And like the proverbial knight in shining armour, PayPal, a traditional finance institution, makes its first forays into crypto, starting with $PYUSD, a stablecoin - but who cares.

There are arguments for and against PayPal’s stablecoin adventure, but one thing is sure – DeFi is alive and kicking, and it no longer needs validation from TradFi.

And despite recent setbacks like the Vyper compiler exploit, the future of DeFi has never been brighter.

So, what’s in store for DeFi assets over the next few months? Let’s find out.

TLDR 📃

- PayPal introduces a stablecoin ($PYUSD), but concerns about centralisation persist.

- Curve Finance uses a bug bounty program to reclaim 73% of funds lost in the Vyper exploit.

- A 0xMantle and Lido Finance partnership aims to create a robust liquid staking token ecosystem.

- We reaffirm that LIDO is a solid investment in the LSD-Fi space.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

PayPal makes an uninspiring entry into crypto 🍲

Many traditional financial institutions dislike cryptocurrencies, but that is changing.

Case in point, Paypal just launched its U.S. dollar-denominated stablecoin, PayPal USD ($PYUSD).

On the positive side, Paypal is a $70B+ company with 435m users who now have exposure to the crypto. If all goes well, PayPal’s foray into the world of stablecoins could help onboard new users into crypto.

However, beyond potentially adding more legitimacy to crypto, there’s a chance that PayPal’s entry won’t move the need for the DeFi industry.

For one, the stablecoin $PYUSD brings no innovation to how stablecoins are currently designed. Therefore, it will likely face similar challenges as USDC and USDT. If anything, this stablecoin will only dilute the stablecoins market capitalisation.

But it gets worse!

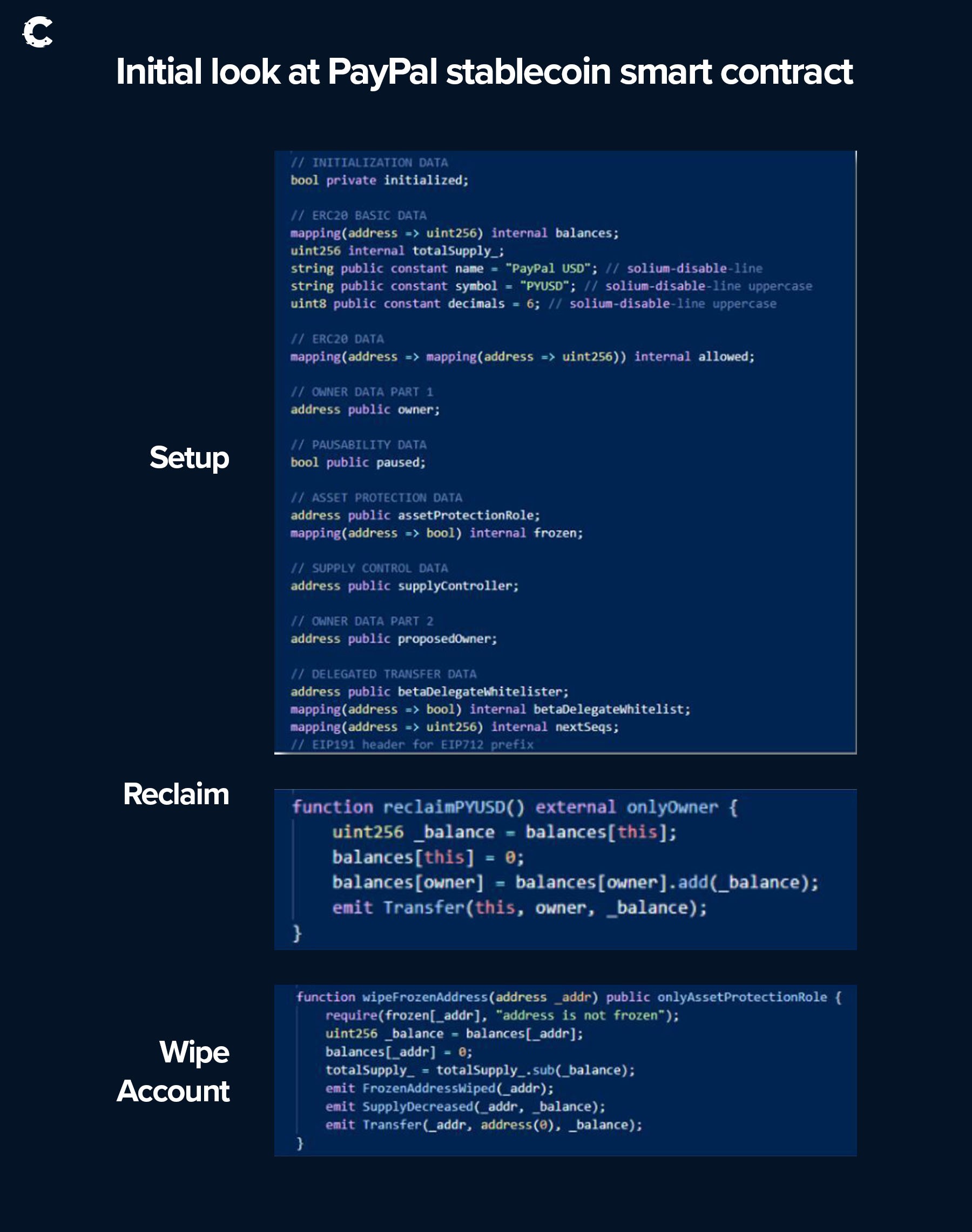

The analysis of PYUSD’s smart contract code shows it is more centralised than expected. For instance, the tokens can be frozen and even removed from the holders' wallets - this is not how decentralised money functions.

However, the PayPal brand is big. So it’s unsurprising that centralised exchanges such as Houbi and BitMart have expressed their desire to list the stablecoin. BitMart even traded it against USDT as a primary listing.

Centralised exchanges will find a way to work with PayPal, but what’s happening with Decentralized exchanges?

Hint: the PYUSD news has scarcely made a dent; we have bigger things on the menu.

Curve is on the path to recovery ❤️🩹

Back from the dead, Curve Finance is starting to recover from the fallout of the recent Vyper exploit.

Over the last few days, the future of Curve Finance looked bleak due to a Vyper compiler exploit that affected the protocol's liquidity pools, causing a loss of $75 million. The loss and cascading events resulted in a 15% decline in the price of $CRV in less than 24hrs.

Thankfully, Curve Finance and other affected protocols set up a bounty program to pay 10% on funds reclaimed or returned from the loot. And the plan worked. In less than 24hrs, the recovery began with one of the hackers sending $8.3M to Alchemix.

The affected protocols have now recovered about $52M, approximately 73% of the stolen funds. All is well that ends well.

The LSD revolution ⚔️

And now, the third reason to remain optimistic about the future of DeFi.

The LSD momentum has kicked into higher gear with the news of a partnership between Mantle Network and Lido Finance.

The partnership will see an injection of 40,000 ETH (~$80m) from the BITDAO treasury to stETH.

Although the partnership aims to start a vibrant and sustainable liquid staking token (LST) ecosystem on Mantle, LIdo Finance would also gain from the 10% charge placed on staking rewards. On a year-on-year basis, this would amount to $320,000 from the 4% APY on the $80M injected.

But while the rewards will be shared between the Lido DAO treasury and the node operators, Lido Finance also gains from the liquidity injection. We expect this partnership to boost Lido’s TVL and, ultimately, the price of the $LDO token.

So, how should you handle LDO?

Price analysis 📊

Despite the indecision around LDO from the past few weeks, we still view it as a solid investment and, even better, a solid trade.

Last week, we saw LDO closing under $1.85. In theory, this has invalidated the move to $3.10, but there's a catch - BTC managed to hold support and start its rally.

Therefore, LDO is back above $1.85 and will likely stay above this level by EOW. A weekly closure above $1.85 will reopen the possibility of testing $3.10. Or, at the very least, testing higher prices.

We'll actively be monitoring LDO's performance in Discord. Join now and stay up to date!

Cryptonary’s take 🧠

We aren’t ecstatic about the news of $PYUSD from Paypal. It makes great news headlines, but fundamentally, the stablecoin is more or less a USDC/USDT fork launched to allow Paypal to have a share of the revenue generated by the stablecoin sector.

With $PYUSD launching on the Ethereum network, transactions could also incur high gas fees, which could impede the ability of the coin to scale across its millions of potential users.

While it is refreshing to see traditional financial players make forays into Web3 ecosystems, we believe that the success of the DeFi sector will continue to be driven by the ingenuity, innovation, and determination of crypto natives.

And that’s why the adoption of Lido Finance into the Mantle ecosystem is very bullish for the Liquid Staking Derivatives narrative; with almost $80m flowing into Lido Finance, we would be looking into LSDs as the shining light of DeFi.

As always, thanks for reading! 🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms