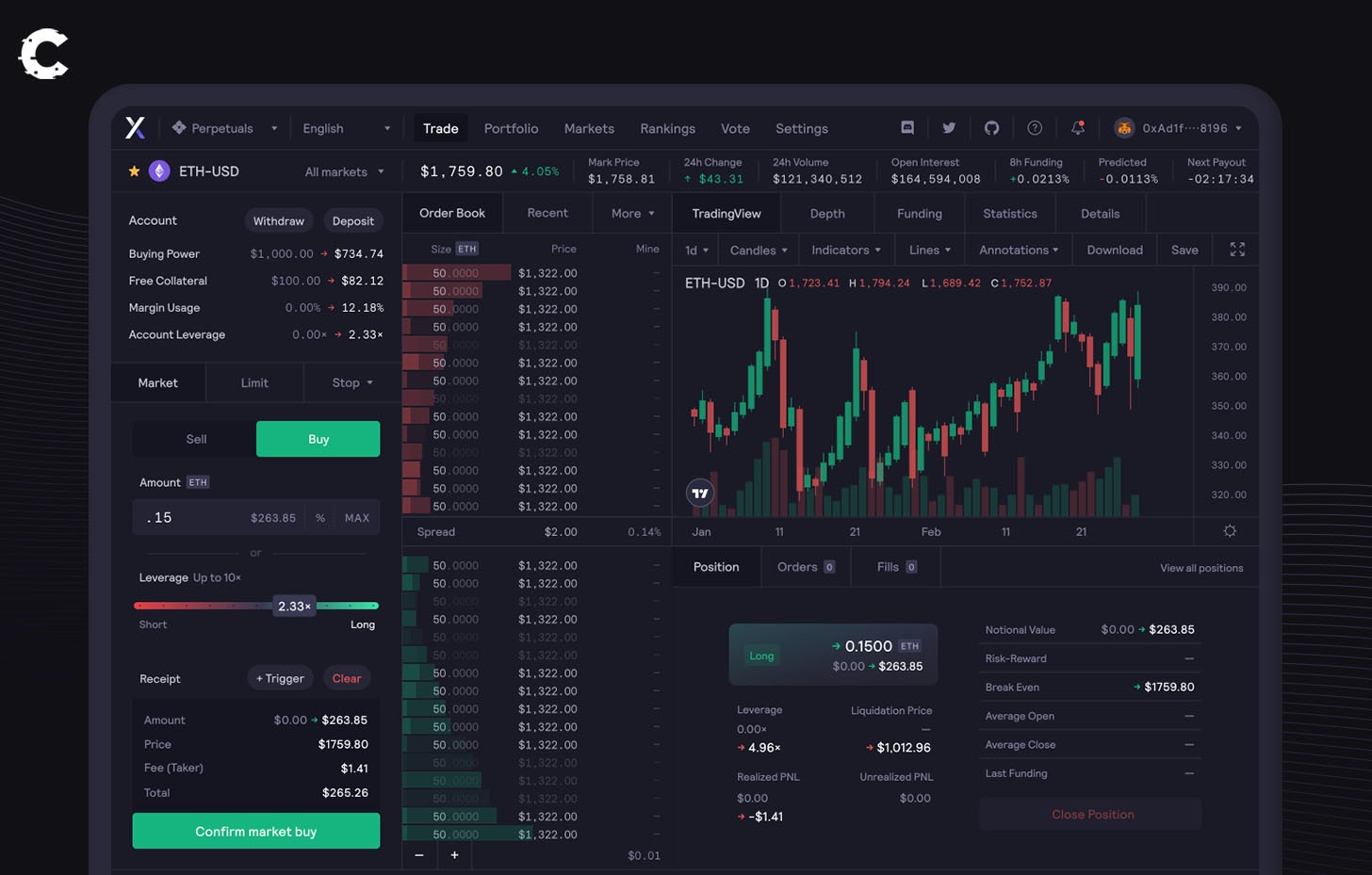

dYdX currently holds the title of DeFi's largest decentralised exchange (DEX), focusing on simplifying perpetual futures contract trading. It boasts substantial trading volumes of $858.06 million.

Established in 2017 by Antonio Juliano, dYdX launched officially in 2018. It initially gained recognition for spot trading and later introduced perpetual futures contracts. Its early launch positioned it among Ethereum's pioneering DeFi applications, where it grew to attract DeFi traders and investors.

Despite its early success, dYdX faced Ethereum's scalability challenges, prompting a shift to StarkEx, Starkware's Layer 2 solution, in 2020 for enhanced performance.

Today, dYdX confronts renewed scalability issues on Starkware, leading to its most significant endeavour yet: transitioning to its own dYdX Chain on Cosmos.

This strategic move paves the way for further ecosystem development and expansion through the forthcoming dYdX V4 upgrade.

Who is dYdX for?

While dYdX aims to onboard the people to DeFi. Its current focus is on advanced and institutional traders with a strong understanding of crypto and DeFi. These traders can use dYdX to replicate the centralised exchange experience while retaining control over their assets.The ultimate goal is to onboard institutions, market makers, and traditional finance players into DeFi by offering a superior product to centralised exchanges.

Why Do People Need dYdX?

dYdX has already become the largest decentralised perpetual exchange. However, the primary purpose behind dYdX's creation was to provide users with a centralised exchange-like experience while allowing them to self-custody their assets, eliminating counterparty risk.This use case has been emphasised even more as centralised exchanges have faced bankruptcy, resulting in customers losing their assets. Over the years, incidents involving exchanges such as Mt. Gox and FTX exemplify the risks of trusting third parties with your assets – not your keys, not your coins.

Where is dYdX going to be in the future?

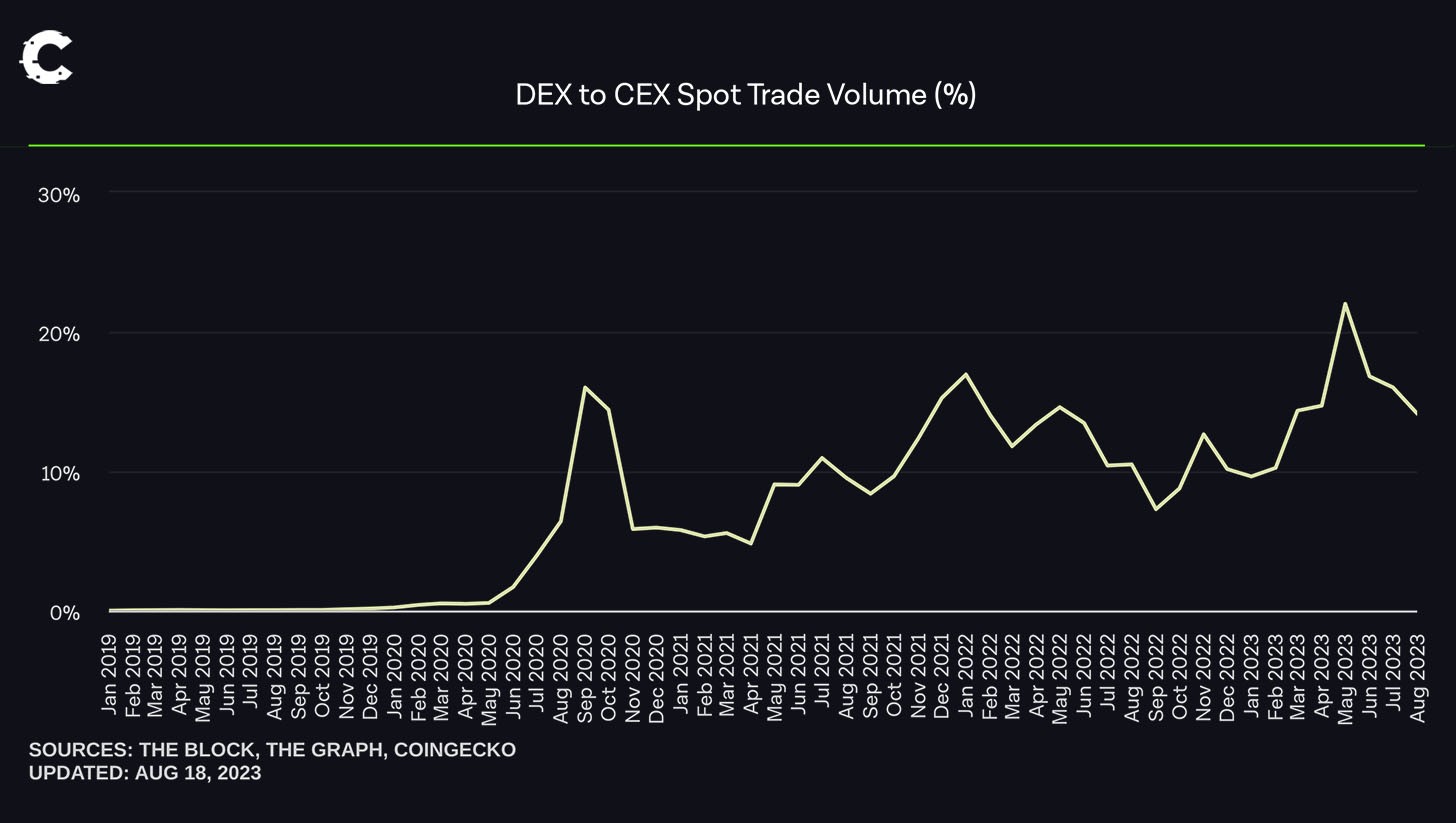

While dYdX is still in its early development stages, the dYdX Foundation expressed its objective again during the interview. And it’s quite straightforward: they want to onboard the remaining users who continue to trade on centralised exchanges into the world of DeFi.

A potential future scenario that would drive dYdX’s adoption involves integrating major centralised exchanges like Binance or Crypto.com. This integration will allow users to seamlessly trade on dYdX through these exchanges' websites or simplified interfaces.

Other scenarios involve substantially reducing entry barriers as wallets become more user-friendly. Other potential tailwinds include more user education and an increased understanding of the need to prioritise self-custody. This shift could prompt them to transition from centralised exchanges to platforms like dYdX.

When can we anticipate mass adoption?

According to the dYdX Foundation, dYdX is still in its early stages. The foundation projects that it would take dYdX about five years to achieve its goals. It's worth noting that many potential future scenarios for dYdX are highly speculative due to its long-term outlook.However, one of the first major steps dYdX has taken to reach this stage of mass adoption is the significant V4 upgrade, which will present their most significant challenge yet👇

dYdX V4 Upgrade: What's Inside 🔍

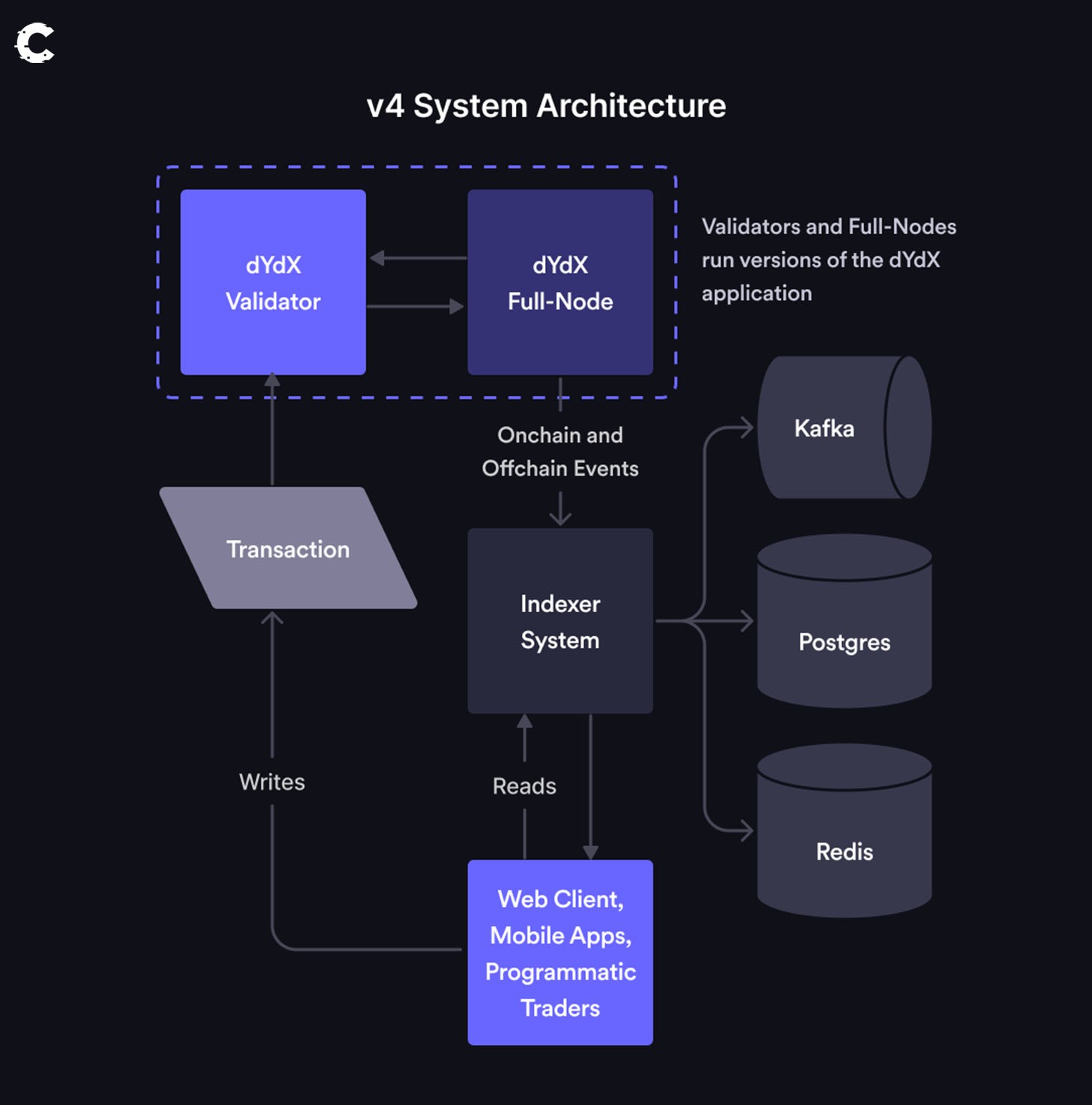

In dYdX V4, the protocol is making a significant shift. Instead of using existing infrastructure, it's building everything from the ground up with the Cosmos SDK.Why did dYdX choose this path, what are the pros and cons, and how will it affect the dYdX token?

Why is dYdX moving to its own chain?

According to the dYdX Foundation, one of the primary reasons for transitioning from its Layer 2 solution on StarkEx to its dedicated appchain on Cosmos is to enhance scalability. The move will also help it fully decentralise the off-chain order book and matching engine.They believe that such a level of decentralisation wasn't achievable with StarkEx.

Moving to Cosmos offers them greater customisation and the ability to design a solution that aligns best with their protocol rather than relying on existing solutions.

And why Cosmos? They opted for Cosmos because it offered the simplest route to creating a chain with its unique Layer 1 staking token.

The pros & cons of launching on Cosmos

However, in the crypto space, no single solution addresses every challenge. Therefore, let's explore some of the pros and cons of the move to dYdX Chain.Pros

- Users wouldn't pay gas fees to trade; instead, they'd pay fees based on executed trades.

- Having your chain allows for more incredible customizability and more control over the infrastructure, enabling specific components like the orderbook and sequencer to become more decentralised.

- The dYdX token can serve as the Layer 1 token, enabling users to stake it and become validators, enhancing its utility.

- By launching its chain, dYdX aims to boost its trades per second and improve finality, making it a more competitive alternative to centralised exchanges.

Cons

- Moving to Cosmos, dYdX loses Ethereum's security; setting up its initial validator set with only 60 validators is a potentially more centralised setup.

- dYdX might isolate itself on Cosmos without adequate cross-chain communication, especially due to lower liquidity on Cosmon than on Ethereum.

- A sharp decline in dYdX token value or reduced revenue could deter validators due to their reliance on the token's success, potentially impacting economic security.

How will the new chain impact the dYdX token?

Besides the protocol, the transition to the dYdX Chain will also affect the dYdX token, as its tokenomics and use case are scheduled for an overhaul.dYdX was known for rewarding traders based on their trading volume in dYdX tokens. This practice resulted in token inflation.

In V4, the foundation has introduced changes to the trading reward system, as outlined in a recent article, focusing on four key points.

- Stop people from making money by trading with themselves.

- Give rewards based on how much people pay in fees.

- Hand out rewards regularly, like every block.

- Don't let the protocol spend too much on trading rewards.

In addition, a significant change for the dYdX token is its transition from being solely a governance token to becoming a Layer 1 token. Validators securing dYdX will now need to stake the token for this purpose.

This would enable validators and individuals who delegate their dYdX to these validators to earn gas and trading fees. This allows people to generate additional yield on their dYdX tokens by contributing to the chain's security. The specific amounts are yet to be determined by governance.

What is the timeline for dYdX V4? 🕒

Things are moving quickly regarding the timeline, as dYdX V4 has been live on the testnet for a few months.On September 4th, a governance vote approved a proposal to transition dYdX to version 4 and make dYdX the Layer 1 token for its planned blockchain, setting the move in stone.

While no date is set in stone, the aim seems to be to have the mainnet live between September and October, which is already just around the corner.

But what do all these changes mean for the price of dYdX? Let's take a look👇

Our outlook on the dYdX token 📈

When it comes to dYdX, it's all about PATIENCE.

Since May '22, the asset mostly ranged inside a large accumulation area between $2.50 and $1. Specifically, dYdX has ranged (and continues to do so) for 483 days. We saw both levels tested multiple times, offering trading opportunities during this boring period.

To us, accumulating anywhere between $2.50 and $1 is a steal. The price of dYdX is slowly but surely preparing for the bull market, and with the Bitcoin halving arriving in April 2024, there's no better time to accumulate than in 2023.

As soon as we break $2.50, the race is on -market structures will turn bullish, and dYdX will be headed for the $4 - $4.40 resistance region, with the potential for higher targets such as $7 or $10.

Cryptonary's take 🧠

We support dYdX's direction but acknowledge risks like the limited number of validators. This calculated move aims to enhance dYdX's utility and user experience through the dYdX Chain.However, it's essential to note this isn't a short-term play; it's a long-term commitment, possibly taking up to 5 years to realise its full potential.

Considering impending investor unlocks, we advise caution. Holding some dYdX in your portfolio offers derivatives exposure, but its attractiveness hinges on a bullish market structure and the price breaking out above $2.50.

As always, thanks for reading! 🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms