TLDR📃

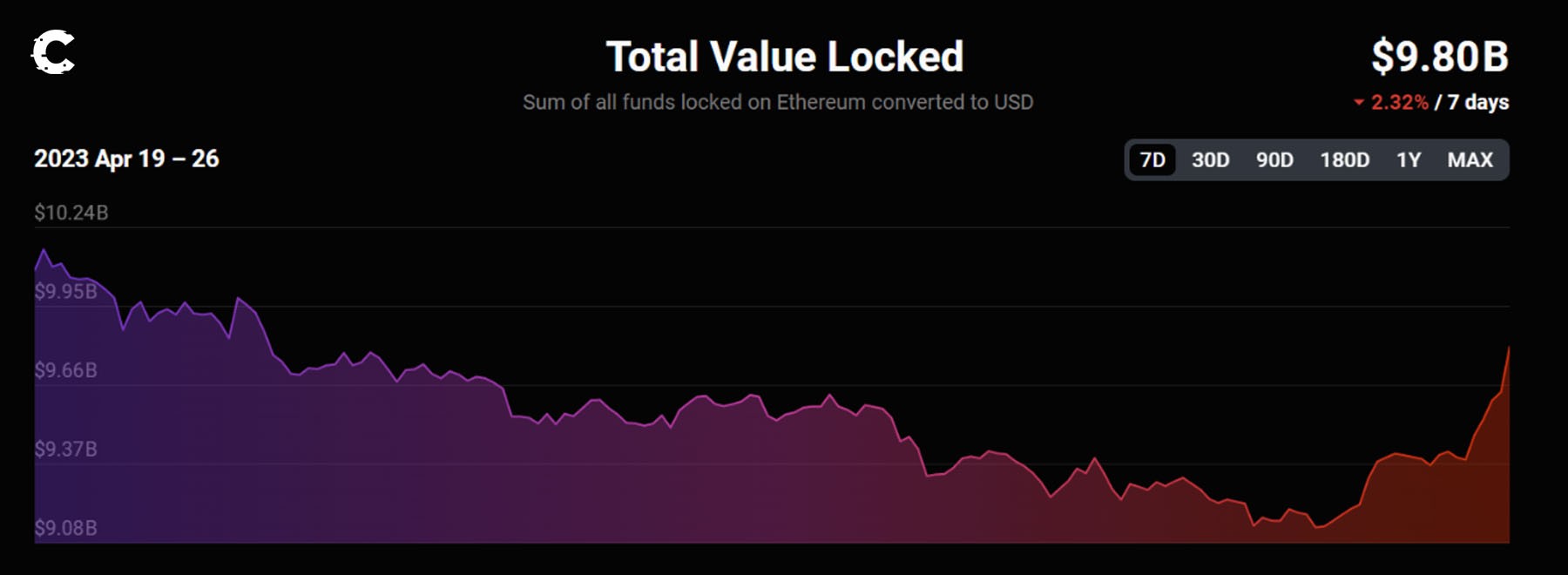

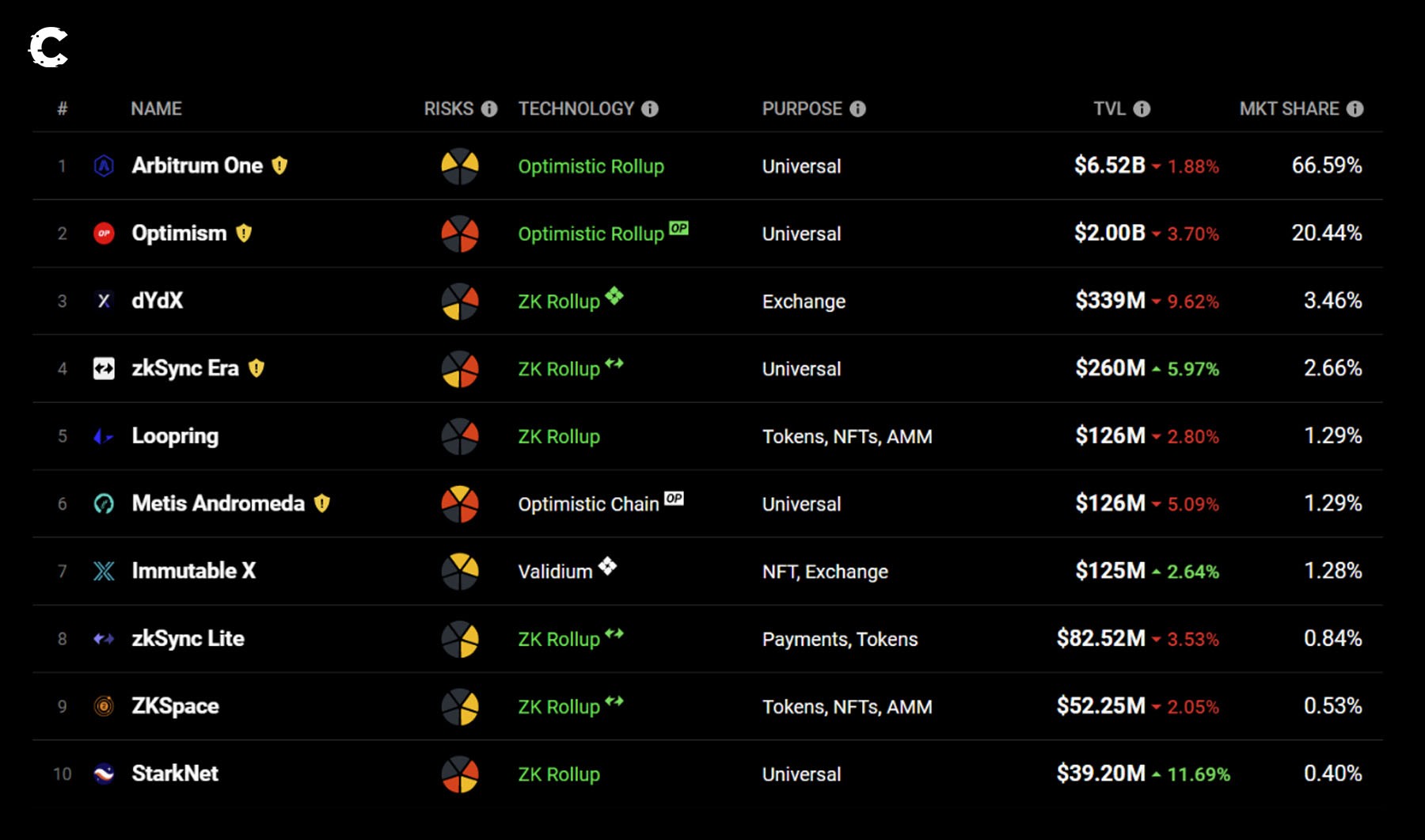

- Total value locked on layer 2s fell below $10B. zkSync Era maintains its winning streak, growing TVL despite the drop in crypto prices.

- The airdrop is complete! Arbitrum-based projects have received 113M ARB. Scroll down for a preview of how they will spend their windfalls.

- New L2s are looking to heat up the market. Say hello to Base, Scroll, and Mantle!

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

Layer 2 overview 🔭

As the price of BTC and ETH fell from their highs last week, so did TVL within the L2 ecosystem - no surprise there. TVL fell from $10B to $9.8B, a decline of 2.32%.

Key developments🗝️

a16z is developing Magi: An Optimism-based rollup client: It’s positioned as a “blazingly fast” alternative to existing rollup clients.1inch to Launch on zkSync Era: This makes 1inch one of the first brand-name protocols to launch on a zero-knowledge EVM.

Starknet reveals 2023 roadmap: 2023’s challenges: functionality, performance, user experience. Next year the team hopes to shift its focus toward enhanced decentralisation.

How will DAOs use airdropped ARB? 💵

The thunking sound you heard on Monday was the sound of ARB tokens worth $120M landing in the wallets of projects in the Arbitrum ecosystem. Arbitrum has made a strategic investment in its future by airdropping tokens to projects that draw users into the ecosystem.The full distribution of the DAO airdrop will take place today with those that have confirmed receiving the test transaction that was sent earlier last week.

For more details on the DAO distribution, please read the thread below. 🧵👇 https://t.co/naApiR7uT2— Arbitrum (💙,🧡) (@arbitrum) April 24, 2023

Now everyone’s wondering: What will the DAOs that manage the projects do with all this free ARB? Here’s an exclusive peek at plans that are under discussion:

- Amount received: 8M ARB ($10M)

- Status: Governance proposal

- In the works: Some ARB will be used to incentivise GMX V2, which will go live later this year, by rewarding traders who use it.

- Amount received: 3.8M ARB ($5.3M)

- Status: Announced plans on Twitter

- In the works: This decentralised options exchange will use ARB to incentivise its products and reward early token holders. Details are not yet public.

- Amount received: 2.7M ARB ($3.7M)

- Status: Governance proposal

- In the works: Vesta is considering using ARB to incentivise liquidity on VST liquidity pools.

- Amount received: 772,621 ARB ($1M)

- Status: Governance proposal

- In the works: Lido is considering awarding ARB to liquidity providers in wstETH pools on Arbitrum.

- Amount received: 386,311 ARB ($529K)

- Status: Announced plans on Twitter

- In the works: Lyra will use 77,000 ARB ($105K) of its ARB windfall to reward users who trade on the exchange.

- Amount received: 1.67M ARB ($2.29M)

- Status: Governance proposal

- In the works: Stargate is considering airdropping ARB to users who have locked their STG tokens and converted them to veSTG.

The full list of projects receiving ARB is posted at arbvalues.com. Keep an eye on Discord and Twitter for news about their plans.

New L2 ecosystems to explore 🧭

A wave of L2 scaling solutions is headed our way as protocols emerge to compete with Aribtrum, Optimism, Stakenet, and zkSync. Here’s an advance look at some of the L2 networks scheduled to enter testing or production this year.Base

Coinbase built Base with Optimism’s OP Stack. Last week, Coinbase revealed that Base is set to launch on its mainnet by the end of the year.

Binance Smart Chain onboarded tons of new users during the 2021 bull run. Binance’s user-friendly platform made it easy for people to get started with DeFi.

Coinbase is looking to make history repeat itself by introducing users to the L2 ecosystem with Base. We expect Base to extend Coinbase’s mass-market appeal to the L2 world with a polished, user-friendly experience.

Here are some Base projects in the works:

- Moonwell: This DeFi lending protocol operates on MoonRiver and Moonbeam, but it intends to extend its services to Base.

- Ondo Finance: Ondo is launching a stablecoin alternative that will pay interest to holders through a tokenised money market fund. Coinbase has invested in the project.

- DackieSwap: This very basic decentralised exchange has already launched on the Base testnet.

Scroll

Scroll is an Ethereum L2 solution that leverages ZK rollups. We see it as a competitor for ZkSync Era and Polygon.

The network is available on the testnet today and it should launch on mainnet later this year. The Scroll team raised $50M in a recent funding round, bringing its valuation to $1.8B.

Scroll is in the race to become the largest zero knowledge EVM, but it faces strong competition from projects like zkSync and Polygon's zkEVM.

Scroll is taking its time developing an EVM that emulates the Ethereum Virtual Machine perfectly - something that neither ZkSync nor Polygon has accomplished. The team hopes to make up for lost time with a superior product.

Here are some coming Scroll-based projects:

- Zada Finance: This decentralised exchange plans to launch with an order book.

- Scroll Kingdoms: This MMORPG is currently hosted on Scroll's alpha testnet.

Mantle

With a warchest of more than $1.7B, BitDAO has created the Mantle network, a layer 2 optimistic rollup.

Most DAOs are built around specific DeFi projects. BitDAO functions more like an investment house. Mantle will serve as the connective tissue for BitDAO initiatives.

Mantle will use BitDAO’s BIT token for gas fees, staking, and other ecosystem functions in addition to its current role as the DAO’s governance token.

Mantle went live on testnet in the first quarter of the year and is expected to launch on mainnet later this year.

In contrast to conventional protocols, Mantle uses a modular design with separate layers for network consensus, transaction execution and settlement, and data availability. The project has partnered with Eigenlayer to provide data availability services, making it the first layer 2 network to use Eigenlayer’s data availability layer.

Mantle hopes to compete by being more scalable and cost-effective. It remains to be seen whether the network will live up to these expectations.

Mantle has invested $200M in a grant program to attract developers, so expect many projects to run on this L2. For the time being, however, the protocols on the Mantle testnet are extremely limited.

Here are some of the projects in the works:

- FusionX Finance: This decentralised exchange has recently announced an incentivised testnet to attract developers and users.

- MantleSwap: Mantleswap is a very basic decentralised exchange that is currently live on the Mantle testnet.

Other news📰

- Recursive looks to connect rollups with Eigen Layer-based Omni Network: The protocol supports communication between L2 rollups while deriving security from the Ethereum mainnet. Recursive aims to support cross-rollup stablecoins and other DeFi primitives that can aggregate liquidity from different L2 rollups.

- Optimism unveils Superchain Token List: This tool will make it easier for users to bridge tokens between Ethereum and chains built on the OP stack such as Optimism mainnet and Base.

- Reflexer Finance reveals stablecoin plans for Optimism: The Reflexer community intends to launch HAI, a stablecoin, on Optimism. The stablecoin will have an initial anchor price of $1 USD instead of RAI's $3.14 USD. The testnet launch is scheduled for June 9th, and the mainnet launch is expected by the end of July.

Cryptonary’s take🧠

With the market cooling down, L2 TVL has also decreased. But there’s still plenty of interest in zkSync, likely due to the anticipated airdrop.This week’s excitement will come from watching how Arbitrum DAOs use their airdrops. Watch for details to emerge quickly in the days ahead.

Keep an eye on Base, Mantle, and Scroll, the new kids in L2 town. Base’s Coinbase connection means an easy on- and off-ramp for users. This could help Base ultimately reach a much wider audience than its competitors. But we’ll be checking out the testnets for all three.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms