In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments

This basically means that they understand that rate hikes take time to have a visible effect on economics and will adjust the coming hikes accordingly. They went on to say:

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals

In this statement, they’re acknowledging that continued hikes into actively restrictive territory will have an impact on economic growth. It’s important to note here that this is the goal – they are trying to slow the economy, slow demand, to better match supply with demand. When supply cannot meet demand, then prices increase – this is inflation.

The market took the Fed statement as mildly dovish, and both stocks and crypto rallied. However, Fed Chair Powell’s press conference almost immediately reversed these gains (and some). Why? TLDR:

Powell said that we are far away from a hike pause (yikes)

He also said that he envisions a higher terminal rate than previously anticipated (YIKES)

With these two statements he pretty much directly contradicted the Fed statement, and some would argue this is more hawkish than before. So, what’s the outlook? Is there any good news?

We are of the thesis that despite these statements, we have likely seen the worst of Fed hawkishness. There is tangible evidence that interest rate hikes are beginning to have the intended effect (housing/rents, for example - check the latest macro reports). Now, we’re not saying that a bull market is imminent or anything along those lines. However, the idea that the Fed will keep slapping 75bps hikes at the next few meetings is highly unlikely - the current pace is unsustainable, mostly due to the lagging effect rate hikes have.

The Fed will likely start slowing the pace of hikes – we expect a 50bps hike in December followed by several 25 bps hikes in 2023. The key figures to look out for will be US labour numbers tomorrow, and subsequent CPI prints before the next meeting (14th December) – of which there are 2 (10th November & 13th December).

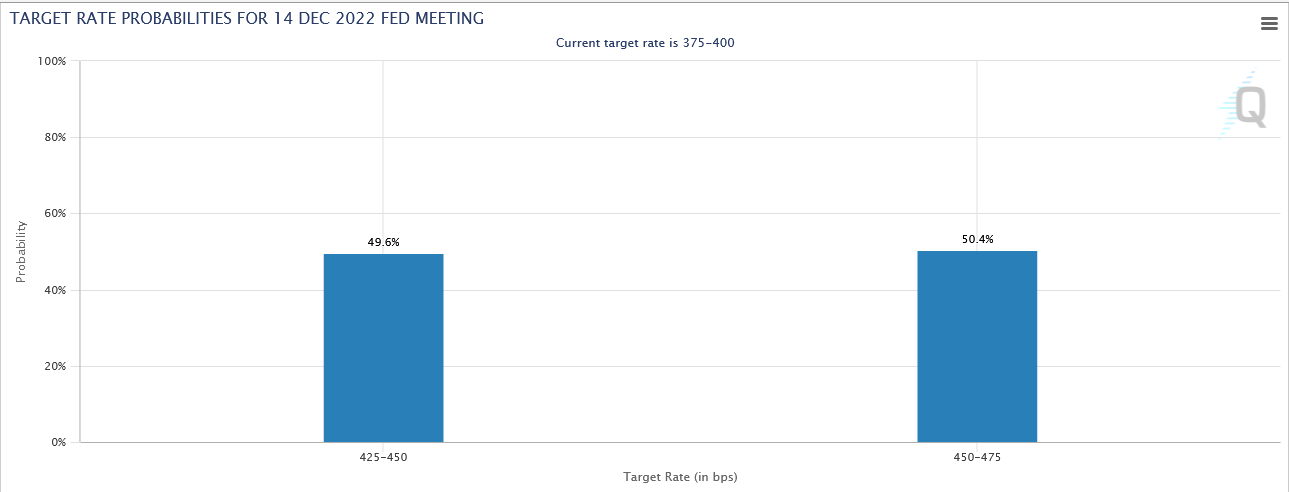

It's currently a coinflip between expectations of a 50bps or a 75bps hike in December:

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms