The main issue is the arrival of new competitors within the Layer-0 space. And yes, there’s also the horrendous performance of the parachain tokens.

Long story short, Polkadot is in the intensive care unit, and the investors are debating whether to pull the plug.

So, is there any hope or is Polkadot destined to fade into oblivion?

We discussed all this and more in this report and the embedded video (see below).

Let’s dig in!

TLDR 📃

- Polkadot has struggled to gain momentum, with stagnant user growth and low transaction volumes plaguing the network.

- The top parachain tokens have crashed due to high inflation from token unlocks, with Astar being the lone standout thus far.

- New competing chains like LayerZero have stolen Polkadot's thunder by offering interchain capabilities without requiring a full migration.

- While niche utility remains, reducing inflation and expanding reach beyond Polkadot diehards is key for the ecosystem to revive itself going forward.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

State of Polkadot 🕵️

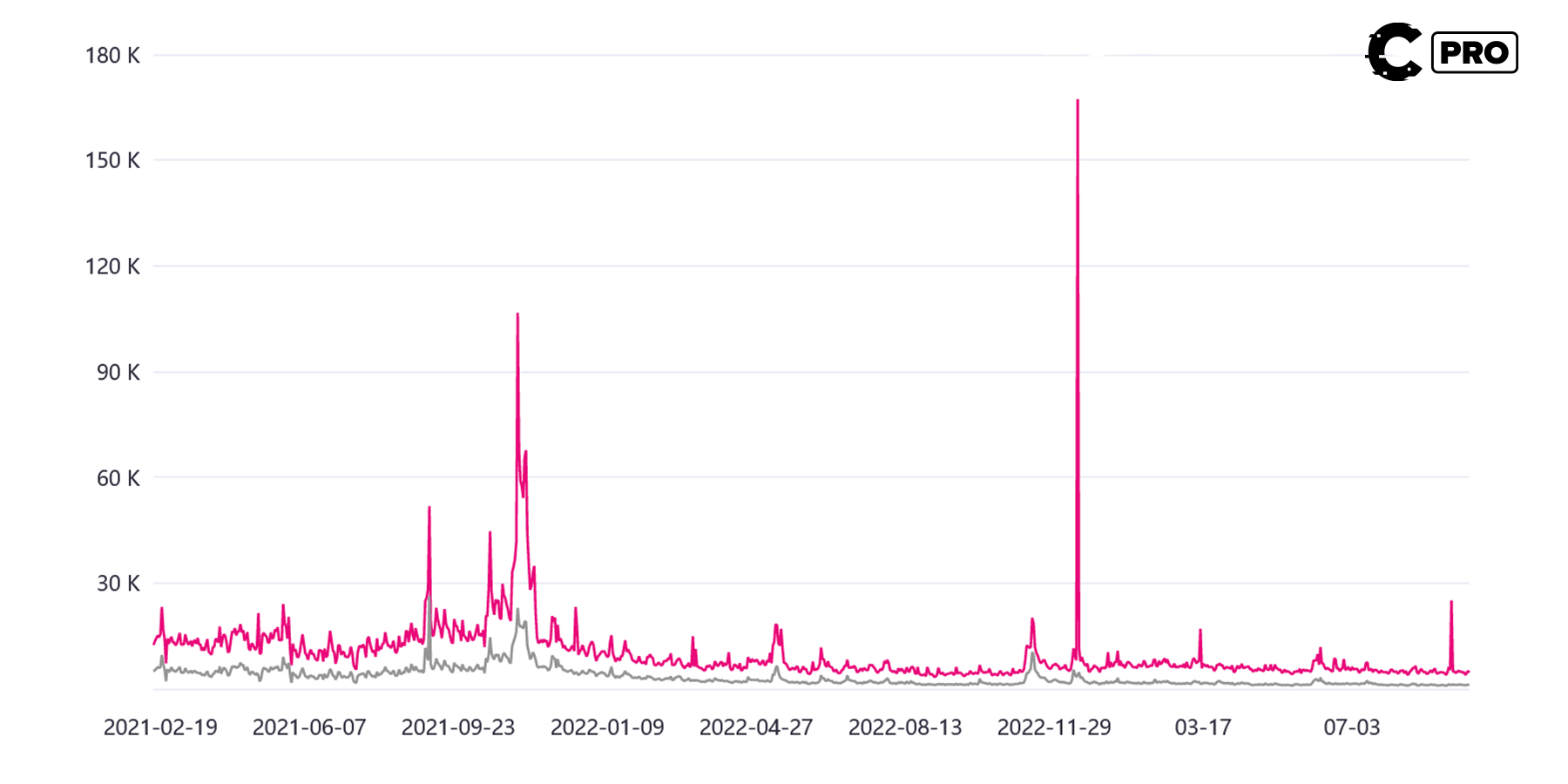

Polkadot has been suffering from stagnant users and relatively low transactional volume. After an initial spike in active wallets around the launch of the first parachain auctions, the number of active wallets is actually worse off than before parachains launched.

This decline is because users are now distributed among the various parachains. But this isn’t the full story.

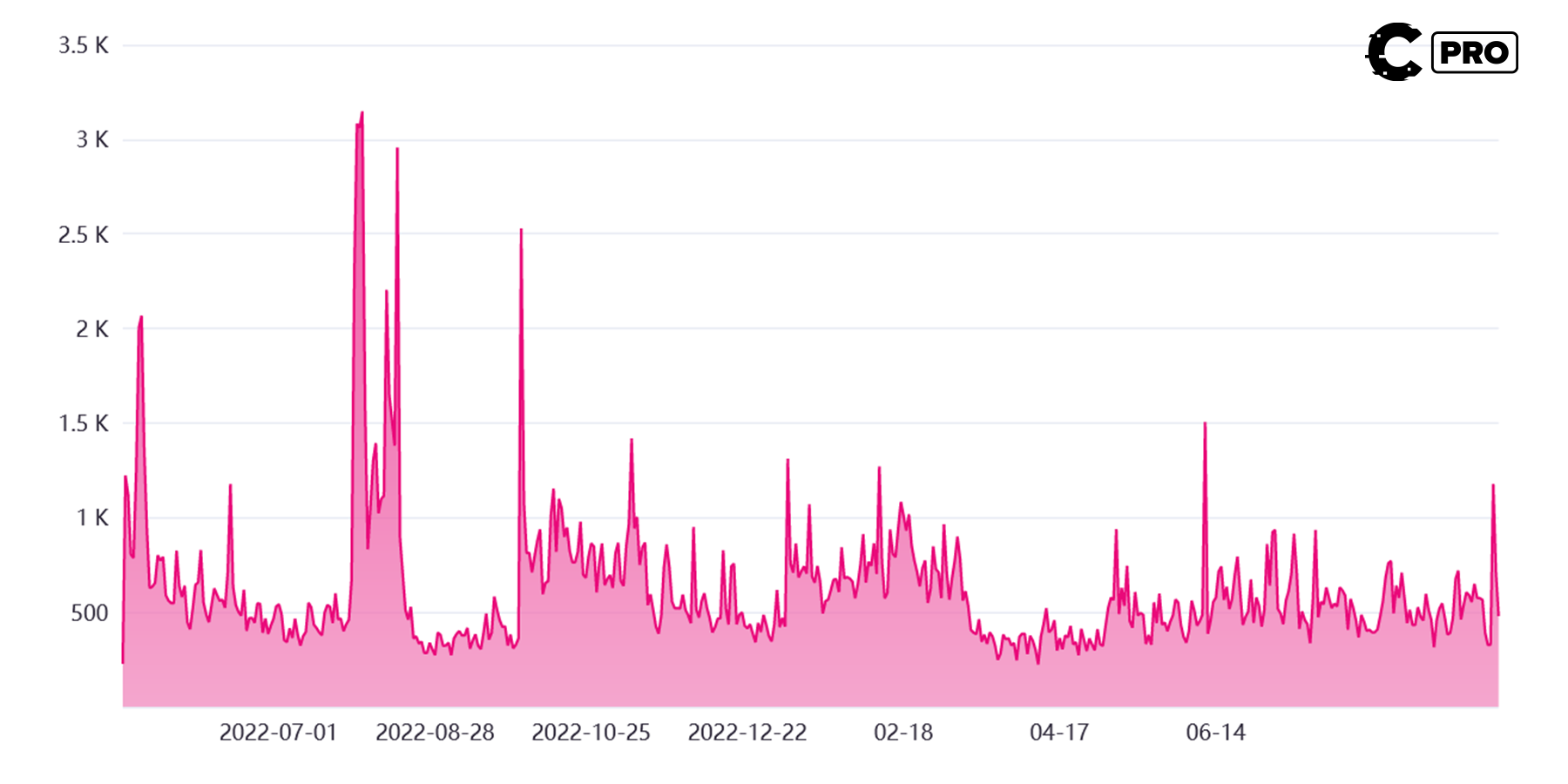

When we look at Polkadot XCM transfers, we can see that it’s struggling to produce 1000 transactions per day consistently.

For perspective, that’s just ~41 transactions per hour between parachains.

This does not scream, “I’m an active ecosystem”.

But why is this the case? What went wrong with Polkadot?

Struggling against competitors 🤒

Polkadot’s unique selling point (USP) was initially to establish an ecosystem of interconnected blockchains. This was something that was previously unheard of. Getting assets from chain A to chain B had always been a monumental nightmare.

However, Polkadot took its time launching parachains, and the first auctions took place in Nov/Dec 2021. And if you remember clearly, the timing of the auctions was just before the market took a massive hit. Simply put, the parachains launched at the eve of what turned out to be one of the worst years (2022) for crypto on record.

However, while we could blame bad luck or bad timing, whatever you choose to call it, some other protocols launched throughout that time. Interestingly, many of those new protocols did the whole “connect chains” thing much better than Polkadot. For instance, when LayerZero launched Stargate Bridge, we immediately saw how much better it was than Polkadot and Cosmos’ version of a Layer-0 protocol.

From then on, Polkadot and Cosmos have been fighting an uphill battle against the wind with a parachute on their back.

Think of it this way:

- For Polkadot to be successful, it needs users and protocols to pack up shop and move over to its infrastructure.

- Many users were/are put off by the idea of trying a new protocol, especially if there are few users on such protocol to begin with.

“Stay where you are - don’t move a muscle. We can connect all existing blockchains and ecosystems without anyone moving an inch.”

This is essentially the story of how LayerZero stole Polkadot’s lunch.

Yet, LayerZero wasn’t the only competitive challenge facing Polkadot – it gets worse.

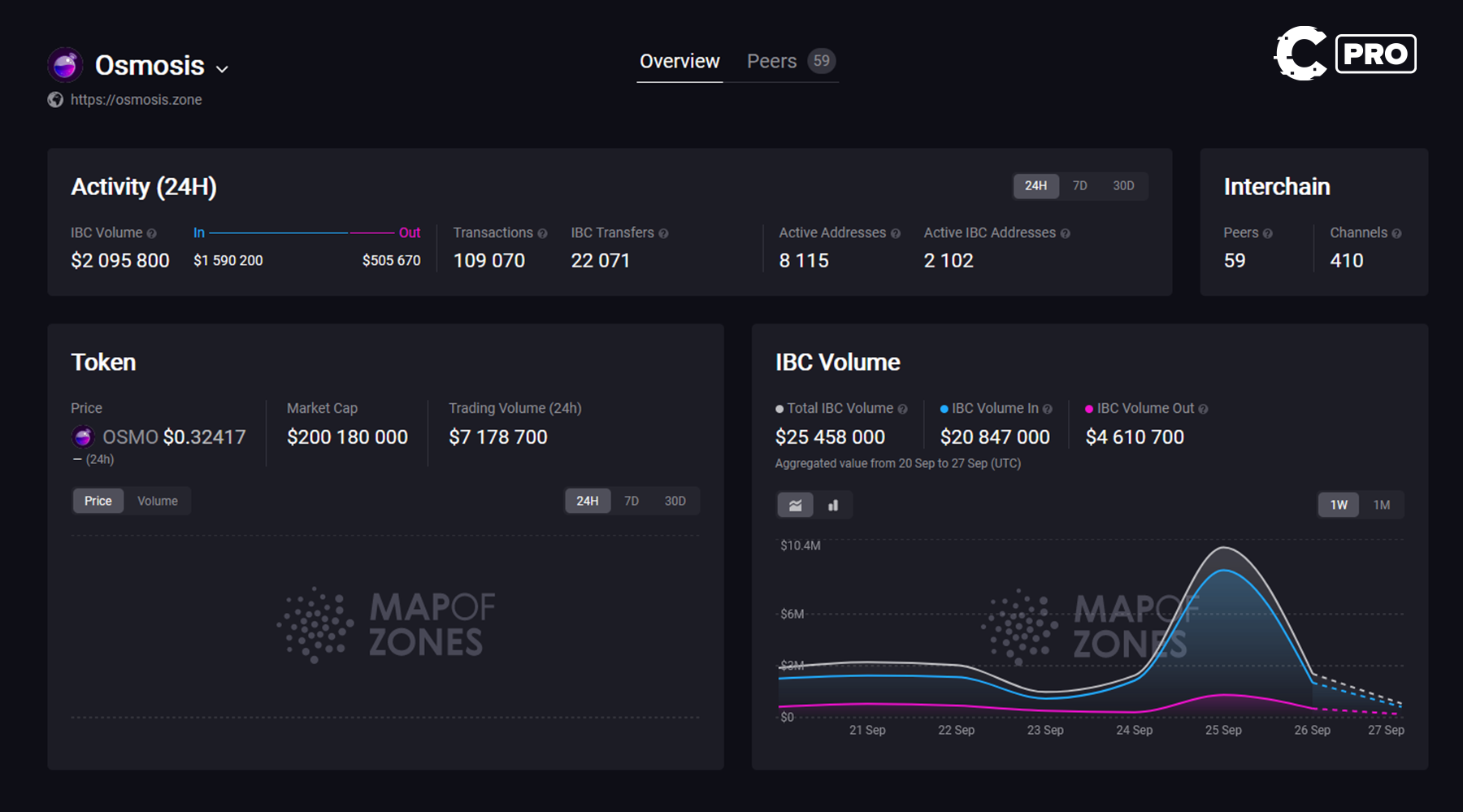

Just a single Cosmos protocol has processed 20x+ as many IBC transfers as Polkadot XCM transfers in the last 24 hours. The difference is night and day.

Interestingly, earlier in 2021, the Cosmos Interblockchain Communication protocol had connected all Cosmos-based chains. Meanwhile, Polkadot was still another 8-9 months away from the launch of their XCM.

At that time, The rising competition was enough reason to be hesitant about Polkadot. Still, we participated in the parachain auctions as the risk/reward was fairly high.

We are now three months away from the two-year waypoint since those auctions; what do we think now?

Batch 1 protocols have suffered due to high token inflation 📉

Inflation is not just killing the dollar - it is also killing the Polkadot ecosystem.Unlocks on the big five parachains - Moonbeam, Acala, Astar, Parallel, and Clover - have driven the price of these assets way down.

From an investor's perspective, the Polkadot ecosystem is dead.

Everyone who bought into the parachain auctions is down tremendously.

The vast amount of salty bag holders will make it difficult to attract new investment, at least in these projects.

However, one token here is only wounded, not beheaded…

Astar leads the way - an oasis in a barren desert 🏝️

Astar is the only parachain out of the original five that has impressed us. As stated in previous journals, the work being done in Asia has set them apart from the competition. But that’s not the only thing they’ve been cooking.Most recently, Astar announced the launch of their new zk-Rollup chain - Astar zkEVM.

Now, for those of you thinking that this means Astar is abandoning Polkadot, think again:

- Astar, by definition, is a multi-chain-capable protocol.

- Astar’s virtual machine is capable of handling smart contracts in a wide variety of languages.

With activity in Polkadot relatively low, even by bear market standards, it makes sense for a protocol as ambitious as Astar to go where the users are.

How long have we been saying Ethereum L2s are where it’s at?

A loooong time.

The new chain will leverage Polygon’s SDK and will be secured by Ethereum. The interesting point is the capitalisation on the zero-knowledge (zk) hype.

This places Astar in direct competition with the likes of zkSync.

We know that attaching “zk” anywhere in your protocol makes it much more marketable.

Coupled with the ongoing work to improve ASTR tokenomics, we remain infinitely more convicted in Astar than any of its compatriots.

One key piece of information we’ll be looking for is the relationship the ASTR token will have with the new chain. We reckon that information will be included in the new tokenomics upgrade currently in development.

So, how does the rest of the Polkadot ecosystem get back on track?

Polkadot’s gambit - inflation is set to decline across the board 🪙

Things look bleak right now. However, as those of us who have been around for the last couple of years know - anything rips in a bull market.Polkadot parachain tokens are seriously struggling with inflation.

But there’s good news - inflation from crowdloans is almost finished.

After two long years of down only, the first parachain leases will end in November/December. This means no more unlocks - at least from crowdloans. The DOT token will likely suffer here as users can reclaim their loans from the auctions.

However, for the ecosystem tokens - it’s the opposite.

The change will be subtle at first - there is still a lot of work to do to attract users. But its very rare to see a situation where a significant reduction in inflation does not benefit tokenomics.

In addition, there is clearly still demand within the Polkadot ecosystem for stablecoin support:

USDC recently launched, which will inject much more liquidity into the ecosystem. Circle’s network is fairly large, so a whole new suite of services will be available to all parachains through the XCM.

There is a growing bull case for Polkadot…

Cryptonary’s take 🧠

The Polkadot ecosystem is still alive. As dramatic as we like to be sometimes, there are ongoing reasons to remain convicted.Tokens are at an all-time low, new features are being added, and new parachains are always launching. Polkadot still fills a niche market in terms of application-specific blockchains.

With Astar launching an Ethereum L2, we want to see other parachains follow their lead with their branches. Polkadot maximalism has yet to work for the ecosystem.

In our opinion, Polkadot must expand its reach and make it easier for those outside the ecosystem to participate. As the old saying goes, if you can’t beat ‘em, join ‘em.

In terms of parachains other than Astar?

We’re happy to hold what we have - but we won’t be buying more in a hurry. There are plenty of higher reward plays in the market at this moment in time.

As always, thanks for reading. 🙏

Cryptonary out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms