So what’s happening this week?

$32B+ worth of $ETH unlocks in a matter of days, but don't panic just yet! Discover why this massive Ethereum event may not create the selling pressure you might expect, and learn why we think this could actually bolster the market’s optimistic outlook.

TLDR

- $32B worth of $ETH will be unlocked on April 12. The real selling pressure will be much lower than that number.

- $ETH’s yearly supply growth rate moved from -0.1% to -0.3% in the space of only one week..

- 330,000 $ETH (worth $600M) has been withdrawn from exchanges.

- Layer 2 chains are the place to be for juicy opportunities, NFTs are not.

- Share this report with your family and friends!

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your responsibility and yours only.

$32B+ in $ETH unlocked in the coming days 📉

The “Shanghai Upgrade” is scheduled for April 12th - barely over one week away, as of this writing. This upgrade is the final stage of the merge where Ethereum PoS stakers will finally be able to withdraw their assets. This means the 18M ETH ($32B+) that are currently in the staking contract will be available for withdrawal.You might be thinking that this will cause massive selling pressure and because people are able to withdraw, they will. The resulting massive waves of sales will cause $ETH to drop to under $1,000.

That’s a scary scenario, huh? Well, let’s take a look at a few facts that prove the above thought process is wrong:

- On average, $ETH stakers are still at a -15% loss on their assets. People who have held their $ETH for 30+ months are likely believers, and probably won’t sell at a loss.

- About half (31%) of the stakers used a liquid staking protocol like Lido. These protocols allow them to “stay liquid”, meaning they can sell them on the market for the current price of $ETH. This upgrade does not impact these holdings.

- Only 1,800 depositors are able to withdraw each day. Those investors have 32 $ETH staked apiece, meaning only 57,600 $ETH can be withdrawn per day. So, there would be a maximum of $100M in daily selling pressure should those depositors sell.

- 33% of the $ETH is staked with Lido alone, and none of it will be available for withdrawal until the holders go through all of the necessary security checks and the protocol upgrade in mid-May 2023.

TLDR: While $32B worth of $ETH will be available for withdrawal, much of it will not be sold on the market immediately. 1M $ETH are likely to be sold (total: $1.8B), which can cause a price decrease, and a pullback from our target level of [$2,000-$2,200].

ETHonomics 💱

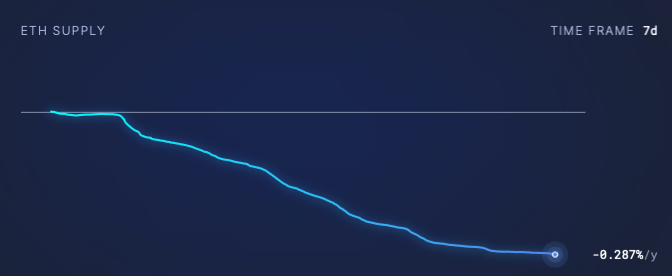

[caption id="attachment_268998" align="aligncenter" width="672"] ETH yearly supply growth rate[/caption]

ETH yearly supply growth rate[/caption]

We did not expect to cover ETHonomics again so soon but the supply growth rate (how much new $ETH is created over time) has dropped by almost 3X. 👀

Only last week it was -0.108% and now it’s sitting at -0.287%. A negative rate means $ETH is deflationary and more attractive as a long-term investment. The less there is of something, the more valuable it becomes.

ETH price chart 📈

[caption id="attachment_268996" align="aligncenter" width="1251"] ETH/USD price chart[/caption]

ETH/USD price chart[/caption]

[caption id="attachment_268997" align="aligncenter" width="2388"] ETH/USD price chart[/caption]

ETH/USD price chart[/caption]

$ETH continues to set higher highs and higher lows on the chart, indicating a bullish market structure. The target sits at $2,200, but it’s very likely that we see a pullback from $2,000 that coincides with $BTC hitting $30,000.

We remain holders of $ETH as long as this market structure stays bullish. If the price were to break below $1,700, we would re-evaluate.

Balance on exchanges 🏦

More than 330,000 $ETH ($600M) have been withdrawn from exchanges since March 21. When there's less $ETH on exchanges, it means investors are holding on to their coins and not selling them. This shows that they believe the price will go up, which is a bullish indicator.

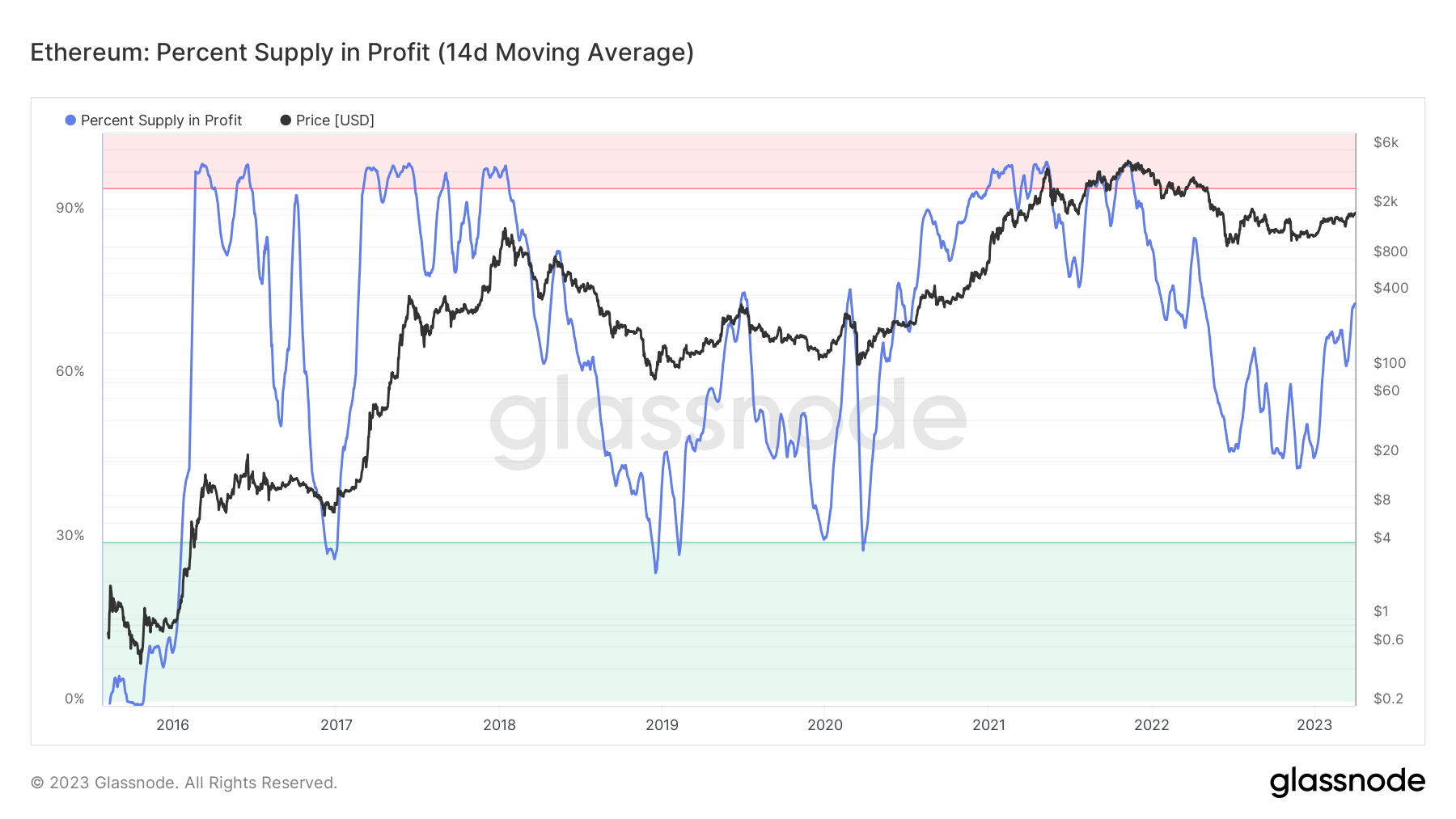

Supply in profit 💵

This chart is self-explanatory from the title, it shows you the percentage of $ETH that is in profit. Right now, 73% of all $ETH is in this state. Historically, figures over 90% indicated an upcoming top. The market isn’t far off from those numbers.

The Ethereum ecosystem 🌖

Decentralised finance (DeFi)

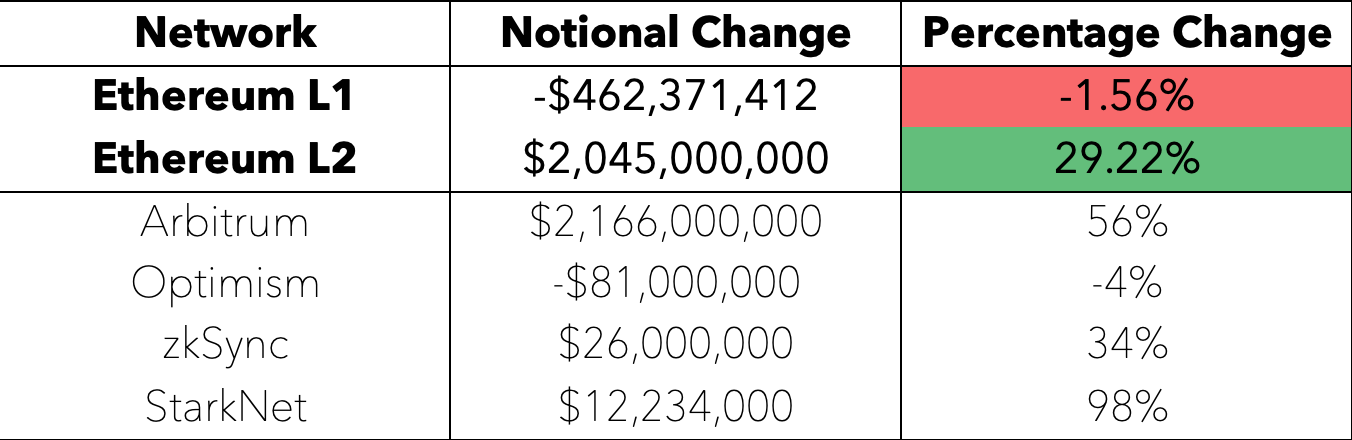

This is the only table you need to look at for an overview of DeFi on Ethereum.

As you can see, the real activity and growth is happening on layer 2s and not the main Ethereum layer 1 chain. The numbers we are seeing indicate that it truly is “L2 Season”!

Arbitrum has been able to attract a lot of new capital after the drop of their much-awaited $ARB token. We’ve made money on a few tokens belonging to this ecosystem and we just launched our new watchlist (view here).

One major issue with Arbitrum was their decision to give 750M $ARB (7.5% of the supply) to the Arbitrum Foundation. Most foundations have a similar allocation but this one in particular was problematic - why?

Because Arbitrum f’d up with poor communication. They presented it as a proposal that holders could vote on, when the decision seemed pre-made, defeating the purpose of decentralisation. Had they allocated those funds to the foundation before launching the token and written about this in the documentation, we’re certain there wouldn’t have been an issue. This is solvable but Arbitrum needed to offer a transparent statement to calm the nerves of their holders - which they did.

Thanks to all the DAO participants and delegates for their feedback on AIP-1. It likely will not pass and we are committed to addressing the feedback received from the community.

More details in the thread 🧵👇— Arbitrum (💙,🧡) (@arbitrum) April 2, 2023

Optimism is, as always, dead, but its two other rival are certainly not. zkSync launched on mainnet and attracted $100M in TVL (total value locked) in a week. Meanwhile, StarkNet doubled its own TVL. Both zkSync and StarkNet are token-less, so we’d strongly recommend looking into those juicy airdrops (learn how here).

For a more in-depth review of DeFi, read our dedicated digest!

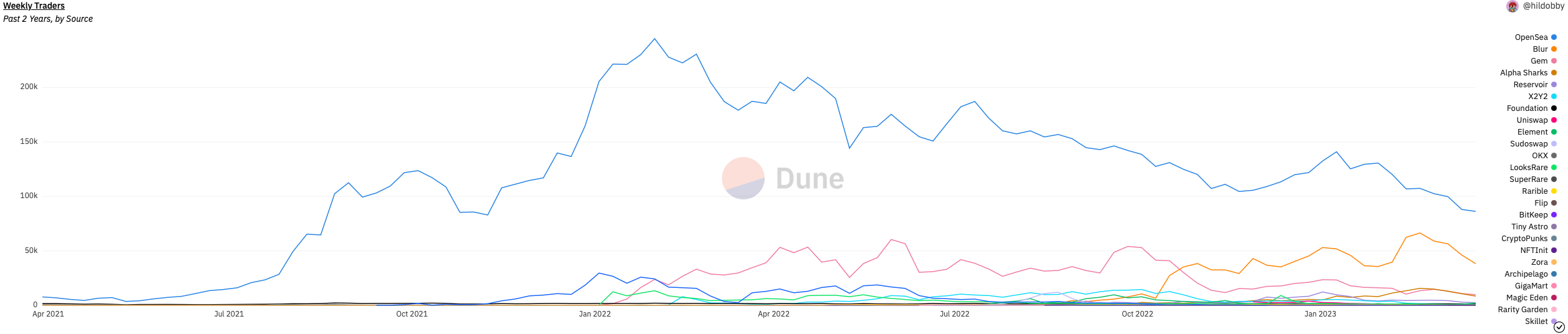

NFTs

The NFT market remains calm, and rather boring. The excitement is happening across a few collections only, which we’ll be presenting to you in the our first NFT digest this week 🖼️We previously looked at the behaviour of NFT traders, and noted their activity continues to trend down. There was one exception to the rule, Blur marketplace, but we knew this uptick wouldn’t last long as the project relies on incentives. Sure enough, it’s subsequently dropping as expected 👇🏼

Cryptonary’s take 🎯

In conclusion, the upcoming $32B ETH unlock will not lead to the massive selling pressure many fear, as various factors will severely limit the impact.With the $ETH supply growth rate becoming more negative and a significant amount of $ETH withdrawn from exchanges, the market outlook remains optimistic and our [$2,000-$2,200] target remains.

If you are looking for juicy opportunities then layer 2s are the place to be. They continue to thrive, and to gain market share, capital, users and developer interest. The same cannot be said of the NFT market.

Stay informed and make calculated decisions in this dynamic market.

As always, thank you for reading 🙏🏼

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms