Now, picture this: a fresh layer 2 solution steps onto the scene, poised to welcome the next 100 million users – potentially a staggering $166 million in revenue.

The problem is Wall Street technically owns it.

So, unsurprisingly, it doesn’t have a token, and there’s no way for the public to profit from it.

But what if we told you we had found a way to get exposure to it?

Let’s dive in.

TLDR 📃

- Base, Coinbase's layer 2 solution, competes with other solutions like Arbitrum and zkSync Er.

- Since its launch, Base has amassed $230M Total Value Locked (TVL), outperforming other layer 2s

- Base earns Coinbase $3M in fees and $2M in revenue.

- Buying Optimism's token (OP) may offer exposure to Base's success.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

The unusual pathway for onboarding normies to DeFi 📈

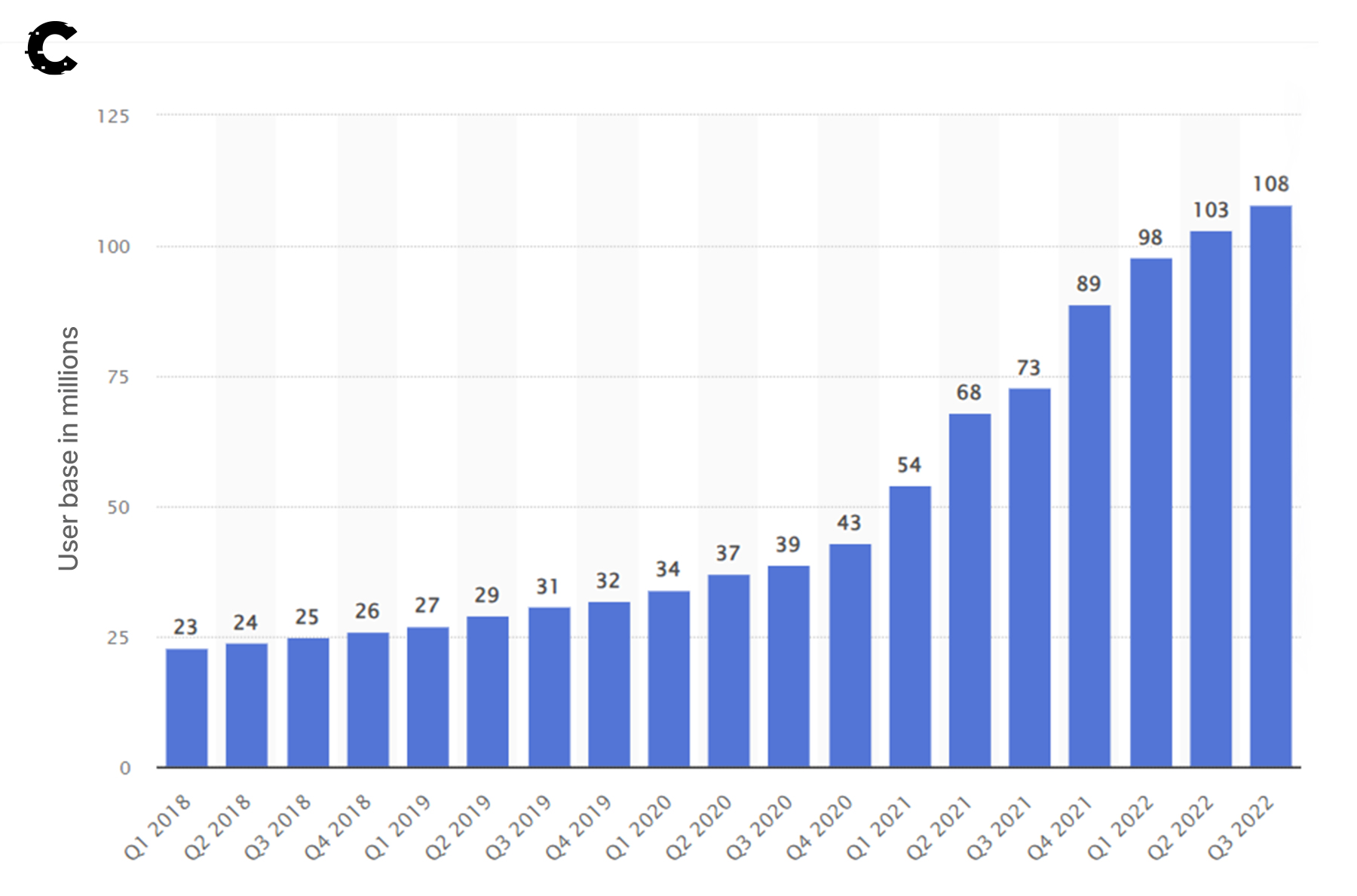

Coinbase is many people's go-to platform for their foray into cryptocurrencies. The company's growth has been remarkable; an impressive 108 million users have a Coinbase account.

Though a major player in the centralised exchange arena, Coinbase is fully aware of the evolving landscape. Coinbase is responding by introducing its own on-chain layer 2 solution called Base. This solution challenges platforms like Arbitrum and zkSync Era, luring users interested in DeFi and NFT activities.

Base, however, has an unfair advantage. With Coinbase’s expansive user base and iconic brand, Base can seamlessly onboard crypto normies into DeFi.

Coinbase’s well-established connections have also conjured an impressive lineup of projects ready to launch in Base. These projects include renowned NFT markets like Magic Eden, influential lending protocols like Aave and Euler, and decentralised exchanges like Uniswap and Sushiswap.

These developments sound great on paper, but how are things playing out in practice since the launch of Base?

Well, let's examine its current status👇

How the Base ecosystem is shaping up 🌱

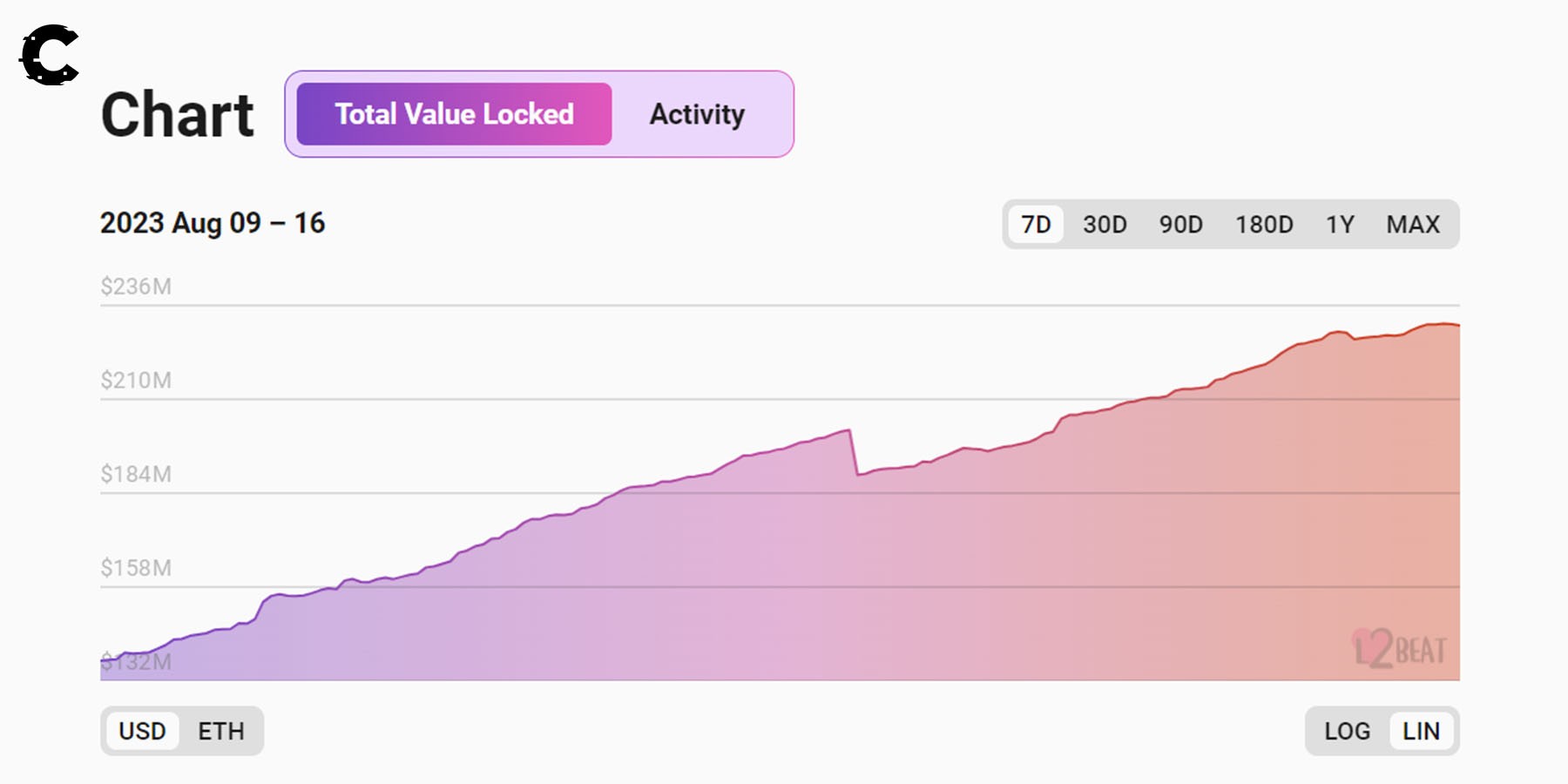

Barely two weeks since its debut, Base is already making waves with a stunning $230M Total Value Locked (TVL).

This feat becomes even more remarkable, considering many other new layer 2 solutions struggled to match such figures. Mantle, for instance, reached a TVL of only $90M post-launch, while Linea remained stuck at $30M.

Base? It's confidently claiming its spot among the top 5 contenders!

Of course, it’s not all been a walk in the part for Base. Base's initial launch and momentum were fueled by speculation surrounding memecoins. Tokens like BALD received substantial attention and usage only to turn out as rug pulls, resulting in financial losses for many investors.

However, after the frenzy of speculation, the spotlight has shifted to reveal Base's true potential— the launch of friend.tech, a decentralised social media that converts crypto personalities into tradable tokens.

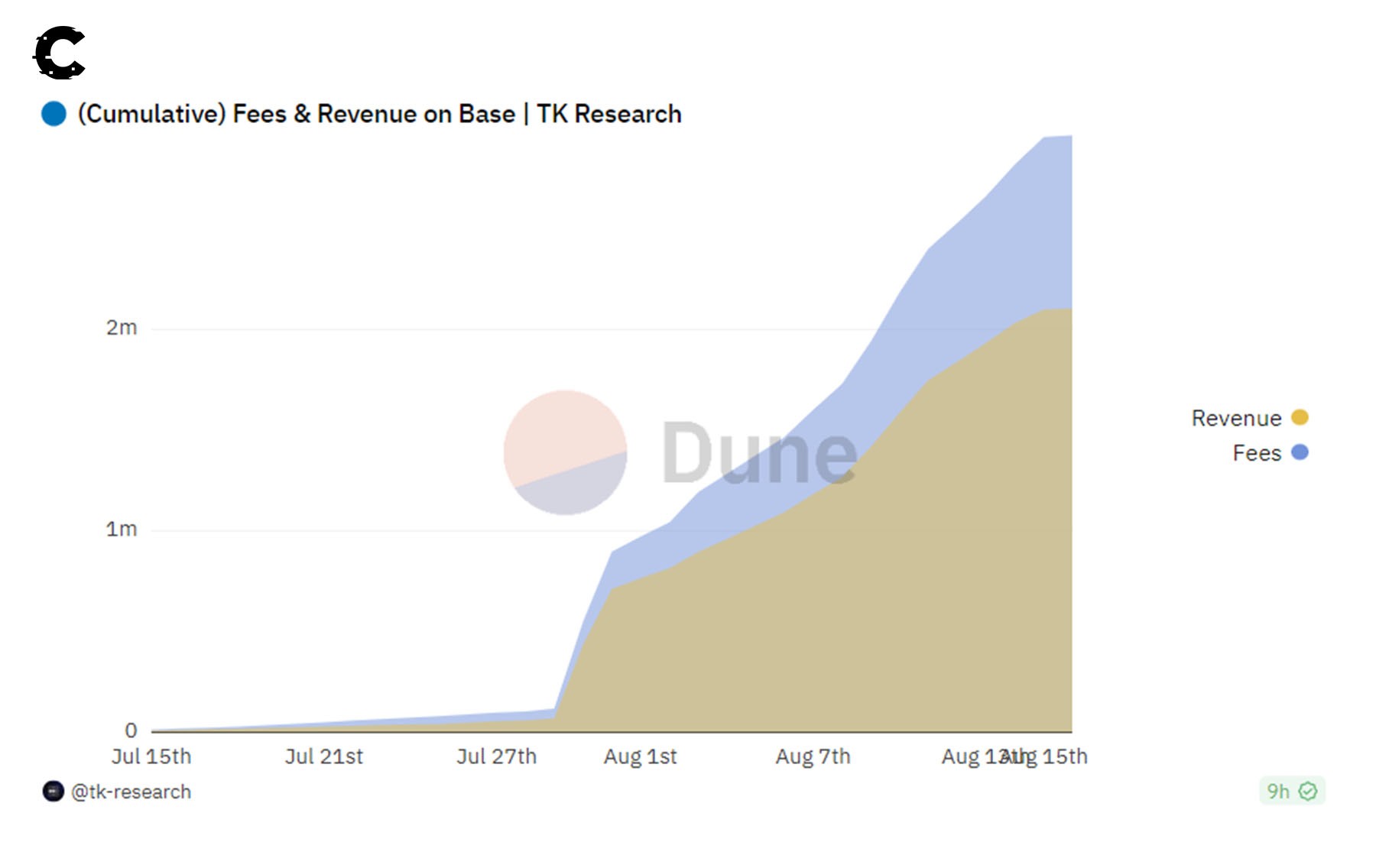

The project attracted significant attention, culminating in a trading volume of 7,336.2 ETH ($13,382,916.13) through 320,344 transactions. As you can imagine, all this activity occurring on Base is highly beneficial for Coinbase. Base has generated nearly $3 million in fees since its launch, resulting in a substantial $2 million in revenue for Coinbase.

So, how can you grab a slice of this revenue pie? While $COIN is an option, we're not big fans of the legacy system.

Here's an alternative way to claim your share and profit from Base's growth – through a token.

The shortcut to getting exposure to Base 🗺

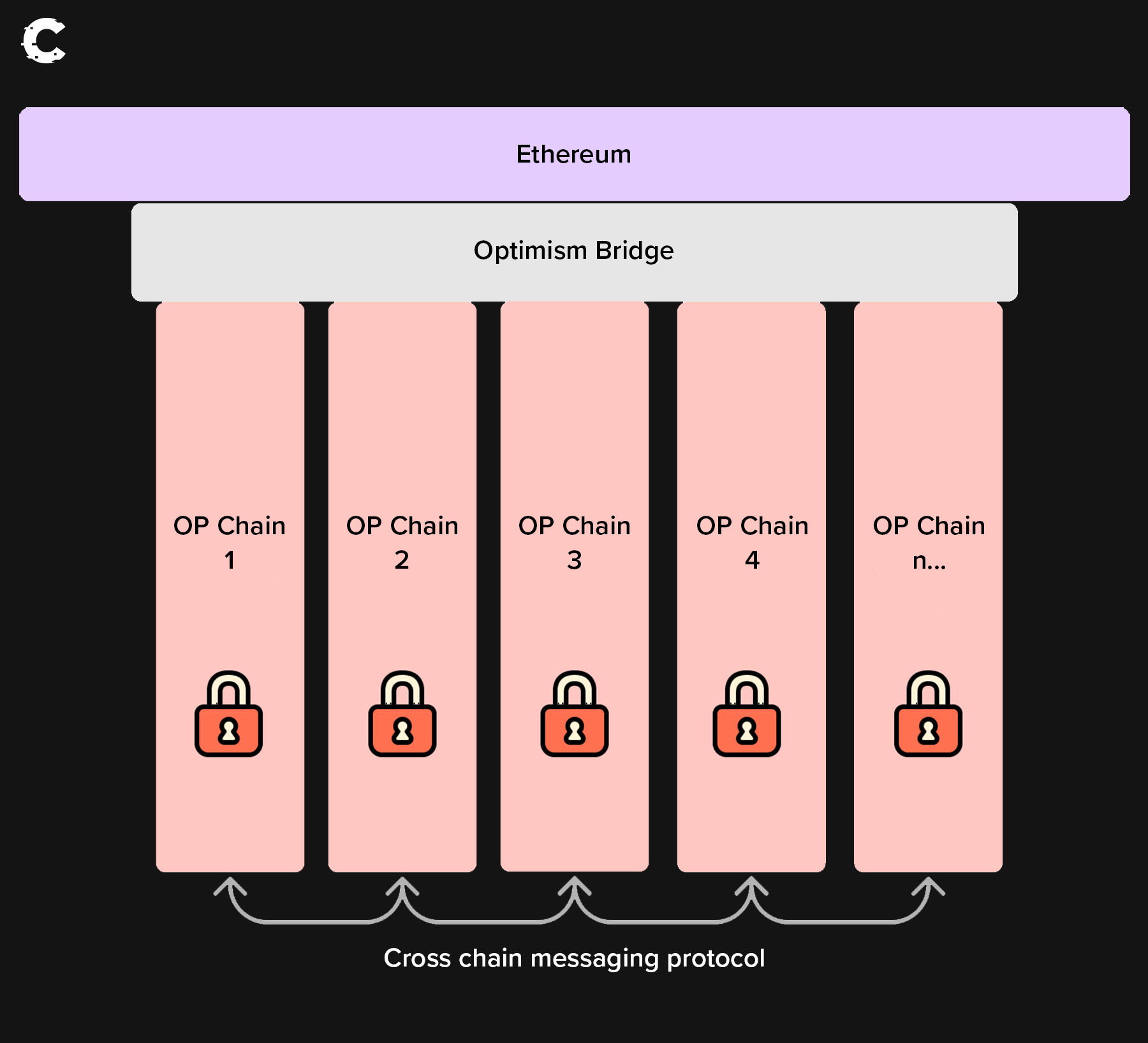

Coinbase didn't build Base from scratch; it leveraged Optimism’s ‘OP Stack’ infrastructure.This integration makes Base a part of the Optimism ecosystem, thanks to Optimism’s 'SuperChain,' network. For Base to be part of this ecosystem, it must adhere to specific 'laws' that make it part of a coherent and interconnected system.

This integration is beneficial as it allows millions of users who join Base from Coinbase to easily transition to Optimism because, as you can see in the image, these 'OP Chains' are all connected.

Also, Base will provide a percentage of the fees earned through transactions to the Optimism Collective. This means that as Base grows, Optimism benefits monetarily from it.

Because of this, since Base doesn't have a token yet and its ecosystem is still such a wild west, the real play to get exposure is buying OP, Optimism's token, as it benefits the most from Base.

OP price analysis 📊

OP's performance didn't meet our initial expectations, but no need to fret. The trajectory remains intact; only the timing shifted.

Last week, OP closed below $1.557, a strong indicator of potential downside. Despite that, we anticipated a rebound from that point.

With this thesis invalidated, two fresh scenarios emerge:

- OP holds $1.40, then bounces toward $1.557 and above. This is the ideal case, one which we'll be monitoring ourselves.

- OP fails to hold $1.40 and drops to the grey support region between $1.25 - $1.15, where its price will meet some buying pressure. From there, we expect OP's price to bounce toward $1.40, $1.557 and above.

Cryptonary’s take 🧠

Base will be crucial in onboarding normies into DeFi in 2024, especially in the bull market. Coinbase will put a lot of capital and resources into marketing the chain, and a large part of Coinbase’s existing 100 million users will try Base.However, the primary challenges for Coinbase will be harmonising its legacy brand with the wild west of DeFi and ensuring a continuous influx of innovation to Base. While friend.tech currently steals the spotlight, expanding the ecosystem is essential for propelling it to the next level.

If everything proceeds according to the plan, Base is poised to become one of the preferred layer two solutions in the upcoming bull market.

If you're looking for exposure, know that we are closely observing whether OP maintains its position at $1.40 and then rebounds towards $1.557 and beyond.

On Friday, we bring you another edition of Cryptonary’s smart money. Is the smart money taking up a position in Optimism? Are there better plays out there? Don’t miss the opportunity to know what is happening in the portfolios of the biggest winners in crypto.

As always, thanks for reading! 🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms