What were the biggest ripples in the market this week?

The Voyager ruling could serve as a useful precedent in the Ripple lawsuit. The latest Fed announcements caused a sharp drop across the market, $XRP soared 26%. Investors put in $150M to $XRP ahead of the "Ripple vs SEC" ruling.

TLDR

- A Judge accepts Ripple's fair notice claim, a promising sign of things to come.

- Optimism following the recent court proceedings pushed the $XRP token up 39% to $0.53, its highest level since November 2022.

- 50 new $XRP whales join the ranks of holders accumulating over $150M since February.

- Ripple gained new allies against the Securities and Exchange Commission (SEC), as the regulator served Coinbase and Tron court notices.

Regulatory war

Attacks on crypto

Regulators have been going hard on crypto, more specifically the very SEC that launched a lawsuit against Ripple in December 2020. This lawsuit arguably caused XRP holders to miss out on new ATHs during the 2021 bull market. What has the SEC done since?- 22 March: The SEC threatened a lawsuit against Coinbase because of its staking program that rewards validators on their Base network. CEO Brian Armstrong stated on Twitter that the SEC was not being “fair, reasonable, or even demonstrating a seriousness of purpose” with its recent line of lawsuits.

- 23 March: The SEC charged Justin Sun, creator of Tron, for market manipulation and the sale of unregistered securities. However, the eccentric developer responded on Twitter, declaring the SEC's charges to be baseless affronts against prominent blockchain and crypto personalities.

The SEC’s civil complaint earlier today is just the latest example of actions it has taken against well known players in the blockchain and crypto space. We believe the complaint lacks merit, and in the meantime will continue building the most decentralized financial system.

— H.E. Justin Sun 孙宇晨 (@justinsuntron) March 23, 2023

What the SEC fails to realize is that it now has three powerful opponents with very deep pockets: Ripple, Coinbase and Tron. If they lose any of these battles it will have lasting consequences on the commission as precedent is set to be used by future accused companies to get out of the lawsuits with ease. What the SEC is also ignoring is that the crypto trio has joined hands in solidarity against the commission. They, along with a growing number of other prominent crypto icons, are openly criticizing the SEC for displaying a total lack of empathy or clarity in relation to digital assets.

Ripple vs SEC update

So, what's the update on the Ripple lawsuit?The SEC's core argument is that by selling $XRP tokens, Ripple Labs executives violated the Securities Act (the overarching law that regulates the sale of financial assets). The counter-argument is that the $XRP does not qualify as a security per the Howey Test (a rule that helps decide whether a type of investment is considered a security under US federal law). The SEC and the developer have litigated the issue since 2020, under the meticulous jurisdiction of the presiding Judge Analisa Torres.

There have been many motions back and forth, including the proposed declassification of William Hinman’s documents - the former SEC director’s statements in these documents reportedly absolve $ETH (and by extension other cryptocurrencies) of securities status. Now the end may finally be in sight as summary judgment draws near.

The most recent court update was Ripple Labs’ motion for the defense of fair notice. The company also cited the ruling of Judge Wiles in the Voyager bankruptcy case which was concluded March 7, this means Ripple are using elements from a failed case by the SEC as precedent to win theirs. If the ruling is in favour of Ripple, it can open up much needed clarity on the regulatory position of many cryptocurrencies.

The latest court updates certainly enthused investors enough to accumulate 420M $XRP ahead of a potential positive judgment.

Whale's accumulating

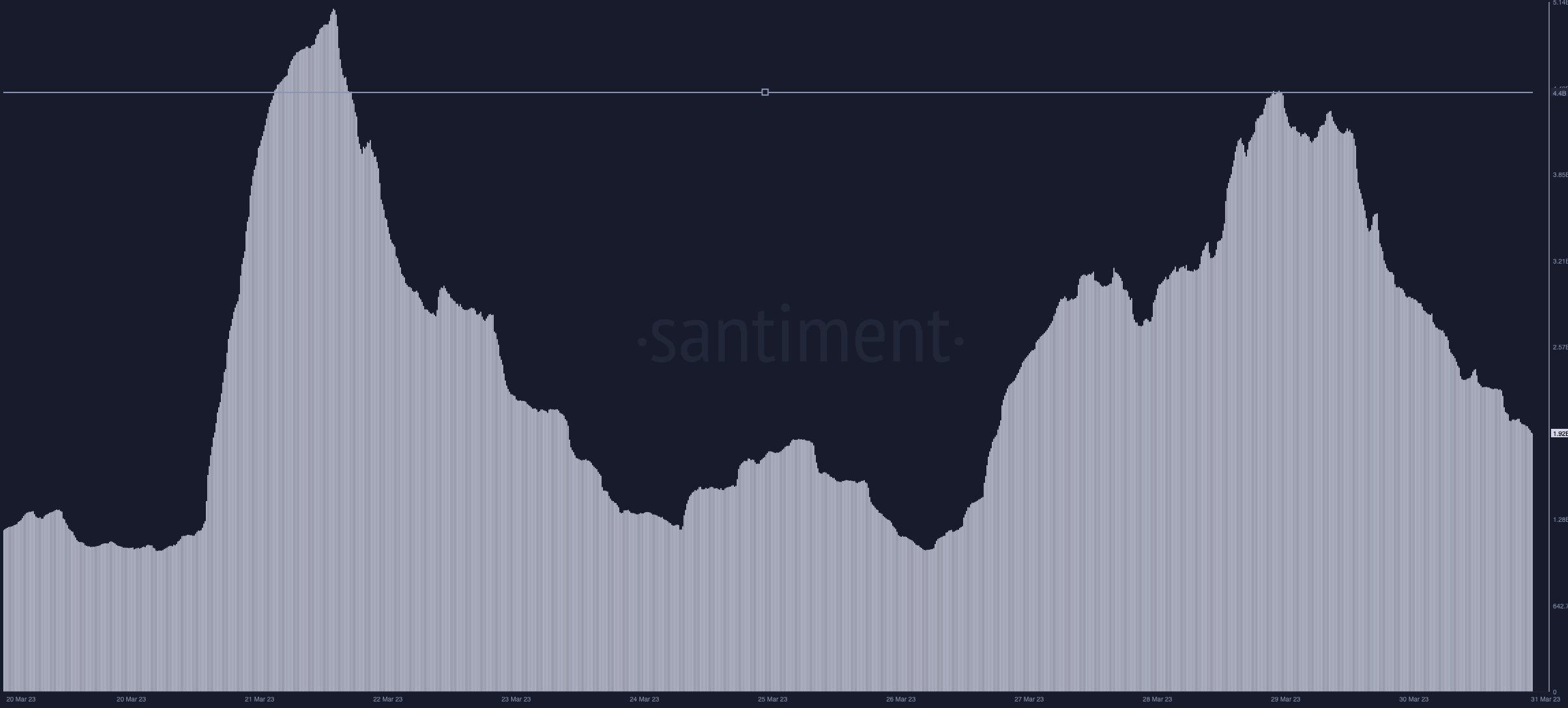

Despite regulatory uncertainty $XRP has managed to outperform 90% of the cryptocurrency market this month. $XRP’s 24-hour volume rose from $1.2B in February to $4.5B on the 21st of March; that's over a 70% increase in one month.

More interestingly the uptick in activity indicates traders renewed interest in the digital asset and has gradually pushed price up from $0.32 to $0.53.

50 new $XRP whales are also partly responsible for the recent surge in liquidity. These volumes indicate that institutional actors are anticipating a positive judgment to end the Ripple case and this may be followed by a potential bull run as retail investors eventually flood the market.

Investors accumulated up to 420M tokens between February 13 and March 22. At the current price, their collective investments equate to $222M (0.9% of total market cap - $22B). This movement is also accentuated by the increased $XRP trading volumes on South Korean exchanges within the past 24 hours, Specifically $XRP trading made up over 35% of all the volume on the top 3 exchanges in the region; UpBit, Bithumb and Korbit - indicating retail action.

Price analysis

The crypto market entered a period of sideways movement since the Federal Reserve's most recent rate hike on March 22nd.$BTC and $ETH have held their ground at ~$28,000 and $1,800 respectively. XRP on the other hand, managed to rally by +26% taking price over $0.56 for the first time in almost a year. At the moment, XRP is at a historic resistance level. If it is able to overcome it and sustain an entire week over $0.62 then $1.00 may finally come back! Don't get too excited though, as confirmations are necessary.

Truth be told, OG $XRP holders may not experience the same level of excitement at the token’s current trajectory (it’s roughly 89% below its 2018 all-time high of $3.80), but newer holders are ecstatic and now focused on positioning their investments ahead of the court’s ruling.

We expect to see further upside if a positive court ruling comes through of course.

Cryptonary’s take

Ripple is, as they say, “armed to the teeth” and very well prepared for the last stretch of its legal tussles with the SEC. The compound effects of the Voyager ruling, the high optimism of top Ripple executives, investors, and the greater crypto community generated enough momentum to push $XRP up to $0.56+ in the last week; a level it has sustained since.In the short term, we may see more upward sprints to convert the $0.57 resistance to support, as retail investors take advantage of the upward volatility ahead of a potential positive judgment. And, on the larger time frame, we can expect choppy movements from the capital inflow of more institutional investors and long-term holders.

All things considered, $XRP is primed for very exciting months ahead. If things continue on the same positive trajectory, $XRP will be briefly rejected at its current $0.54 support region, and then climb ahead for a push to $0.63 - $0.70. While an upward trend may be delayed if the case keeps lingering, once $XRP rises past $0.62 the token becomes conveniently primed to reach the $1 mark within weeks.

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms