DeFi protocols co-exist as plug-and-play money legos without all the convoluted BS and red tape of licenses and copyrights that plague the TradFi industry.

Within DeFi, a new prodigy is taking this paradigm to the next level - LSD-Fi.

Just look at PENDLE's incredible 4000%. It's clear that LSD-Fi isn't just keeping up with DeFi - it's racing ahead.

But with such huge gains already made, many ask, 'Did we miss the LSD-Fi wave?'

Now, let’s answer the question.

TLDR📃

- LSD-Fi is expanding 10x faster than DeFi, opening avenues for potential investors.

- The surge in stablecoin innovations is fueling further growth and competition within LSD-Fi.

- The minimal utilisation of Liquid Staking Tokens in LSD-Fi suggests a largely unexplored market.

- Given its strong performance and exciting prospects, LSD-Fi is a must-watch DeFi sector in 2023.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make is your full responsibility.

Surveying the LSD-Fi terrain 🌋

To understand LSD-Fi's trajectory, let's rewind to DeFi's growth in 2020/21.What took DeFi a year, LSD-Fi is doing in months - it's scaling 10x faster.

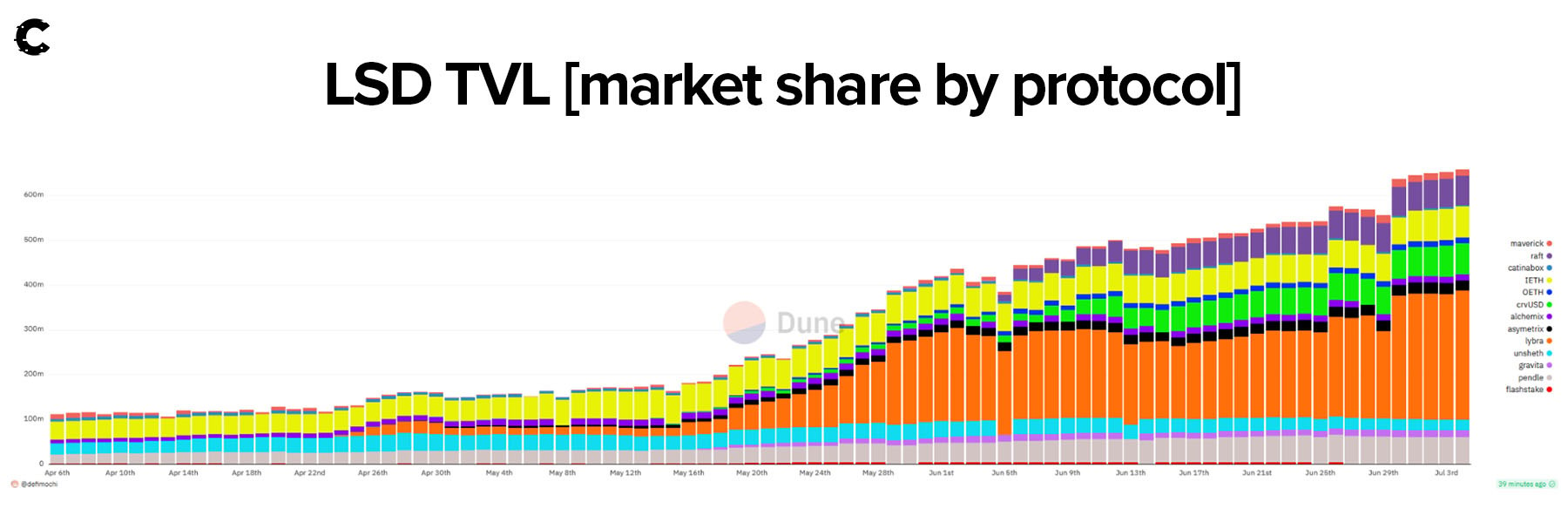

Since April, protocols have been sprouting, and Total Value Locked (TVL) is soaring exponentially. The numbers are startling - a 500%+ surge in TVL in just three months.

Binance, among others, has recently listed PENDLE, capitalising on the feverish hype. This move has thrust PENDLE into the mainstream limelight, and it's only a matter of time before other LSD-Fi tokens follow suit.

But does this spate of exchange listings signal the climax of the LSD-Fi rally?

The fundamentals line up ✨

To know if we're nearing the end of the LSD-Fi rally, we need to dig into the data:

So, the momentum is there.

But how sustainable is it?

Short answer: very sustainable.

Less than 4% of Liquid Staking Tokens (LSTs) issued by the largest decentralised liquid staking providers are currently used in LSD-Fi.

To recap:

- LSD-Fi TVL: $630 million.

- LST TVL: $20 billion.

So, have we reached the end of the line with the exchange listings of LSD-Fi tokens? Quite the contrary - we're just warming up. Continued growth hinges on increased awareness, which depends on the ease of access to these tokens.

The stablecoin market heats up 🛎

As the drama around UST stablecoin unfolds, it's time to shed light on the emerging stablecoin innovations in the LSD-Fi space.

The frontrunner in this race is Lybra Finance (LBR) with its eUSD stablecoin, a major catalyst for the LBR token's spectacular gains. But the market is ripe for innovation, and a new contender is about to enter the ring.

Lucid Finance is gearing up to introduce a fresh stablecoin, Digital USD (DUSD). Much like Lybra's offering, DUSD is backed similarly, but it brings a unique twist - integration with the LayerZero infrastructure, enabling cross-chain compatibility for DUSD.

While it hasn't officially launched, plans are underway to make eUSD available on Arbitrum, Optimism, and Polygon shortly after the launch. Given that LayerZero connects to various other chains, it's safe to assume DUSD will enjoy widespread accessibility.

This is yet another testament to the potential of blockchain composability.

While we await confirmed launch dates, rest assured we'll delve deeper once more information comes to light!

Cryptonary’s take 🧠

The numbers don't lie.Considering the rapid development, innovative strides, enormous potential market, and the relatively modest market caps of many LSD-Fi protocols, it seems clear that having a stake in LSD-Fi should be part of your game plan. It feels as if we're witnessing the sequel to the 'DeFi Summer'.

To circle back to our initial question - have you missed the boat?

The answer is a resounding “No”.

Sure, we're not suggesting you pour your entire savings into LSD-Fi. But when performance speaks volumes, as we mentioned last month, it's hard to look the other way.

Monitoring the evolution of this sector in recent weeks and foreseeing the opportunities poised to emerge with the roll-out of new protocols, we're convinced that LSD-Fi is the space to keep a keen eye on for 2023.

As always, thanks for reading.🙏

Cryptonary, out!

Other news

- Over $100 million in token unlocks across three protocols are set to hit the market throughout July, with APE (4.23% of supply), OP (3.75%), and APT (2.17%). Historical token unlocks from these protocols have led to a short-term downside - be aware if you’re a holder.

- On Friday, Celsius was permitted to liquidate altcoins for BTC and ETH to repay creditors. Tokens impacted include MATIC, ADA, LINK, LTC, and BCH. Additional selling pressure is likely over the short term.

- The long-awaited dYdX Chain testnet is set to launch today. For those interested, dYdX has encouraged users to provide feedback.

- After losing $600 million in the largest hack in DeFi history in 2021, Poly Network has been hit with another exploit. Up to $10 million has been stolen by the hacker. Yikes.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms