Ethereum Digest: Deflation, surging stakes, and bears

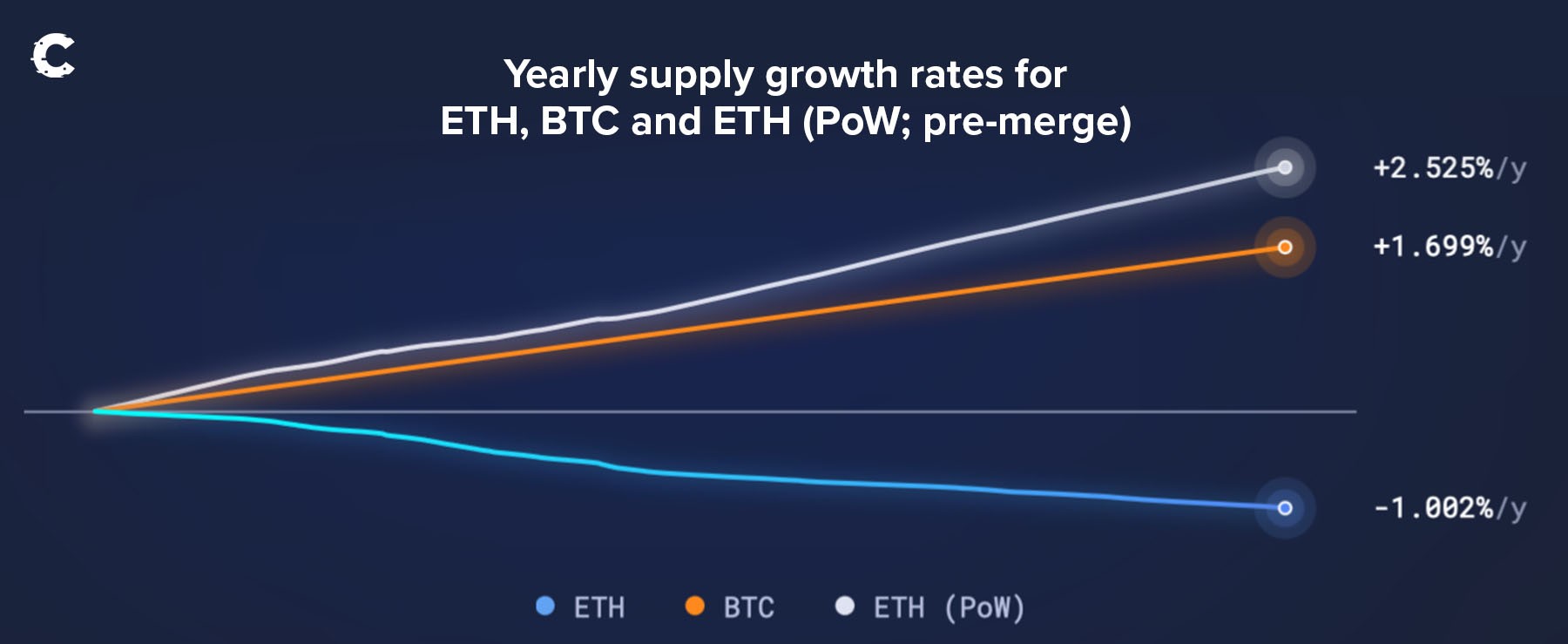

Hold on to your hats, folks! ETH's yearly supply growth rate keeps plunging, hitting a new low of -1%. So while BTC's supply grows at a steady +1.7% per year, ETH's is actually shrinking. That's right, ETH is deflationary now, making it even more precious to long-term investors.

TLDR 📃

- Ethereum's yearly supply growth rate just hit a record low, making it deflationary. How cool is that?

- The bears predicted otherwise, but the Shanghai upgrade actually bumped up the percentage of staked ETH. Go Ethereum!

- ETH's technicals might be bearish, but if it holds steady at $1,850 support, there's still hope for a comeback. If not, $1,400 is coming.

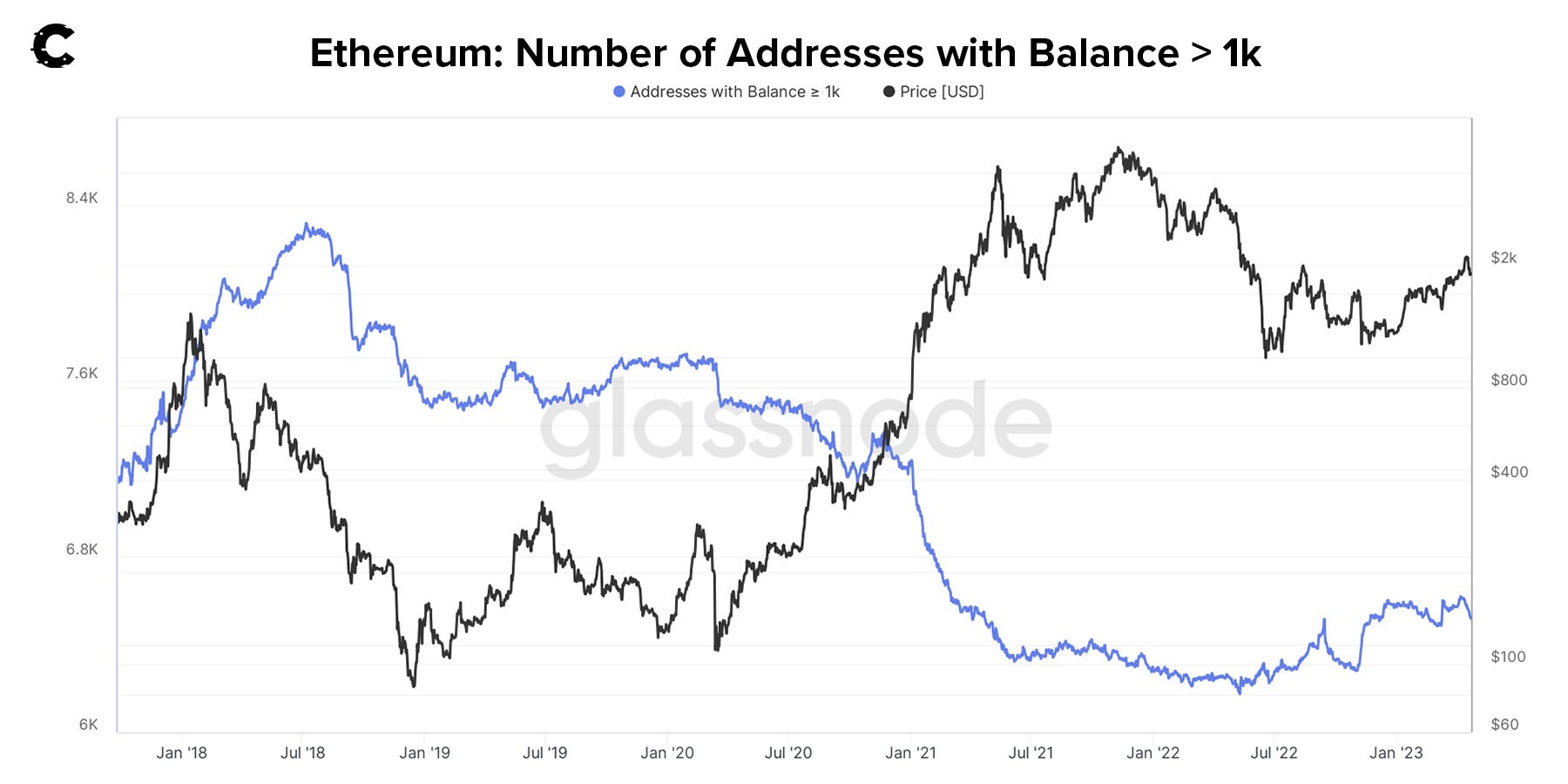

- While the market's been a bit rough, ETH whales are staying cool as cucumbers, and we're even seeing an uptrend in their numbers.

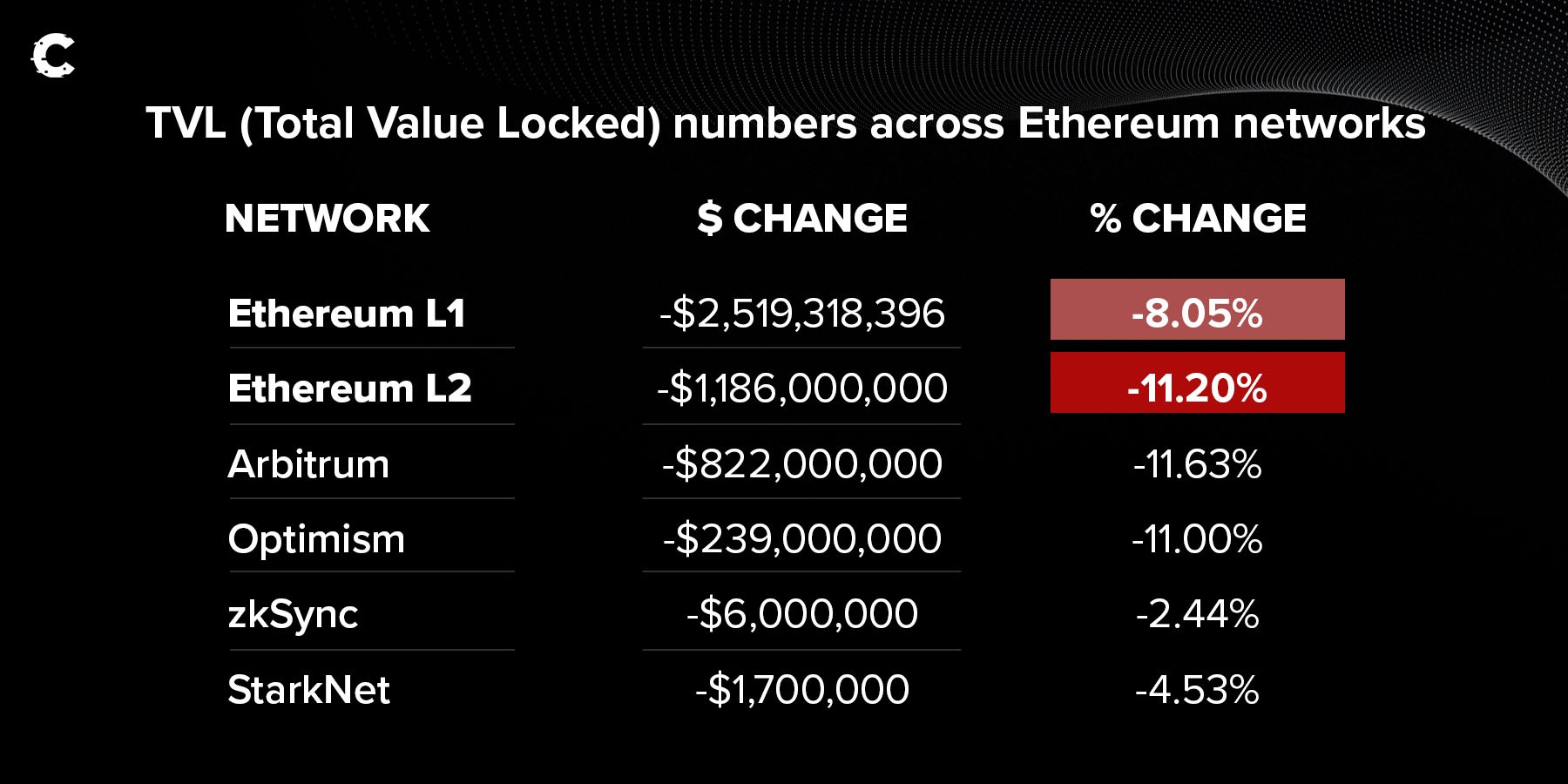

- DeFi on Ethereum took an 11% hit in total value locked, but it's mostly tied to ETH price fluctuations, so don't fret.

- NFT enthusiasts, hang in there! Market sentiment is bearish for now, but we expect the spotlight to shine on NFTs again before long.

Disclaimer: Not financial or investment advice. Any capital-related decision you make is your full responsibility.

The fundamentals are better than ever before 💥

ETHonomics

Stakers keep staking

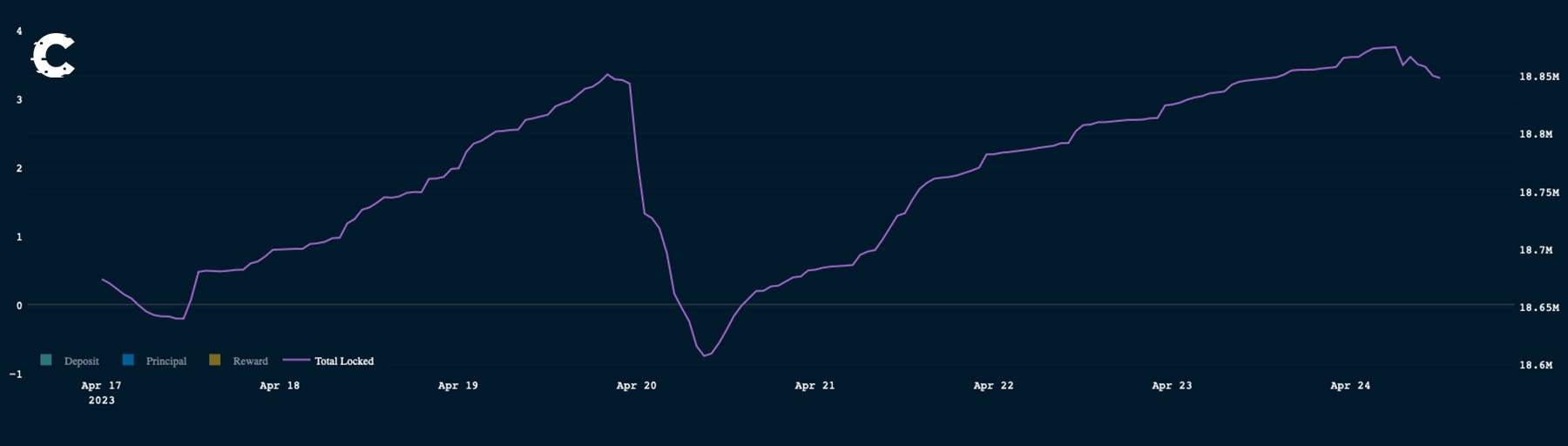

Here's a fun fact: The number of ETH staked matters because it represents locked-up ETH that’s unavailable for sale. Combine the lock-ups with a decreasing supply, and you've got a recipe for sky-high ETH prices over time.

Now, when Ethereum staking kicked off with the Shanghai upgrade on April 12th, naysayers thought the number of staked ETH would drop as people cashed out. But surprise, surprise — the number of staked ETH actually increased! Before the upgrade, 15.4% of ETH supply was staked, and now it's risen to 15.8%. Turns out the upgrade was a win-win.

And we're not done yet! We're pretty sure the percentage of staked ETH will keep growing, reaching 30%. So buckle up and expect more excitement!

The technicals aren’t as good… 📉

Price analysis

ETH's technicals may be in better shape than BTC's, but they're still looking a bit bearish. We've witnessed a shift in market structure from bullish to bearish, complete with a new daily low and a pesky quasi-bearish engulfing candle (the worst kind). But don't worry, ETH might have a chance to save the day if it can hold on to the $1,850 support level.

Here's the game plan:

- If ETH can cling to $1,850, we'll see it bouncing between $1,850 and $2,000 until it finally breaks free to the upside, putting us back on the bullish express.

- But if ETH slips below $1,850, watch out — it could take a tumble, potentially sinking to $1,400.

Funding rate

Here's another reason to be excited about ETH over BTC: the funding rate.

The funding rate is the volume of regular payments exchanged between those betting on price increases (longs) and decreases (shorts) in perpetual futures contracts.

The rate has recently gone negative, which is actually a good thing! It signals that a local bottom is close or already here, meaning a bounce could be just around the corner. And wouldn't you know it, this lines up perfectly with ETH's $1,850 support level.

Smart money 💵

All right, let's take a break from the numbers and check in on the whales.

Both BTC and ETH whales are keeping their cool during this market downturn. This chart shows two key points:

- A downtrend in the number of whales in 2021 — they were busy selling into the rally and cashing in on profits.

- An uptrend starting mid-2022, with new whales joining in to capitalise on the next bull run. Sure, there's a tiny dip lately, but the overall uptrend is what we long-term investors love to see.

Ethereum ecosystem 🌐

DeFi

If you want a quick snapshot of decentralised finance on Ethereum, this is the table you need:👇🏼

The Ethereum DeFi ecosystem has lost over $3.5B in capital. But don't panic — this 11% drop isn't too crazy when you consider that ETH prices have fallen by 13%. DeFi and ETH are pretty closely tied together, after all.

Want to dig even deeper? Check out our DeFi and L2 digests!

NFTs

Here’s a preview of the NFT digest we’ll publish on Wednesday: 👀Bearish market sentiment continues exacerbated by the recent climb in ETH and memecoin season. We expect attention to eventually rotate back to NFTs, especially considering the fact that PEPE and WOJACK were both created by NFT communities.

In the meantime there are two viable approaches:

- *Dollar cost averaging into flagship ecosystems like *******************.

- ******** out and ****************.

Stay tuned!

Cryptonary’s take 🧠

With ETH's yearly supply growth rate hitting a new low of -1%, it's now deflationary and increasingly scarce — excellent news for long-term investors. The percentage of staked ETH defied bearish expectations and actually increased since the Shanghai upgrade.Although ETH's technicals are currently bearish, there's a glimmer of hope if it can maintain support at $1,850. The negative funding rate may even signal a local bottom and a bounce back. But if the $1,850 support breaks, we could see ETH sliding down to $1,400 soon.

Despite the market downturn, ETH whales remain calm, and there's been an uptrend in whale numbers since mid-2022. DeFi on Ethereum experienced an 11% drop in TVL, which is closely linked to ETH price fluctuations. While NFT market sentiment is bearish for the time being, we anticipate attention's eventual return.

What's your takeaway?

Ethereum is demonstrating resilience in a bearish market, with promising signs for the future. Keep an eye on the $1,850 support level: Its fate could determine whether we see a bounce or a drop to $1,400. Stay informed, watch the market closely, and as always, thank you for reading.

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms