The U.S. Securities and Exchange Commission (SEC), in its pursuit of prominent crypto exchanges, Binance and Coinbase, has labelled MATIC as an unregistered security. Talk about a regulatory setback!

But hold on tight because this takes an unexpected twist. Despite the hurdles, signs point to MATIC's comeback.

Now, here’s the big question that has us all scratching our heads. Should we start paying more attention to MATIC despite the regulatory uncertainties? Let’s find out.

TLDR 📃

- MATIC recently faced a regulatory setback as the SEC classified it as an unregistered security.

- MATIC is delisted from Robinhood and eToro; raising concerns about how far the backlash will go.

- It’s not all doom and gloom; the Polygon 2.0 vision can be a game changer.

- In the meantime, Polygon’s zkEVM ecosystem is flourishing with a record-high Total Value Locked (TVL).

- Investing in MATIC amidst the Polygon 2.0 launch might be risky due to market uncertainty, but there’s a potential buying opportunity.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

Is MATIC a security or not? 🤔

Last week, Polygon received some tough news.The SEC classified MATIC as a security in its lawsuit against Binance and presented several arguments supporting the claim.

And boy, did it rattle the investors. You could practically taste the fear in the air! As soon as the news broke, the price of MATIC took a nosedive, plummeting a jaw-dropping 25%. Ouch!

Interestingly, MATIC is not directly involved in the lawsuit, but the fact that the SEC is using it as an example against Binance isn’t exactly good news.

To add insult to injury, popular U.S. exchanges like Robinhood and eToro decided to delist MATIC. And that sure didn't help the overall gloomy mood surrounding MATIC.

But there’s a bright spot in all of these. Polygon Labs, the masterminds behind Polygon, didn't fold. Instead, they sprang into action and released a statement to clear the air. They made it clear that they have no intentions of targeting the U.S. market and are not operating stateside.

Their goal? To reassure investors that the SEC's shenanigans won't harm the Polygon ecosystem because the main focus is on the rest of the world.

And to be fair, that's a solid strategy, right? Polygon already has a significant user base in India, and many places in the Middle East, Europe, and Asia are on a fast track to providing regulatory clarity for crypto.

However, in this global game of crypto chess, let's not overlook the fact that the United States remains the capital of the world's finance. If Polygon faces SEC troubles as Ripple did, it will generate the kind of publicity that no brand wants to have.

Sure, there's a valid argument that MATIC isn't a security, given its purpose of gas payments and securing the Polygon network. But any mention of MATIC in those SEC documents leading to lawsuits would deepen the negative sentiments; the same hold if true exchanges like Kraken or Coinbase ditch the token. On the bright side, there’s the possibility that this regulatory setback is already priced in.

The rise of Polygon zkEVM ↗️

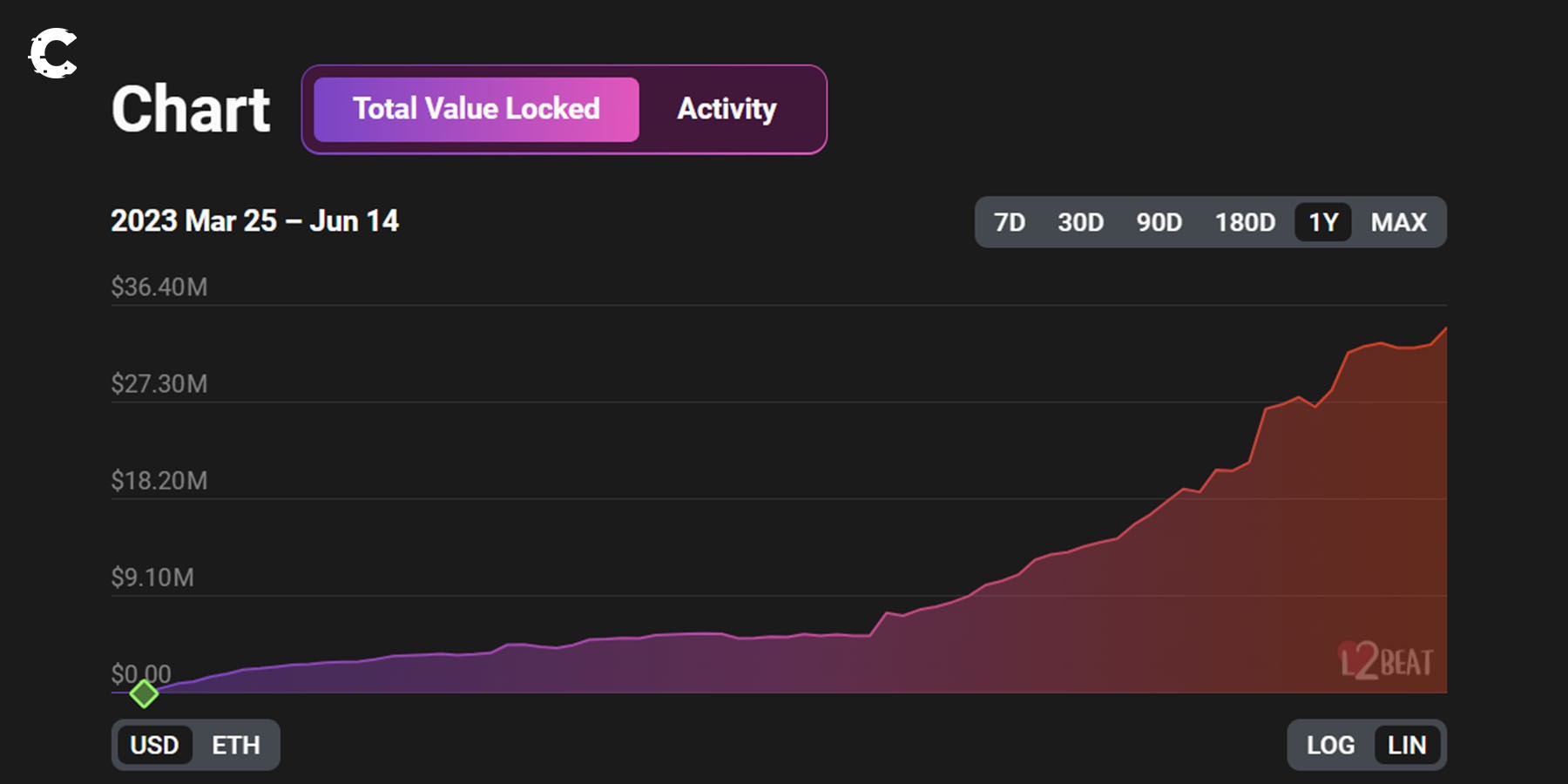

About three weeks ago, we discussed Polygon's plans for its zkEVM. And guess what? It seems our prediction will be right on the money!Despite the SEC drama, the Total Value Locked (TVL) has skyrocketed to an all-time high. And that's no small feat! Sure, $34M may not be a fortune, but the growth rate has us on the edge of our seats.

One big reason for this surge in interest is the jaw-dropping reduction in bridging costs for using Polygon's zkEVM. You can’t go wrong with money-saving solutions. And if that's not enough to get you hyped, there's even talk of a possible airdrop from the Polygon team.

Whenever a new ecosystem emerges, it's like witnessing the birth of a thrilling competition. We're talking about decentralised exchanges (DEXes) and derivative exchanges vying to become the kings and queens of the zkEVM realm. And for context, projects like Camelot on Arbitrum or Velodrome on Optimism have shown that coming out on top can be like hitting the mother lode.

To save you time, we've compiled a promising protocol list. These gems are early-stage, but could be the backbone of Polygon's zkEVM. So, keep your eyes peeled.

- Dove Swap: Polygon's native DEX. Ready to challenge Quickswap. TVL at $2.6M, climbing fast. $DOV token may outshine Quickswap. Let the game begin!

- Shrike Perps: Fresh protocol by the Dove Swap team. First GMX fork. Trade perpetuals on Polygon's zkEVM. $SHK IDO recently, revenue-sharing for stakers. Potential growth alongside zkEVM. TVL at $188K, early days.

The Polygon 2.0 vision 👁

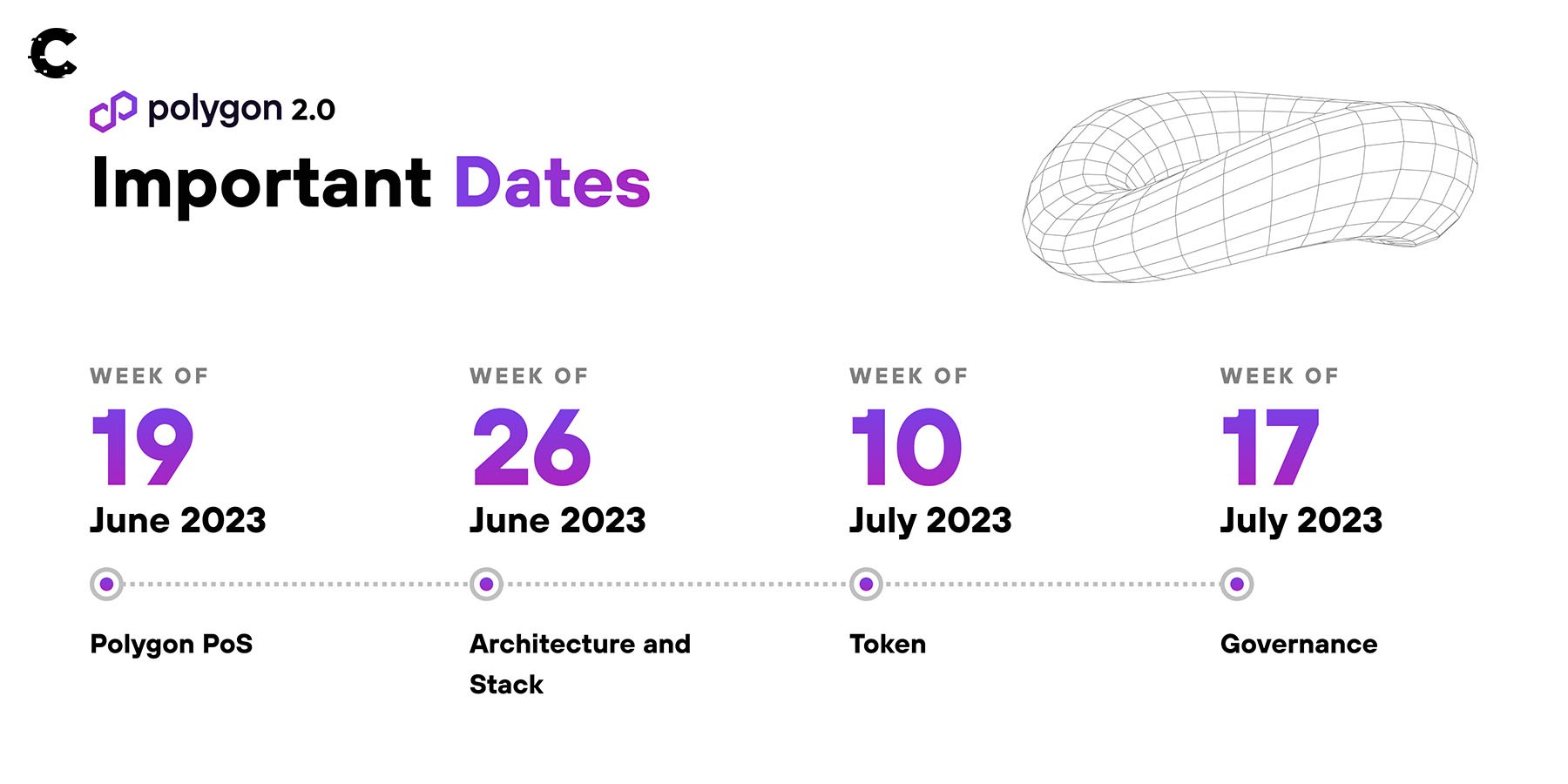

If you thought the momentum gained by Polygon zkEVM was the only positive news for Polygon this week, prepare to be pleasantly surprised.Despite the negative SEC news, the Polygon team has made a big announcement: the unveiling of its Polygon 2.0 vision, marking one of its most substantial upgrades to date.

Of course, the announcement was more of a teaser, as Polygon is yet to reveal all the details. From the tidbits, you can describe Polygon 2.0 as a way to transition from its current state of two separate blockchains into a more interconnected ecosystem.

Think of it as similar to Cosmos, where all the chains being built will be connected and able to communicate. Polygon's plans also include building out a comprehensive network of layer-2 solutions.

The team has released a roadmap outlining specific dates for revealing more details about various aspects of the Polygon 2.0 vision. These dates will be worth marking in your calendar, as they will provide crucial insights into the future of the Polygon Proof-of-Stake (PoS) chain.

Is it wise to invest in MATIC now? 📈

With the SEC's negative impact on Polygon, the positive developments around the thriving zkEVM, and exciting upcoming announcements, you might wonder if investing in MATIC is smart.Short answer – it depends.

Long answer? We believe the market will only offer a few opportunities in the coming months, probably not for the rest of the year. The reason? Too much uncertainty.

We're expecting more downside and consolidation across the board, so we could see MATIC coming down to test the $0.3875 - $0.3150 support region in the coming weeks.

To us, this is a great zone to buy from with a target of $0.76 in mind. That's somewhere around 115% in profit.

By that point, the market would've already experienced a lot of downsides, and the waters might've calmed down, allowing MATIC to shine again.

Now, there are invalidation criteria that we're keeping our eyes on. For example, MATIC could face more regulatory scrutiny and delistings, bringing its price lower than anticipated. On a brighter note, flipping $0.76 back into support will invalidate our potential scenario and bring upside to the table before it reaches our buy zone.

Buying now comes with many risks, given that MATIC doesn't have support anywhere near its current price. So instead, we're keeping our eyes peeled on the $0.3875 - $0.3150 region.

Cryptonary’s take 🧠

The SEC's comments have cast a dark cloud over Polygon. Despite our belief that MATIC doesn't qualify as a security, perception is everything – and right now, it’s negative for MATIC.So, despite the bullish announcement of Polygon 2.0 and the growth of zkEVM, we are hesitant to dive into MATIC because of the regulatory uncertainty and overall market sentiment.

However, if the price drops to $0.3875 - $0.3150, it could present an excellent buying opportunity.

Where we see more potential is in the new and upcoming Polygon zkEVM ecosystem, which is currently being built. It's still in its early stages, but we strongly recommend bridging some funds and experimenting with it – this could be the start of an incredible ride.

You can expect us to provide a more detailed analysis of the Polygon 2.0 announcement once the specific details are shared. We anticipate some volatility in MATIC when those announcements are made. Now, here's our friendly advice: if you are a short-term momentum trader, paying attention to these fluctuations might be a smart move.

However, we recommend that most folks should focus on the long game. Keep your sights on the horizon and let the magic of Polygon unfold.

Thanks for reading. Cryptonary, out! 🙏

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms