Will FraxChain rev up FXS to a rally?

Today, we are taking a ride in the supercar that is Frax Finance, one of the emerging players in DeFi. This project recently made a bold move to join the elite class of L2 DeFi projects with the launch of its own Layer 2 solution, FraxChain.

Buckle your seat belts as we speed around on an exciting lap of the possibilities that FraxChain brings and its potential impact on FXS, Frax Finance's native token.

Gas on the pedal, this might just be the nitro boost that takes FXS to the moon and beyond!

TLDR 📃

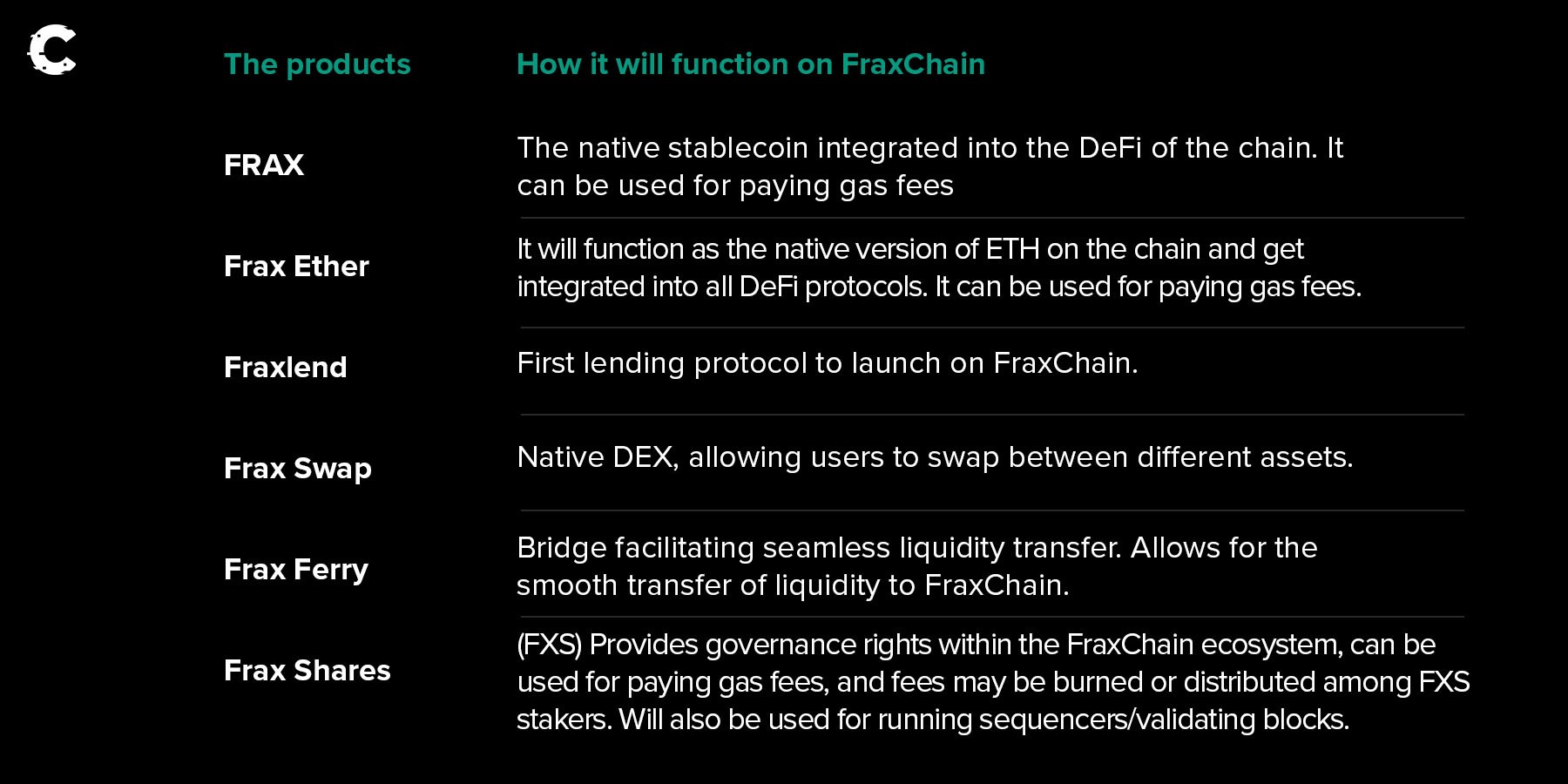

- FraxChain is not your average DeFi project. It combines FRAX, frxETH, Fraxlend, Frax Swap, Frax Ferry, and Frax Shares (FXS) into a robust DeFi ecosystem.

- FraxChain doesn’t scrimp on security. It’s got all of Ethereum's security features, just like Arbitrum and Optimism.

- There’s a proposal to buyback $1M FXS if the token goes back down to $5

- FXS must break above $7.50 and establish a strong support level for a significant upward move.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

Frax Finance to launch FraxChain this year 🚀

Frax Finance is no stranger. It is the powerhouse behind FRAX, one of the biggest stablecoins in DeFi with its impressive $1 billion market cap. It also lays claim to frxETH, a popular liquid staking token worth another $400 million.

Now, Frax Finance is revving its engines to join the L2 race with its own Layer 2 solution, FraxChain. But what exactly is FraxChain, and how does it fit Frax Finance’s ecosystem?

Let's take a closer look!

FraxChain integrates all the key components of Frax's ecosystem, giving the tokens more utility. Let's break it down.

The idea here is for FraxChain to become the ultimate pit stop for all your DeFi needs. It's like a one-stop shop where you can conveniently carry out all your DeFi activities.

But wait, there's more! FraxChain goes the extra mile by emphasizing community control. FXS holders have the power to vote on the sequencers, acting as the traffic directors of the roll-up. This democratic approach ensures that collective decisions by the users guide the operations of FraxChain.

And here's the cherry on top - when you stake your FXS tokens, you not only get a say in decision-making but also earn fees generated by the network.

Corporate speak aside, what does FraxChain mean for FXS? 🤔

Interestingly, when FraxChain's launch was announced, Ouroboros Capital, a crypto research firm, proposed a token buyback strategy. It's a move that often signals confidence in the project and indicates that the token may be undervalued.

Here's how it works: If the FXS falls below $5, Frax will kick off a buyback program worth $1 million. And if the price dips even further, below $4, they'll launch an additional buyback of $1 million that will last for a whole month.

This kind of proactive approach shows that Frax's founder, Sam Kazemian, supports the proposal and believes in the token's potential.

But why does Kazemian think FXS is undervalued? Well, let's take a closer look.

Currently, Frax's main revenue stream comes from its liquid staking product, Frax Ether. It's projected to generate around $1 million in revenue this year. However, with the introduction of FraxChain, the revenue potential is expected to skyrocket.

Just by comparing the monthly revenues of Optimism and Arbitrum, two other layer 2 solutions, we can see the exciting possibilities. BTW, check out our latest scoop on Arbitrum here.

Now, imagine if FraxChain captures just 30% of Optimism's usage. Even at that conservative estimate, FraxChain would be able to increase its revenue by 220%!

And here's the exciting part: unlike Arbitrum and Optimism, who don't share that revenue with token holders, Frax will distribute a portion of the revenue to FXS token holders. That's a game-changer because it will likely make FXS much more valuable in the long run.

Price analysis 📊

If you are wondering where you can get in on the action and accumulate some FXS for yourself. Here’s what you need to know!

With the market rising, FXS has more upside potential. It's nearing the $7.15 - $7.50 resistance range, about 20% above its current price.

To confirm a significant upward move, FXS must break above $7.50 and establish it as a strong support level.

To make an investment, wait for FXS to establish $7.50 as support. Alternatively, consider dollar-cost averaging to invest calmly without focusing too much on market fluctuations and achieve a favourable average price.

Cryptonary’s take 🧠

We're downright thrilled about the upcoming launch of FraxChain! With FraxChain, the main goal is to help Frax capture even more value and give its tokens extra utility.

However, there's a challenge ahead—convincing other DeFi protocols to jump on board and join the new chain. We'll be keeping a close eye on how this pans out because it will shape the future of FraxChain.

That said, Frax will have the opportunity to generate a lot more revenue and this revenue will be shared with FXS stakers. That's why we believe FXS is undervalued right now.

If you're eager to get in on the action and grab some FXS, here's a tip. Keep an eye on the support level around $7.50 for FXS. Once it establishes itself there, it could be a good entry point.

Another approach worth considering is dollar-cost averaging. By gradually investing over time, you can navigate market fluctuations and build your FXS position steadily.

As always, thanks for reading.🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms