And that’s an impressive feat, except that DeFi has hit a roadblock in the last few quarters. Higher TradFi yields have made it easier for big money to earn yield directly from the US government through treasuries – so there are fewer reasons to take on DeFi risks.

Now, an emerging new sector with a revolutionary idea could swing the balance back towards DeFi over the long term – and you heard it from us first.

Drum roll… LPDFi

Now, this is not another fad – we think it will be a development just as exciting as LSD-Fi.

And more importantly, you can get in before the rest of the market even knows it exists.

LFG!!!

TLDR📃

- LPDFi presents a new opportunity to capitalise on a sector that doesn’t even exist yet.

- Logarithm Finance is building the first iteration of LSDFi.

- Lido officially expands its reach to the Cosmos ecosystem by endorsing the Axelar Bridge.

- Logarithm Finance doesn’t have a token yet - there’s the potential for an airdrop.

- Read on to find out more!

Disclaimer: This is not financial or investment advice. Any capital-related decisions you make are your full responsibility and yours only. The information made available in this report is NOT for replication. The purpose is to share the thought process behind our decision-making for entertainment purposes only.

What is LPDFi? 🪙

We’ve seen DeFi, LSD-Fi, GambleFi, and Social-Fi – and now, LPDFi.Liquidity Providing Derivatives represents the latest in liquidity-enhancing derivatives.

As we know, liquid staking (LSD-Fi) adds another layer of efficiency to staking.

LPDFi brings that same efficiency to DEX liquidity pools and liquidity providers.

Just as LSD-Fi made staking more attractive to the masses, LPDFi has the potential to make providing liquidity much more appealing.

Here’s the scoop👇

Why do we need LPDFi? 📋

One simple reason - impermanent loss.In the current LP landscape, liquidity providers are on their own to manage their positions and mitigate risks. This lack of support often leads to impermanent loss for many retail users. Therefore, not many people want to risk funds in an LP position they don’t understand or one in which they are likely to lose money.

Note: For the vast majority, “impermanent loss” should be considered a marketing term to attract users. “Impermanent loss” actually turns into a real loss when the user withdraws from the position.

Liquidity Providing Derivatives could revolutionise the way LPs earn yield from DEX pools.

How? By leveraging DeFi protocols specifically designed to manage LP positions on behalf of users.

It is similar to Yearn Finance, which developed yield strategies to do the heavy lifting for users.

But who is building LPDFi?

Logarithm Finance is set to be the first protocol to offer LPDFi services.

It has brought hedging techniques to the table and implemented them into the product. This feature involves shorting assets in the LP using on-chain derivatives. The ultimate goal is to make LPs more profitable and thus more attractive as a yield-generating activity.

In theory, this should deepen liquidity across DEXs and make them more attractive to larger swaps (whales) due to lower slippage, generating more fees and making LPs more profitable.

Can people use Logarithm Finance already? The project is still in testnet, with the Beta launching in the coming weeks. But once it goes live, this could be the destination for you.

Did someone say airdrop?

Airdrop?🛫

The Logarithm Finance Discord can be found here.The protocol does not have a token or a product - Beta will be launching soon, and there are Zealy quests to follow on Discord that may lead to an eventual airdrop.

LPDFi is still nascent, but there are still some exciting developments in DeFi today 👇

Lido’s stETH set to launch on Cosmos 🖨

A collaboration between Axelar and Hadron Labs will bridge wstETH to Cosmos.Previously, Canto, Injective, and Osmosis had bridged wstETH to their ecosystems independently.

However, the current solutions present a problem for Lido over the long term. Here’s the challenge: when protocols outside the control of Lido DAO issue wrapped stETH, it means that Lido relies on the good faith of the bridge. Any exploit or hack would directly impact Lido, even though it did not issue such stETH.

The new bridging solution will eventually be transferred to the control of Lido’s Aragon contract, which controls Lido operations through the DAO.

This is an exciting development for Lido since the Cosmos IBC connects this new development to 50+ Cosmos SDK chains. The best part is that the demand for Ethereum staking derivatives on Cosmos is clear.

Lido is expanding its reach and will likely present a catalyst for Lido’s market dominance to rise. This development presents one more reason to be mid-term to long-term bullish on Lido.

But now, to the bad news…

DeFi needs the US government to stop printing cash ⛔

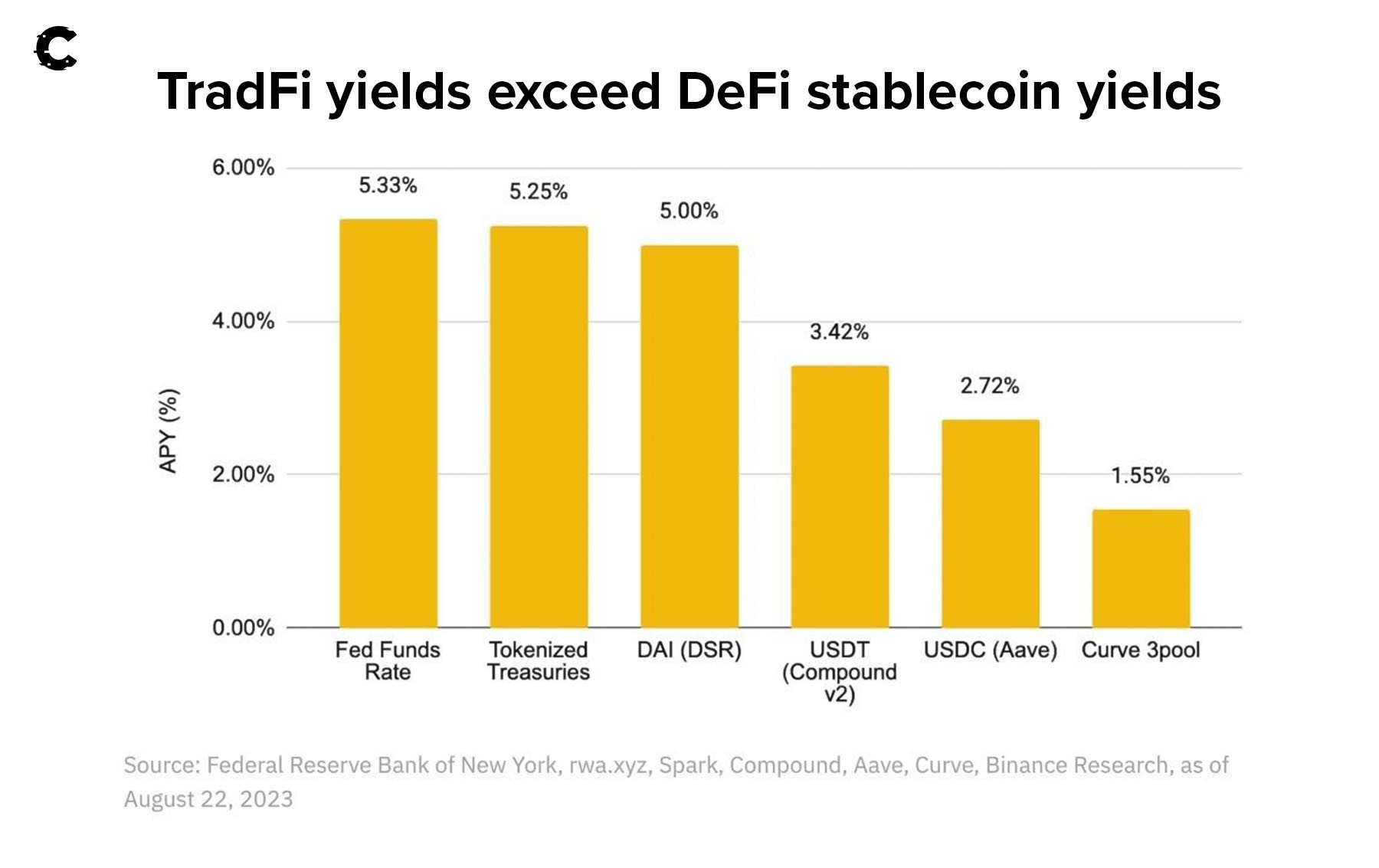

DeFi yields are being eclipsed by yields offered in TradFi – only MakerDAO (DAI) seem to be mounting any significant competition to TradFi.

High base interest rates in the US and other jurisdictions have led to more attractive yield opportunities in TradFi through treasuries.

This means that the big money is more than happy to continue investing in treasuries rather than go hunting for yield in DeFi.

For DeFi to return to the limelight, yields from treasuries and other traditional vehicles must come down.

This will only happen once the Fed starts cutting interest rates.

There isn’t enough incentive for smart money to consider DeFi. We believe the earliest the Fed will cut rates is by the end of 2023.

Cryptonary’s take 🧠

DeFi is in a tough spot and will continue to stagnate until the Fed starts cutting rates.This challenge with DeFi brings us back to the opportunities that the staking derivatives sector provides.

The utility derivatives sector is growing, with use cases beyond base-layer liquid staking taking shape. Most people don’t have the skill, knowledge, or time to pull off a profitable position over the long term.

With LPDFi, the efficiency of LPs will increase, making them more attractive to retail and institutions. It takes away the active management part that is required to be profitable.

If LPDFi is successful, it will set up deeper liquidity for DEXs and make the whole experience of interacting with DEXs, both as an LP and as a trader, a much smoother experience in terms of fees and slippage.

In the meantime, we will be watching protocols like Logarithm Finance, Panoptic, and Smilee, and the overall TVL locked in DEXs like UNISwap. Stay tuned for more updates on this emerging sector.

As always, thanks for reading.🙏

Cryptonary out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms