Fertile Ground: The Best Countries to Launch Your Crypto Project

Imagine having a big idea for a cryptocurrency project that could revolutionise the industry… but being located in a jurisdiction that’s resistant to financial innovation. There are more than a few out there, and unhappily this list includes some of the richest countries on the planet.

Today, we explore the challenges faced by developers and identify the best countries to launch your crypto project.

TLDR

- Switzerland has comprehensive crypto regulations and a favourable legal framework for decentralised entities.

- The United Arab Emirates (UAE) is emerging as a leader in blockchain technology, with tax-friendly measures for residents.

- The Cayman Islands has lax tax laws and regulations for virtual assets, making it a popular choice for investors and DAOs (Decentralised Autonomous Organisations).

- Gibraltar is also known for its crypto-friendly regulations. It’s particularly attractive for hedge funds and exchanges, but may not be the best choice for decentralised projects.

Disclaimer: The information provided in this article is for educational and informational purposes only. It is not intended to provide legal or financial advice

Regulatory challenges for crypto developers

Regulation plays a crucial role in the cryptocurrency market as it provides a framework for conducting business and ensures the safety and protection of investors. Without proper regulation, any market could become a breeding ground for fraudulent activities and scams.However, the challenge for developers is navigating different regulations in different countries. Every one has its own set of rules and regulations, and something that might be legal in one country could be illegal in another. This creates a complex and uncertain environment for developers looking to launch projects.

1. Switzerland

This beautiful Alpine country is not just famous for its chocolate and breathtaking scenery. It has also emerged as a global leader in innovation, and established itself as a top locale for crypto and blockchain technology.The country has some of the most comprehensive crypto regulations in the world, including guidelines for initial coin offerings (ICOs) introduced by the Swiss Financial Market Supervisory Authority (FINMA) in 2018. These regulations offer clarity and protection for both individuals and businesses.

Switzerland also has a long list of crypto-friendly banks like SEBA Bank AG and Sygnum, making it easier for crypto firms to do business.

When it comes to setting up a DAO, Switzerland doesn't have any specific regulations, but applies existing ones with the country’s Code of Obligations and Civil Code providing a solid legal framework for decentralised entities.

Although the high cost of launching a crypto project as a startup in Switzerland can be a barrier to entry, with its strong legal foundation it’s still a top choice.

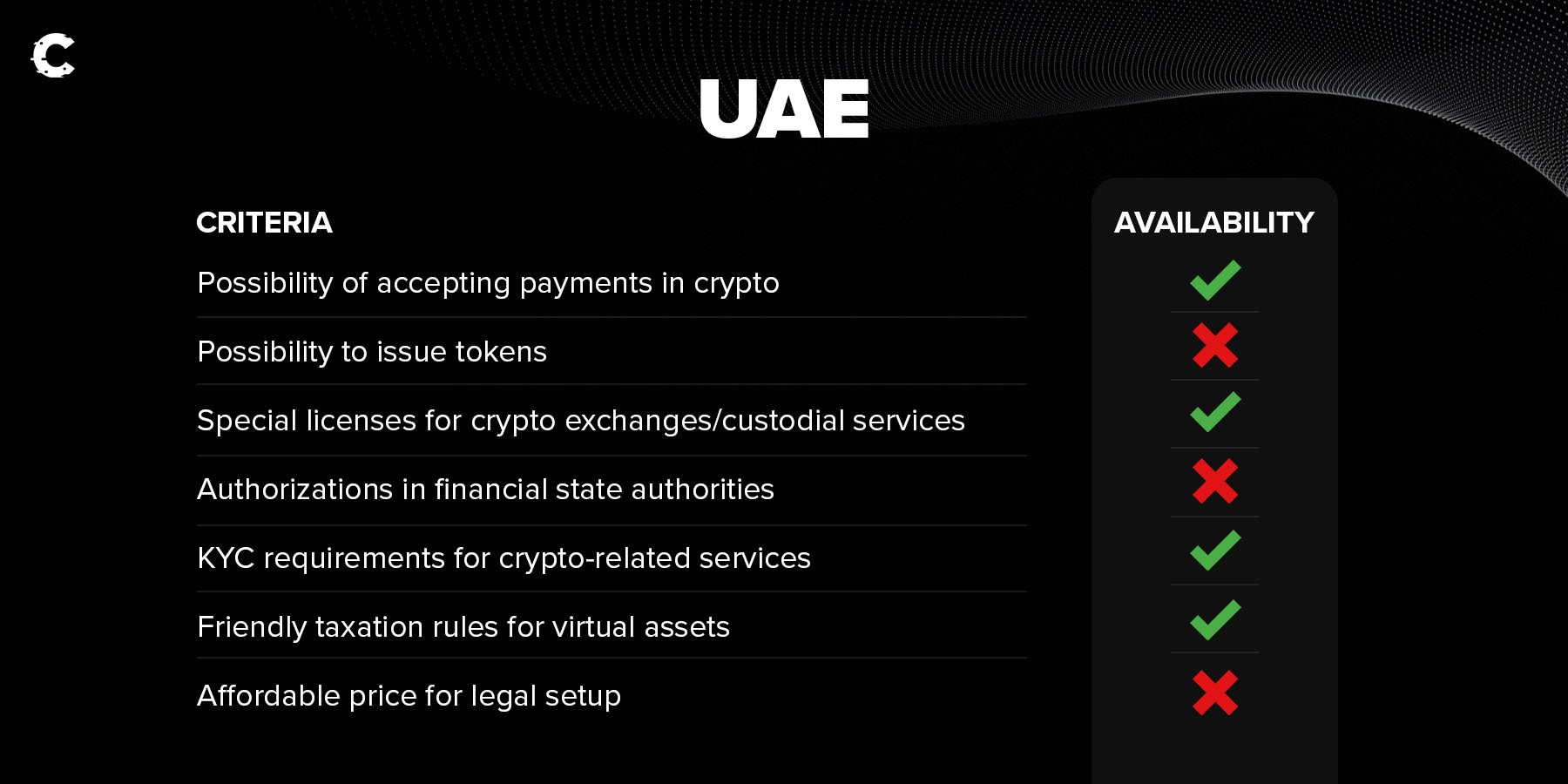

2. United Arab Emirates

The UAE, ever a model of rapid economic development, is quickly becoming a leading destination for crypto and blockchain technology. The government has been actively promoting the use of these technologies and is working on comprehensive regulations.If you're planning to build a virtual assets exchange in the UAE, the rules and regulations you'll need to follow depend on where you set up shop. One option is to operate in a free zone like the Dubai Multi Commodities Centre (DMCC) or the Abu Dhabi Global Market (ADGM). The ADGM has its own set of rules for virtual assets, while Dubai has a special law that applies to all zones across the emirate (except for the Dubai International Financial Centre).

Dubai is also a pioneer in crypto-friendly tax measures that will make your wallet happy. Tax residents in Dubai pay no taxes on capital gains, company income or salaries, making it one of the world's most tax-friendly countries.

However, there’s limited information available on how Dubai handles the setup of decentralised entities like DAOs. Most of the laws in the UAE seem to be designed to attract crypto exchanges and centralised companies, which is something to keep in mind. Nonetheless, the UAE remains one of the most innovative and crypto-forward countries on our list.

3. Cayman Islands

Looking for a crypto tax haven? Check out the Cayman Islands! It's a popular choice for both crypto businesses and individual investors because of its lax tax laws.The Cayman Islands doesn't charge corporate, income or capital gains tax. Instead, this long-standing financial haven earns money from tourism, work permits, and its GST (goods and services tax).

Additionally, the Cayman Islands is a great choice for creating a DAO because of its special regulations for virtual assets, the flexibility of its common law system, low costs, and well-designed setup process.

The Cayman Islands might not be the best choice for crypto hedge funds trying to save money, however. The country now mandates annual audits of private funds, which for obvious reasons increases costs for developers.

However, it’s a fine pick for those interested in starting a DAO.

4. Gibraltar

Gibraltar was the first in the world to regulate the blockchain environment, in 2018.While companies are subject to Gibraltar taxation, capital gains aren't taxed. However, entry can be challenging as the territory complies with all transparency and information standards applicable in the U.K.

Gibraltar is a British Overseas Territory, so it’s subject to many of the same financial regulations and transparency standards as the U.K. Therefore, companies that wish to operate in Gibraltar must comply with these regulations, as well as local laws and regulations that apply.

Gibraltar is particularly attractive for crypto hedge funds and exchanges, with some funds accepting subscriptions and redemptions in crypto. Additionally, starting a private hedge fund is easier than in otherwise flexible jurisdictions like the Cayman Islands. However, the process of establishing a DAO isn't as clear-cut, so “The Rock” might not be the best choice for decentralised projects.

Cryptonary’s take

Each country offers different benefits that will suit particular types of crypto projects. These countries offer a much more welcoming approach to crypto than that seen in the United States.Other upcoming areas to watch and consider include Hong Kong, Singapore, and Malta. Hong Kong's proposal to allow retail investors to trade certain "large-cap tokens" on licensed exchanges sets it apart from mainland China's ban on crypto-related transactions and positions the city as a potential crypto hub.

As always, it's crucial to consult with lawyers before starting a crypto project.

Action points

- Research and carefully consider the regulatory environment in different countries before launching a crypto project. This includes understanding the rules and regulations around initial coin offerings (ICOs), virtual asset exchanges, and decentralized autonomous organizations (DAOs).

- Determine the specific needs and goals of your crypto project before deciding on the best country to launch it. Factors such as cost, tax laws, and ease of setup should all be considered.

- Seek legal advice and guidance from experts in the crypto space to ensure that your project complies with all necessary regulations and laws in your chosen country. This can help minimize risk and ensure a smoother launch process.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms