TLDR 📃

- Shanghai Upgrade went live opening up withdrawals for stakers and pushed up the price of ETH to $2,100+.

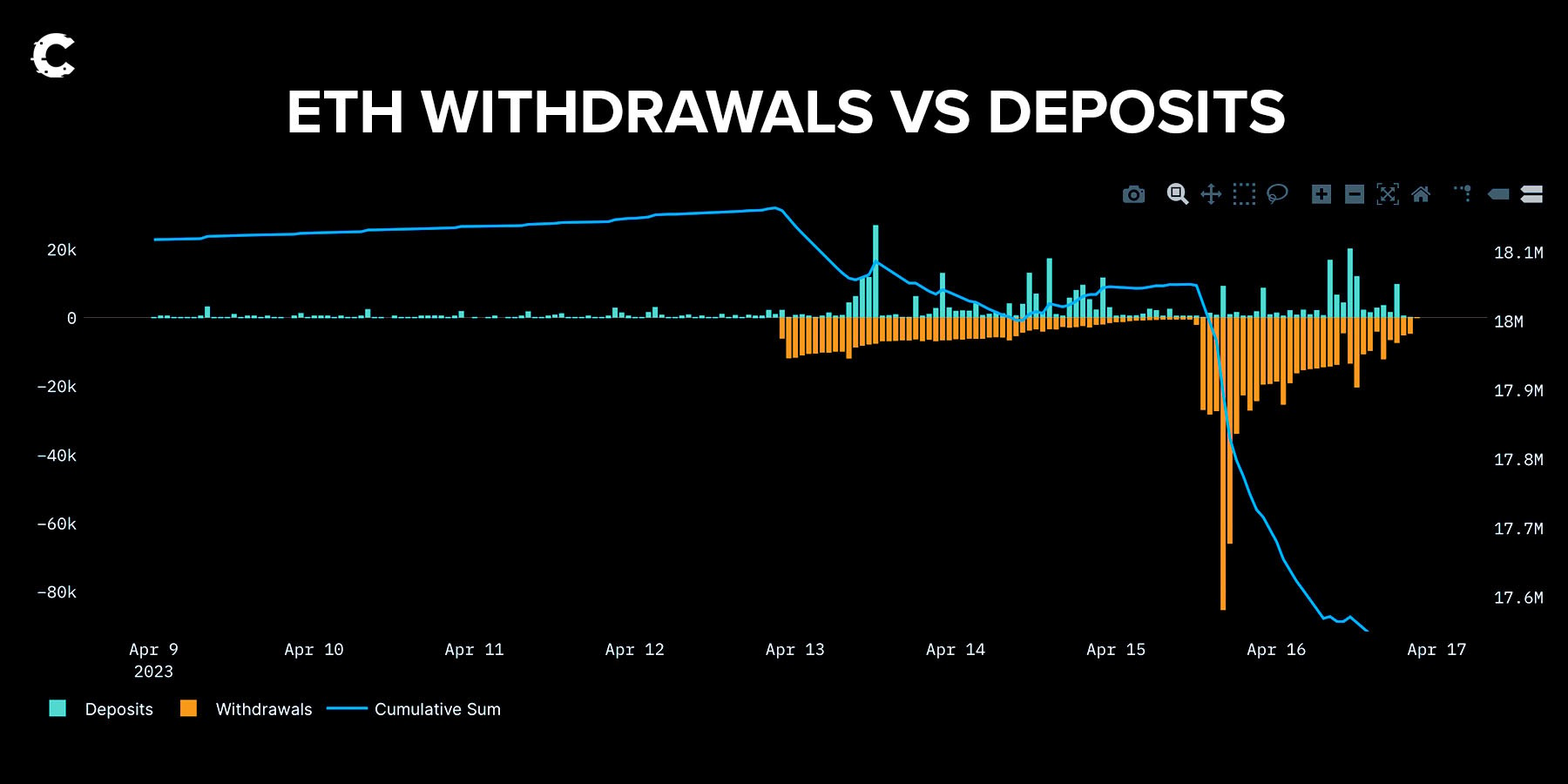

- 218,000 ETH withdrawn, 106,000 ETH deposited, making it a net change of -112,000 ETH.

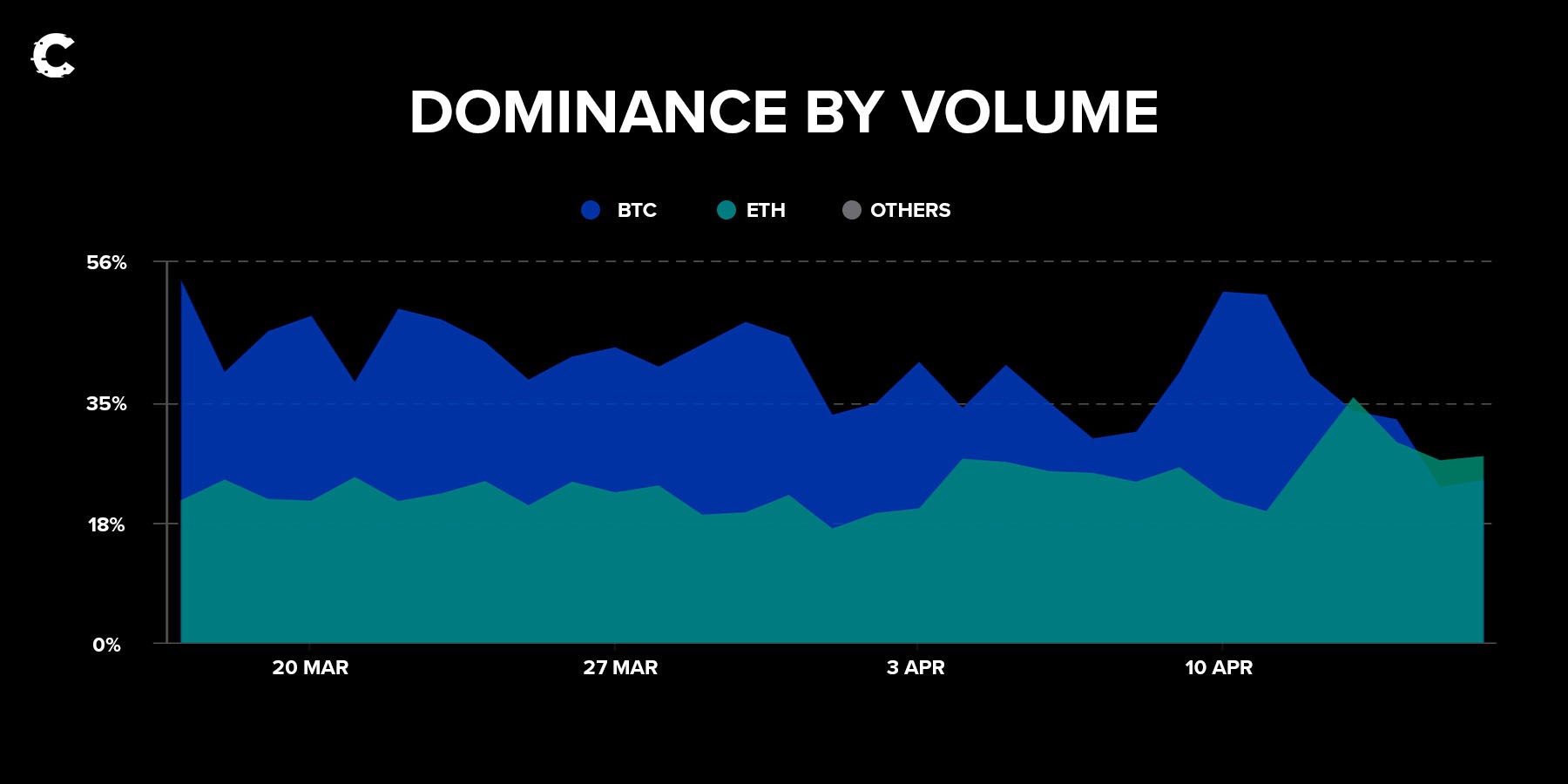

- Interestingly, ETH surpassed BTC in trading volume after the upgrade.

- ETH price is closing in on the $2,200 resistance, rally's still alive but reaching limits.

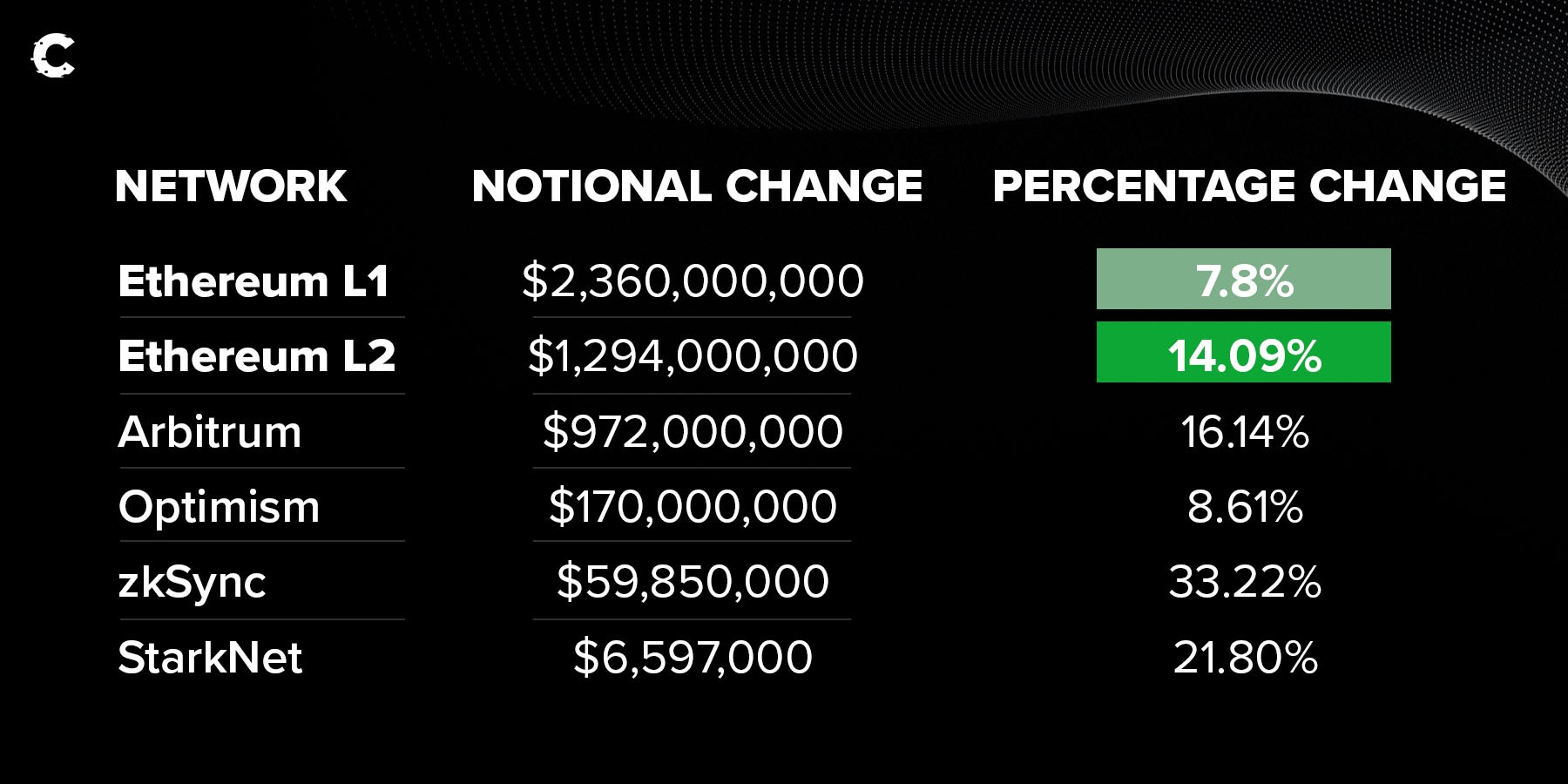

- L1 DeFi TVL growth is lackluster compared to Layer-2s, with zkSync & Arbitrum leading the way.

- Share this digest with your family and friends!

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your responsibility and yours only.

No, ETH withdrawals didn't crash the market💰

Last week, Ethereum’s Shanghai Upgrade finally went live! ICYMI 👇🏼The Ethereum Shanghai/Capella Hard Fork is coming tomorrow (12 April) and it will unlock $34,000,000,000 in ETH.

Worried and want to sell?5 reasons why we think you’d be overreacting 🧵 pic.twitter.com/UUdOtD3bZv

— Cryptonary (@cryptonary) April 11, 2023

Most people were bearish before the upgrade, yet as soon as it went live ETH’s price surged from under $1,900 to $2,100+. Did you panic sell sir? We told you you’d be overreacting.

Here's a quick lowdown on the on-chain action:

We've got "partial" and "full" withdrawals. While partial ones are pretty normal (claiming staking rewards), full withdrawals might hint at validators bidding adieu. However, some full withdrawals are expected as people test the upgrade.

Now, here's some tea: Kraken, a big-time crypto exchange, had to shut down its staking service and is currently withdrawing a whopping 1.2M ETH. But don't freak out – that ETH is very likely to be re-staked elsewhere.

Now the juicy data:

Here's the scoop: 218,000 ETH have been withdrawn, and 106,000 ETH deposited so far, resulting in a net change of -112,000 ETH (that's over $230M!). There's still an exit queue of 848,000 ETH, with 83.2% of it coming from centralised exchanges like Kraken, Binance, and Coinbase.

No worries, though – unstaking rates are pretty low at the moment. We'll keep tabs on it and fill you in next week. For now, things are looking way better than people anticipated!

ETH overtakes BTC in volumes

You know what's interesting? Although BTC’s market cap and trading volumes are larger than ETH’s, the recent Shanghai Upgrade has turned the tables a bit.

Right when the upgrade happened, ETH’s trading volume share actually overtook Bitcoin's! Now, some might say it's a one-time thing, but we reckon it's part of a bigger trend. BTC and ETH have been battling it out for volume-share for quite a while, taking turns at the top.

So, who'll come out on top in the end? If we had to put our money on one of them, we'd choose ETH – but we're not expecting that to happen overnight. Stay tuned, and let's see how this crypto tug-of-war unfolds!

Price analysis 📈

Alright, folks, time to claim some bragging rights!

We told you ETH was on its way to hit $2,200 (our first target), and now it's less than 4% away. Last week, we mentioned the need for the $1,845 level to hold for this push to happen – and guess what? It played out just as expected.

So, what's next?

We need to see how ETH’s price reacts to the $2,200 resistance. Will it flip from resistance to support like Bitcoin did? Or will it bounce off and put an end to the rally?

This single chart can't give us the full story, so let's dig a bit deeper into the data.

Futures’ market health 🚑

To answer the above question, we have to get to the heart of the matter: is this rally still going strong, or is it about to run out of steam?

To figure that out, we need to look at a couple of key indicators: the funding rate and open interest. Here's a quick refresher:

- Funding rate: the regular payments between those betting on price increases (longs) and decreases (shorts) in perpetual futures contracts.

- Open interest: the total number of open perpetual futures contracts at any given time, showing the market's overall activity and liquidity.

A sky-high funding rate means folks holding long positions are paying through the nose to maintain them, which is a red flag that the market is overheating. Take a look at the 2021 circled example on the chart – it led to a bearish rally. Currently, the funding rate has been creeping up, but it's not in the danger zone just yet.

Now, open interest (OI) is a bit more complex, so stick with us here. We're looking for an inverse relationship between price and OI – either "price up, OI down" or "price down, OI up". Why does that matter? Well, it shows that most traders are betting against the market (not the sharpest move). Eventually, these contrarians will cave and jump on the bandwagon, giving the price an extra push. This shift marks the beginning of the end, and Ethereum has reached that point.

Lately, traders have been coming to terms with ETH's trajectory, and both price and OI are moving together. The rally will probably wrap up when the funding rate starts to overheat. So, when you put all the pieces together, it looks like this rally still has some life left in it, but it's inching closer to its limit.

Ethereum ecosystem 🌐

DeFi (Decentralised Finance)

Let's take a quick peek at Ethereum's DeFi landscape from a bird's eye view ⬇️

We've seen some movement as TVL (total value locked) has gone up, but it's been a bit underwhelming. With ETH up by 14.4% over the last week, a 7.9% jump in TVL isn't all that impressive. If you're after a more in-depth review of DeFi, check out our dedicated digest here.

On the other hand, Layer-2s have been shining with double-digit TVL growth. zkSync leads the pack in terms of percentage change, while Arbitrum has gained the most value in dollars. Adding $1B in a week is quite the achievement! 👀 Yes, we also have a dedicated L2 digest!

Speaking of Arbitrum, its token ARB has shot up by 45% in the past week alone. We'll let you in on a little secret – we covered it in our previous SITG report. Fancy getting exclusive insights like these? Why not upgrade to our Cryptonary Pro membership? With Pro access, you'll unlock our monthly Skin in the Game (SITG) reports and loads more valuable content to stay ahead of the curve.

NFTs 🖼️

Here is an extract from our NFT digest that’s filled with alpha 👀”If ETH continues to surge expect to see NFT prices fall in ETH denomination while remaining stable in USD. Historically, ETH valuations do eventually stabilise before being followed by the strongest collections making major gains as Crypto Traders look to roll their profits back into NFTs.

This is a great time to snipe bargains if you are looking to make long term investments. We see Cryptopunks, Azuki, Beanz, Captainz, DeGods, y00ts and Pudgy Penguins as the collections to watch. Azuki/Beanz are particularly bullish considering the number of grail sales in the collection and provide a nice entry for newcomers into the NFT space.”

Cryptonary’s take 🧠

Ethereum had a banger of a week! Upgrades coming through smoothly, price rising and capital flowing in.The long-term vision for ETH has never been brighter. The short-term though, is in limbo land. This rally still has fuel but it’s increasingly looking like a top is coming soon so tread carefully!

Layer-2s are still buzzing with opportunities, and Arbitrum is shaping up to be this cycle's Solana, keeping L2s as the prime hotspot. NFTs are just about ready to shine too! Stay in the loop with our other digests and Alpha reports to ensure you're well-prepared to seize all the exciting prospects on the horizon.

As always, thank you for reading.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms