Is DeFi dead? Here’s proof of life from LSD-Fi

After the SEC's latest round of attacks on the crypto industry, many people are starting to wonder if DeFi is set to take its final bow. After all, the recent onslaught targeted exchanges, and many altcoins are in the crosshairs.

To make matters worse, DeFi's Total Value Locked (TVL) has nosedived, plummeting a whopping 25.7% since April Fool's Day. We're talking a drop from $61.58 billion to a slightly less cool $45.78 billion.

But no, dice, Ethereum staking forges ahead unfettered. Just last week, it bagged an additional 207,000 ETH, bringing the total to a mind-boggling 22.913 million ETH staked. Seriously, the hunger for yield on Ethereum seems to be insatiable.

But wait, there's more! There's a fresh breeze blowing through the DeFi landscape, and it goes by the name LSD-Fi. No, no, it's not about hallucinogens in the crypto market, although that would be quite the trip!

Here’s the low down on this sizzling hot new sector that's making heads turn with its impressive growth numbers.

TL;DR:📃

- Is DeFi dead? Not quite! Despite declining DeFi TVL, Ethereum staking is thriving, with 22.913 million ETH staked.

- Introducing LSD-Fi, a sizzling new sector in DeFi with impressive growth numbers.

- LSD-Fi represents a tiny portion (2.3%) of the $16.7 billion ETH liquid staking economy, indicating substantial room for growth.

- LSD-Fi's growth has been exemplary, and it is expected to soar in the next bull market - we’ve got eyes on a few projects.

- Long story short, DeFi is alive and kicking; in fact, LSD-FI might just be the silver lining in Gensler's attack on crypto.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the R:R trading tool to help you understand our analysis very quickly. They are not signals and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

Getting high on LSD-Fi 😶🌫️

Now, let's get down to business. The TVL in the LSD-Fi sector has skyrocketed from a humble $50.64 million to a mind-blowing $381 million – an incredible gain of 652%! Talk about hitting new highs!

Now, what's driving this wild ride? Well, it's the insatiable desire for yield. ETH stakers can leverage their derivative tokens to generate even more yield. It's like turbocharging your financial journey!

- When users stake through a liquid staking protocol, they receive a derivative token equivalent to the ETH they deposited. For example, stETH when staking through LidoDAO.

- And here's the clever part - while you contribute to Ethereum's security, you can still keep your assets liquid and use them. It's like having your cake and eating it too!

- But hold on a second. These derivative tokens don't have many uses...yet. That's where LSD-Fi comes into play!

- LSD-Fi is a sector dedicated to unlocking the full potential of Ethereum LSD tokens.

Pendle is one example - hint, we’ve covered it before.

Basically, Pendle separates a crypto asset from the yield it generates. Rather than have exposure to the underlying ETH, with all its price volatility, users can buy into a share of the yield generated by that ETH. It's like getting a slice of a stock dividend without owning the underlying stock. Simple, right?

Or, if you're feeling adventurous, you can gain exposure to ETH at a cheaper-than-market rate. The catch? You won't get any access to the yield potential of that ETH. It's like buying a stock without getting any dividends. But hey, sometimes you gotta make choices, right?

Pendle allows for much more versatility when interacting with yield-generating assets. It turns an asset into something like a Swiss army knife with more utility and uses than it was ever designed for.

Now, let's talk about Lybra, another player in this trippy landscape.

Lybra is a decentralised stablecoin (eUSD) issuer that uses deposited ETH as collateral to back the stablecoin and generate yield. And guess what? It's been flying high in TVL growth since May, up a jaw-dropping 1000%+.

Users deposit ETH to mint eUSD. The yield generated from that staked ETH is then used to generate yield for eUSD holders. 1.5 ETH is required to back the equivalent of 1 ETH worth of eUSD. Thus, $1000 worth of eUSD benefits from an outsized share of the Ethereum staking yield compared to simply staking $1000 worth of ETH. 50% more yield, to be exact.

Now, while Ethereum staking might not solve the stablecoin dilemma entirely, it's definitely a step in the right direction. Unlike other stablecoins that rely on centralised methods to generate yield and combat inflation, LSD-Fi brings a fresh approach to the table.

And these examples we've explored are just the tip of the iceberg in the exciting world of LSD-Fi. The sector is in its infancy, but judging by its performance so far, it's in high demand.

However, there’s the elephant in the room - has the SEC’s attack affected Ethereum staking? Well, obviously. It has! But not in the way you may be thinking…

Coinbase gets sucker punched👊

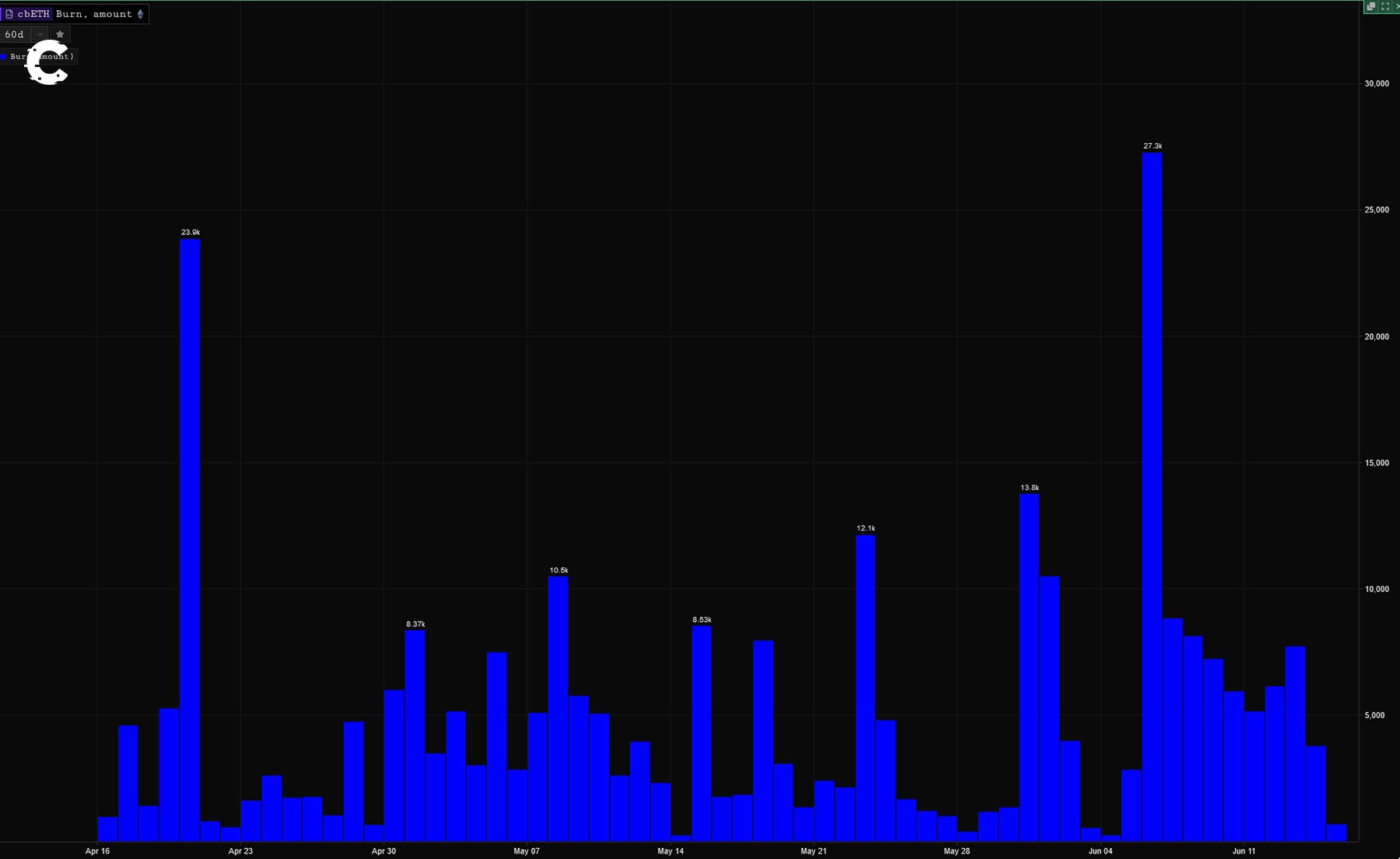

Ever since the SEC decided to rain on Coinbase's parade, ETH stakers have been hightailing it out of there. On June 6, they withdrew a whopping 27,300 ETH, and the withdrawals keep coming. Talk about making a swift exit!

It’s highly unlikely these users will just give up staking ETH. So where do they go?

Well, take your pick - Lido, RocketPool, or Frax are the likely candidates. But hold on one sec, has the migration from Coinbase actually taken place?

Let's crunch the numbers and find out.

Turns out, while Coinbase might be shedding some weight, other liquid staking protocols have been happily gobbling up ETH over the past 30 days.

What does this represent?

ETH staking is becoming more decentralised.

The rotation away from Coinbase, the second largest liquid staking custodian, into decentralised alternatives can only benefit Ethereum. The recent events with the SEC have shown that having so much of the ETH stake locked up in a centralised provider is a huge risk.

What if these assets had been seized? That would've been a nightmare.

Cryptonary’s take 🧠

Is DeFi doomed? Not on your life! We refuse to wave the white flag just yet.DeFi (at least TVL) has performed on par with BTC and ETH. However, we're not expecting any mind-blowing surges in the next few weeks and months. That said, we can’t just ignore the capital flow in DeFi and what that means for opportunistic investors and traders.

Despite the ongoing regulatory madness, Ethereum liquid staking is not just surviving; it’s thriving throughout the bear market. It’s the only sector to have positive performance over the last week. What's the secret to its success, you ask? Well, it's all about that sweet, sweet Ethereum staking yield. It's the missing puzzle piece that has finally been found, bringing utility to liquid staking like never before.

Granted, LSD-Fi still only represents a tiny portion, 2.3% to be exact—of the whopping $16.7 billion ETH liquid staking economy. The directly addressable market is still huge. Very few DeFi protocols have the advantage of capitalising on an already-established decentralised economy.

Considering the state of the broader market, the growth of LSD-Fi has been exemplary! We're placing our bets (and we've already done so) that LSD-Fi will skyrocket in the next bull market. It's like watching a rocket ship taking off to the moon!

And guess what else? While the SEC tried to play the villain, its actions unintentionally became the hero's cue. The decentralisation of Coinbase's custody of ETH has breathed new life into LS protocols. It's like turning lemons into lemonade,

Finally, we have found one of the few silver linings to Gensler’s attack on crypto.

Stay crypto-fabulous, Cryptonary Out🙏

Other news

- USDT has depegged slightly after Curve pools became unbalanced. Tether is still redeeming USDT, so there are no major issues, and we believe the issue is a nothing-burger.

- EigenLayer, a re-staking protocol, launches on Ethereum. The protocol essentially allows ETH stakers to stake their derivative tokens (e.g. stETH) for use in securing other protocols in return for additional yield. This comes with additional slashing risks.

- Synthetix has approved stETH perps on the platform after a governance vote.

- After a shambolic run-in with regulators in 2022, Tornado Cash has proposed a V2 upgrade that will introduce a zk-powered “Proof-of-Innocence” mechanism to comply with regulators.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms