If you've been pondering this, you're in the right place.

Let's get started!

TLDR 📃

- Staking is strong with over 21M+ ETH being staked, representing 18% of the supply. We're still predicting this to reach 30%.

- ETH HODLers are diamond-handed, with decreasing liveliness showing they're not keen on selling.

- ETH could either break through the $2,000 mark and stride towards $2,500 or dip under $1,850 and slide down to $1,400. Stay patient for the breakout.

- 450,000 ETH was withdrawn from exchanges recently – a bullish sign.

- Ethereum wallets are the new bank accounts, and the UX is improving. We’re giving you a list to try.

ETHonomics 💱

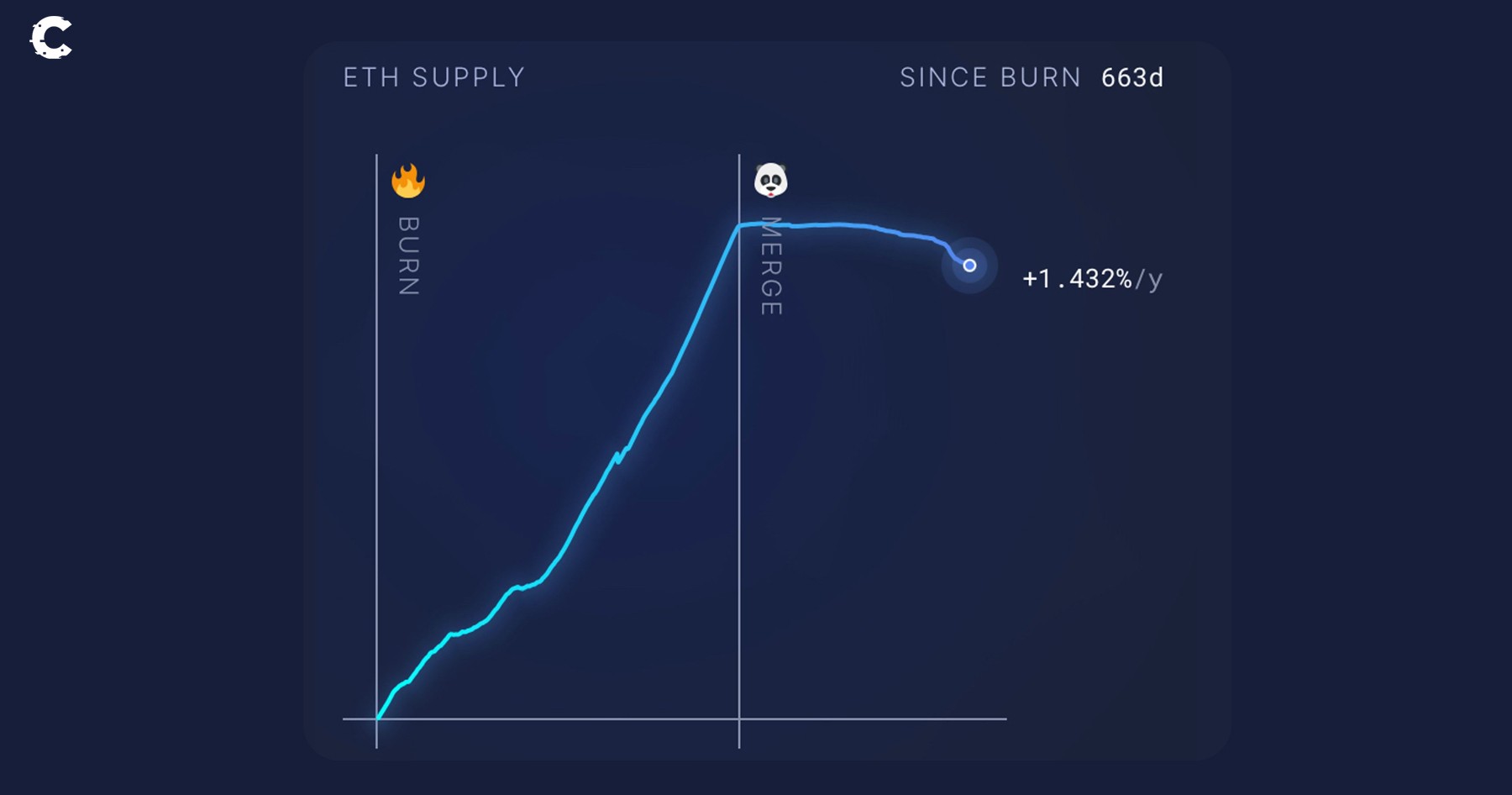

The first thing every ETH investor wants to know is how the fundamentals are shaping up for ETH. Let's first consider its supply growth.ETH is deflating quick!

Before the merge, ETH's supply was ballooning at a rapid rate. It went from 72M ETH to over 120M+ ETH in just 7 years. Despite this, ETH's value rocketed from $0.30 to $5,000. Now, things have changed a LOT.Check out this new way to visualise this info 👇🏼

It's pretty simple - the smaller the supply, the more bullish the price, especially if demand remains robust. But the million-dollar question is - is demand actually holding up?

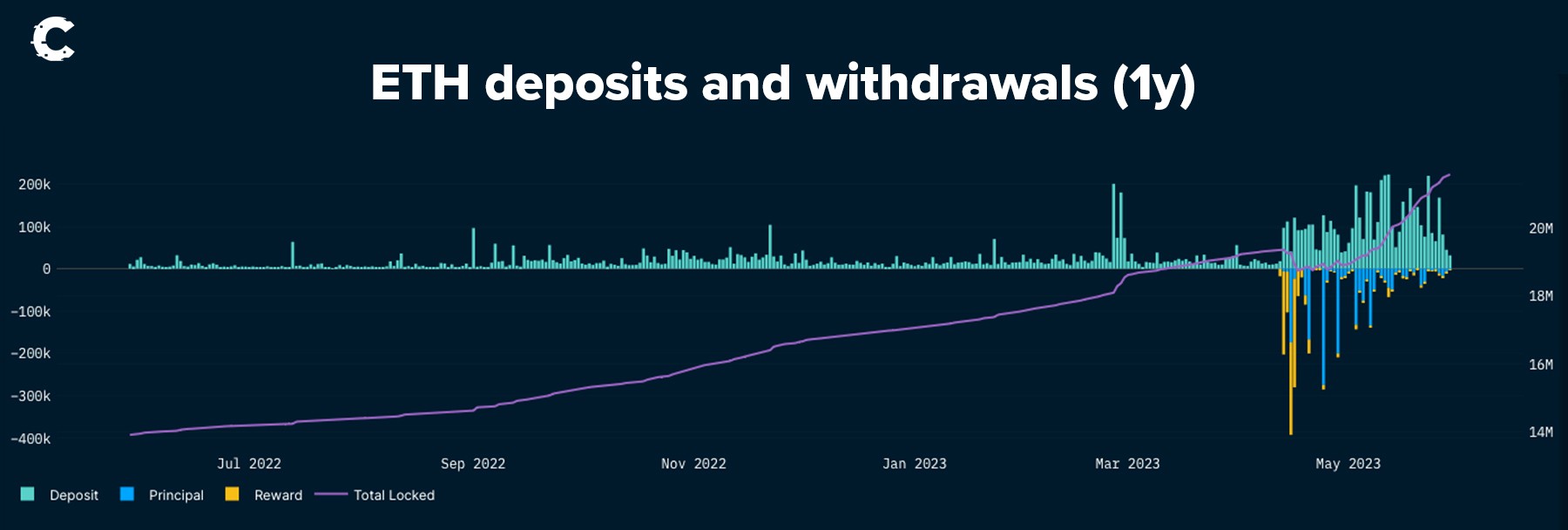

18% of the supply is locked

Staking is a pretty solid gauge of whether there's a strong demand for ETH or not. Why, you ask? Well, one of the main perks of owning ETH today is the annual yield of around 5% you can earn by staking it.

Take a look at the recent uptick and the ongoing rally in the staked supply. So far, over 21M+ ETH have been staked, making up 18% of the total supply. When that percentage was around 14%, we predicted it would reach 30%, and we're sticking to that prediction!

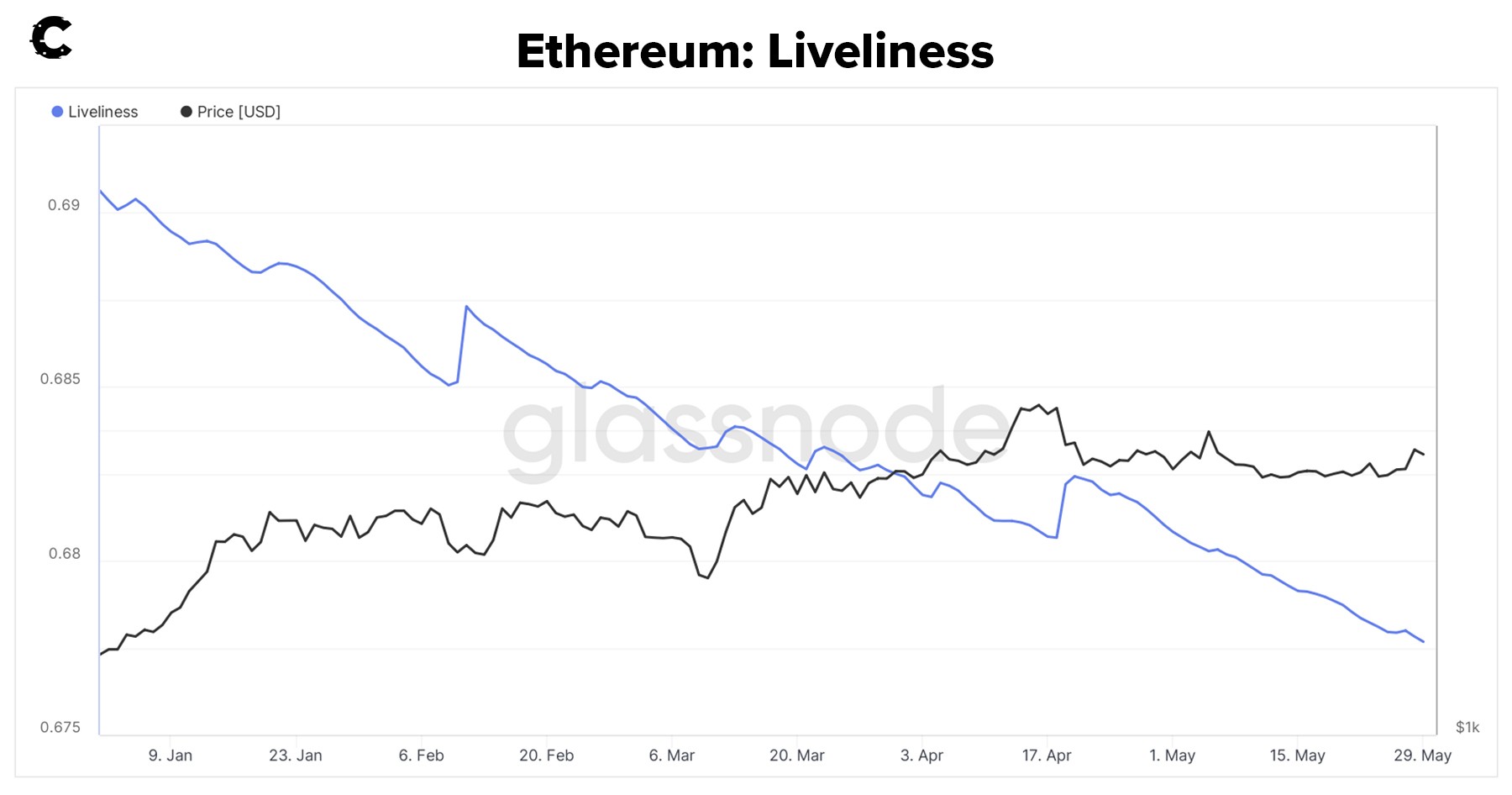

Diamond Hands are HODLing strong

Check out this number - it's one you'd want to see going down.

This is the ETH Liveliness measure. It gives us a clue about the activity of coins - are they being moved around a lot (which would mean increasing liveliness), or are they being tucked away in wallets for long stretches (meaning decreasing liveliness)?

Well, as the graph shows, liveliness has been taking a sharp nosedive since the start of the year. That tells us the HODLers are holding their ground (or should we say, their diamonds?) and aren't too keen on selling.

So, if the supply is dwindling, a chunk of it is locked up, and the rest is being staunchly HODLed, you might wonder - what the heck does that mean for the price?

ETH price analysis 📈📉

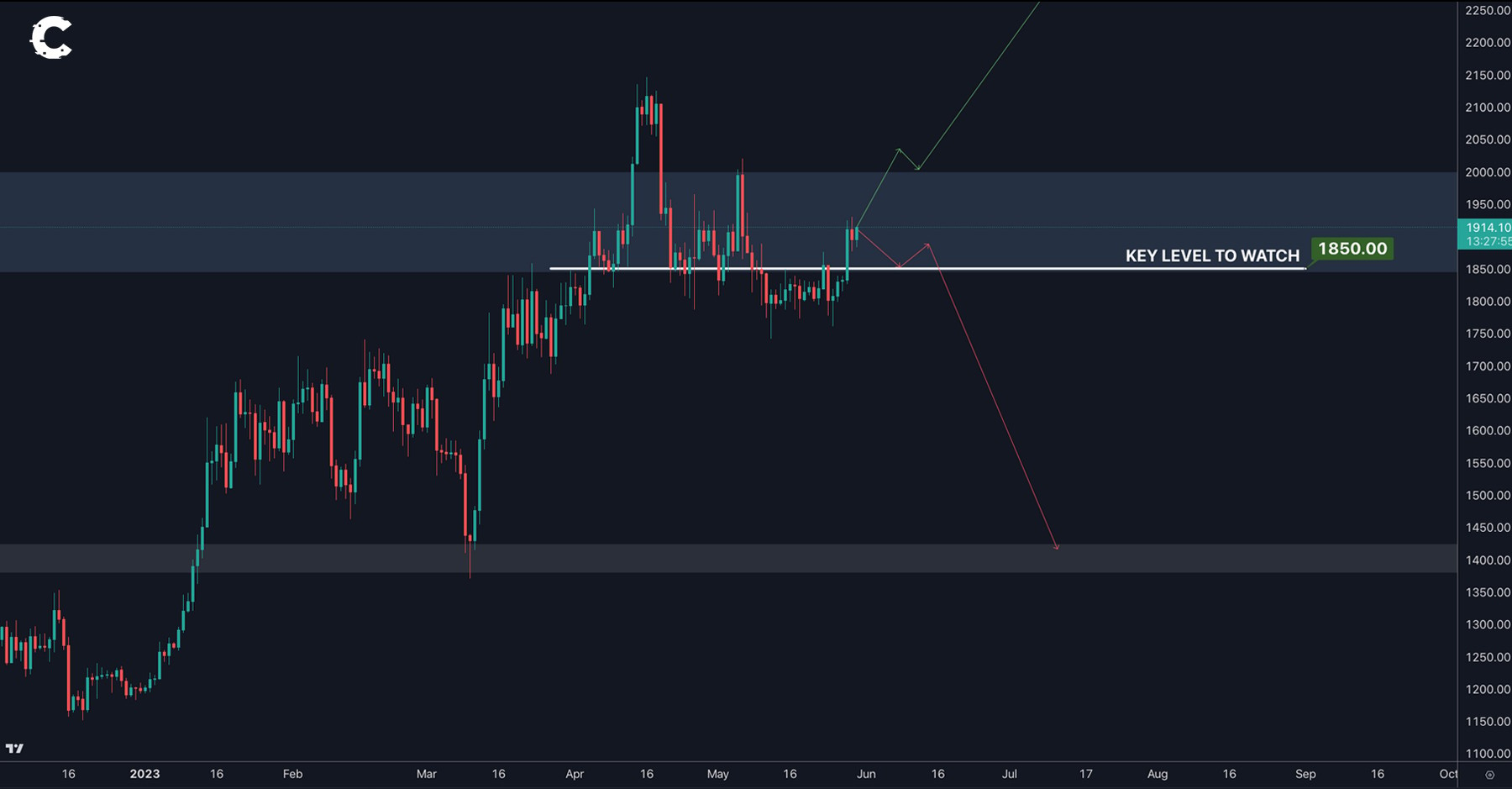

Alright, let's take a step back and look at the big picture. Long-term, ETH seems incredibly bullish. We're talking about the perfect storm to surge past its all-time highs. But what about right now?We're at a crucial juncture with ETH.

ETH managed to close a daily candle above $1,850 - our "key level to watch". So, the bulls have made progress, but they haven't fully shaken off the bears yet.

Here's the two potential paths for ETH:

- Break through the $2,000 mark and stride towards $2,500.

- Dip under $1,850 and slide down to $1,400.

But hang on, there's a significant metric we've deliberately left out. Let's delve into that...

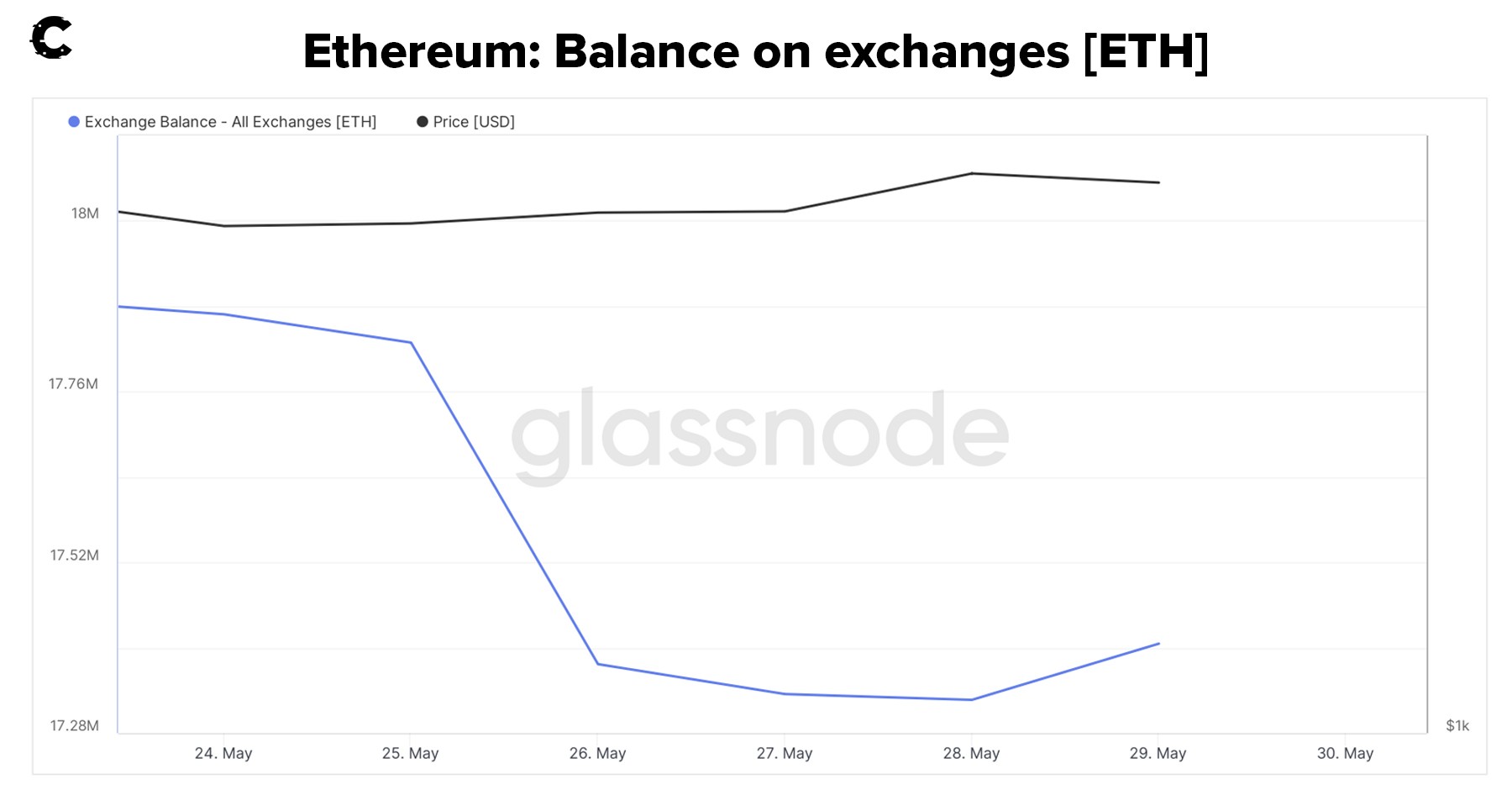

Massive withdrawals 🏧

On May 25th, a whopping 450,000 ETH were pulled out from exchanges. In today's value, that's over $850M!

This isn't something you see every day and it's actually a pretty bullish sign because it suggests less ETH is available for sale. But here's the catch with Ethereum - DeFi exists. So, even when ETH is withdrawn, it can still be traded in the DeFi space.

Now, based on the liveliness data we've seen, it's unlikely that this will happen with the bulk of the withdrawn ETH. However, this won’t always be the case for all withdrawals and we do think a lot of ETH finding its way back into DeFi. And here's why...

An Ethereum wallet is your new bank account 🏦

Ethereum wallets are like your new digital bank accounts. They're here to simplify all those financial services - lending, trading, borrowing, you name it! But, there's been a hitch - the User Experience (UX) hasn't been easy for most folks.Let's be honest, the UX for blockchain wallets has been challenging. They're confusing, fragmented, and can feel risky, despite the safety of DeFi. That's why we're seeing new wallet providers stepping up, ditching old-fashioned approaches and making things way easier for users.

Here are some wallet options we think you should check out for a smooth "bank account" feel:

- Pillar: This open-source wallet provider uses the smart wallet method ERC-4337. Supporting multiple chains, it's got its own token ($PLR) which has risen 16% in the last 24 hours. They've been on the scene since 2018 but only adopted ERC-4337 recently.

- AnCrypto: This multi-chain smart wallet brings messaging in-app. It's got a token ($AWT) which is up 17% today, but still has a small market cap of just over $1m. They've built bridges in the app for easy funds transfer between blockchains.

- Blocto: Designed for several L1's including Ethereum, Blocto uses the ERC-4337 framework. They don't have a token yet, but they boast over 1.6 million users who use emails instead of seed phrases.

- Candide: This smart wallet, designed for the Optimism network, comes with a mobile app (no seed phrases here!). While they don't have a token yet, they're taking a community-led approach with decisions made via voting, hinting at a move towards decentralised governance (i.e. token).

Cryptonary’s take 🧠

HODLers are diamond handing, demand is rising and supply is shrinking. ETH is on the right path but patience is required to reap the rewards. The short-term will continue to be turbulent but if you zoom out, you’ll see the bigger picture.You, the enthusiast and investor need to do three things:

- Stake your ETH and earn. This small 5% compounds and yields to large returns over the years.

- Trial these new smart wallets and start contributing to this next wave to users flowing into crypto. Turn Ethereum into your bank account.

- Stay patient.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms