Now, we must warn you, we are still in a bear market. What we’re seeing right now is a rally, and there is most likely a correction coming in the next few weeks. How will this affect prices? And are current prices sustainable, or is the market about to crash back down?

One of the biggest factors here is the actions of the U.S. Federal Reserve (Fed). Let's take a look at the macro markets and put on our fortune teller hats to see what’s coming up, and answer the all-too-important question…

Will the Fed hard stop this bullish rally?

Let's find out!

TLDR: Too Lazy, Didn’t Read

- Inflation seems to have peaked and is starting to decline. However, the drop in unemployment in December was not what the Fed wanted to see. To fix inflation, unemployment needs to increase.

- China has reopened, which is a net positive for the global macro economy. The world’s factory is ramping up again, which should positively affect supply of most finished goods. That said, it will likely inflate the prices of commodities like oil and electricity.

- We believe this rally is sustainable. Crypto was hit big over the FTX fallout, and the decreases in price were not justified from a macro perspective.

- We are not exiting long-term positions.

- We do not think there’s a lot the Fed can do to significantly disrupt the rally. A possible issue would be a 50bps hike instead of 25bps. However, the Fed generally doesn’t like to scare markets - and that would be a scare. (It’s unlikely to happen).

Inflation – Are We Past It?

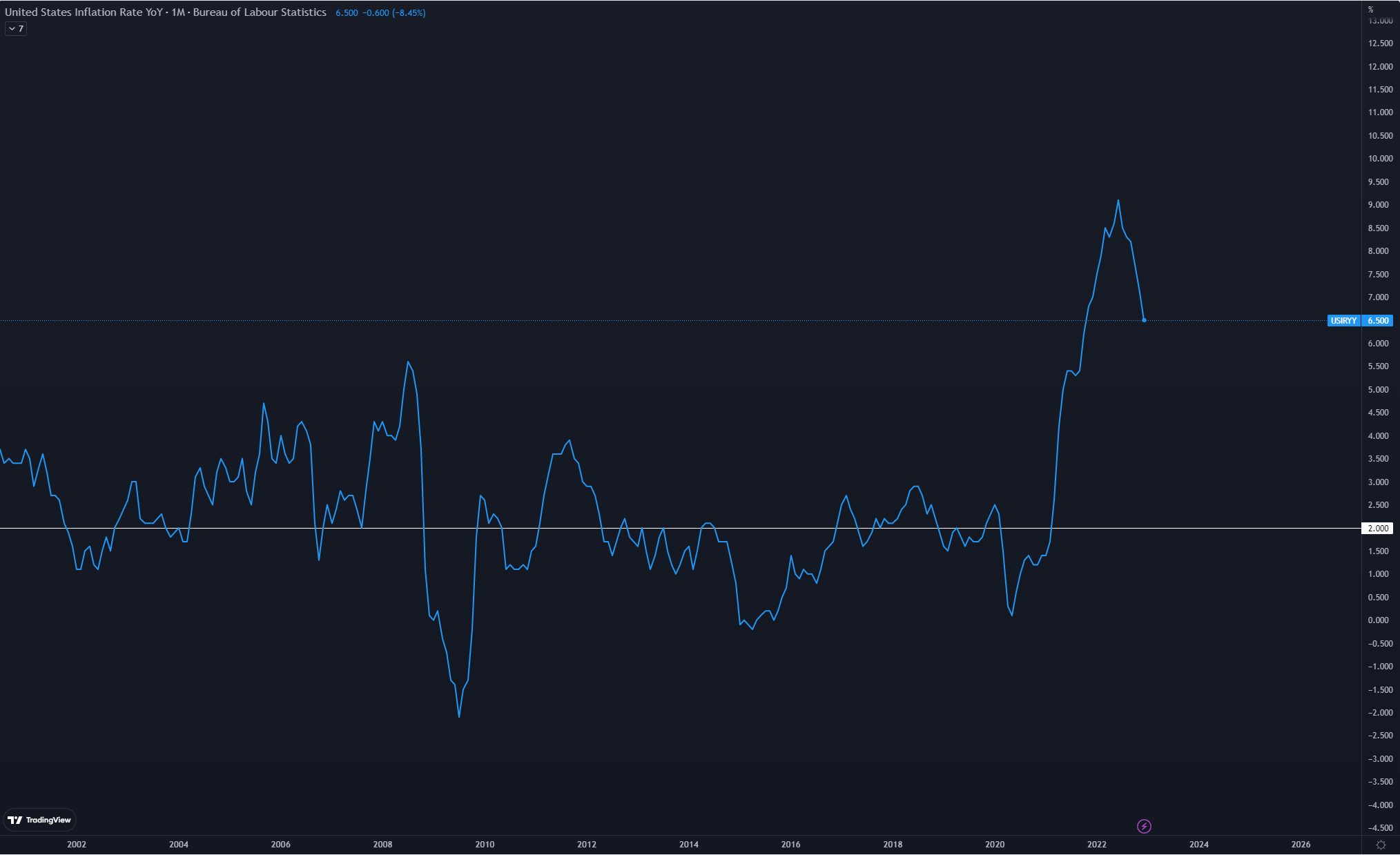

US headline CPI dropped from 7.1 to 6.5%. At first glance, this appears to be good news for investors, and for the most part, it is.

There is, however, a catch.

The Fed believes people need to lose their jobs – fewer people in the jobs market mean employees command lower salaries. Unemployment up, inflation down.

The issue? Unemployment actually fell to 3.5% in December, down from 3.7% in November. The jobs market holding strong is not something the Fed wants to see.

Inflation may have peaked, but the jobs market suggests there is still work to do to get it under control.

The Fed is ultimately trying to avoid something called a Wage-Price Spiral.

The wage-price inflation spiral is when employees demand higher wages because the price of everything has gone up. These increased costs mean businesses need to boost their prices…. You can see where we’re going with this.

If the Fed can increase unemployment and put more people out of jobs (we know it sounds brutal), then theoretically, employers can pay less, meaning they can drop their prices. This of course counters inflation.

If this happens, the likelihood of a Fed reversal in policy. If you’ve read our When Will the Bull Return report, you’ll understand how important this is!

China Reopens – Supply and Demand

In other news, China has finally opened after three years of lockdowns!China is the second-largest economy in the world. This superpower will play a pivotal role in the fight against inflation.

Here’s why…

There are two factors that determine price: supply, and demand.

The Fed controls demand. At any point, the Fed can kill demand as it controls the money supply. And indeed, this is what they’ve been achieving through rate hikes.

However, the control of supply falls in the hands of the country with the big red flag. With China reopening, supply should increase faster than expected.

This means huge competition across thousands of different industries. What does increased competition and supply mean, friends? That's right, lower prices (decreased inflation).

But not all is sunshine and rainbows…

With the Chinese economy ramping up, their need for commodities will increase. Anything China uses as an input to produce will increase in price.

So the price of any good produced by China may decrease, but commodities like oil and electricity will likely spike.

Not a complete win, but a net positive for global disinflation nonetheless!

Is This Sustainable?

As we’re all aware, the market reacted well to these recent developments. Stocks and crypto have rallied. Yet, the big question remains – is this sustainable?A positive month (so far) lends credibility to the illusive “soft-landing” (reducing inflation without a deep recession). Another contributing factor is the weakening dollar.

Risk-on assets (such as BTC, and stocks) generally have an inverse relationship with the DXY (Dollar Strength Index). We won’t get into why the dollar is losing strength (it includes treasury yields and all that boring stuff). The important point is this is another good indicator of inflation topping out. The market is beginning to price in the Fed pausing/pivoting.

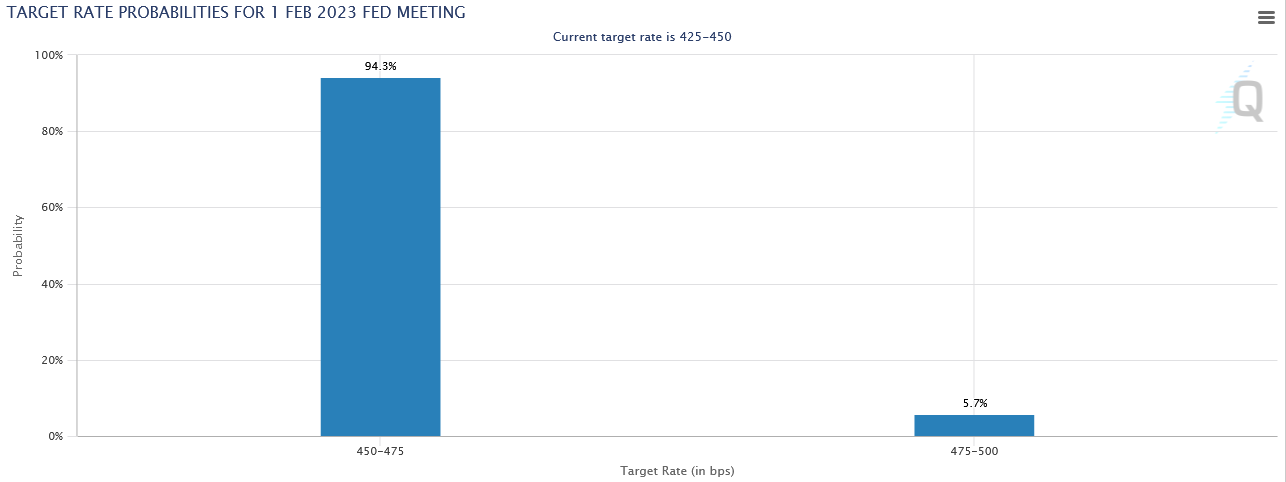

The next FOMC meeting is on the 1st of February. We expect Chairman Powell to remain hawkish (bearish, in other words) and announce a 25bps hike (the market agrees):

Predictions for the FOMC Meeting

Everyone loves fortune tellers, so let's look into our crystal ball to see what the Fed has planned!- Powell states inflation numbers are looking better.

- He “complains” about the jobs market for the reasons outlined above.

- He shares his thoughts on China reopening (essential).

- He announces there’s still a way to go for rate hikes to keep market expectations in line. (This has never worked, but we go through the motions).

Cryptonary’s Take

So, will the Fed hard stop this bull rally? We don’t believe so. The market has a relatively well-defined idea of what will happen in the next couple of months. There’s not a huge amount the Fed could do at the next meeting to affect this rally. Still, it’s important to keep an eye on data points (like CPI, PCE, and PPI) in the coming months. The macro situation is always evolving, and our strategy needs to evolve with it.Action Points

We see no reason to de-risk long-term positions. We still believe the bottom has been set. We view this rally as sustainable.Why, you ask? The collapse of FTX caused crypto to decouple from stock market moves (to the downside). Although crypto rallied, it is still behind where it should be had FTX not collapsed.

- It should be noted that this is still a bear market rally. It will not go up forever, and there will be a correction in the coming weeks.

- For those in early and looking to trade the move, scaling out incrementally for reinvestment can be profitable.

- For those looking to enter, we would use a DCA strategy for the same reasons above.

- Remember, the risk/reward for entering gets worse the higher the price. Avoid FOMO.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms