From BRC-20 to LTC-20 and DRC-20, it's like an alphabet soup out there in the Web3 world 🍲

These are the new kids on the block - "Ordinals", shaking things up by hinting at DeFi possibilities on chains that weren't originally designed for DeFi. Imagine, Bitcoin DeFi? Mind-blowing, right? 😮

But here's the million-dollar question: Does this new DeFi economy hold water? Let's dive in and find out…🔎

TLDR 📃

- Bitcoin led the way but Dogecoin and Litecoin just followed. A new DeFi ecosystem is being built.

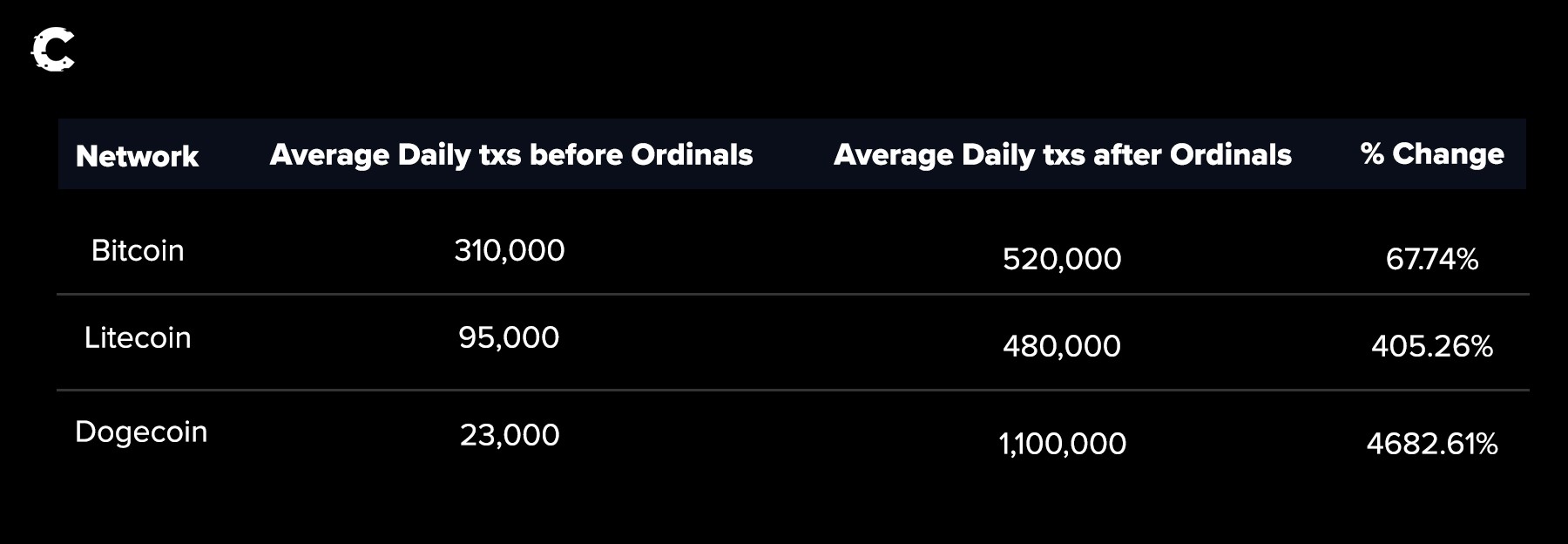

- Activity on Litecoin is up 5X while activity on Dogecoin is up 40X!

- DeFi without stablecoins? Of course not, Stably has launched the first-ever Bitcoin-based stablecoin (it’s centralised though).

- Even with the innovation, Ordinals can't yet overthrow the current DeFi economy - they lack a yield mechanism and are a tiny fraction of the $52.5 billion DeFi economy.

- BUT, opportunities arise. Amid memes, the token B20 is gaining traction - and for good reason.

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make is your full responsibility.

What’s the deal with Ordinals? 🪙

Ordinals are essentially unique, non-fungible digital goodies, etched onto a satoshi - the tiniest slice of a Bitcoin. Think of them like NFTs on steroids, carrying unique info on the blockchain.Now, take a gander at these experimental tokens called Bitcoin (BRC-20), Litecoin (LTC-20), and Dogecoin (DRC-20). They're made using these ordinal inscriptions right on their respective chains.

Boy, has this been a game-changer! Back in April, BRC-20s on Bitcoin turned the network into a rush hour freeway. 🚦But wait till you see the numbers 📊 - it's mind-blowing! Litecoin and Dogecoin chains, previously gathering dust, came back to life with a bang with these Ordinal tokens.

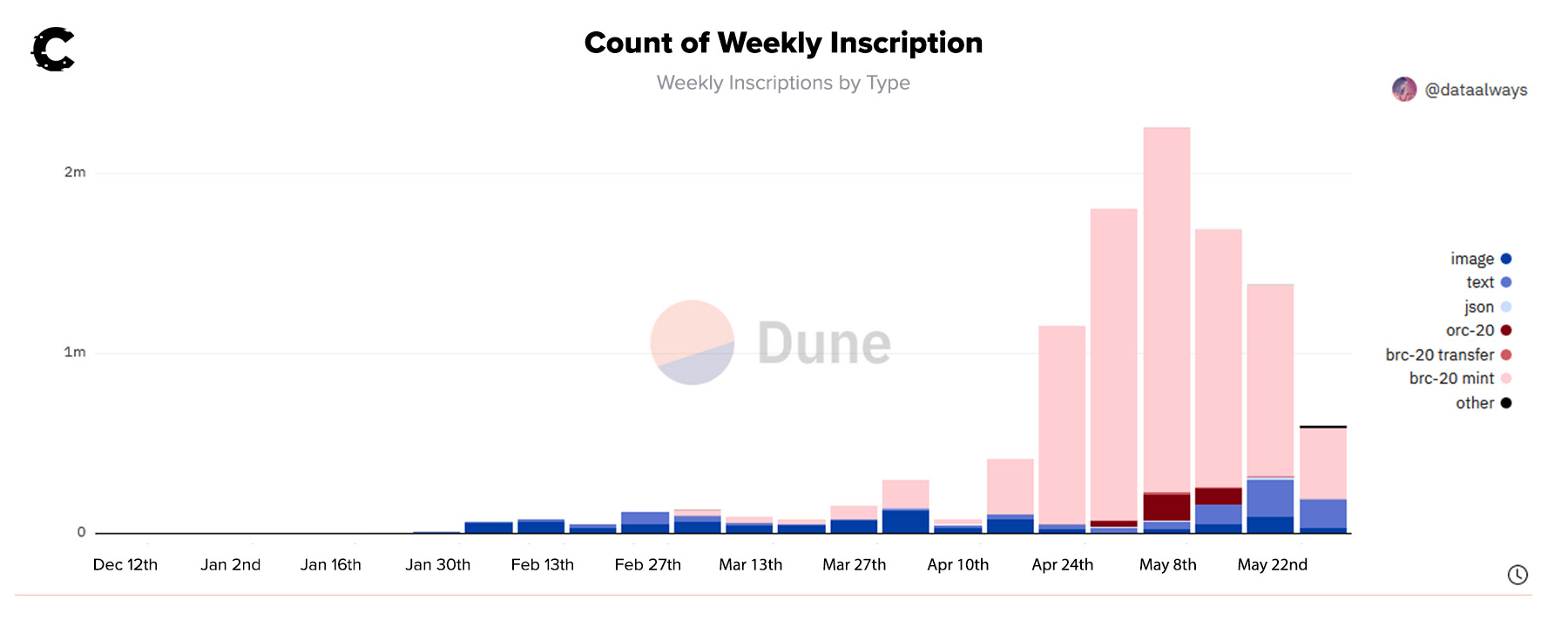

Digging deeper, it's clear Bitcoin is the big player in the Ordinals game. The minting of new tokens hit its peak during the first half of last month, syncing up perfectly with the traffic jam we saw on the Bitcoin network.

Bitcoin is now home to the top dogs of Ordinal tokens. The BRC-20 token market cap is comfortably lounging at $475 million, down from its lofty $1 billion peak in early May.

The tokens are mostly memes - PEPE, for example, which ripped 2200%+ earlier this year.

An interesting DeFi token (we’re clutching at straws here by calling it that) is B20. The ALEX exchange, one of the latest hubs for trading BRC-20 tokens, launched B20 - mostly to capitalise on the hype and get a quick payout. Make no mistake - it is a meme; however, as far as BRC-20 tokens go, it’s the closest to a UNI or SUSHI equivalent.

But hey, it's not just about the tokens themselves. People are taking notice, and not just in a "huh, that's interesting" sort of way. They're rolling up their sleeves and building a whole new DeFi economy around these tokens. Get ready, because this is just the beginning…

Building the infrastructure 🪜

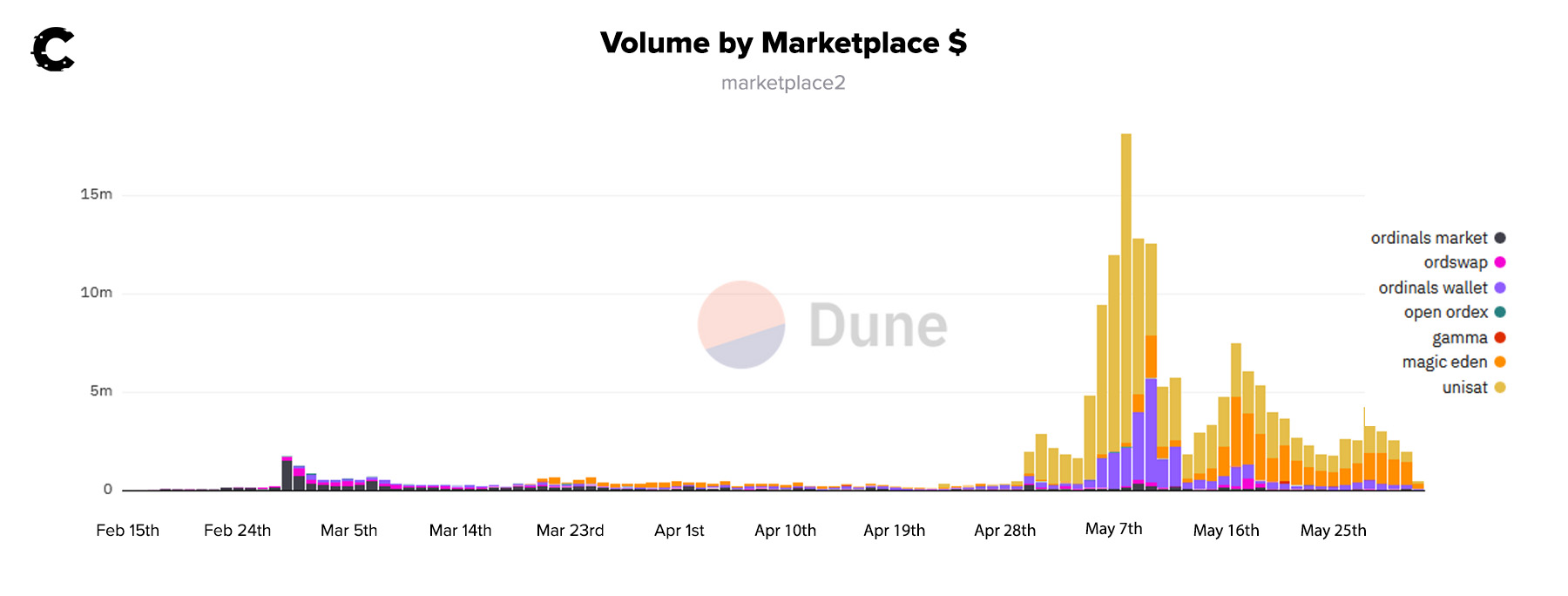

Bitcoin Ordinals marketplaces saw an explosion in volumes in May.

Picture this: daily volume hitting a fever pitch of $18-19 million on the 8th of May, matching the height of the Ordinals minting frenzy. Leading the charge was Unisat, a wallet and BRC-20 exchange lookalike, followed closely by Ordinals Wallet.

Now, there's a twist in the tale - money's been flowing into Bitcoin NFTs like a river. It's a mini bull run, mirroring the capital rotation we saw in the 2020-2021 market, sweeping across the entire crypto landscape.

Riding the wave of BRC-20s' success on Bitcoin, the new kid, BRC-721E, is flexing its muscles. This token standard has paved a bridge for Ethereum NFTs to make a grand entrance into the Bitcoin network - like we needed more traffic there! This addition might pump up the volumes, though we can't quite figure out why someone would want to bring their Ethereum NFTs over to Bitcoin.

But it's not really about crossing this bridge. The point is, the bridge is built, it's here, and you bet people are gonna use it!

And hey, speaking of booming marketplaces, let's talk about the life of the DeFi party - stablecoins. Can’t imagine DeFi without them.

Bitcoin stablecoins - wut?! 💵

Stably, a centralised stablecoin provider, just dropped a game-changer - the first-ever dollar-backed BRC-20 based stablecoin. It's feeling a bit like the Matrix around here with new levels adding up in this crypto equation. #USD just entered the scene last week, so don't rush to ship your life savings onto the Bitcoin network just yet.

But let's get this straight - stablecoins are the lifeline of any DeFi economy. If DeFi rockets on Bitcoin, Litecoin, Dogecoin, or any other BTC-tethered coin, we can almost guarantee that the big kahunas like Tether and Circle will be elbowing their way in. The real deal? There's now a choice to trade with stables, pushing open a whole new world of possibilities for those already cruising on the chain.

So, we've got the DeFi basic building blocks sorted. Now, for the billion-bitcoin question - are these shiny new innovations set to overthrow the current DeFi economy?

Cryptonary’s take 🧠

The basic building blocks for DeFi are now available within the Bitcoin, Litecoin and Dogecoin ecosystems. Will these innovations be enough to replace or compete with the existing DeFi economy?Short answer - no. 🚫

Bitcoin, Litecoin, and Dogecoin were never designed to facilitate DeFi activity.

The long answer? 📝

A thriving DeFi world needs more than just NFTs and stablecoins.

Our current toolkit for creating DeFi apps? Still pretty skeletal. Plus, we can't overlook the need for Web3 programming languages for penning dynamic smart contracts, or solutions for scaling up to accommodate the surge in transactions.

In terms of users, simple elements like yield farming are key to DeFi, but these chains are missing a yield mechanism.

While the Bitcoin network has been jazzed up with recent improvements, Litecoin and Dogecoin Ordinal landscapes are still trailing.

So, how do we feel about Ordinals? As it stands, they're a bit of a novelty. Sure, the market cap of Bitcoin Ordinals might seem like a big deal to the average bystander, but it's just a drop in the colossal $52.5 billion DeFi bucket.

Other news 📰

- DEX to CEX trading ratio breaks records: As CEX trading volumes dip, this ratio is at an all-time high.

- SNX outpaces GMX in trading volume: In a face-off of derivatives exchanges, SNX leads the pack.

- Subnet boom sparked by Multiverse incentives program: An explosion in the number of Avalanche subnets thanks to the incentives.

- High correlation in token prices of Layer-1 chains: Data reveals a striking similarity in the price patterns of all smart-contract Layer-1 chains.

- MakerDAO proposes bumping DAI yield to 3.3%: A new proposal aims to increase the yield of DAI.

- Hacker's proposal passed by Tornado Cash DAO: Control of the protocol is set to return, following the DAO's approval of the hacker's proposal.

Missed DOGE? Catch the next big thing with Cryptonary

Did you know we reported WIF at $0.003 (+62,308%), POPCAT at $0.004 (+48,233.33%), and SPX at $0.01 (+6,200%)? Imagine what our research could uncover next.

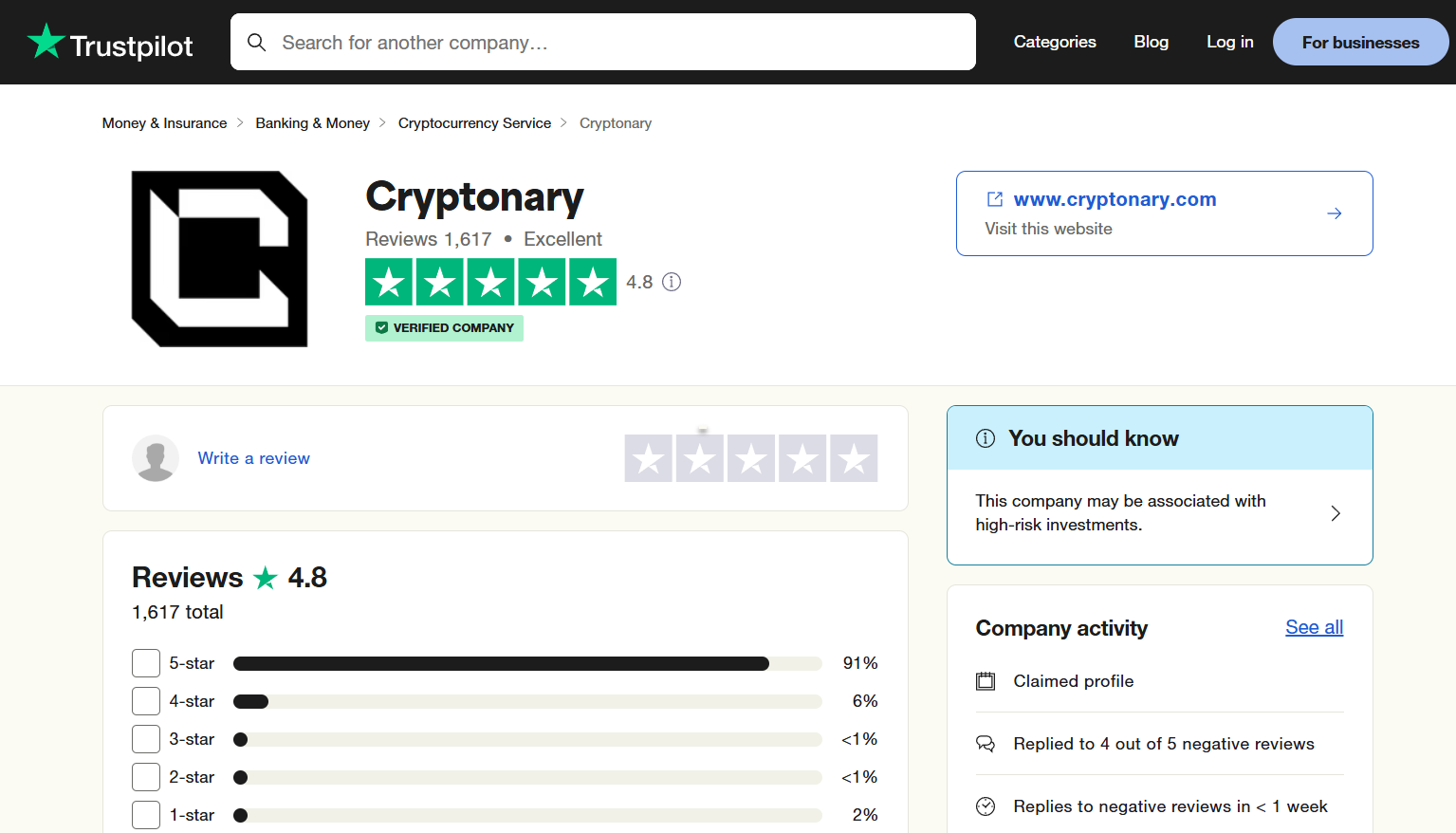

With a 7-day free trial and a 4.8/5 rating from over 1,600 reviews, there’s no reason not to give it a try.

With a 7-day free trial and a 4.8/5 rating from over 1,600 reviews, there’s no reason not to give it a try.

Continue reading by joining Cryptonary Pro

$0

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms