It can be overwhelming to keep up with the new projects and protocols that pop up every day. But don’t give up!

With a handful of basic principles and a bit of research, you can increase your odds of choosing a successful crypto investment.

We've got you covered with four simple steps that break down the whole process.

TLDR 📃

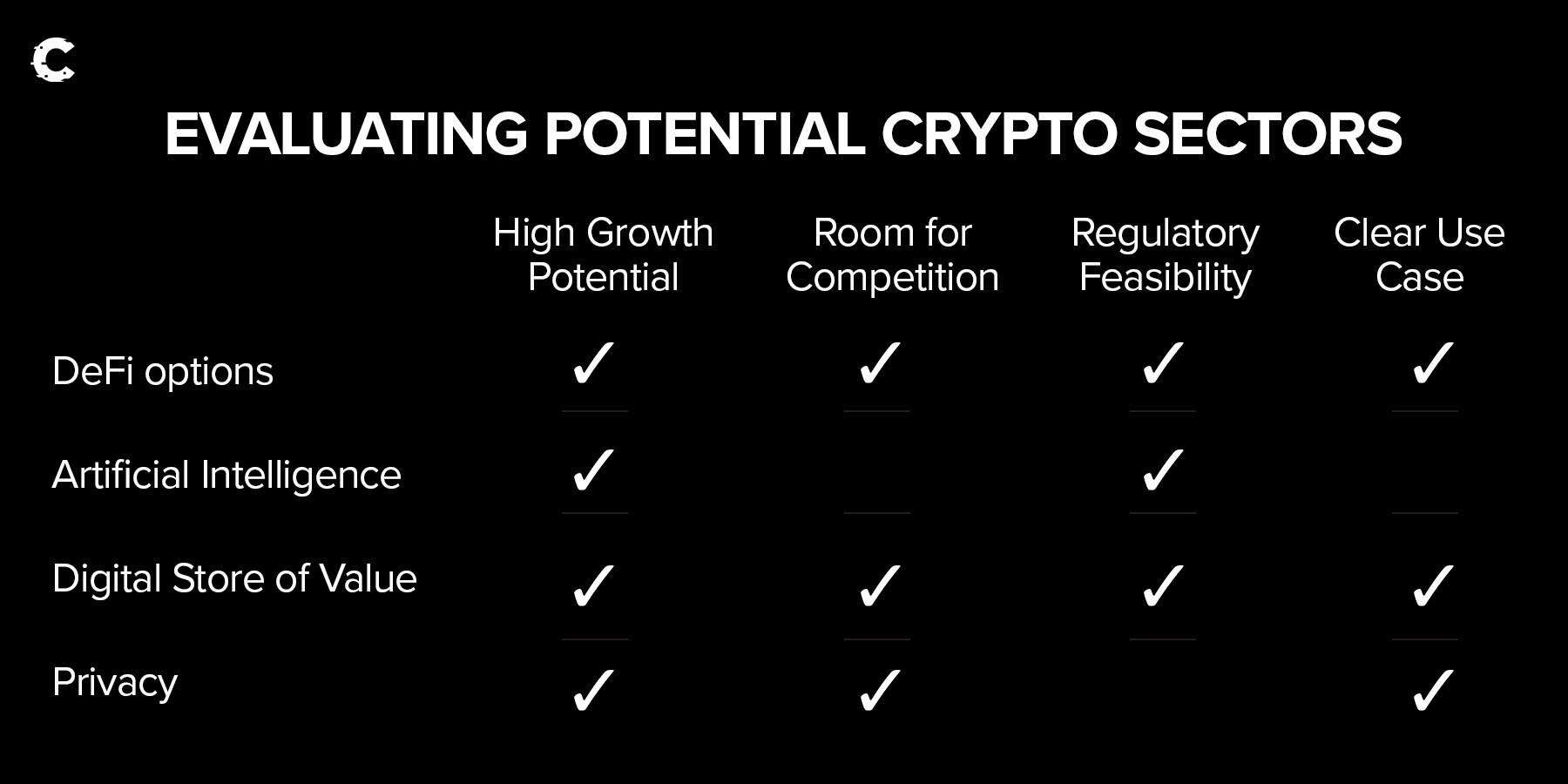

- Choose a sector with lots of potential for growth, some space for competition, a realistic level of regulation, and clear use cases.

- Find the problems that are pain points within the sector.

- Look for projects that relieve the pain points. Make sure that they’re built in networks with metrics showing good product-market fit.

- Be sure the token you're looking at is tied to the project's growth, like through revenue sharing or a similar method.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

Investing in crypto is like being a VC

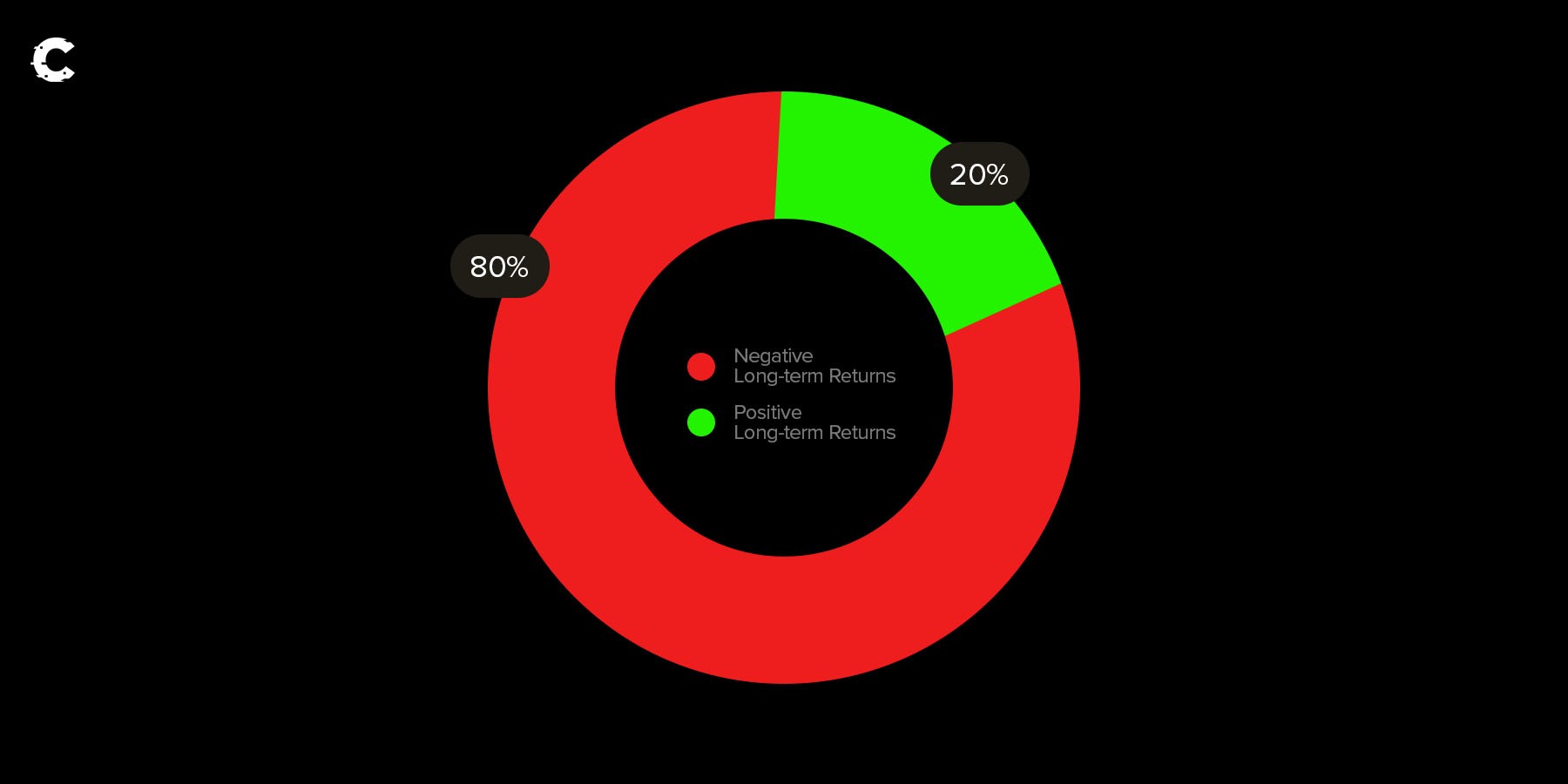

It’s tempting to think that crypto investing is like buying stocks in the company that made the coin. The parallels are obvious.The truth is, crypto investing is more like funding a startup. In fact, about 80% of crypto projects end up losing money in the long run, which is a ratio that will sound familiar to venture capitalists.

In the crypto scene, you'll want to channel your inner venture capitalist, not a stock purchaser. Look for projects that show promising growth, just like how VCs decide which startups to invest in.

We've whipped up a four-step strategy inspired by VC investing to help you discover winning crypto projects. While we can't promise that you'll always see positive returns in the volatile crypto landscape, this approach can help you identify projects with a higher likelihood of landing in the successful 20%.

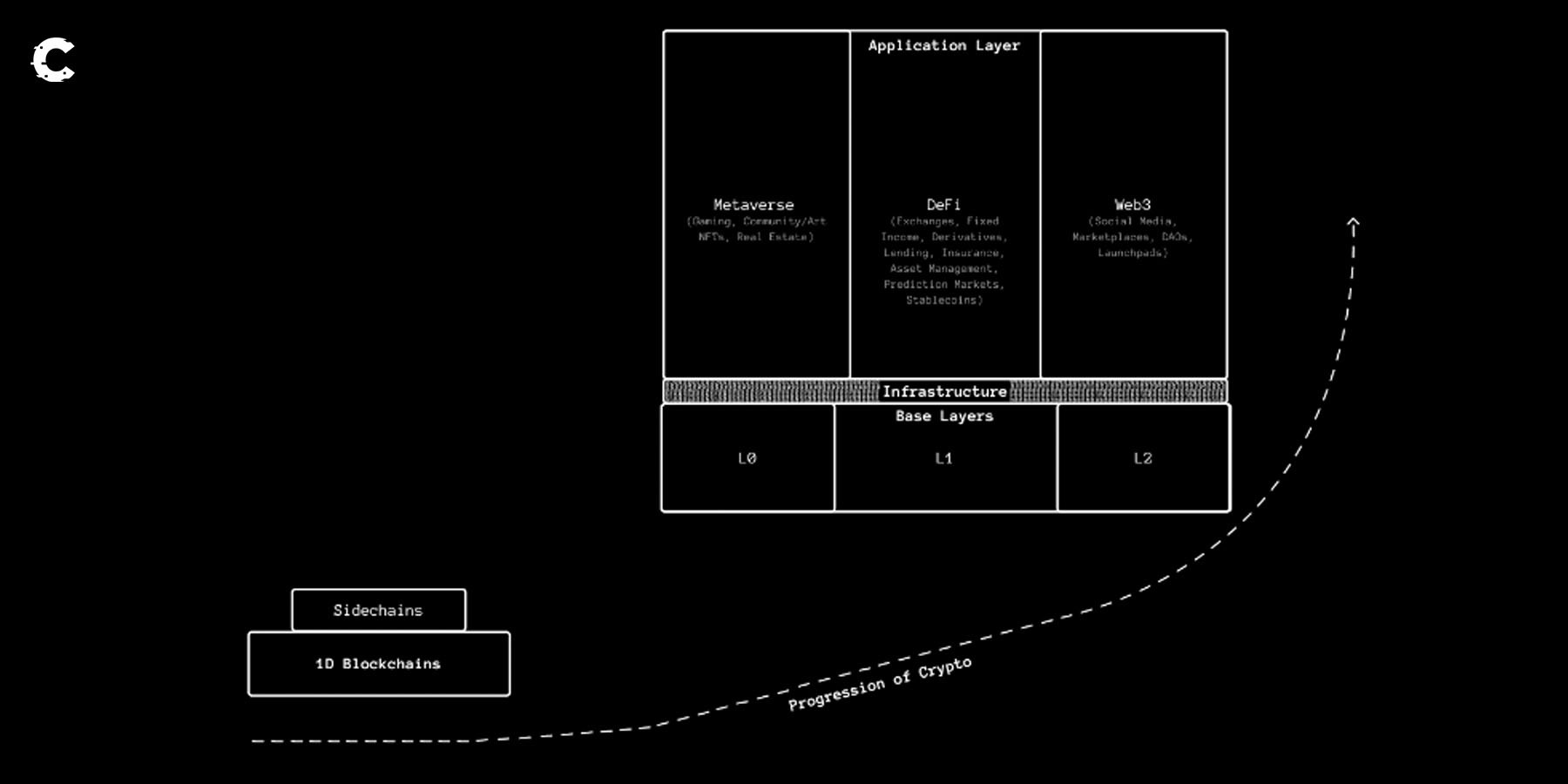

Step 1: Choose a promising sector

Investing in crypto without choosing a market sector is like going on a treasure hunt without a map. You'll wind up wandering around aimlessly. You've gotta figure out which sector of the crypto market you want to invest in before you start thinking about specific projects.

Quick tip: Aim for a sector with room to grow.

In a mature sector, opportunities are limited – imagine a coin trying to dethrone Bitcoin as the top store-of-value asset. Not gonna happen.

But DeFi is still developing. Fixed-interest lending and crypto options trading have tons of growth potential.

But not all underdeveloped sectors are winners. AI seems exciting, but there aren't clear crypto use cases yet. Privacy is fascinating, but it's facing regulatory hurdles, as investors in Tornado Cash learned the hard way.

If you invest in areas you're interested in and understand, you'll have an advantage over others. For example, if you have a finance background, DeFi might be a good fit. If you're a fan of art or gaming, then NFTs and metaverse are your go-to.

CoinGecko has a comprehensive list of sectors with info on their current size and associated projects. It’s a great resource for finding inspiration and conducting further research.

Step 2: Identify a problem

To find successful projects, focus on solutions to problems.First, find out the challenges in that sector and search for investments that could really pay off. Try out some products, chat with people in the know, and discover problems that need solving. And remember, going after big, obvious issues can lead to sweet rewards.

Take Ethereum's “high fees” struggles back in 2019-2020, for example. Smart investors found alternatives like Solana, BNB Chain, Avalanche, Arbitrum, and Optimism. These projects tackled Ethereum's challenges, and outperformed the rest of the market.

Imagine if you'd invested in Solana (SOL) when it was just $3, you would've seen it skyrocket to $250—that's a mind-blowing 8,233% increase! Avalanche (AVAX) jumped a massive 3,414%, going from $3.50 to $123.

So, by finding the right problems at the right time, you can really make the most of some awesome investment opportunities. Dive in, follow your passions, and uncover those hidden gems that can supercharge your investment portfolio.

Step 3: Ignore the whitepaper

So you’ve spotted a problem. Now it’s time to look for projects that aim to tackle it. You’ll probably find several of them. Figuring out which one has the best chance of taking off isn’t as simple as reading the whitepaper. You’ve got to keep a few things in mind.Think of it like investing in a restaurant: You'd want to make sure it's in a busy area with lots of hungry people, right? Same goes for a blockchain project. Look for ones built on blockchains that are likely to grow.

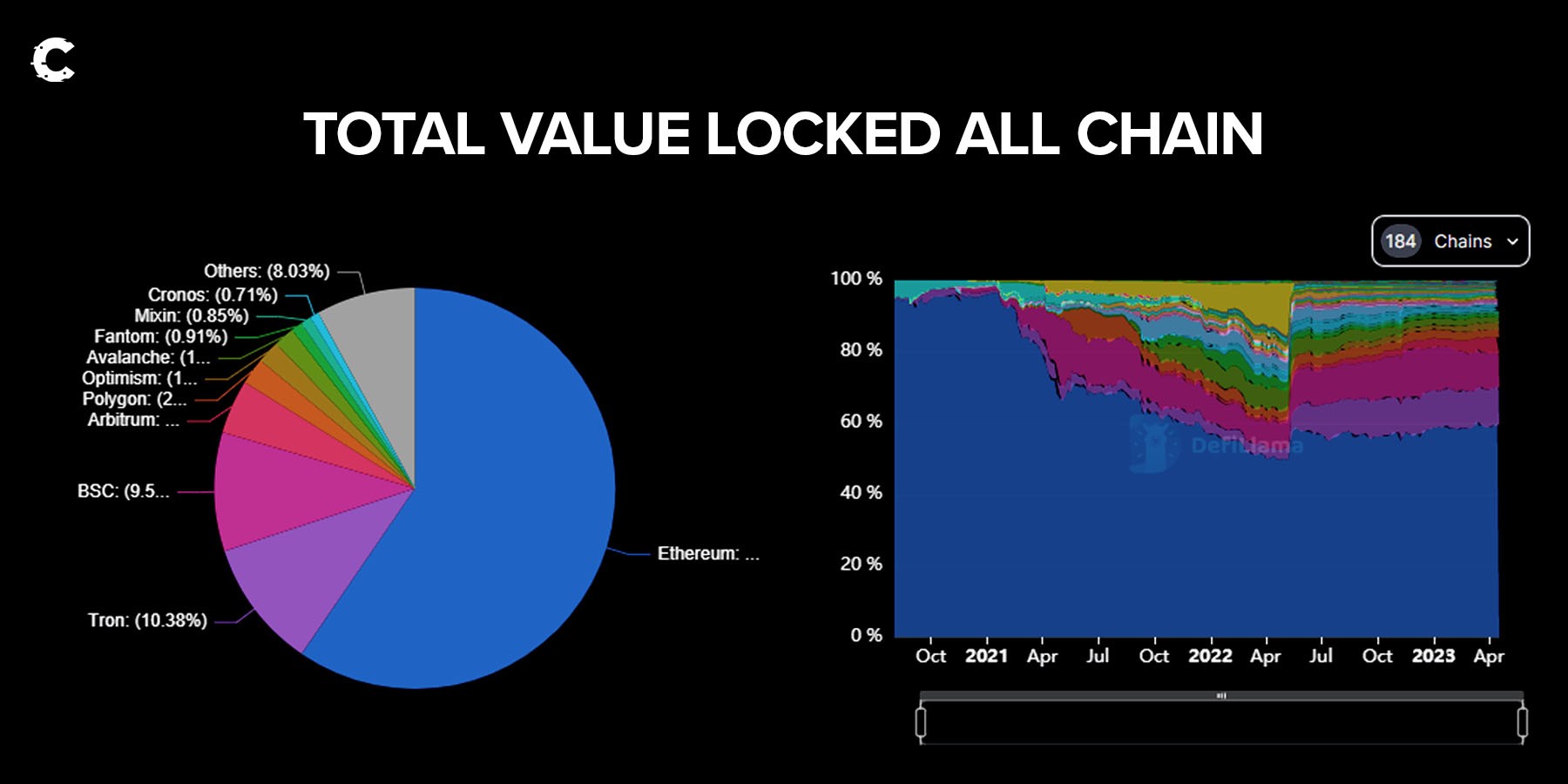

One way to do that is to check out the most popular blockchains based on total value locked and transaction volume.

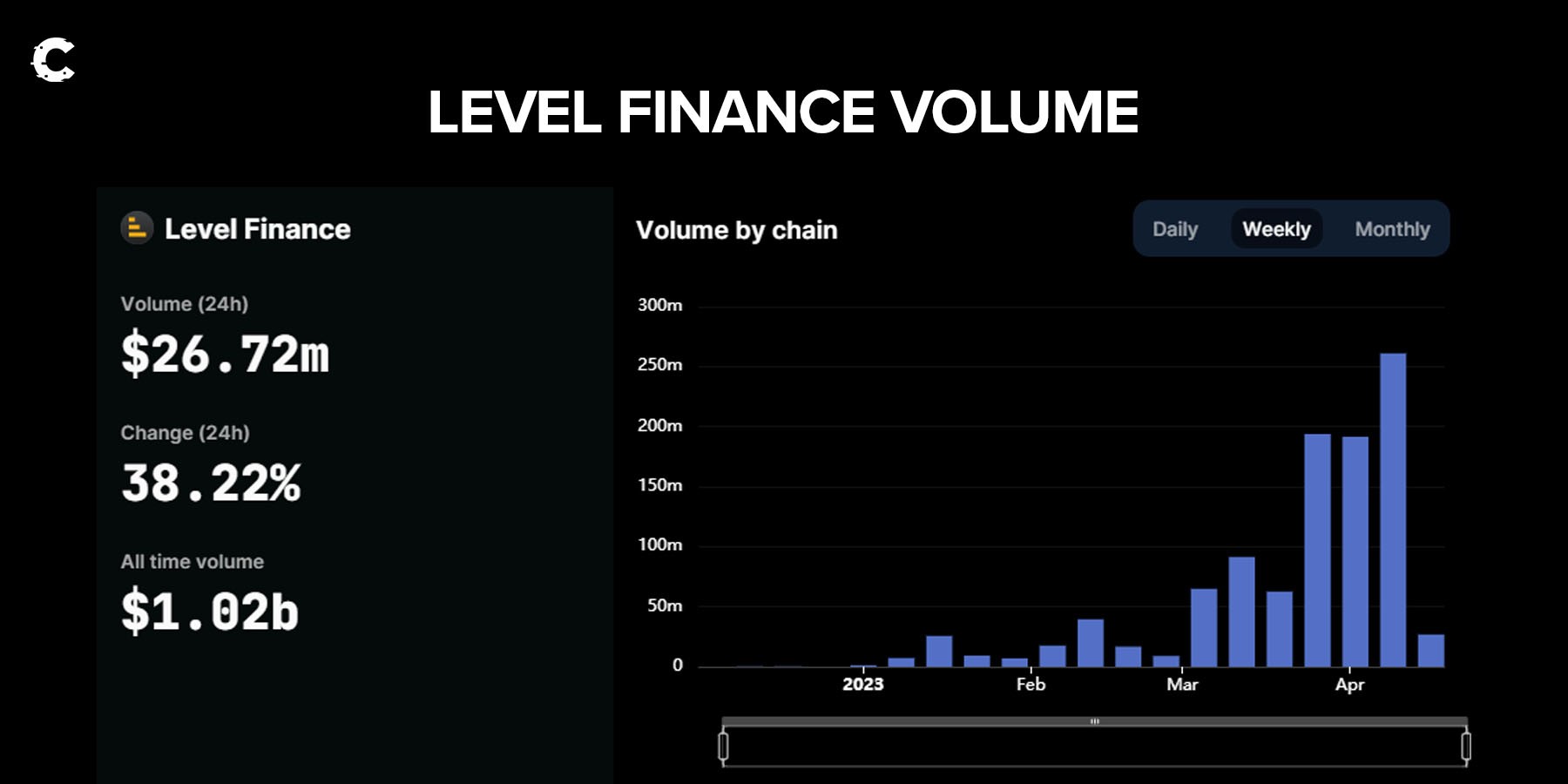

So, you want to know if a project you're checking out is a good investment, right? Well, see if people are actually using it. Find the main thing that makes money for the project and keep an eye on how it's performing. For a decentralised exchange, you'd wanna look at trading volume.

Take Level Finance, for example.

This year, they launched on the BNB Chain and are a fork of GMX, which was already a big deal on Arbitrum. They managed to grow on the BNB Chain by offering a similar solution to a problem BNB Chain users were facing. Pretty cool, huh?

Sometimes, you'll need to estimate a project's revenue. One way to do that is to figure out what actions they make money from. For example, with liquid staking protocols, fees come from the rewards participants get. So, you'd wanna watch the deposited ETH to understand the protocol's potential to rake in cash. Don't worry, websites likeTokenTerminal and DeFiLlama can be your best friends for this stuff.

Not into crunching numbers? No worries! You can still get a sense of whether a project is hitting the mark. Give the product a try and see if it's something you'd use. Or join the project's Discord community and see if users are struggling or happy.

Relying on your own experience and what customers have to say can give you some surprisingly useful insights into whether a project has found its sweet spot.

Step 4: Avoid token pitfalls

Just because a project looks successful doesn't mean it's a great investment. Picking a winner in crypto investing can be tricky, so watch out for common traps.Some projects use tokens as marketing-spend by cranking up inflation. But if inflation gets too high, it can create selling pressure, which means token holders' value goes down. You might think a protocol is super-popular when it's actually just paying people to use it. Compound is a good example of this. High token incentives led to negative earnings and as you can see in the chart this also led to massive underperformance against ETH.

To understand the actual revenue situation for lots of projects, check out TokenTerminal. It shows the actual earnings of protocols. This way you can’t be fooled!

another issue you might run into is when a token's value isn't directly tied to how well the protocol's doing, or there isn't a solid plan to connect the two. As an investor, you'd usually want to see the cash flowing to token holders from the projects you put your money into.

But here's the thing—sometimes protocols don't share that sweet revenue with token holders. Sure, the project might grow, but the token's value might lag behind because investors just don't see what's in it for them. To find out which tokens are actually making money for holders, you can head over to sites like DeFiLlama and check out their fee revenue page.

This is just the beginning. For more on pitfalls, check out our tokenomics guides, where we dive into a bunch of them.

Ideally, a token's value should go up as the project gets more successful. Yes, there have been projects that gave governance rights without sharing revenue and still did well, but that's not common these days.

Cryptonary’s take 🧠

So, picking winning crypto projects takes some homework. There's no one-size-fits-all approach, but these four steps can help you kick things off:- Pick a promising sector

- Find a problem

- Check out potential solutions

- Dodge common token traps

Action points 📝

- Build a well-diversified portfolio that minimises risk with the Cryptonary Portfolio Builder. Just plug in the tokens you’re considering and this handy tool will make sure your portfolio is balanced and set up for success.

- If you’re really serious about crypto investing, you should think about becoming a Cryptonary Pro member. As a Cryptonary VIP, you’ll get weekly research articles to keep you in the loop on the projects we’re investing in and major market happenings.

- And if you want a sneak peek at how our team rates popular cryptocurrencies, don’t miss our Ratings Guide. It’s filled to the brim with expert opinions on which projects are worth your attention.

- Keep this article handy for the next time you’re searching for winners in the fast-paced world of crypto investing.

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms