What does he mean by this?

For as long as we can remember, Europe's economy has been driven by cheap energy used to produce high-quality goods for global export - even during the Cold War the Soviet Union maintained energy supplies to Europe. In addition, European governments and corporations have essentially leveraged themselves to the teeth due to sustained low-interest rates and cheap debt over a span of decades.

However, with that source of energy under threat, there is no longer the cheap energy input that has fueled the European economy for decades. Economic output is set to suffer across Europe (and in many cases, already has), and energy inflation has skyrocketed in all the major European economies. Consumers face negative real wage growth (their wages don't go as far as they did before), and businesses face huge increases in operational costs, which significantly affect profitability. This is what Putin is implying with the above statement.

Take the German economy, for example.

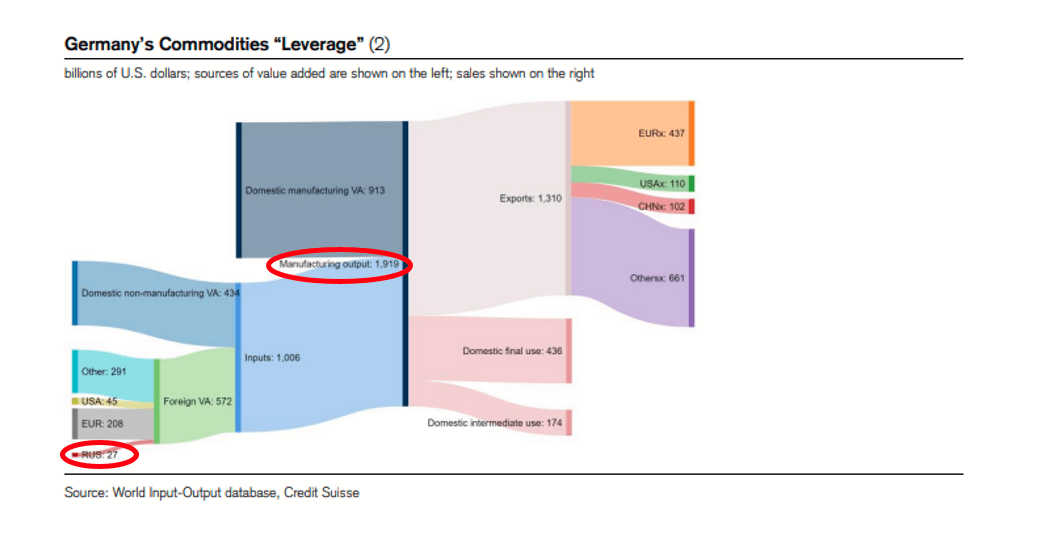

The image above (data from Credit Suisse) implies that around 1.9 trillion Euros of German economic/manufacturing output relies on just 27 billion Euros of Russian energy imports - this is the cheap input. With Gazprom shut down indefinitely as a response to G7 price caps on Russian energy, this cheap input essentially no longer exists.

To combat the subsequent energy inflation, the European Central Bank has to raise interest rates to control inflation - it's really the only tool they have. This forces a deleveraging of the economy - mortgages become more expensive etc. Collateral damage due to energy inflation making things untenable, but with the leverage inherent in most European economies, it becomes a house of cards situation.

This is what Putin is attempting.

The ECB will not take the same route as the US in tackling inflation (shrinking the balance sheet) since the causes for inflation in the EU are very different to the causes in the US. The logical route for protecting the private sector is to cushion the blow they'll take from higher production costs - this will be done using the ECB balance sheet. Raising interest rates without reducing the balance sheet provides options whilst still maintaining credibility that they are actually attempting to tackle inflation.

However, the main point is that using the balance sheet buys Europe time - time to find alternative energy suppliers and time to build and implement the required infrastructure. Time to find a solution in the medium-term. This throws a spanner in the works for Putin - there is a war to fund, and Europe has made up a large portion of Russian energy revenue for decades. Essentially it has become a case of who can sustain sanctions the longest - the EU, or Russia.