How a US default impacts crypto

The stablecoin market, with a whopping value of $130 billion, is packed with assets, with a heavy focus on US government treasury bills. Think about this: what if the US defaults?

Just for perspective, Tether holds a staggering $53 billion in treasury bills as of March 2023. If a default occurs, it’s going to be a rough ride for everyone.

If a default happens, buckle up.

Even with the current stability, the potential US default is like a looming storm cloud. USDT and USDC, being the heart and soul of DeFi with their massive transaction volume, are in for a real rollercoaster. And it’s not just them.

Decentralised stables aren't safe either as they heavily rely on USDC/USDT for collateral.

It's a tightrope walk, but will we actually fall off?

TLDR📃

- The US is facing a crisis - the debt ceiling needs to be raised, but parties can't agree on conditions.

- Most stablecoins are backed by US treasuries. If the US defaults, it can't pay interest.

- Treasuries would become highly volatile, bringing into question the stability of stablecoin reserves. Panic would likely ensue, with most major stablecoins de-pegging.

- The default could happen as soon as the beginning of June.

- It's unlikely the default will happen - but we have stated some possible scenarios and how to mitigate risks.

- Read on to find out more!

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your full responsibility.

How urgent are we talking?⏳

The US government could default as early as June 7th or 8th. They may scrape by till July using tax revenues, but a government shutdown might be just a hop, skip, and a jump away.It's all politics, as usual. Both parties know the budget needs a fix to slim down the deficit. Yet, while Biden is pushing for higher taxes, Republicans are urging him to slash spending. Classic case of party agendas overshadowing national interests.

There's no white or black hat in this game - both sides are playing their own game, with the country's needs getting sidelined. With so much on the line (and that's an understatement), it's downright ironic that a self-imposed rule, irrelevant for at least two decades, could potentially topple the US empire.

If we hit default, some US treasuries would stop paying yield... and that's not a pretty picture, especially for us stablecoin holders!

What’s it got to do with stablecoins? 💸

Circle (USDC) and Tether (USDT) have long relied on US treasuries to back their stablecoins. The real trouble lies in holding treasury bills due after this month. Should a default happen, the fallout could be brutal for a stablecoin's peg, with affected treasury yields plummeting to 0% - rendering them virtually worthless till the US starts paying the yield again.Imagine a collapse of UST - that could be the fate of any unprotected stablecoin.

Remember the chaos when Silicon Valley Bank went under, dragging over $3.3 billion of Circle’s deposits with it? Picture that drama across all stablecoins.

Time to panic? Hold your horses!

Circle is playing it smart. To guard their reserves, they've shifted assets from post-May expiring treasuries to other financial instruments. They've moved $8.7 billion into repo bills, cleverly passing on the default risk to someone with more faith in Uncle Sam.

As Circle is publicly listed, we know their moves. The same can't be said for Tether, but we're betting they're doing something similar behind the curtains. That's a big assumption, of course.

As we edge closer to June 1st without a resolution, the situation turns more volatile.

This turbulence in the bond market is stunting the growth of an emerging DeFi sector...

Decentralised T-Bills?🏛️

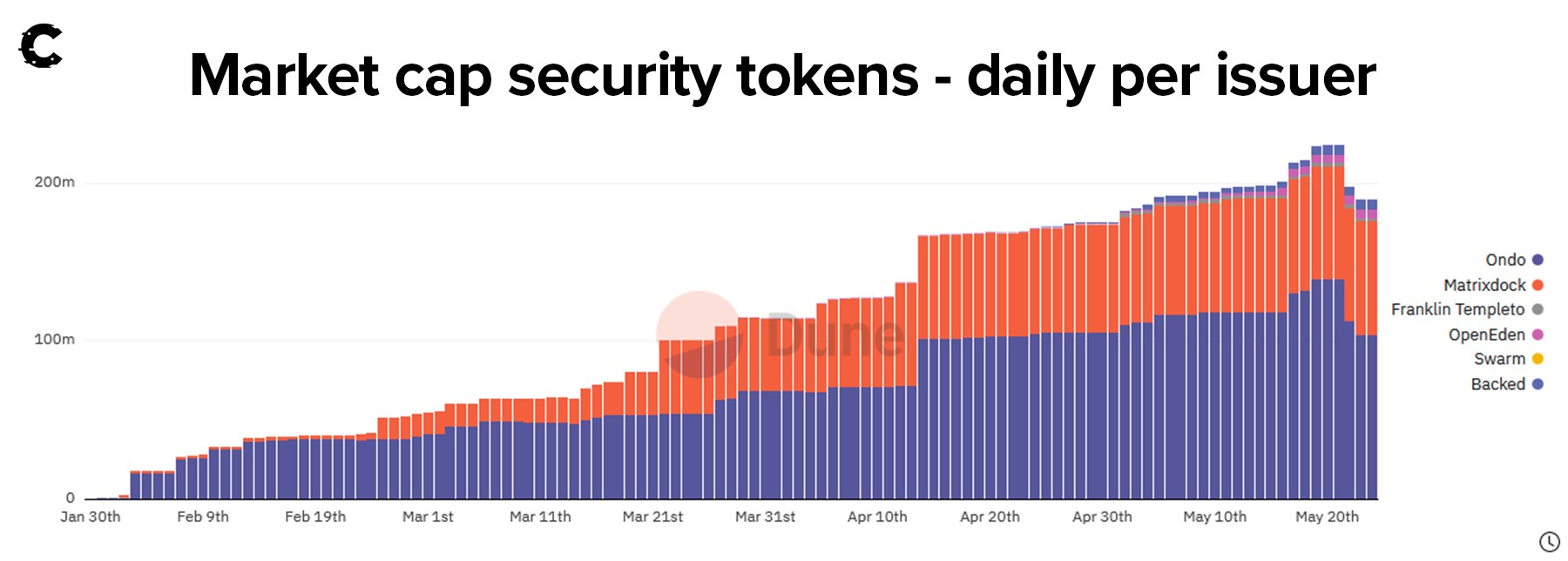

From zero to hero! The decentralised securities market has seen an explosive growth this year, driven by yield-hungry investors. In the last 5 months, the market cap for on-chain securities ballooned from practically nothing to a staggering $220 million.

But as the TradFi treasury markets get hammered, decentralised securities tokens are feeling the heat. Holders are shedding treasury bills like hot potatoes, both in TradFi and DeFi.

With everyone, including stablecoin providers, scrambling to safeguard assets, where does DeFi stand?

DeFi in danger?🧾

Now, DeFi has never weathered a US government shutdown. The last one happened in 2018 under Trump and lasted for 35 days. So, the big question is: what would a stablecoin depeg mean for major issuers overexposed to treasuries?If the major players - USDT, USDC, or DAI - go through a prolonged depeg, it's a perfect storm for DeFi and crypto in general. You'd see a mass exodus from stables, with users scrambling for safer assets. Where to?

BTC seems like the prime candidate. A bank analyst is actually saying BTC would pump +70% in case of a default.

But what about the rest of the market? It's a bleak picture. DeFi liquidity would take a colossal hit across all chains. Services like Curve, a stablecoin hub boasting over $4.2 billion in TVL, could see its value plunge to zero.

But it's all a guessing game at this point. A default is uncharted territory. Expect many alts to behave like sinking securities. The downside is unfathomable.

Cryptonary’s take 🧠

Take a deep breath. Let's break this down.Chances of a full-blown US government default are pretty slim. Yes, we might be looking at a shutdown, but it's highly unlikely the government would just leave creditors hanging. Seems like Congress is playing a deadly game of Russian roulette with all chambers loaded.

Here's the rundown:

- Worst case scenario: Agreement? Nope. Treasury funds? Dried up. And we hit default in June/July. The economic blowback would be just as severe as we've painted.

- Base case scenario: Default dodged, but only after a nail-biting debate running till end June or early July. The market stays on tenterhooks, but this buys stablecoin providers some crucial time to secure reserves.

- Best case scenario: Default averted, debt ceiling lifted. This could pan out if parties finally hammer out a budget, or Biden plays the 14th Amendment card and sidesteps the debt ceiling.

But hey, better safe than sorry, right? So, if stablecoins are on the ropes, where's the safety net? We've got a couple of contenders:

- High-risk - BTC: If stablecoins start to lose their peg, it might be wise to jump ship to BTC. In a crypto stablecoin liquidity crunch, BTC could be the lifeboat absorbing the capital flight. But be warned, BTC might also take a tumble in the initial stages of a financial bust-up. However, remember that BTC was born to stand tall amidst human corruption/incompetence.

- Medium-risk - Gold Derivatives: More specifically, those with real gold backing. Gold tends to hold firm in a US default scenario. While gold stablecoins might not handle tens of billions in demand, they're a solid choice. Current hot picks include Tether Gold (XAUT), PAX Gold (PAXG), or Kinesis Gold (KAU).

Other News 📰

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms