EDX Markets, backed by Fidelity, Citadel, and Charles Schwab, just started offering ETH to its customers. A move that offers traditional institutions a clear pathway to adding Ethereum to their portfolios.

There's also an ongoing debate about the participation of TradFi institutions in ETH staking services.

What do these developments all mean for ETH prices and your portfolio? Let's dig into it!

TLDR 📃

- EDX Markets is set to provide traditional institutions with a pathway to add Ethereum to their portfolios.

- More institutional participation in ETH is expected, potentially leading to increased interest in ETH staking as institutions seek guaranteed yields.

- Ethereum developers are exploring the possibility of compounding staking rewards.

- We could also see ETH staking becoming more appealing and less technically complex for institutions.

- Over 20 million ETH are currently staked, with additional ETH ready to join.

- Concerns arise regarding Ethereum co-founder Vitalik Buterin's association with Prometheum, an entity close to the SEC.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

Old money set to dive into Ethereum 🪙

EDX Markets, the crypto exchange backed by Citadel, Fidelity, and Charles Schwab, is finally live. EDX Markets has the DNA of TradFi platforms, and its launch provides institutional players with a familiar entry point into the world of cryptocurrenciesBut more importantly, it positions itself as a safe and compliant cryptocurrency marketplace, bringing the best bits of traditional finance into crypto.

What's on EDX Markets' menu, you ask? Its offerings cater exclusively to institutions, with enhanced liquidity and a non-custodial model, among other things. It is also set to unveil EDX Clearing later in the year.

EDX's institutional offerings also potentially create a flywheel effect where traditional players like Fidelity and Charles Schwab buy crypto and then offer the same to their retail customers.

EDX's institutional offerings also potentially create a flywheel effect where traditional players like Fidelity and Charles Schwab buy crypto and then offer the same to their retail customers.

Having more institutional participation in ETH sounds excellent on paper, but what exactly is in it for them? We have a few ideas, one being that these institutions will want a piece of the ETH staking piece once they start loading up on ETH.

There's precedence for this. Staking has been the preferred route for many institutional hodlers because it provides "guaranteed" yield while they wait for price gains.

Improving the staking experience for institutions 💥

As institutions come into ETH full steam ahead, the staking landscape might soon change significantly.First, Ethereum developers are exploring the possibility of compounding staking rewards. This would be the first staking alteration since the PoS transition last September. The latest proposal by an Ethereum Foundation researcher suggests pushing the "MAX_EFFECTIVE_BALANCE" from 32ETH to a staggering 2,048 ETH.

This transformative shift has the potential to improve the staking experience for institutions. For one, the technical complexity of staking sizable amounts of ETH could significantly decrease, making staking even more appealing. Institutions could quickly offload a large part of their ETH to existing validators in a single move without the hassle of launching new nodes every 32 ETH interval. Also, validators could allow their rewards to compound organically, thereby reaping higher yields.

Eth staking hits new milestones 🛣

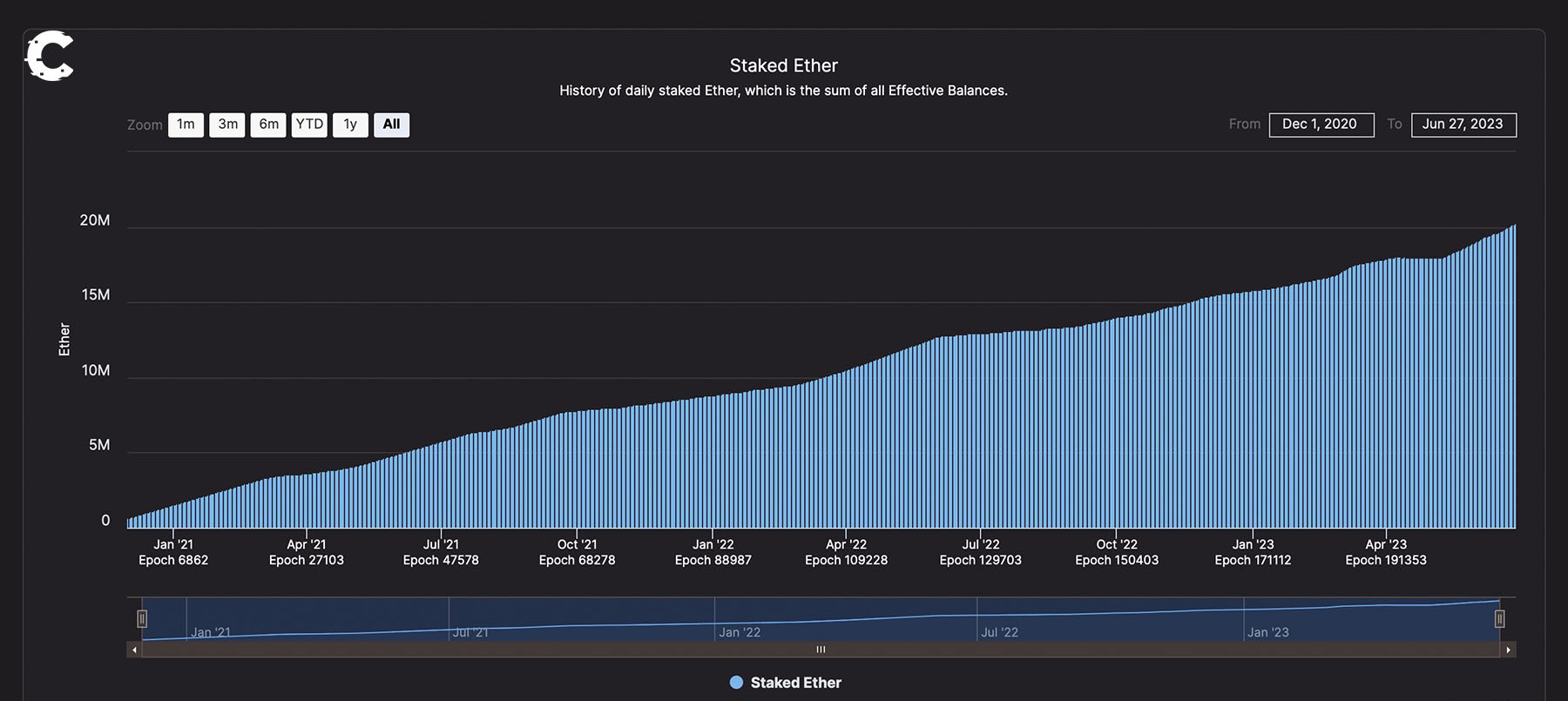

Whether the proposed changes to ETH staking make it past the idea board remains to be seen, but one thing remains clear – ETH staking is more popular than ever.

Over 20 million ETH are staked, with another 3 million ETH chomping at the bit to join the fray. Collectively, it's close to a fifth of ETH's total supply! Interestingly, the exit queue is a ghost town, with no validators looking to cease staking.

Vitalik takes heat for Prometheum ties ⛓

Amidst the gathering column of institutional players vying for a slice of the Ethereum pie, one institution has struck a nerve within the Ethereum community. The spotlights are on Prometheum, the entity issued with a "special purpose broker-dealer" license by FINRA and the SEC.Long story short, the Ethereum community discovered that Vitalik Buterin closely knitted with Wanxiang Blockchain Lab, a nonprofit holding a significant stake in Prometheum. Vitalik also bears the title of "Chief Scientist" at Wanxiang.

Now, that shouldn't be much of a big deal, but Prometheum's co-CEO recently whistled the SEC's tune, asserting that there's no need for fresh crypto regulations. This pro-SEC stance conveniently strengthens the SEC's case against the crypto industry.

The question buzzing in the crypto beehive is why the Ethereum co-founder is involved with a firm eerily close to the SEC. Time reveals all…

Price analysis 📊

Last week's performance changed the game for ETH. While we were almost certain $1,420 was next, that trajectory was taken off the map within a few days, putting ETH on track for $2,000. Its price is currently trading inside a range between $1,740 and $2,000, and our eyes are on a weekly closure above the upper level of the range.

Once that's out, nothing is stopping ETH from reaching $2,500.

Cryptonary's take 🧠

With traditional finance titans finally jumping into the pool, ETH and staking will likely become even more popular.All the pieces seem to be lining up for ETH to cross over the $2000 hurdle and head straight for $2,500 - feels too good to be true.

While institutional participation also comes with challenges, the positives are a win against the SEC's recent attacks. So, it's nice to see more institutions buying ETH and staking it, doing what regular people like us have been doing for months.

And as always, thanks for reading. 🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms