Ethereum Digest: Who’s selling all that ETH? The answer will surprise you

You know how people usually focus on revenue when talking about crypto-businesses? Have you ever thought about looking at their actual earnings instead? Revenue can be a bit misleading, since many projects offer incentives – which means they're basically paying to get activity and boost revenue. What really matters is their earnings. You know… profits.

TLDR 📃

- Ethereum earnings are soaring, with ~$50M in profit in just two days!

- Staking is thriving as new staking deposits reach an all-time high after the Shanghai upgrade.

- Somebody with a track record of selling at the top has been selling large amounts of ETH.

- ETH is ranging between $1,850 and $2,000, with a potential break to $1,400 if $1,850 is breached.

- The DeFi scene is quiet but NFTs are making a comeback, fueled by memecoins and new projects.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make is your full responsibility.

Ethereum earnings are HIGH 💵

Now, if you take a peek at earnings (you can do it right here), you might be surprised to find that only a few crypto projects are truly profitable. Ethereum happens to be one of them. In fact, it’s made about $50M in profit in the last two days! Pretty impressive, huh?

The state of staking 💾

New staking deposits

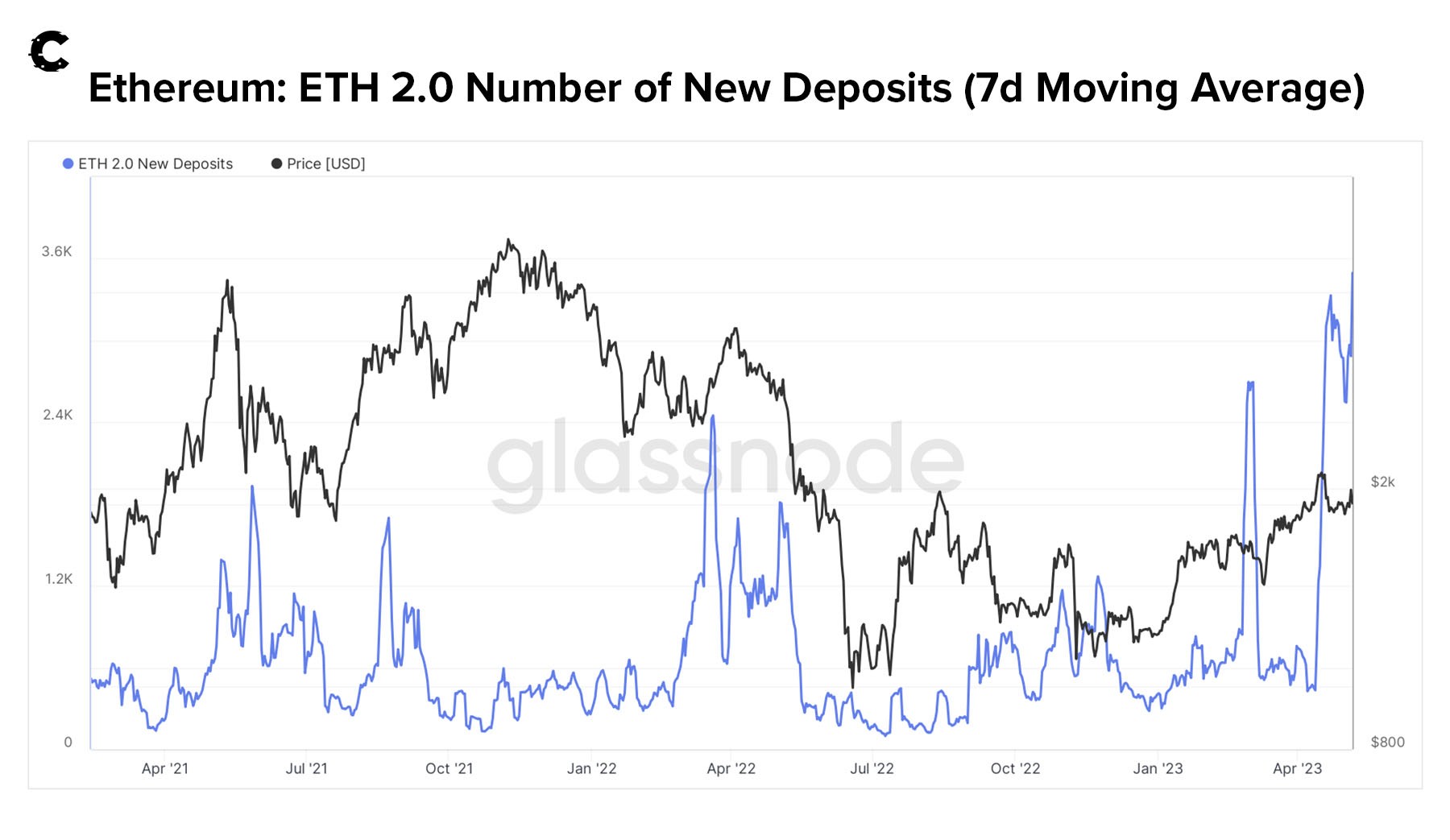

Yes, we’ll continue to brag for being right in saying that the Shanghai upgrade would be a positive development for Ethereum and not a bearish one. The upgrade rolled out smoothly and staking remained fully functional once withdrawals were enabled.

Just look at the chart (above) – new staking deposits hit an all-time high! 👀

Staking's looking great, with deposits outpacing withdrawals. Last week, 15% of the supply of ETH was staked, and we predicted it could reach 30% or more. Now it's already at 16%! At this rate we’ll hit our prediction by summer's end.

But people are withdrawing. Should we worry?

Withdrawers aren’t who you think they are

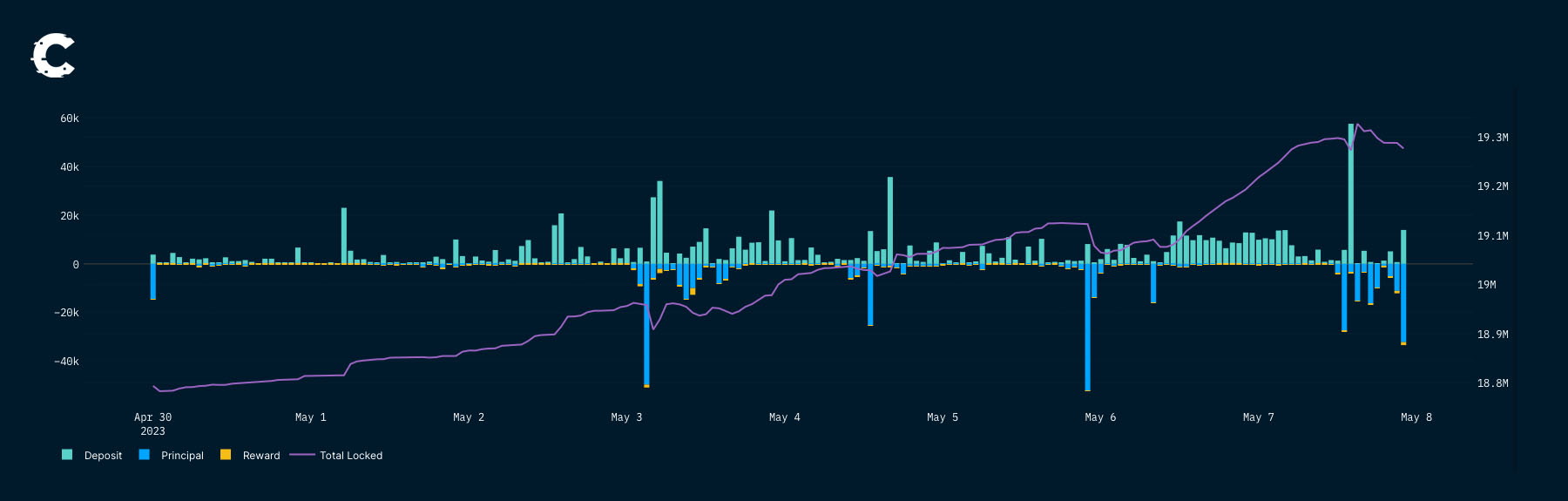

It’s normal to see a certain amount of turnover in any staked crypto, but as long as deposits keep growing, it’s no big deal.Last week, 2.5% of staked ETH was queued for withdrawal, and now it's just 0.9%.

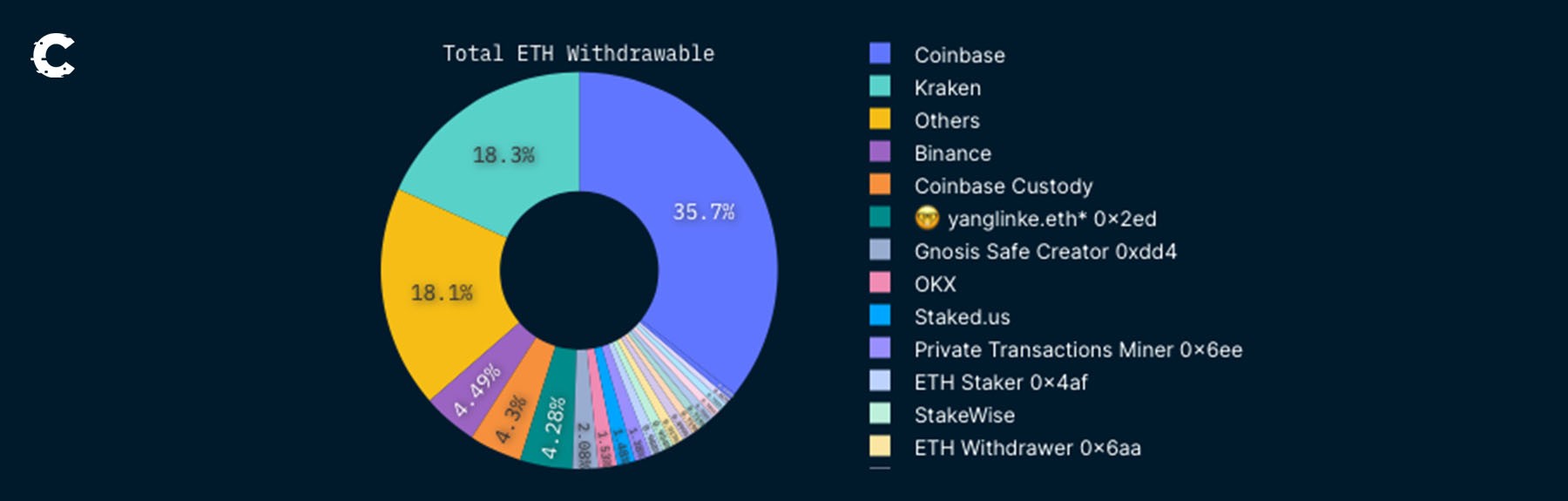

We like to track withdrawals, as that can reveal important insights. For instance, if a large portion of withdrawn ETH comes from Lido, that would be a red flag and we would want to investigate.

So where are these withdrawals coming from?

Right now, 62.8% of the ETH waiting to be withdrawn is from Binance, Kraken, and Coinbase. It appears that centralised exchanges are losing market share to decentralised ones.

Who's selling all that ETH? 🧸

Have you ever looked into the Ethereum Foundation's selling habits? Are they good traders? Right now they're holding 320,000 ETH (you can check out their address here). They've got bills to pay in fiat currency, so they sell a bit of ETH now and then.

But here's the thing – they've been pretty spot-on at selling near the top, and they just sold 15,000 ETH yesterday. We don't let the Ethereum Foundation's moves dictate our investments, but when history shows us a pattern, we pay attention.

Price analysis 📉

ETH had a rally on Friday, trying to push past $2,000, but couldn't quite make it. Now it's hanging out between $1,850 and $2,000 – which is perfect for range traders. Just long at $1,850 and short at $2,000, easy peasy! Buy $1,850 and short $2,000.

For the rest of us, it's a bit dull. But hey, a breakout is bound to come sooner or later. If we had to guess (and we've put our money where our mouth is), we'd say ETH likely breaks below $1,850 and drops to $1,600 first, then maybe even down to $1,400. That's where we'd be happy buyers.

Of course, if ETH manages to flip $2,000 from resistance to support, we'll have to rethink our strategy. But right now, that doesn't seem likely.

Ethereum ecosystem 🌐

DeFi (Decentralised Finance)

Here's a handy table for a quick peek at the DeFi industry 👇🏼

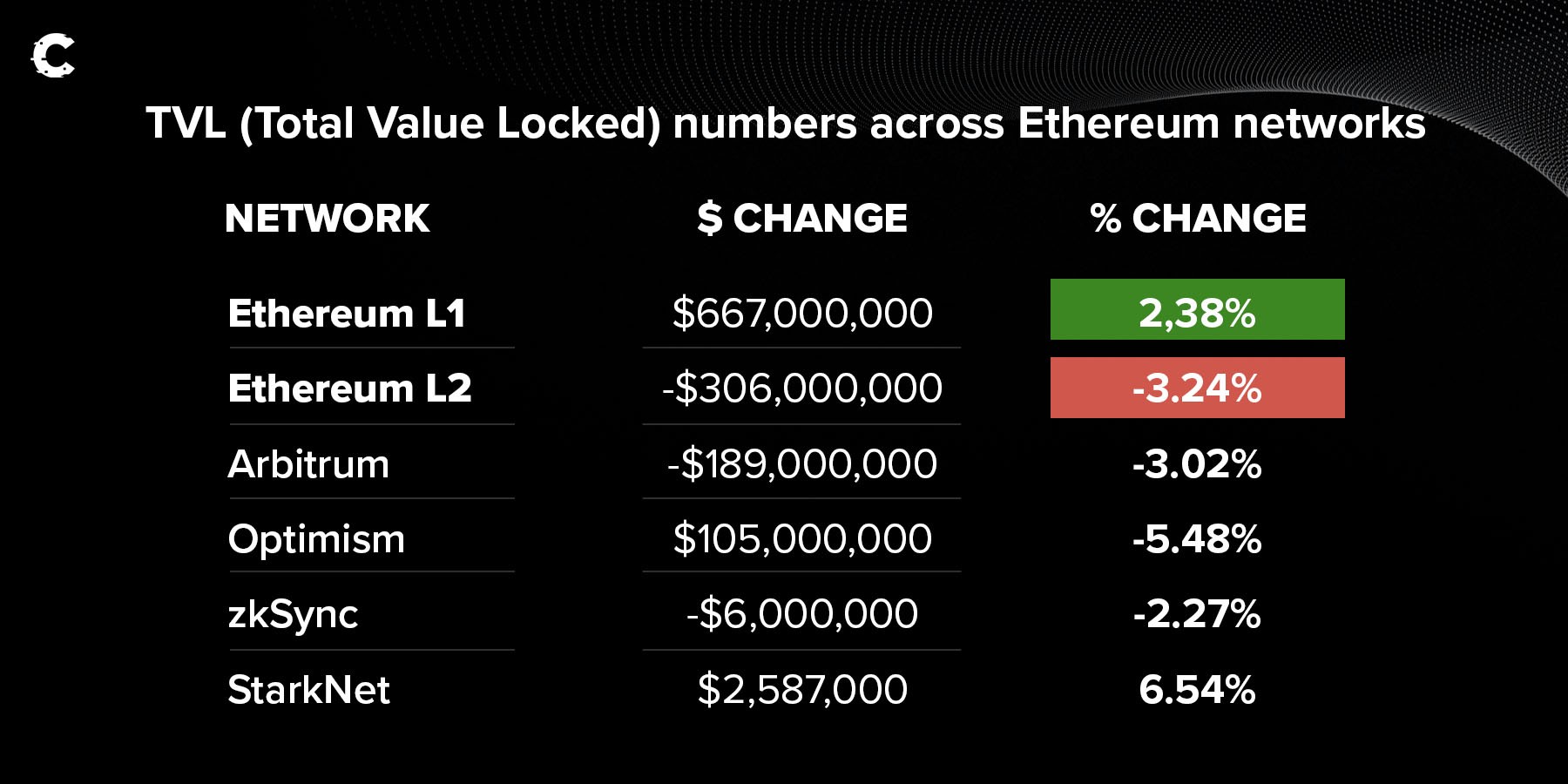

Things in the DeFi world seem pretty quiet right now – any change under 10% is practically nothing in the crypto world. Instead, people are focusing on memecoins and NFTs.

But before we dive into those, let's check out a snippet from our Layer-2 digest:

”Arbitrum was a huge success in September 2021, remember? But it turned out there was a problem. Most of the projects on layer 2 were meme coins like ArbiNyan, which attracted lots of attention and money but were unsustainable. And then there were rug pulls, sneaky scams that tricked investors into parting with their cash.

History may be repeating itself as zkSync finds itself in a similar situation. The highly anticipated decentralised exchange Merlin turned out to be a scam, stealing $1.8M from investors.” Read more by clicking here!

NFTs

Oh NFTs, you bored us for weeks and now you are back! We missed you and your volatility.CryptoPunks are now worth over 60 ETH, while Azuki and Doodles have both skyrocketed by more than 50%. And Miladys? They’re nearing a solid 4 ETH floor price. This is all thanks to the memetic value brought by PEPE’s meteoric 3,000%-in-two-weeks rise and Blur’s new Blend product, which lets you access top-notch NFT collections easily without breaking the bank.

Keep an eye on token launches from Memeland and Azuki – people are already talking about them. And check out the one mint we believe will be attracting a lot of hype here.

Cryptonary’s take 🧠

Alright, so here's the lowdown on Ethereum:It's making some serious cash with its earnings, and staking is going through the roof with new deposits hitting all-time highs after the successful Shanghai upgrade. But let's not forget that the Ethereum Foundation has been selling quite a bit of ETH. They’re notorious for selling the top.

ETH's price is bouncing between $1,850 and $2,000. This is fantastic for range traders, but we might see it dip to $1,600 or even $1,400 if it breaks the $1,850 mark. So stay alert and be ready for price shifts.

DeFi has been a bit quiet lately. But NFTs are making a big comeback thanks to memecoins and some cool new projects. You can read all about those in our NFT Digest.

Continue reading by joining Cryptonary Pro

$997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.