🎄 Cryptonary Christmas Sale! 50% OFF. Save $500 Now Only ⏰ : 1d 5h 51m 30s

And right now, it seems that Mantle is a diamond in the rough, currently undergoing a period of transformation.

Since its July launch, it has been cast in the shadows by competitors like Base, stealing the spotlight.

Now, it's time to delve deeper and determine whether this seemingly raw gem has the potential to emerge as a polished masterpiece.

We will explore the birth of its ecosystem, the challenges it faces, and the opportunities it presents 👇

TLDR 📃

- Mantle distinguishes itself with a modular design, allowing various technologies for different functions, making it highly scalable.

- Mantle's ecosystem initially grew but now lags with a TVL of $86.34M, hindered by a lack of compelling applications and no incentives like airdrops.

- The $200M grant program and a partnership with Lido indicate potential growth in TVL.

- The MNT token serves as governance and gas fees. It trades with a market cap of $1.36B, largely due to its treasury holdings. The key to sustaining this valuation is ecosystem development.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

What made Mantle unique again? 🧑🎓

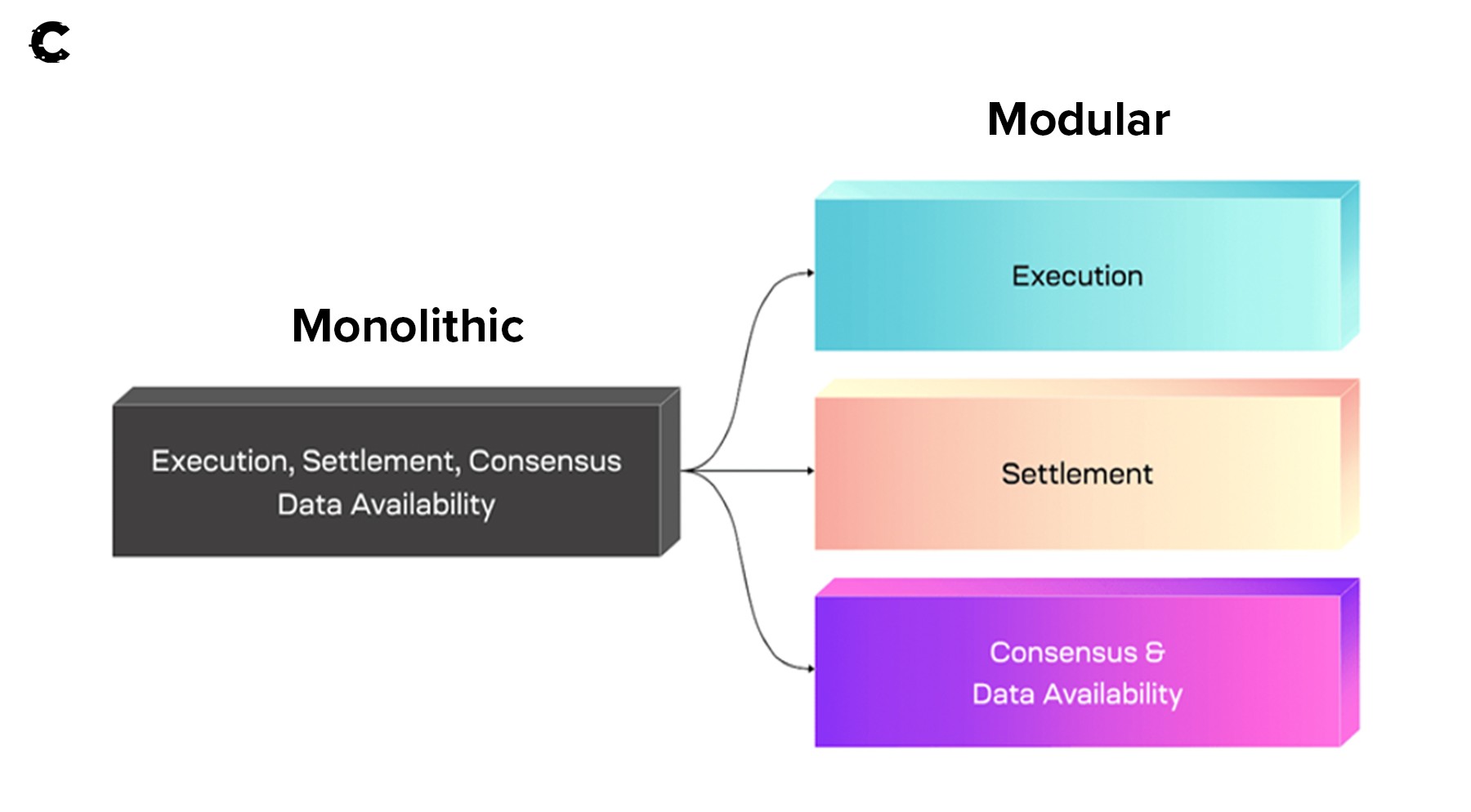

What distinguishes Mantle from other Layer 2 solutions like zkSync Era and Base? The answer is simple: a modular design.

What does that mean?

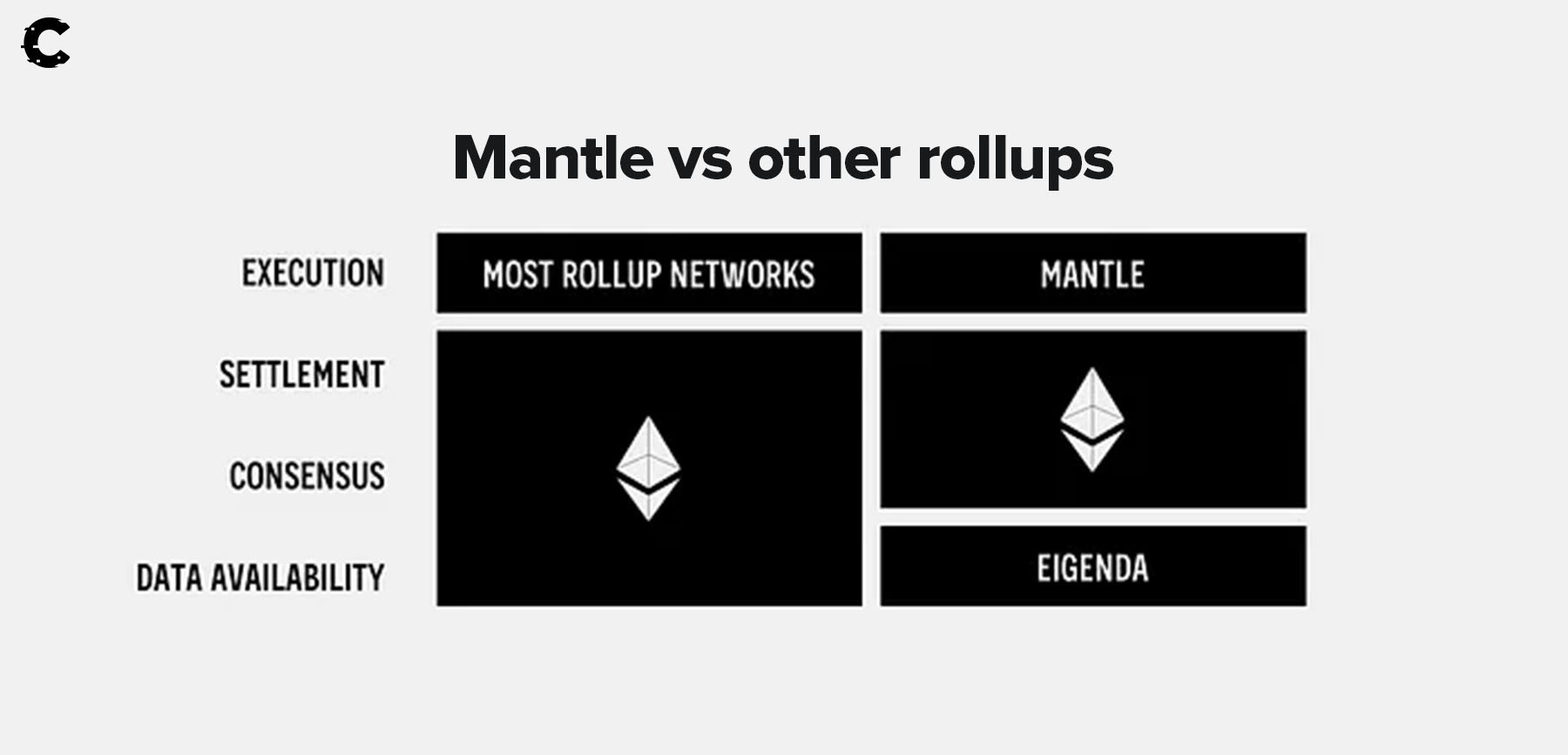

It means Mantle has different tech stacks for executing various functions instead of completely relying on the Ethereum network. Whereas other L2 rely on Ethereum for consensus, executing and settling transactions — Mantle isn’t tied to Ethereum alone. For instance, Mantle can leverage providers like Eigenlayer and its 'EigenDA' to manage data availability.

This modularity helps Mantle achieve cost-efficiency and speed unmatched by other Layer 2 solutions.

Another key factor that differentiates Mantle from other Layer 2 solutions is that gas fees are paid in MNT, not ETH. Also, the ecosystem and the network are built by BitDAO, which has now renamed itself Mantle.

This relationship has allowed the Mantle to inherit a $1.947B treasury, of which $200M has already been allocated to grants for protocols built atop the network.

Now that you're up to speed on what sets Mantle apart, let's take a look at how things have been progressing since its launch 👇

The Mantle ecosystem today, in a nutshell 🌍

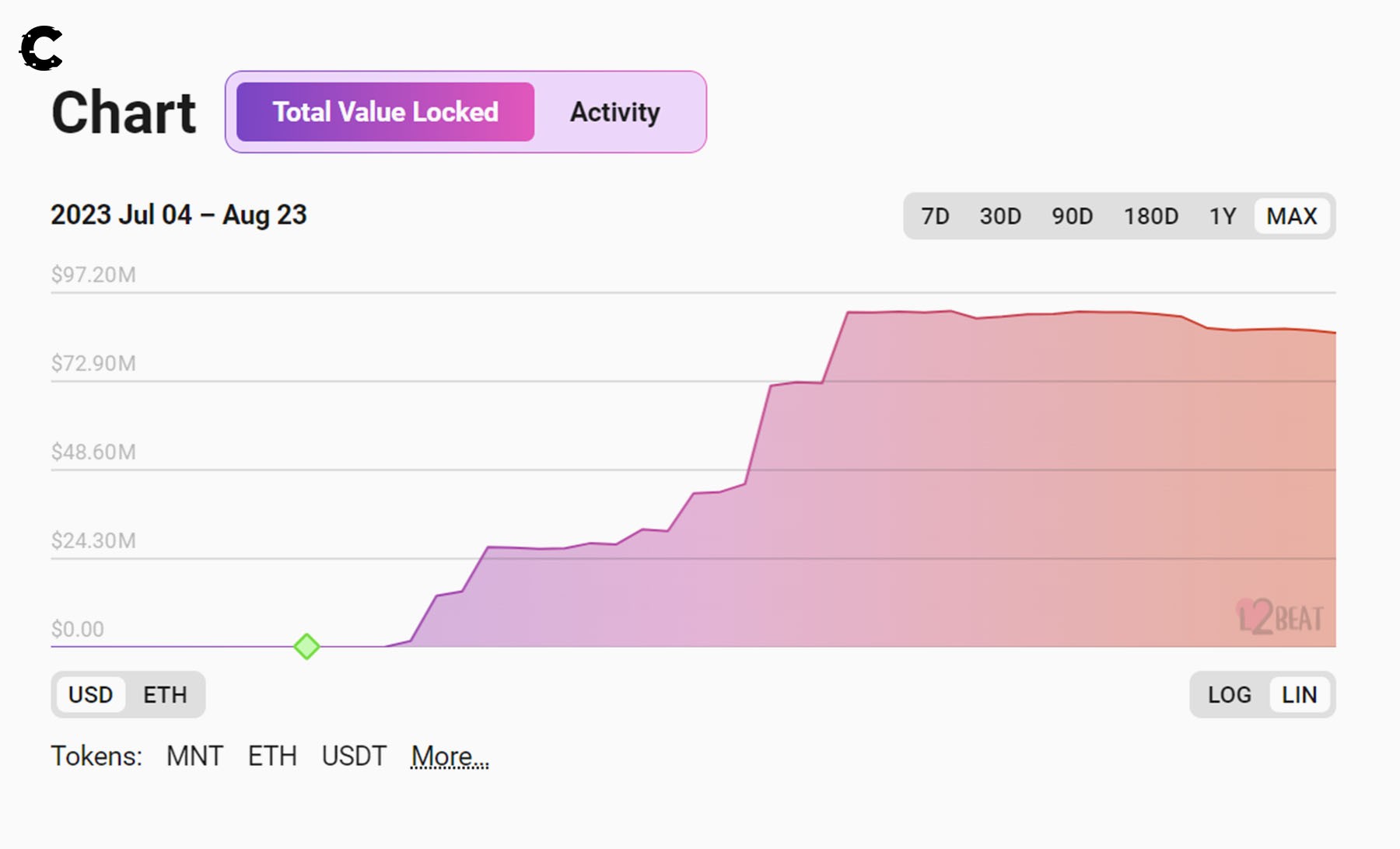

Since its launch, the Mantle ecosystem has initially experienced robust growth.However, as depicted on the chart, it has now largely stalled, with a current total value locked (TVL) of $86.34M, placing it in the 9th position among Layer 2 solutions in terms of TVL.

So why hasn't a Layer 2 network with significant technological advancements and ample resources managed to achieve a TVL of more than $100 million?

Mantle has struggled to attract applications compelling enough for users to bridge their assets.

Most applications on the network are currently standard DeFi offerings like lending markets or decentralised exchanges, lacking any unique features.

The absence of expected airdrops or incentives since Mantle's token launch makes it less attractive than tokenless networks like Base or zkSync.

What can Mantle do differently?

To improve, Mantle should prioritise its grant program, which funds projects to bring unique applications to the network. This is crucial for the development of Mantle's ecosystem, although results may take time.Another growth catalyst for Mantle is its recent partnership with Lido, a positive indication of its progress.

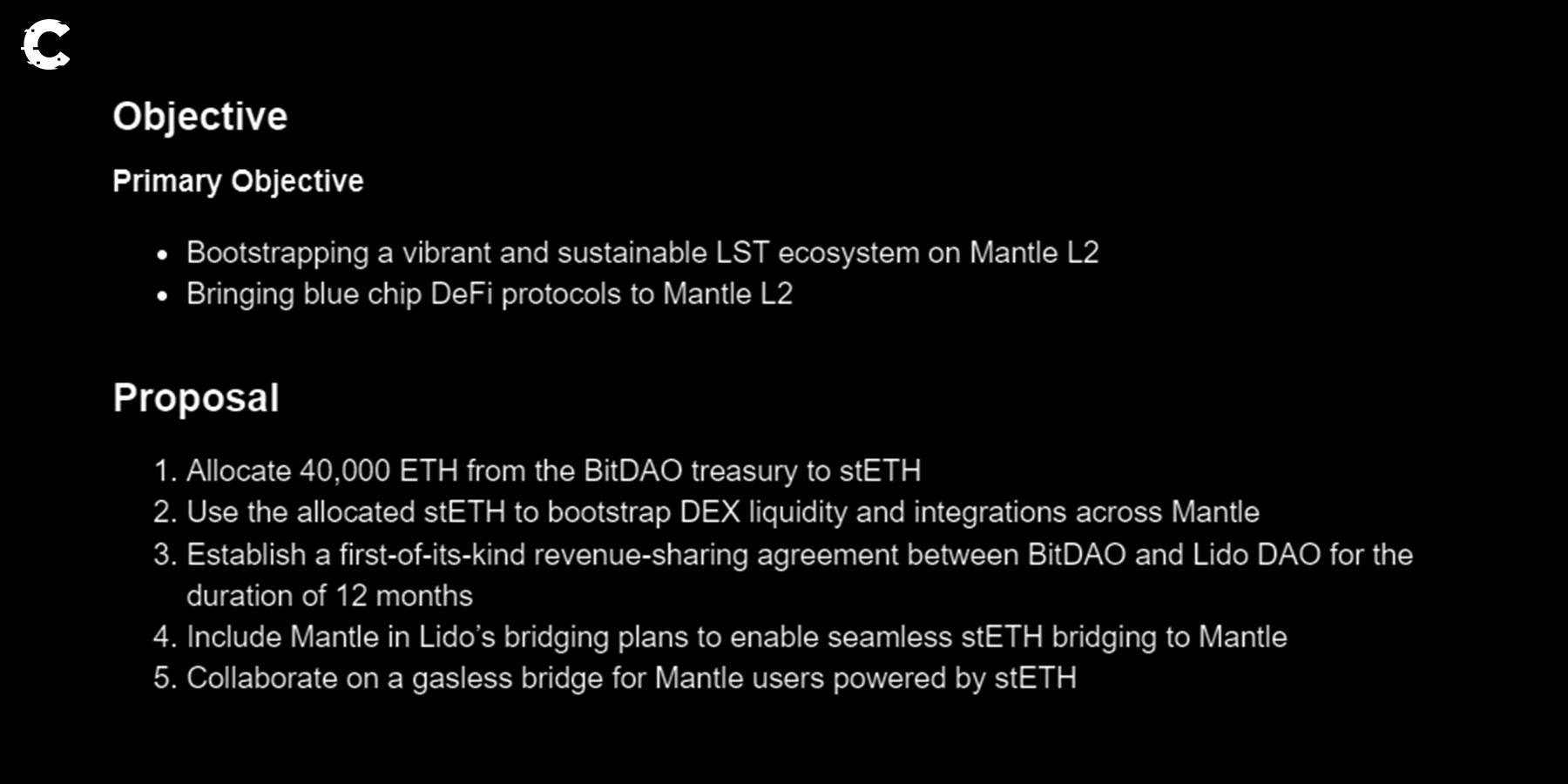

Due to this partnership, Mantle staked 40,000 Ether ($66M) on the Lido staking protocol following a successful governance vote on treasury management earlier this month.

While this might sound like something that primarily benefits Lido, as they now have a lot of extra ETH in their staking protocol, the partnership also includes a few objectives that will greatly benefit the Mantle ecosystem.

For instance, stETH will be leveraged to bootstrap liquidity, and Lido will deploy a bridge to Mantle, making it easier for liquid staking tokens to be onboarded to the ecosystem.

It remains to be seen exactly how these developments will impact TVL and liquidity, but it looks like things are moving in the right direction.

While the ecosystem appears underdeveloped, catalysts like the $200M grant program in the pipeline and the Lido partnership to improve liquidity suggest potential opportunities. Consider getting familiar with Mantle.

Now, let's talk about the MNT token 🤔

Mantle may not have a flourishing ecosystem, but its technology does offer the potential to transform a rough stone into a polished cube.This makes us wonder: What if we could gain exposure now while the ecosystem is still in its early stages and be there when it matures? To explore this opportunity, we must shift our focus to MNT, their token.

As mentioned earlier, what sets the MNT token apart from other Layer 2 tokens is that it serves as a governance token and a means to pay gas fees.

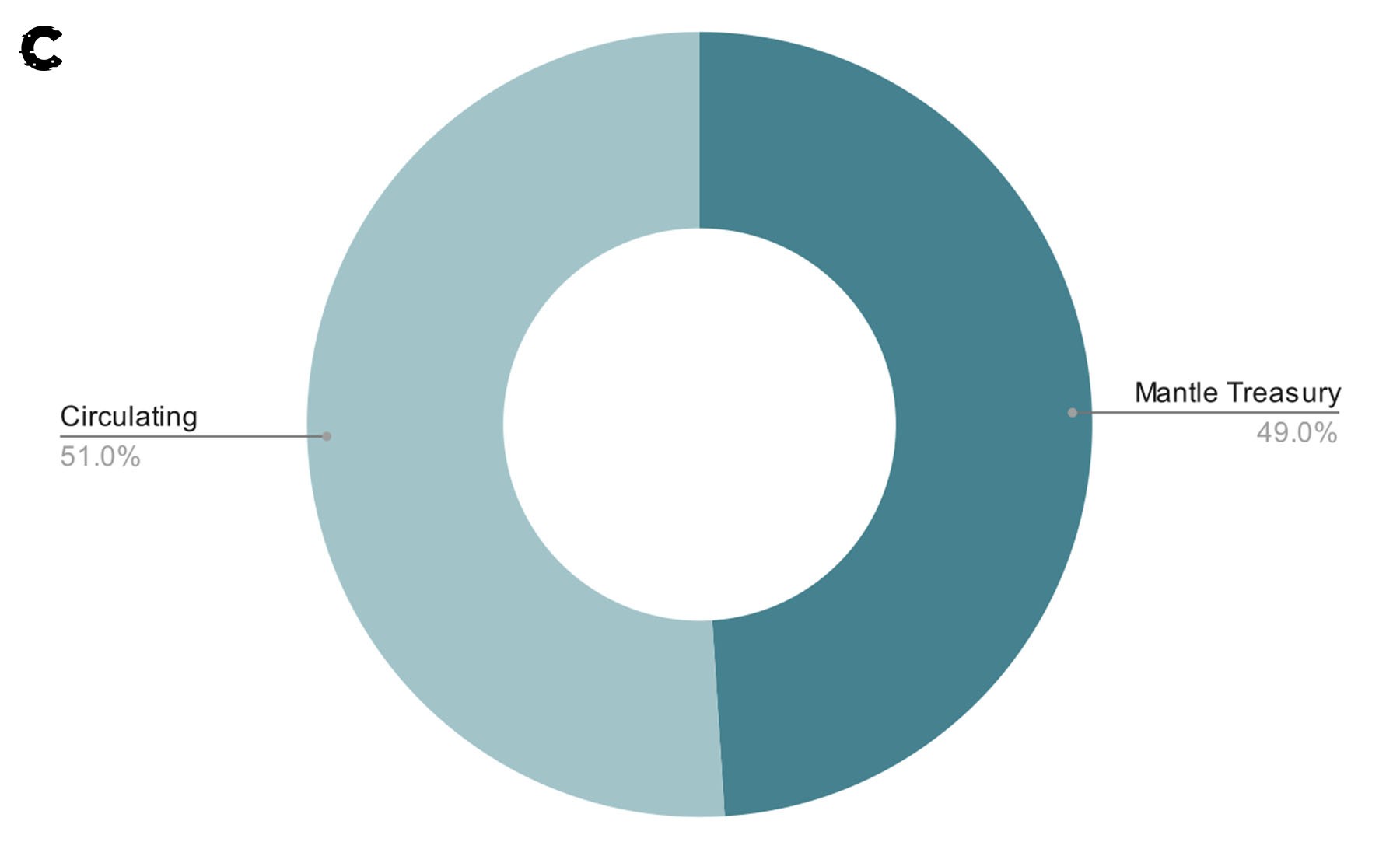

Furthermore, another unique benefit lies in the token's straightforward tokenomics, with no private investors or unlocks involved.

Most of the tokens are held in the treasury, allowing the DAO to decide their use. Additionally, 49% of the tokens are already in circulation, eliminating the possibility of investor unlocks that could disrupt existing holders.

The token trades with a market cap of $1,361,821,092, surpassing even Arbitrum's market cap.

While this might initially seem overvalued, it's crucial to consider that Mantle's treasury holds $681.08 million in value, excluding its governance token. This treasury alone accounts for approximately 50% of its total valuation.

So, would we buy $MNT now? Here's your answer:

Are we considering buying MNT?

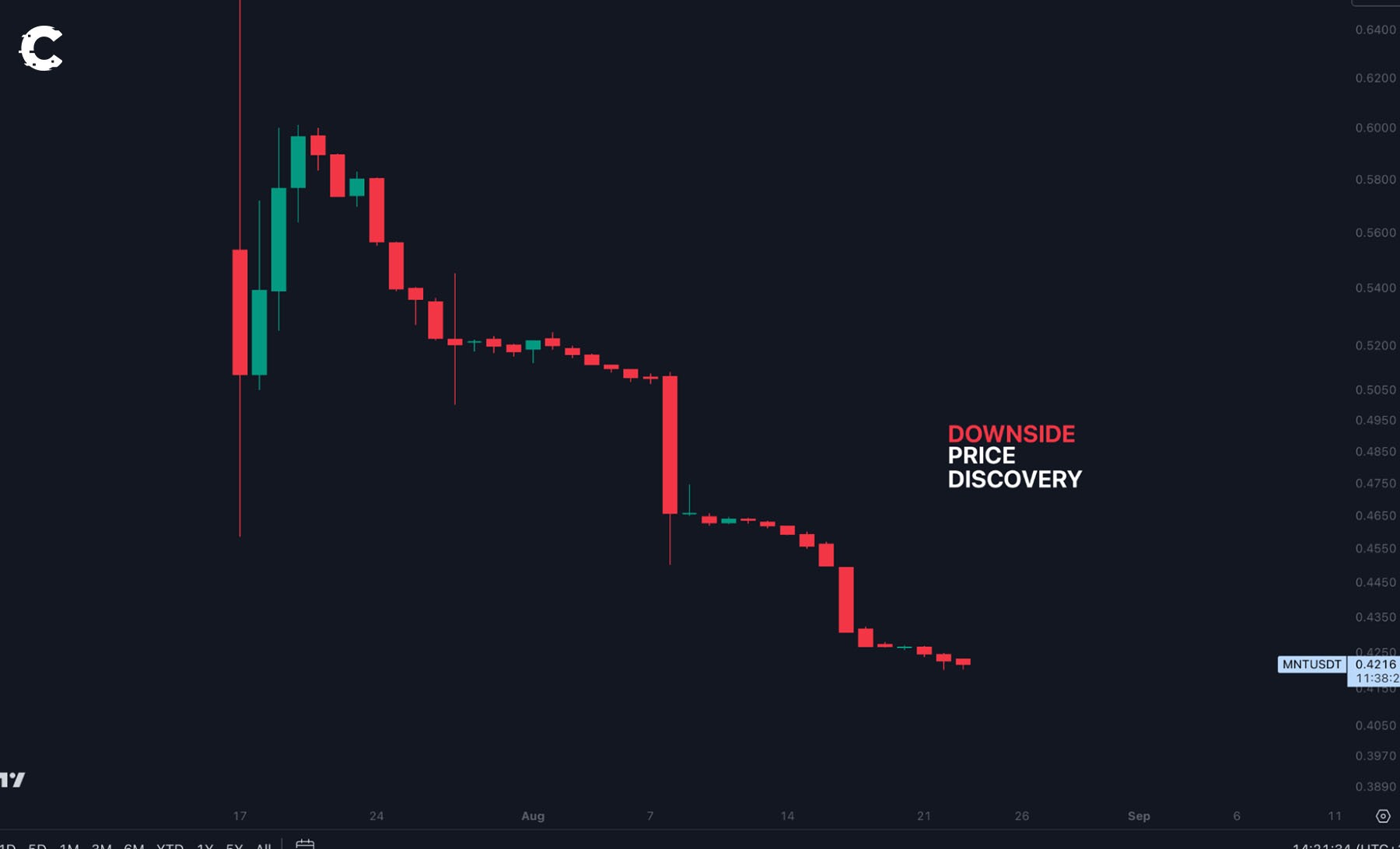

The continuous price decline of MNT since launch makes technical analysis challenging due to limited data. In such cases, caution is key.

One strategy is identifying potential support at psychological price levels like $0.40, $0.30, and $0.20.

Fundamentally, these levels can guide potential buying opportunities. MNT's $681 million treasury comprises 50% of its market cap.

If the token declines further and the treasury approaches 75% of the market cap, purchasing around $0.30 could align closer with treasury value.

Currently, the chart displays a steep downtrend. We await signs of strength, increased demand, or lower valuations before considering an investment in this token.

Cryptonary’s take 🧠

Mantle's uniqueness in layer 2 solutions is evident, but its main challenge is a need for more users due to a shortage of innovative applications.Attracting talent is vital for improvement. We'll closely monitor Mantle's journey and see if a potential killer app could boost its TVL.

However, currently, TVL is stagnant, making it more appealing to wait for a lower valuation than catch falling knives.

We are interested in buying as close to treasury value as possible. So that's either at $0.30 to $0.25 or after observing signs of strength and increased demand.

As always, thanks for reading! 🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$497/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.