L2 Digest: Three protocols that could change the game

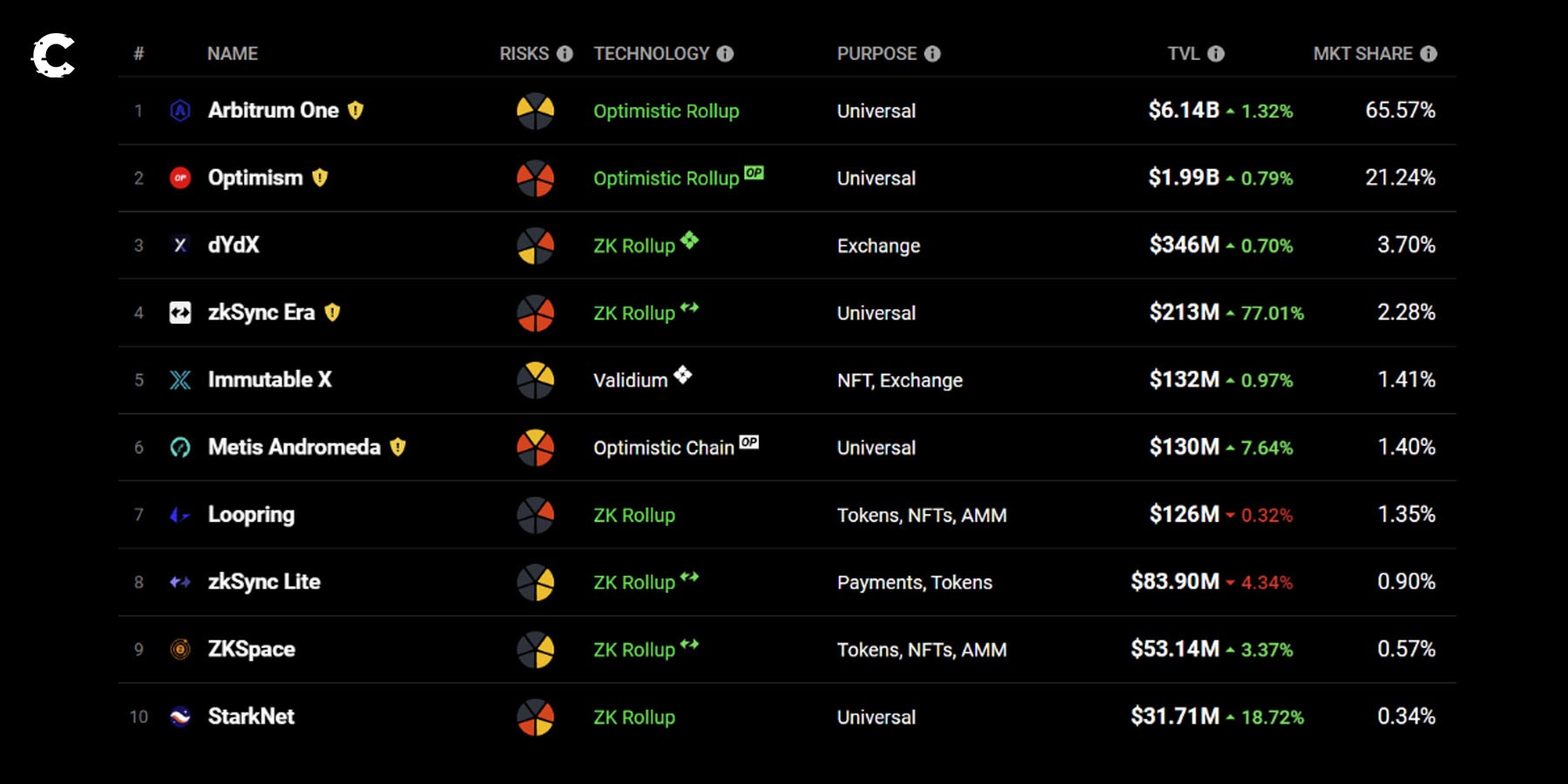

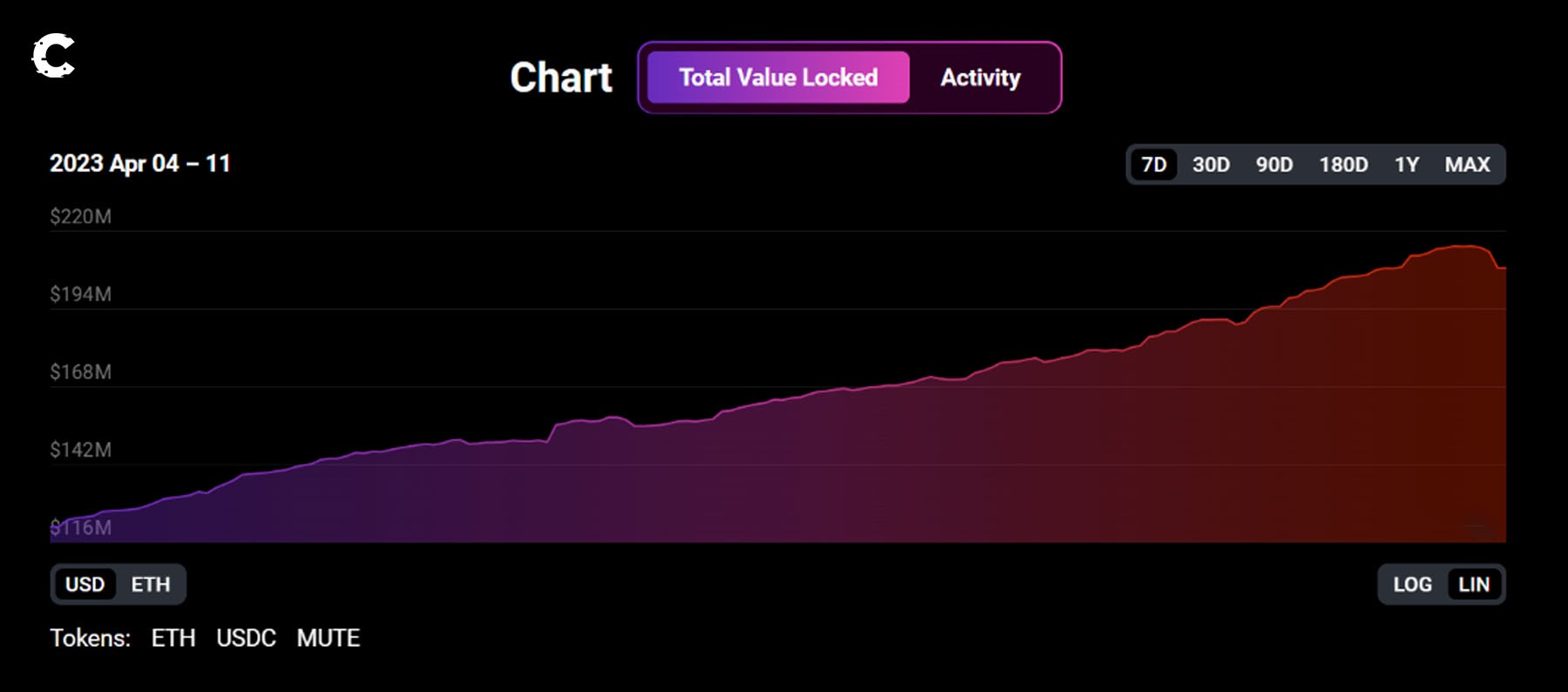

zkSync Era is the clear winner, with a 77% rise in TVL to $213M. But almost all layer 2s have been raising TVL, with green numbers across the board. Outliers include zkSync Lite as usage shifts to Era, and Loopring, which had a 0.32% decline for the week.

TLDR 📃

- Arbitrum has released two new governance proposals to address community concerns.

- Optimism is preparing for its Bedrock upgrade.

- DeFi protocols are increasingly adopting the OP Stack to create their own application-specific chains.

- zkSync has experienced a 77% increase in TVL to $213 million, maintaining its position as the layer 2 network with the highest growth.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

Layer 2 overview

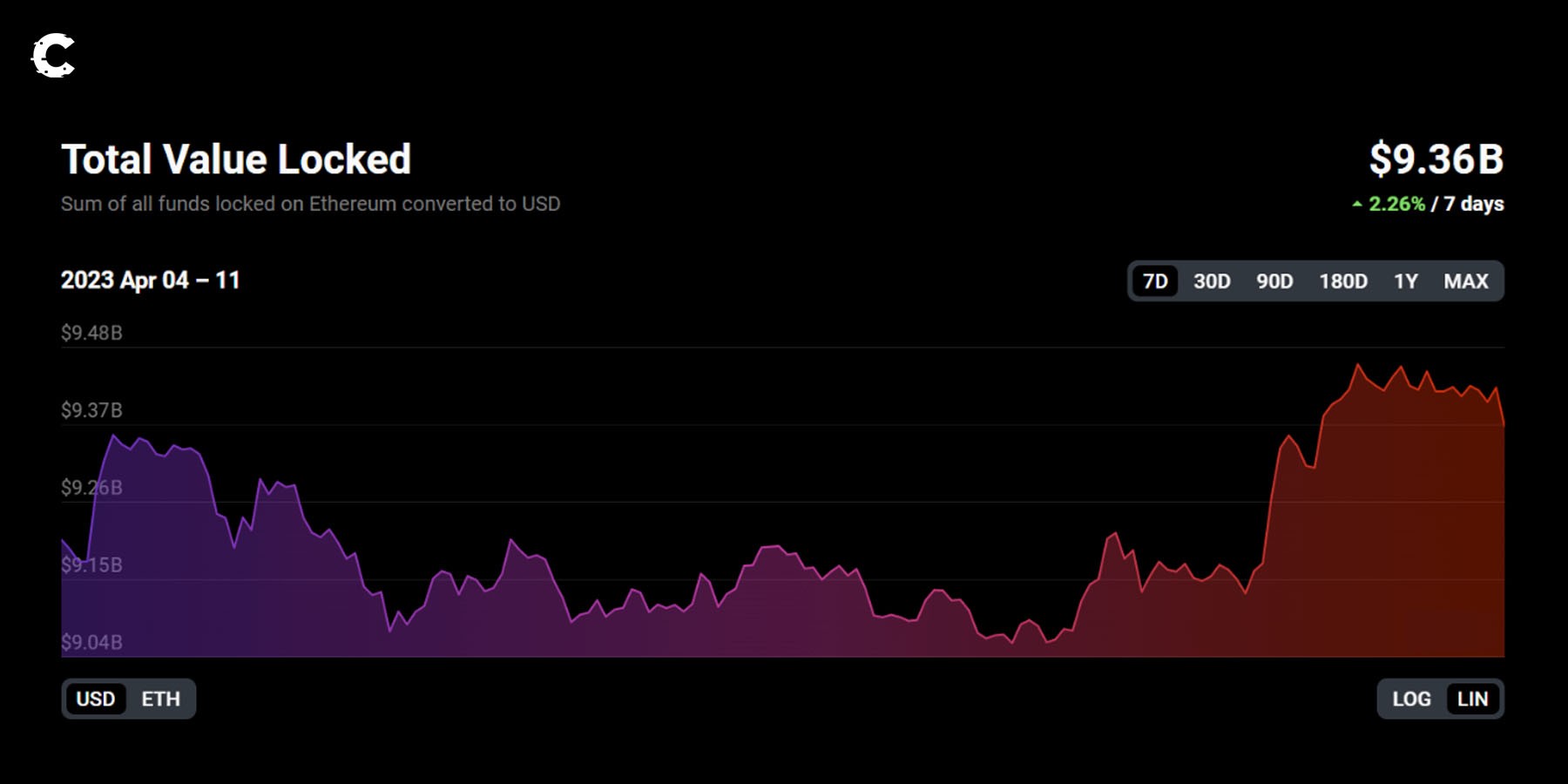

Layer 2 total value locked is up 2.26% this week to $9.36B, confirming that L2s continue to grow. While this week’s growth is not as significant as last week’s, TVL has been on an upward trend since December 2022.

🔑 Key developments

- Arbitrum released two governance proposals to address community concerns: AIP-1.1 addresses smart contract lockup schedules, spending, budget, and transparency. AIP-1.2 deals with amendments to founding documents and reduces the proposal threshold from 5 million to 1 million ARB tokens for increased accessibility to governance.

- Optimism freezes code for Bedrock upgrade: The code for the Bedrock upgrade has now been frozen on the Goerli testnet. The upgrade is intended to improve the scaling solution's performance by increasing throughput and decreasing transaction latency. It is expected to go live in May 2023, but OP Labs, the company behind Optimism, has not announced a definitive launch date.

- Options exchange Aevo goes live on mainnet: Ribbon Finance's Aevo options exchange has launched on the mainnet with $ETH options available in the first version. Additional cryptocurrencies will follow, Ribbon says. The protocol is built on the Aevo Chain, an optimistic roll-up to Ethereum that operates on the OP Stack designed by Optimism for application-specific chains.

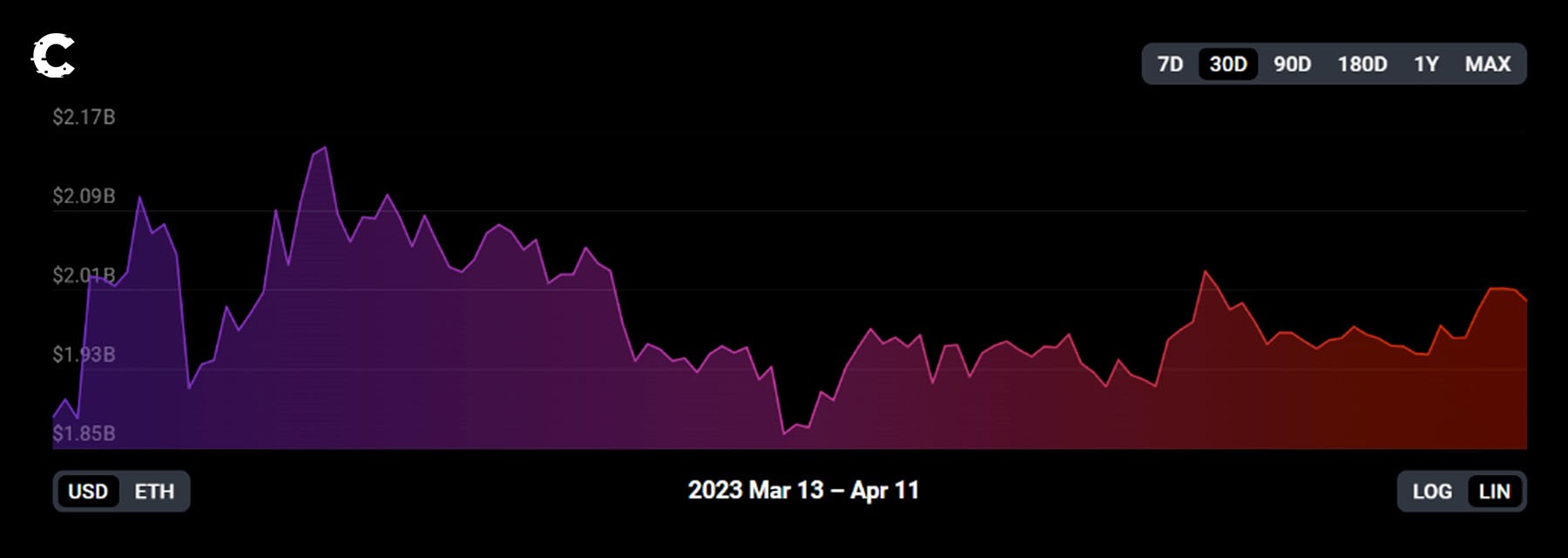

Arbitrum and zkSync are getting lots of attention these days, so it is easy to overlook the interesting things that are happening at Optimism. The network hasn’t seen much increase in usage and TVL over the past month, but its coming Bedrock upgrade, which we extensively covered here, could be a game changer. And we are seeing more and more projects launching with app-specific chains based on Optimism’s modular OP Stack technology.

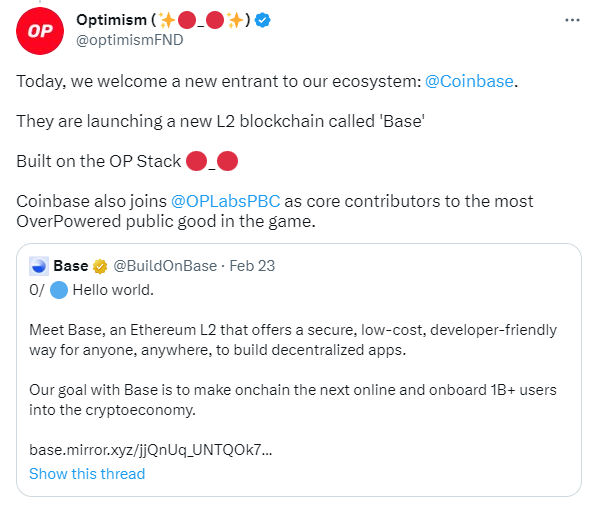

Developed by OP Labs, the company behind Optimism, the OP Stack allows protocols to build their own L2 networks using Optimism’s technology. One of the best-known examples is Coinbase’s Base, which was built with the OP Stack.

One advantage of the OP Stack is that networks built using this infrastructure will connect easily to Optimism. This means that all the chains developed using the OP Stack will be able to work together and interact with each other, providing increased flexibility and opportunities for innovation.

As the development of L2 networks and app-specific chains using the OP Stack continues, much of the innovation on Optimism will occur outside the network itself.

In fact, a number of protocols are currently planning to launch chains using this technology. It’s worth keeping an eye on them for future developments.

- Aevo: An options exchange from Ribbon Finance, Aevo is one of the first app-specific chains to use the OP Stack. The exchange is not yet open to the public, but you can gain access by contacting Aevo on Twitter and requesting an invite.

- UniDex Exchange: Perpetual trading protocol UniDex Exchange has introduced an OP Stack-based chain called Magma Testnet. The chain allows traders and developers to preview how apps will run within the UniDex ecosystem.

- Synthetix: Synthetix, the leading DeFi protocol on Optimism, has recently hinted that it may launch its own chain based on the OP Stack. No official announcement has been made thus far.

- Ethos Reserve: The Byte Masons development collective is working on Ethos Reserve, a fully collateralised decentralised stablecoin based on Optimism. In a recent AMA, they said that if there is sufficient demand for their stablecoin, they want to build an app chain using the OP Stack.

zkSync: The place to be 📈

zkSync has maintained its position as the layer 2 network with the highest growth this week, increasing TVL by 77% to $213 million.

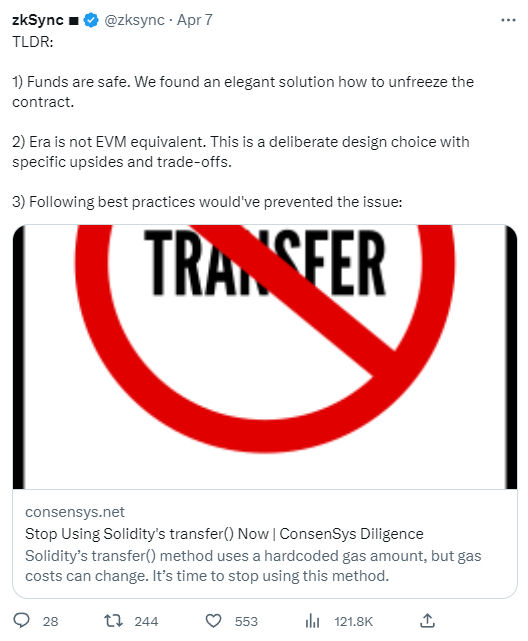

Many projects have launched on zkSync, but not all have found success. One project that received 921 ETH ($1.7 million) during a token sale on zkSync's Era mainnet ended up with its funds stuck in a smart contract.

The zkSync Era team was able to help project members reclaim the funds, but the mistake makes it clear that it’s especially important to invest cautiously, especially when a platform is surrounded by a lot of buzz. Sometimes project teams skip a few tests in their rush to establish a place on a high-growth platform.

Here are a few of the protocols that have been launched or plan to launch on zkSync:

- Velocore: A Solidly-inspired DEX that has seen a lot of activity recently, Velocore has grown to become the second-largest application on zkSync, with $20 million in TVL.

- Meson: Meson recently integrated with zkSync. It supports stablecoin cross-chain swaps across all major blockchains and L2 networks.

- Derivio: This decentralised derivatives exchange is currently in testing. Once it is live, this exchange will allow traders to buy and sell perpetuals and options

Other news 📰

- Stackr Labs introduces a tool for developers to easily create “micro roll-ups” The Stackr SDK simplifies the app-building process for developers on their own layer 2 networks by enabling them to generate small rollups tailored to specific applications such as decentralised social media apps, games, or even DeFi protocols.

- L2 network Scroll announced the winners of the hackathon it organised. The overall winner is a project called Fruity Friends, which tackles the social engineering problem of allowing people to know if they have something in common with someone else while keeping their preferences private.

- Arbitrum-based Camelot DEX to deploy v. 2 upgrade: The upgrade will roll out in three stages, starting with the beta-stage deployment of an automated market maker built on the codebase of the liquidity-focused protocol Algebrat. With the v. 2 upgrade, Camelot's infrastructure will receive enhancements such as automatic pool fee adjustments based on price volatility and demand.

Cryptonary’s take

Optimism is likely to regain momentum with its Bedrock upgrade in May. What's truly noteworthy is the emergence of app-specific chains such as Aevo and Unidex built on the OP Stack. This important development is worth watching closelyzkSync is still in its growth phase, but it has become clear that many inexperienced developers are jumping on the layer 2 bandwagon, resulting in products that appear to be rushed to market. It's important to exercise caution before investing in any of them.

Arbitrum received less attention this week, but we're eagerly anticipating the launch of $ARB incentives.

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms