This week, we saw the much-anticipated launch of Azuki’s third PFP collection, Azuki Elementals.

Following an incredibly successful event in Las Vegas that culminated in one of the best Web3 trailers of all time, expectations were sky-high.

Unfortunately, the whole thing has degenerated into a story of betrayal and backlash.

And now, millions of dollars are lost, and confidence is eroded.

Is this the end of Azuki?

What does the future hold for NFT projects in general?

A quick trip down memory lane 📙

Azuki quickly gained popularity upon its launch in January 2022, capturing the attention of the NFT community. The project boasted a unique and relaxed vibe and a sleek website.

The team was also on fire with its execution, and the mint sold out in just three minutes, raising an impressive $28 million.

Azuki further delighted holders with initiatives like Bobu Fractionalization, a garden party event, and the Beanz Airdrop.

The community was captivated by the NFT reveals, driving up the floor price from 1 to 30 ETH within two months.

Zagabond profited from the initial sales of these NFTs and then abandoned the respective communities. There were also allegations that Zagabond had impersonated a female founder named Amanda during one of the launches, adding to the community's outrage.

Zagabond eventually agreed to return funds to those affected, referring to these incidents as "learnings."

Consequently, the floor price of Azuki's NFTs tumbled from 30 ETH to 10 ETH within a month, signalling a potential end to the Azuki dream.

Azuki’s comeback: when money trumps ethics 💰

What sets NFT projects apart from traditional Web2 companies is the unwavering dedication of their holders. Owning an NFT means you have a strong financial incentive to see the project soar. There’s also an unparalleled sense of community.

When the Zagabond bombshell detonated, numerous deep-pocketed investors found themselves staring at colossal losses. The value of their Azuki NFTs plummeted, and the outlook appeared grim.

But then, a focused narrative campaign took centre stage, determined to reshape perceptions and breathe new life into Azuki. The community rallied, unleashing an endless stream of positive stories across social media, lauding the brand and Zagabond himself. They masterfully reframed his past missteps as learning experiences and stepping stones leading a Web3 empire.

And those whales who had already invested millions? They chose to double down, unleashing a relentless wave of activity on the Azuki marketplace. Their strategic moves created an illusion of soaring volume and insatiable demand.

The team also continued with its flawless execution:

- Twin Tiger Jacket Free Airdrop

- Enter the Alley - IRL Event

- Innovative Online Collector’s Profile

- First Physical Backed Token in Web 3

- Selling 9 Golden Plated Skateboards to their community for $2.5 million

- Ambush Merchandise Collaboration

- RedBull Racing Partnership

By the end of the year, all was forgiven as the floor price had recovered. The team and community ruthlessly silenced any mention of previous failings, making Azuki the second-biggest project in Web3.

Azuki Elementals: a story of failed expectations 🤬

Over the last week, Azuki took Las Vegas by storm, hosting an epic event filled with community celebrations, swag giveaways, and inclusive experiences. The grand finale was a mind-blowing trailer unveiling their newest collection, Elementals—the talk of the Web3 town.

With 20,000 fresh NFTs expanding the Azuki universe, questions emerged about the mint mechanics.

- Airdropping 10k for free to Azuki holders and auctioning off the other 10k among them and Beanz holders raised eyebrows. How would this foster growth?

- What’s with the 10-minute window for minting during both phases? Why the rush? Was it a deliberate ploy to induce FOMO?

- At a hefty 2 ETH mint price, the team aimed to rake in a whopping $40M. But did this encourage new participants?

With the entry price for an Azuki NFT already at 17 ETH (over $30k), concerns about potential dilution loomed large.

Yet, doubts were brushed aside. The team's stellar track record garnered unwavering trust. People liquidated everything they could to secure their minting position.

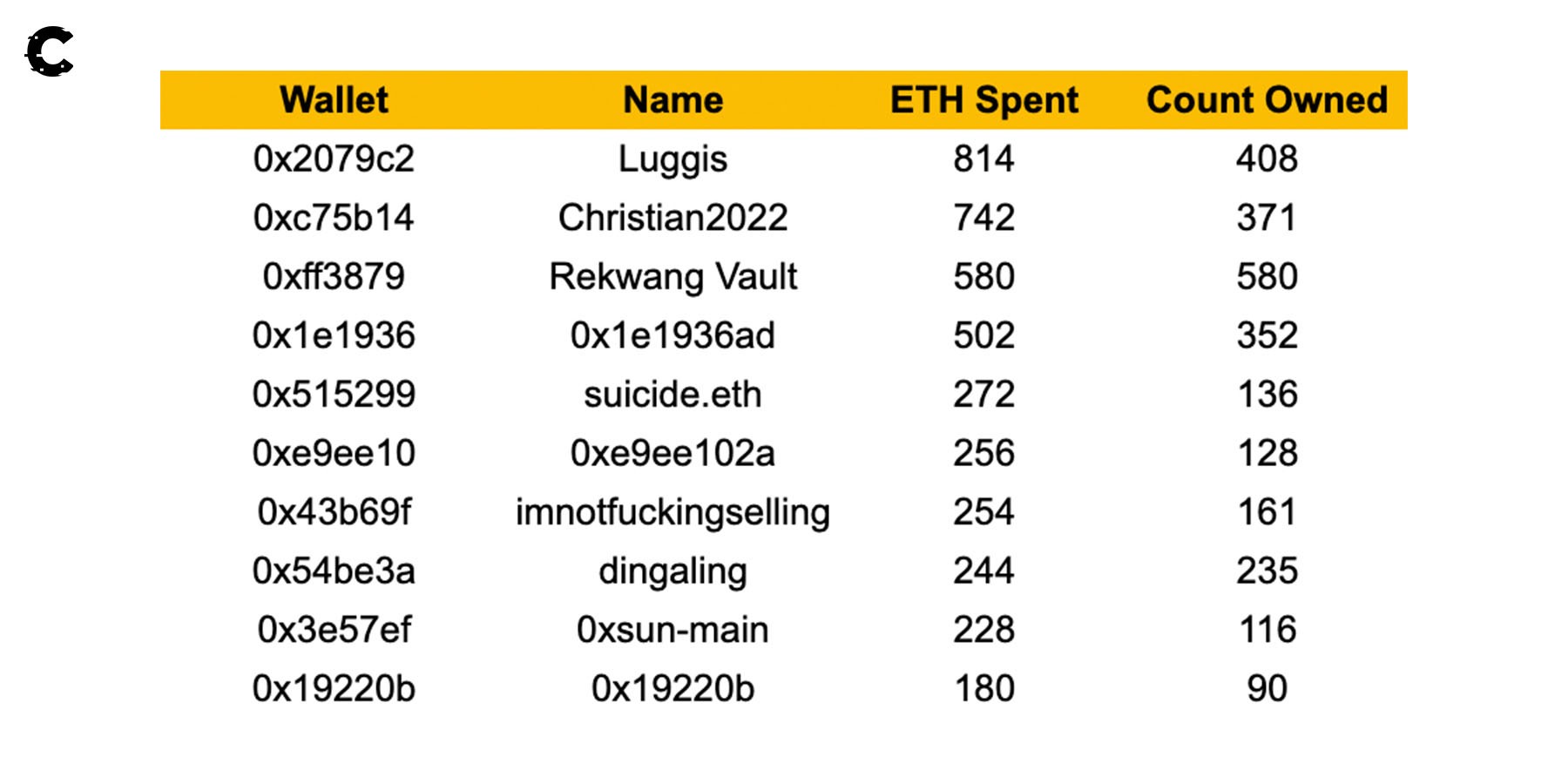

Major Azuki investors seized the opportunity, investing a staggering $7.8M to acquire 20.3% of the total supply, doubling down on the Azuki ecosystem.

Not so fast!

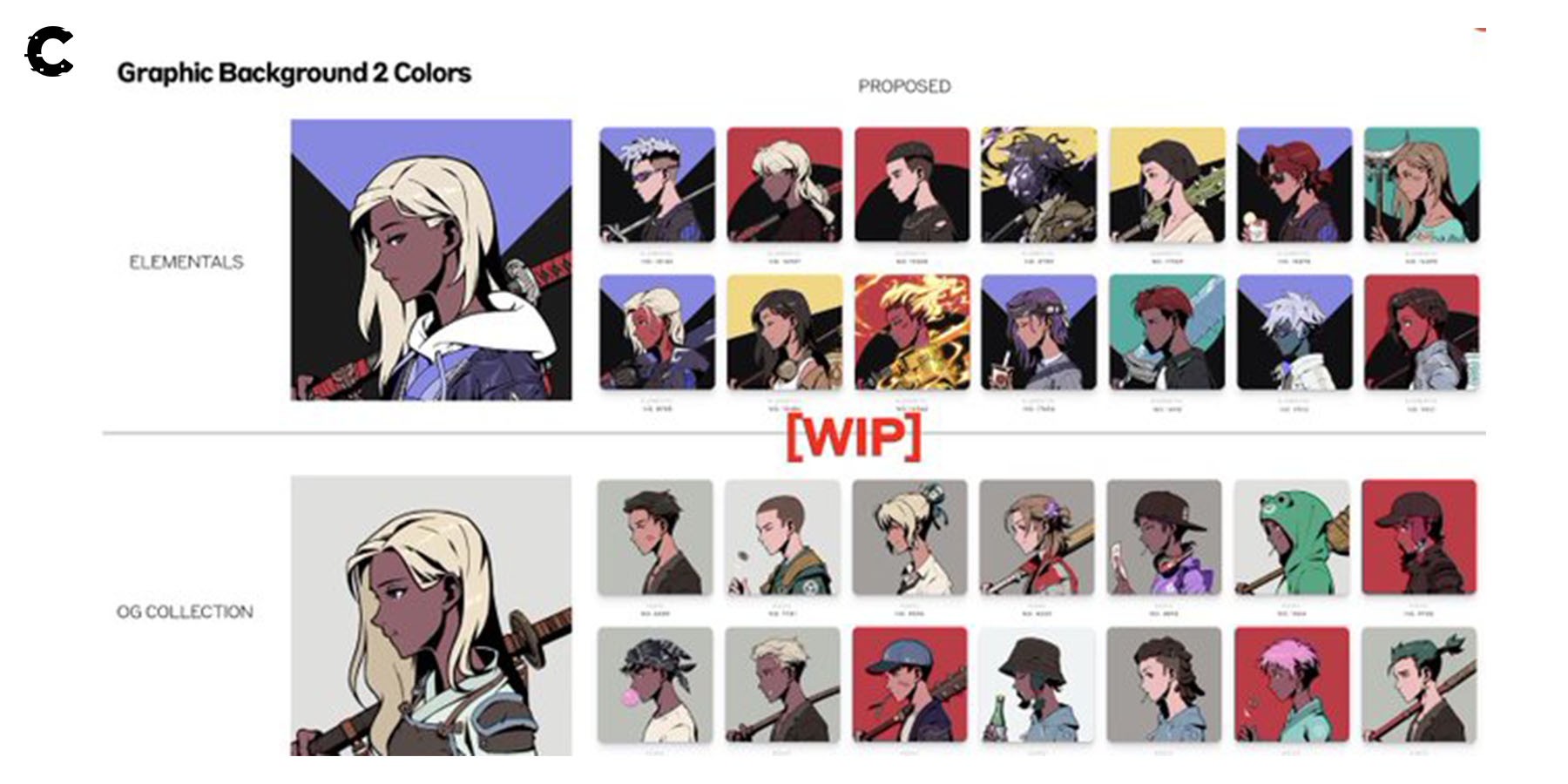

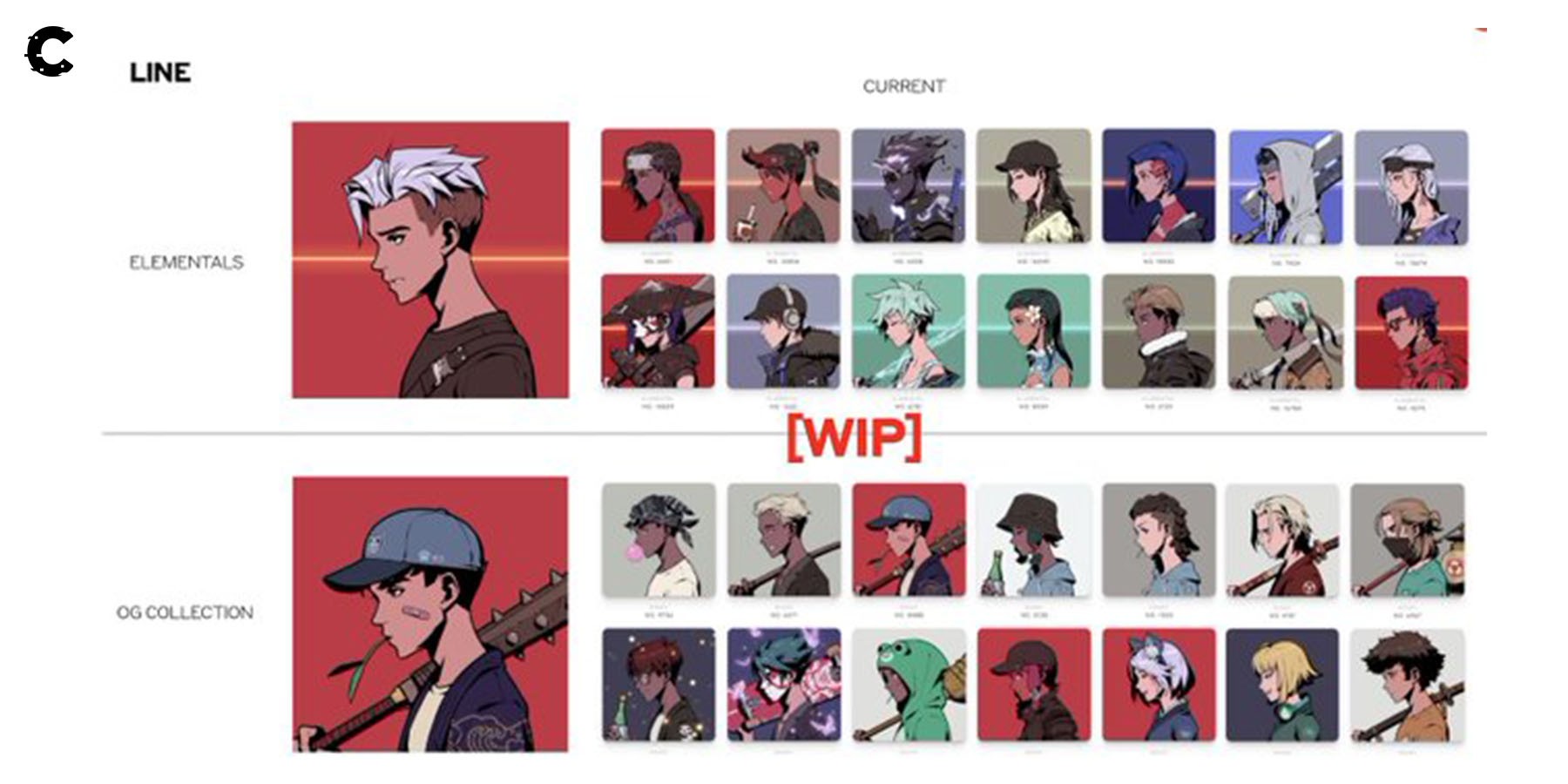

The community eagerly anticipated the new artwork, as Azuki dominated social media trends. But the reveal turned into an absolute disaster. Major holders were livid, discovering duplicates in the collection.

Many saw this as a cash grab and a severe breach of trust. Some people have lost millions of dollars.

The community arranged a call with the team, seeking solutions to restore value and exclusivity to the original Azuki collection—the proposed change: community voting on changes to Elemental NFT backgrounds. Desperate holders embraced the proposal, hoping to break even. This temporary fix sparked yet another uproar.

The essence of NFTs lies in decentralisation and ownership. The team's unilateral decision to alter artwork without consent contradicted Web3 ideals. Elemental owners, who paid over 20 ETH ($35,000+) for aesthetics, questioned the team's authority to change their images.

The Azuki saga epitomises why the mainstream often frowns upon the NFT space. A year ago, doubts about the founder's character were glossed over and whitewashed in pursuit of profits, leading to the community’s predicament today.

Will Azuki stage another miraculous comeback, overcoming the latest setback? Only time will tell.

Cryptonary’s take 🧠

With the downfall of the second-biggest project in the NFT space, trust in NFT PFP teams has hit rock bottom. Buyers seek refuge in established stores of value and PFP projects with minimal external dependencies.

So, what should you consider in this ever-evolving landscape?

Here are our recommendations:

Short Term

- BAYC/MAYC

- DeGods

- Memeland

Long Term

- Cryptopunks

- CC0 Projects: Opepen/Checks, Mfers, Rektguy

- Generative Art: Squiggles, Fidenza, Autoglyphs, Ringers

- Bluechip Digital Art: XCOPY, Claire Silver, Grant Yun etc…

Remember, just like startups, most NFT projects will fail. Founders often lack experience or may have questionable histories.

So, tread carefully, and seek projects with solid fundamentals, visionary teams, and a commitment to community trust.

As always, thanks for reading. 🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms