Lehman Brothers 2.0

On March 10, Silicon Valley Bank (SVB) collapsed. In response, crypto prices plummeted - they have since recovered. From stablecoin de-pegs to liquidity fears, there’s been no shortage of FUD (Fear, Uncertainty, and Doubt) in the wake of this meltdown. But the crypto market has proven resilient.

However, the Federal Reserve (Fed) now has a tough question to answer…do they continue down the path of relentless interest rate hikes? Or do they need to re-assess? A pause in hikes would be seen as extremely bullish for markets. The pump would be biblical. But it would contradict everything Fed Chairman Jerome Powell has been saying for months.

So, let’s jump in!

Disclaimer: This is not investment nor investment advice. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

TLDR

- Silicon Valley Bank (SVB) collapsed on March 10 due to financial stress brought on by high interest rates, and poor risk management.

- Circle (the company backing $USDC) had $3.3B of assets backing $USDC stuck with SVB.

- $USDC lost its $1 peg, briefly hitting $0.87.

- The US government stepped in over the weekend, stating that customers would be able to withdraw funds.

- $USDC re-pegged and a wider crisis was averted.

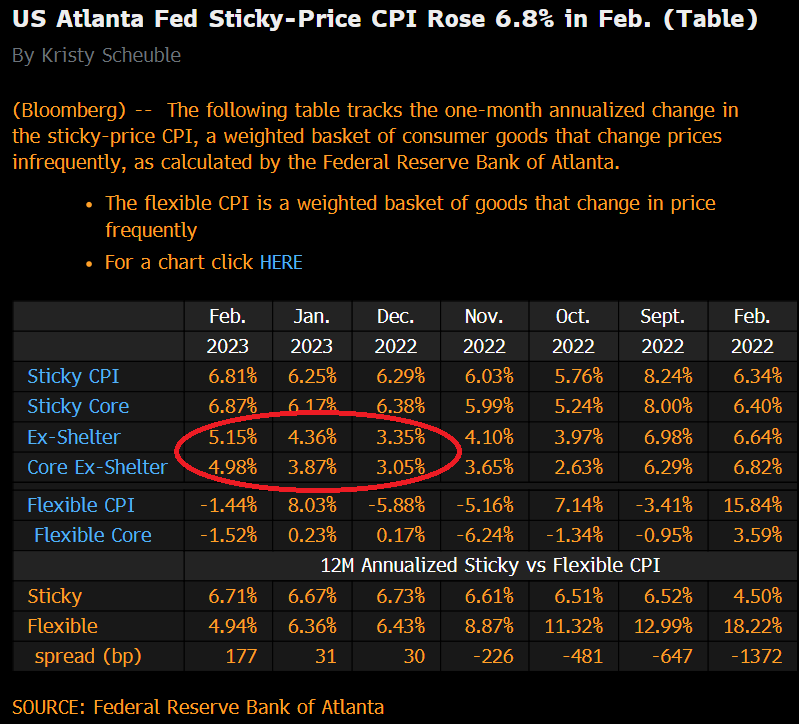

- Inflation is still hot (getting hotter), so it’s unlikely this event will change the Fed’s outlook. Combating inflation is still the number one priority.

- We’re expecting a 25bps hike on March 22nd.

- We believe it’s wise to de-risk as $BTC approaches $30K and wait for confirmation.

Bye-bye, bank

So SVB is now history. The cause? A host of depositors trying to withdraw their funds at the same time, and SVB being unable to meet the demand. In other words, a bank run. Why? It’s a long story but in short…The Federal Reserve has been hiking interest rates like there’s no tomorrow. Banks tend to buy treasury bonds (government-issued debt notes) as a “safe” investment. When the Fed hikes interest rates, the market value of bonds issued before the hike drops, as their yield is lower. Here’s a chart to illustrate:

Usually, the price of a bond isn’t an issue. Pension funds, for example, don’t care about it - they’re long-term investors and are in it for the yield. They’ll hold until maturity in most cases.

However, a drop in the value of bonds is terrible news for a bank. They’ve invested customer deposits in such securities. If the customer wants his or her money back, bonds must be sold to meet demand. In most cases, sufficient cash is available to meet regular withdrawals. Unfortunately for SVB, rumours of liquidity issues spread like wildfire, and the volume of withdrawals became anything but regular.

For context, SVB serviced higher-risk start-up companies (hence the name: Silicon Valley Bank). These companies boomed throughout 2020-2022. But they took a hit when the Fed started hiking rates and slowing the economy. They needed their savings in order to continue operating. Multiply this by hundreds of companies, and you can see an issue developing…

The nail in the coffin was $42B in withdrawals on March 9. SVB was completely illiquid and was seized by the Federal Deposit Insurance Corporation (FDIC). Customers were assured by the FDIC that they would have access to all funds.

Implications

Among the crypto companies that were affected, Circle was the largest. It announced that $3.3B worth of assets backing $USDC were locked in SVB.

As a result, the market hit peak fear. As mentioned, $USDC dropped from its $1 peg to as low as $0.87. Recovery followed almost immediately after the FDIC announced SVB customers were covered, still a de-peg always causes panic.

However, there are further wider-reaching implications. Several regional banks in the US are struggling for many of the same reasons as SVB. Namely, the toxic combination of high interest rates and a slowing economy.

The key question - is it enough to halt Fed policy?

The market seems to think so. According to market probabilities, the chances of the next interest rate hike being 0 is 46%. Just last week, a 50bps hike was on the cards.

But we don’t believe the developing banking issue is enough to change Powell’s view. Why? Because inflation is still far too high.

By all important metrics, CPI is trending up again. As Powell has repeatedly stated, combating inflation is the Fed’s #1 priority. The Fed is fully prepared to break parts of the economy to meet this goal, and it appears that things are now breaking. Nothing major… at the moment. This likely gives the go-ahead to hike at least 25bps at the next Federal Open Market Committee (FOMC) meeting starting on March 22nd.

Is it bad?

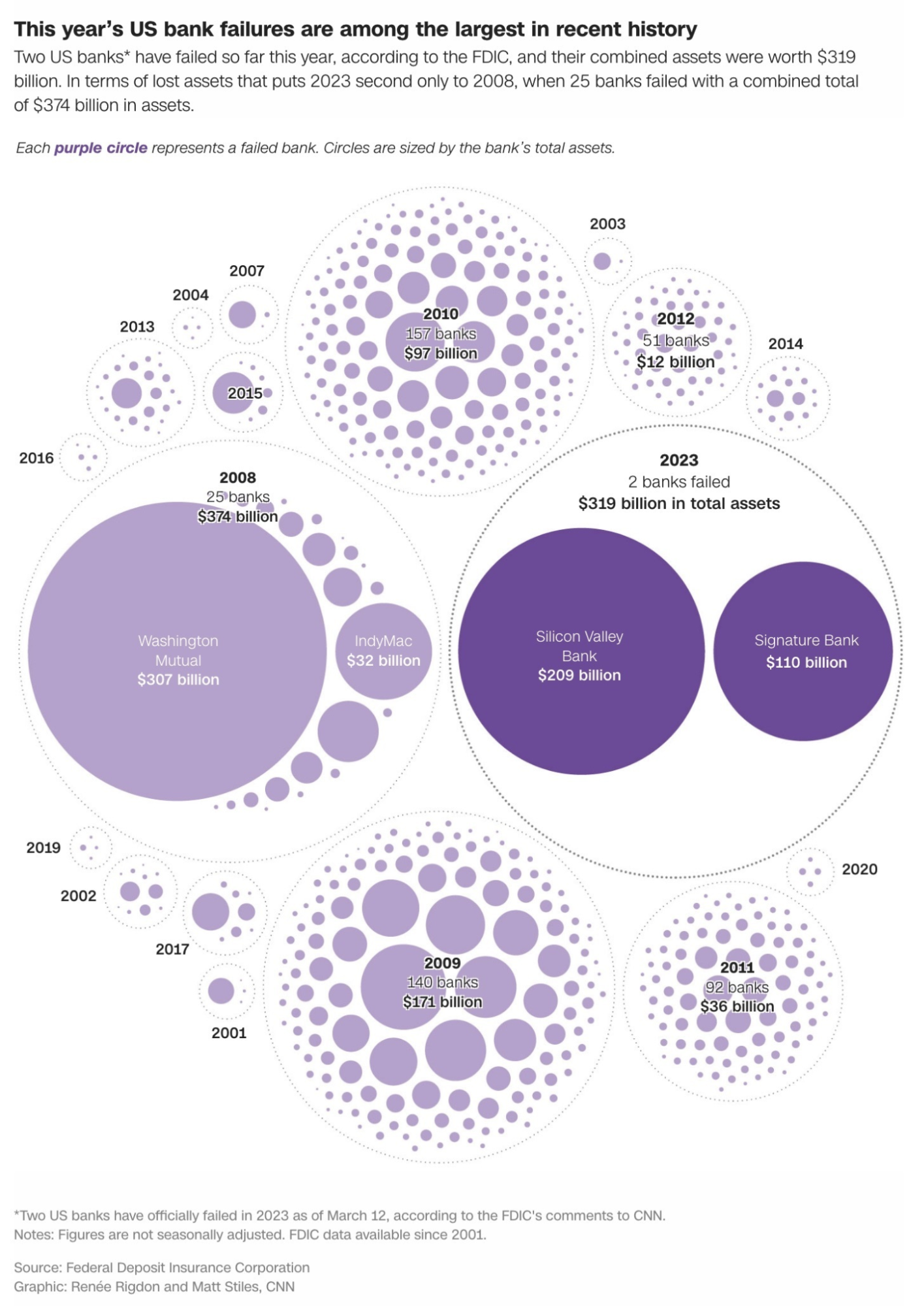

We’ve been saying for months that something will break. Now it appears that moment is here. Although nothing major has gone south, SVB appears to be the first notable casualty. “Only” the 18th largest US bank collapsing is unlikely to change the Fed’s stance.

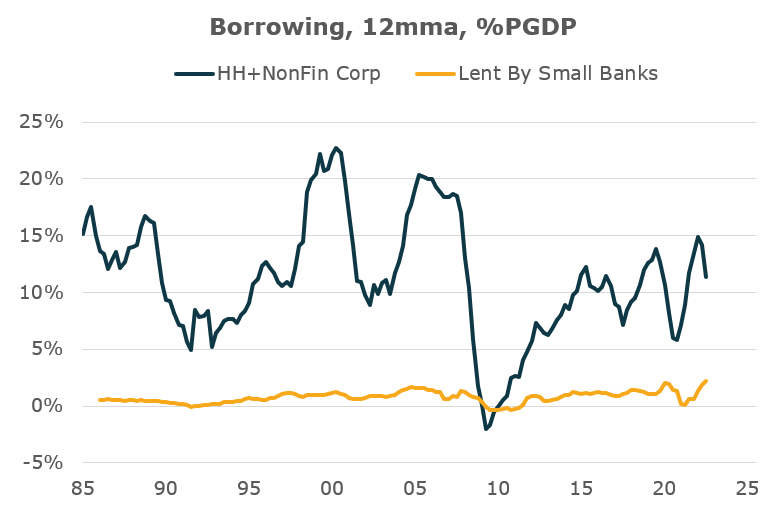

A mere 2% of lending as a % of GDP would be affected if all small banks went under at once. So proportionally, the collapse of SVB is basically a non-event. Well, at least on the scale of the entire US banking system.

Still, compared to previous events, it’s the second-largest individual bank collapse in over a decade. But since a 2008 dollar is worth a lot more than a 2023 dollar - the impact is smaller.

What will happen, though, is a post-mortem. The FOMC will take into account the circumstances of SVB. Was it mismanagement by the bank? And how much of an impact did monetary policy have on the collapse?

Bet on $BTC?

$BTC’s dominance is heading for resistance, which could kill some of the traction for altcoins. Altcoins have been extremely volatile these past few weeks. The volatility goes both ways (upside and downside), so the focus should be on the risk. Preservation of capital is key. If $BTC consolidates, altcoins will catch up, and $BTC dominance will drop. Here’s our latest in-depth look at $BTC.

Cryptonary’s Take

The fact that the government stepped in was more of a token gesture than a full bailout. However, since SVB made headlines, they had no choice.It’s difficult to argue for continued hikes when the economy is falling to bits. At least by “bailing out” SVB, they’ve made a statement. And Powell has repeatedly said that the Fed has the tools to fix the economy if it goes south.

So, we see no pause and continued hikes - at least for the next meeting. Consequently, we believe the market is overreacting with the recent pump. This leads us to…

Action points

As we approach $30K BTC, we believe it is wise to de-risk. Bear market rally is the term that comes to mind. The events of the last week are not quite alarming, but we can expect more shocks similar to SVB going forward. The full impact of rate hikes hasn’t been seen yet.Some ideas for portfolio management:

- Derisk as we approach $30k BTC.

- Wait for confirmation of either a breakout (daily close above $30K) or a rejection of $30K.

- If confirmed, $BTC will move first, then altcoins.

- If rejected, monitor our daily Technical Analysis for further updates and reentry opportunities.

- If the Fed hikes by 50bps on March 22nd, expect severe downside.

- 25bps will be neutral - this is the most probable hike.

- 0bps, or a pause, will be bullish, and markets will pump - a lot.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms