The documents have turned the fight around, placing the SEC in the hot seat, and now, Ripple is the party asking all the questions.

Ripple’s change of fortune in the lawsuit aside, we’ve also uncovered the strategy behind its unstoppable global expansion.

From boardrooms to back alleys, Ripple is making waves like never before – and we have all the deets.

Let’s dive into how the outcome of Ripple vs SEC will ripple across the cryptoverse.

TLDR 📃

- The Himan documents expose a significant weakness in the SEC's argument against Ripple and other projects.

- Ripple is jumping in bed with governments in other parts of the world to run some experiments.

- Ripple's investment in Bitstamp diversifies its presence beyond payments.

- XRP is trading in a bullish market structure, but it still needs to break out to unlock any significant upside.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

Himan files reveal the SEC's weak points 🔎

You’ve probably heard of the newly-released Hinman files and seen one or two posts about them.While not everyone is convinced that the file proves Ripple's claims, they shed light on the SEC's confusion about regulating other cryptocurrencies.

And before you join sceptics to dismiss them as a "nothing burger", here’s how the content of the files supports Ripple’s position.

- The SEC admits that there's a regulatory gap in the crypto industry due to inadequate laws.

- The SEC confesses that Hinman's speech caused confusion and didn't align with the Howey Test.

- Internal SEC discussions show uncertainty and debates on the guidance from Hinman's speech.

The documents undeniably prove that the SEC never had a clear stance on regulating cryptocurrencies. In essence, the SEC left crypto companies without fair notice or sufficient guidance.

If Ripple wins with this argument, it could pave the way for other crypto projects and companies from 2013-2018 to use the fair notice defence.

That would be a game-changer, offering legal protection to many projects in the crypto world.

But hey, let's not get ahead of ourselves. We'll have to wait and see if the judge agrees with Ripple's argument. Fingers crossed!

Ripple's smart moves in uncertain times ♞

The SEC and Ripple agree that the Hinman speech won't significantly impact government policy in determining what makes a token security. So, there’s always the possibility that Ripple losses in court.Guess what? Ripple is not letting the uncertain outcome of its business in the United States hold it back. Nope, it is going full speed ahead and expanding its presence worldwide!

How is Ripple doing it, you ask? Well, it is teaming up with crypto-friendly governments and launching pilot programs for its new CBDC service.

Guess who just joined the club? Colombia's central bank! The country will experiment with Ripple to see if the tech can be used for their digital payment system. Exciting stuff!

But wait, there's more! Ripple's XRP Ledger CBDC platform is also being tested in places like Hong Kong, Bhutan, Palau, and Montenegro.

It is evident that Ripple is spreading its wings beyond the US and grabbing some fantastic opportunities in case things don't go their way with the SEC. Smart move, Ripple!

Oh, and let's remember Ripple's investment in Bitstamp, a crypto exchange based in Luxembourg. Ripple is strategically growing its international presence and diversifying beyond just payments. Talk about thinking ahead!

But here is the thing: While all these moves are great for Ripple's business, they don't directly affect the value of XRP, and the lawsuit remains the biggest driver of XRP price action.

Price analysis 📊

So, how does the lawsuit affect the price action? Well, we've got the information for you.

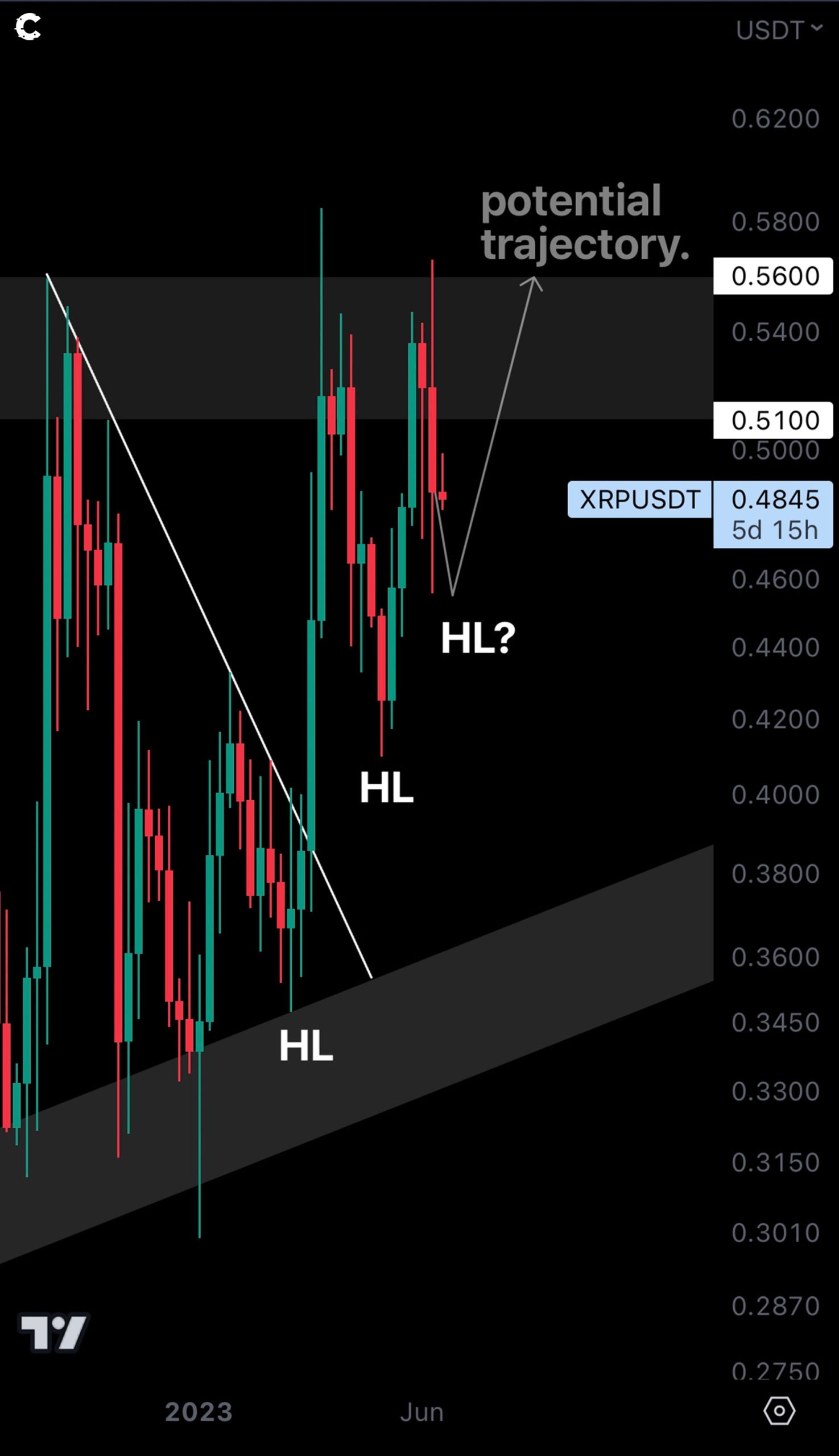

Despite having resistance just above its current price, XRP is trading in a bullish market structure on the weekly timeframe. It is on its way to marking another higher low (HL) as we speak.

However, this can only be bullish for a limited time. What will really confirm a significant upside is a break of resistance at $0.56, the top part of the nearest resistance region. This will put XRP on a clear path to $1.

Unfortunately, the market doesn't agree with that direction, and we aren't going to see XRP reaching $1 anytime soon. Still, more upside is likely if it breaks $0.56 as resistance.

Cryptonary’s take 🧠

The Hinman documents won't magically solve all of Ripple’s legal problems, but they pack a punch on Ripple’s side of the battle.If Ripple wins based on this fair notice argument, it could also have a ripple effect (pun intended) on other cryptocurrencies. Imagine a whole wave of projects using the same defence! That could shake up the entire industry and rewrite the rules.

Ripple's impressive diversification efforts in partnering with crypto-friendly governments and investing in other companies is a masterclass in strategic thinking. Still, it's crucial to understand that these actions won't solely determine XRP's future.

The real game-changer will be the judge's verdict in the Ripple vs SEC case.

We believe that trading XRP will become interesting again once it starts breaking through the $0.56 resistance level, putting it on a trajectory towards $1.

Until that happens, it might be better to sit on your hands and wait it out. We will keep you in the loop as the Ripple saga unfolds.

Until then, stay crypto-fabulous.

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms