Get ready, as buried papers, including conversations within the SEC about the game-changing "Hinman speech" of 2018, are set to surface. This could be a knockout punch to the SEC's case against Ripple.

While the SEC plays checkers, Ripple plays chess, crafting tactical moves that echo beyond the courtroom walls. Join us as we dive into the significance of these looming discoveries and the clever strategic plays of Ripple.

TLDR 📃

- Ripple vs. SEC: As secret documents see daylight, it's heating up.

- Ripple-Hong Kong Monetary Authority: A showcase of Ripple's CBDC platform.

- Acquiring Metaco: A strategic move to power up Ripple's tokenized assets.

- Abu Dhabi-bound: Ripple's Middle Eastern adventure with cross-border payments.

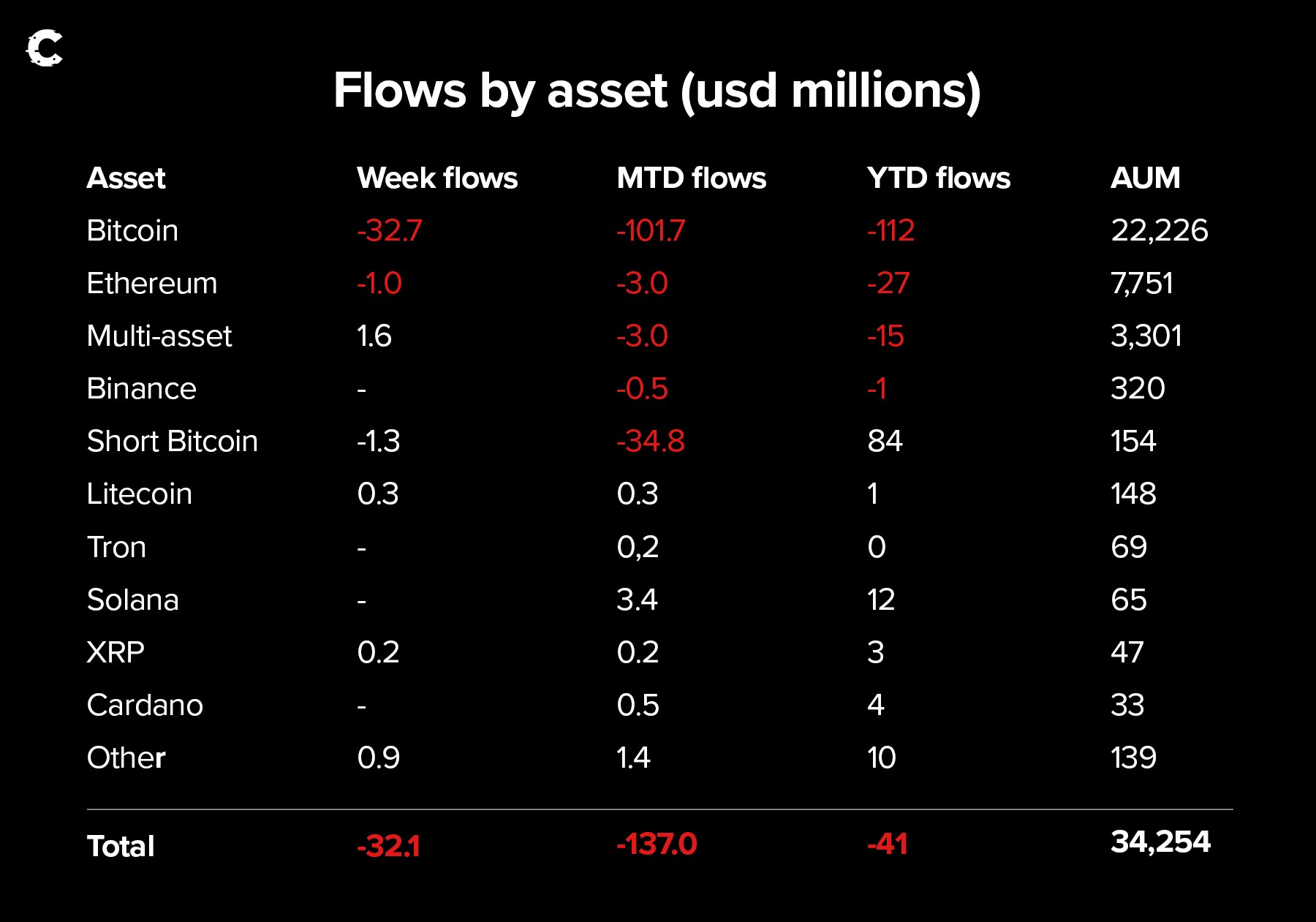

- XRP's popularity: It's a hit with institutions, even as other digital assets face outflows

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your responsibility and yours only.

New documents tipping the balance? ⚖️

The SEC v. Ripple case has hit a thrilling checkpoint, as a court order unveils long-hidden documents.This cache could reveal the SEC's inner talks about the famed "Hinman speech" of 2018. To fill you in, this is when the then SEC Director, William Hinman, broke the ice, saying Bitcoin and Ether weren't securities.

https://www.youtube.com/shorts/dt_sy0y33M0

His speech was a milestone, hinting cryptos might morph from securities to commodities with enough decentralisation. Notice the language Hinman used then versus the SEC's rhetoric under Gary Gensler now?

Well, the SEC didn't want to share those old documents. But the judge, understanding their importance to Ripple, ordered their release within 15 days.

Why the fuss? These documents might show the SEC's real thoughts on cryptos, possibly including Ripple. Imagine if they contradict the SEC's current stance? Total game-changer!

Here's why it matters: if the SEC's crypto views in 2018 were different and shared internally, Ripple can claim they were left without clear guidelines.

In other words, if the regulator's views kept shifting, how clear could things have been?

Ripple isn't just playing checkers with the SEC. They're also playing chess, strategically making moves outside the U.S.

Curious about Ripple's grand strategy beyond American shores? Let's dive in👇

Ripple's double game♟️

Ripple has learnt from their U.S. challenges, deciding to flex their muscles on the global stage, focusing on crypto-friendly countries to grow their business and dodge legal hurdles.Just this past week, Ripple has made power moves in Switzerland, Abu Dhabi, and Hong Kong. Let's dive into the specifics:

Ripple collaborates with the Hong Kong government on CBDCs

On May 18, Ripple made waves by launching their own central bank digital currency (CBDC) platform, a tool for banks, governments, and financial institutions to craft digital currencies.The cool part? Ripple will test their platform live with the Hong Kong Monetary Authority in an e-HKD pilot, showing off its potential.

Ripple's partnership with Hong Kong is strategic, given the city's recent crypto-friendly regulations allowing retail trading of certain crypto assets starting from June 1.

Ripple acquires institutional crypto custody firm Metaco for $250 million

But Ripple's game doesn't stop there! They've shelled out a cool $250 million to acquire Metaco, a Swiss digital asset custody firm operating under clear crypto regulations.With heavyweight clients like Citi, BNP Paribas, and Societe Generale's digital asset arm, Metaco brings an impressive roster and expertise to Ripple's portfolio.

More than just a client list, the acquisition expands Ripple's offerings, enabling them to custody, issue, and settle any type of tokenised asset.

Ripple expands into the Middle East

Lastly, Ripple is making a splash in the Middle East.They've partnered with Lulo Money, a subsidiary of Abu Dhabi's Lulu Financial Holdings, through a payment service provider called Tranglo.

The goal? Streamline cross-border payments in Abu Dhabi. Lulo Money, linked to Lulu Exchange, is well-positioned for this, transacting over $6.73 billion annually.

While this isn't as monumental as the other moves, it signals Ripple's expansion into another crypto-friendly region.

Institutions buying XRP 🏦

Ripple's strategic chess moves amidst their SEC battle seem to be paying off.Despite a five-week-long drain from digital asset investment products, adding up to $232 million, XRP stands strong, pulling in positive inflows.

Just last week, XRP enjoyed over $200,000 in inflows, totalling up to a cool $3 million since the year's start. Quite a feat, considering the current market downtrend!

Wondering how these institutional inflows impact XRP's price? No worries, we're about to break it down for you.

Price analysis 📊

In a bearish market, XRP is standing out with strong demand. Last week's bullish engulfing candle hints that buyers are running the show, possibly pushing prices up. Our first resistance? $0.51.

However, XRP's further rise hinges on BTC's price action, which looks gloomy currently. So, while sellers might step in at $0.51, a bearish BTC could prevent XRP from hitting this mark.

Cryptonary’s take 🧠

It's a thrilling time for Ripple, navigating U.S. roadblocks while eyeing potential benefits from newly revealed documents. While we await the specifics, chances are these documents might turn the tide for Ripple.The impact largely rests on the degree of the SEC's self-contradictions over the years. From an investor's lens, it seems Ripple stands on stronger ground than the SEC.

Ripple's global chess game is captivating. They're aligning with crypto-friendly governments, like Hong Kong, to showcase their tech and broaden their Middle East footprint. Plus, acquiring crypto custody firm Metaco is a key piece in Ripple's strategic puzzle.

And there's more good news! XRP's chart is pointing upwards. A bullish engulfing candle last week signals buyers are stepping in, likely driving prices higher.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms