So, what’s going on this week?

Bitcoin finally flashing bullish signals, exchange reserves are getting depleted from new HODLers - all while volatility sits at all time lows calling for a violent move soon.

TLDR

- Despite the rally, Bitcoin's Volatility remains at All-Time Lows. This is historically followed by a violent move.

- BTC's Market Structure has finally shifted from bearish to bullish, indicating further upside.

- Whales have been HODLing their BTC stacks, with exchange balances continue to drop (bullish).

- We maintain our eyes our on $30,000 as the next target.

- Share this report with your family and friends.

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your responsibility and yours only.

Should you believe the hype or not?

Everyone in crypto-land is enjoying this latest, if not greatest, bullish rally in Bitcoin (BTC). While many believe so – we at Cryptonary don’t believe it’s going to run out of steam.That’s being at least a bit affected by the news, legitimate and otherwise, that has swirled around the star cryptocurrency.

In a case of “another week, another adoption story,” New York State’s legislature has introduced a new bill that, if passed, will allow state agencies to accept cryptocurrencies such as BTC, Ethereum (ETH), Bitcoin Cash (BCH), and Litecoin (LTC) as payment for fines, penalties, taxes, fees, and a host of other financial obligations owed to the ever revenue-thirsty big state.

Fake news is a sign of our times, and few corners of the economy are more rife with fakery than crypto. A wild item circulated that BTC was trading at a 60% premium in Nigeria due to demand that had gotten so strong.

We have to slow that roll – it turns out that folks were basing this tidbit on the official US dollar/naira exchange rate (around 1 USD/460 NGN) rather than the far more typical and accessible black market rate (1 USD/754 NGN). That’s a big difference; when properly adjusted, the Nigerian BTC price was basically the same as it was everywhere else on the planet, i.e. at about $23,200 per coin.

Yet Nigeria, much like other developing countries with weak financial systems, has caught Bitcoin fever. Especially lately, as ATM withdrawal limits have been pushed down to less than $50 per day.

The big story of this week will be the US Federal Reserve’s Open Market Committee meeting, one of those regular confabs where the Fed basically decides on interest rates. As many pundits do, we’re expecting another, perhaps (and hopefully) final rate hike to deal a fatal blow to inflation. As this is a general market expectation, we shouldn’t anticipate that a hike more or less in line with forecasts will quash the BTC rally (read more here).

Yes, we think BTC will generally continue to climb in the coming days. Let’s take a look at the charts.

Bitcoin Price

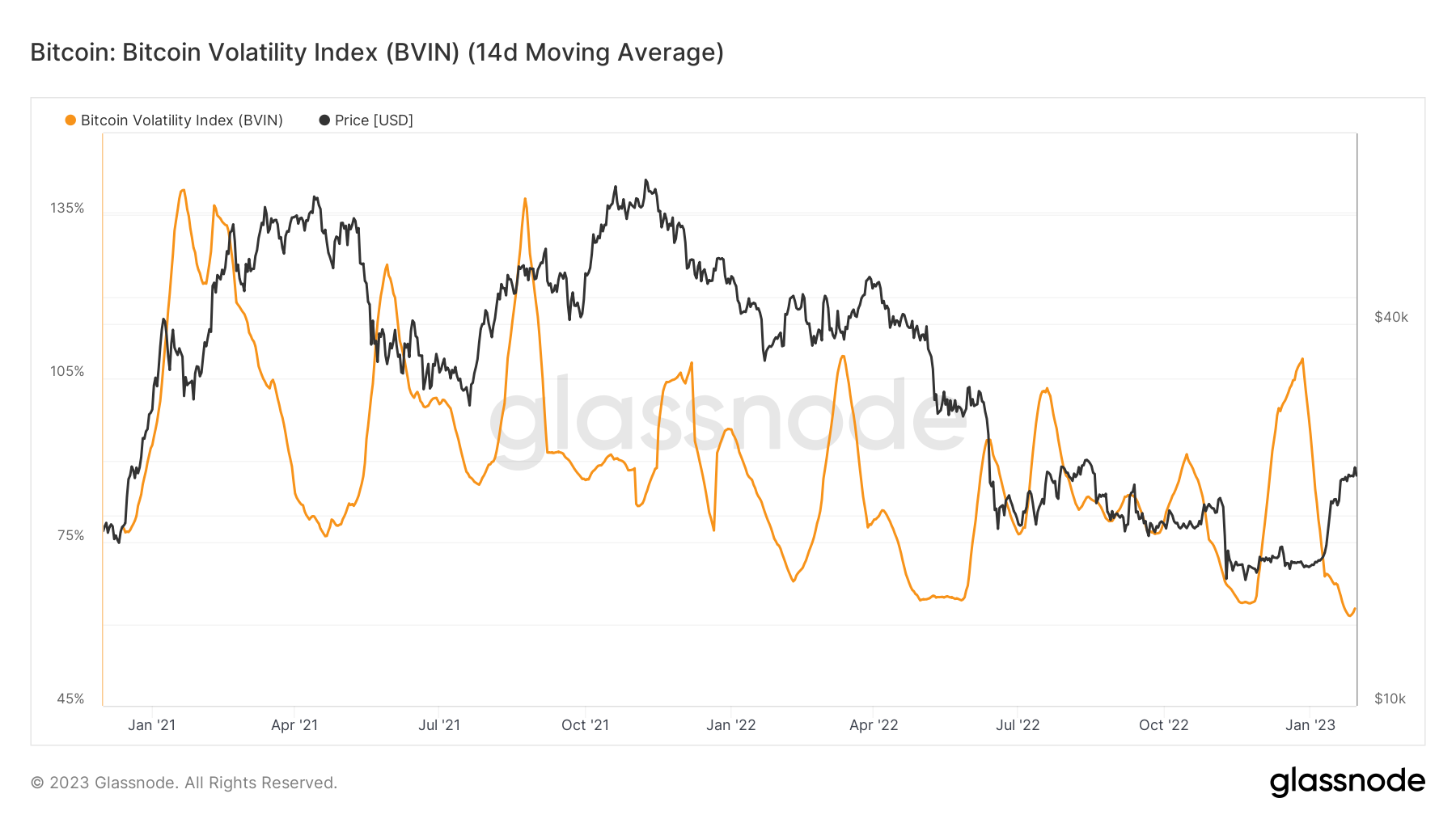

Bitcoin Volatility

Gazing at the first graph we can tell a lot from BTC’s “market structure,” which refers to its price dynamics. Is the market generally setting lower lows and lower highs, indicating bearishness? Or is it the happy opposite – higher lows and higher highs signalling a bullish turn? BTC recently set a new higher high, which tells us that there’s a move from bearish to bullish, portending more upside for the asset. So we have that going for us, BTC holders.

Interestingly, and maybe somewhat counter-intuitively, BTC’s volatility (graph 2) is teasing all-time lows despite the price pop of the past few days. In crypto, volatility is cyclical. Unless one believes that price is going to die near $0 forever (not us) then volatility will pick back up from the lows.

Volatility does not determine direction but it does indicate that large movements are on the horizon. Given the rest of the market indicators, we’re comfortable saying that it’s most likely that any sharp move/jump in volatility will push BTC to the upside.

Now, let’s turn our attention away from price and volatility, and towards some other important metrics.

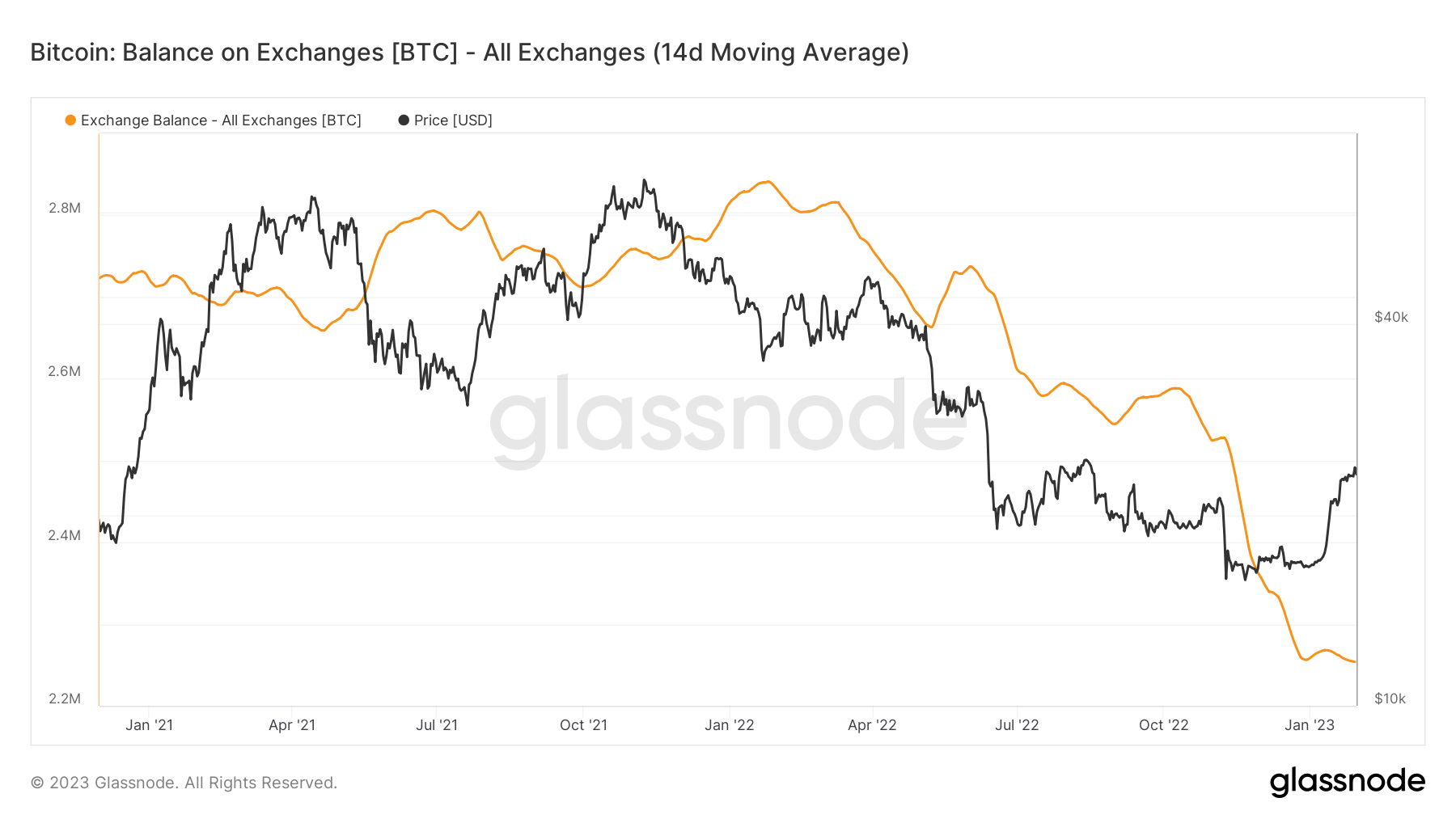

On-Chain Data: Balance on Exchange

This metric shows us how much BTC is on exchanges such as Binance, Coinbase, and the rest. We view this as “supply available,” and we want this figure to be as low as possible. When it rises, this means investors are depositing coins to most likely sell (because there are very few other reasons to deposit BTC) and when it goes down it means they have bought BTC and are now withdrawing their coins into cold storage for holding.

For more than a week, this metric has been in down-only mode, a bullish sign that BTC can at the very least hold its value. While the balance on exchange rate hasn’t drastically decreased in the past few days, it still ticked down slightly to reach new lows.

Meanwhile, the positioning of the whales (the entities holding more than 10,000 BTC, in other words) remains unchanged from last week. This is another bullish sign; these folks continue to cling to their recently-acquired BTC; they clearly think and hope it’ll go up in value.

Mining Difficulty

Mining difficulty is another yardstick worth keeping an eye on. As the name implies, it essentially maps how difficult it is to mine one block; it adjusts every 2,016 blocks (i.e. about two weeks’ time). The more miners endeavouring to dig out BTC, the more competitive mining becomes, and the difficulty rises.

The clear development over the trailing few months and weeks is that miners keep jumping aboard. This is happening despite the fact that block rewards are continuing to go down (albeit slowly, at a pace of once every four years). Like the indicators above, this is a positive development for BTC’s fundamentals, not least because it makes the network harder to attack and thus, more secure… and attractive as an asset.

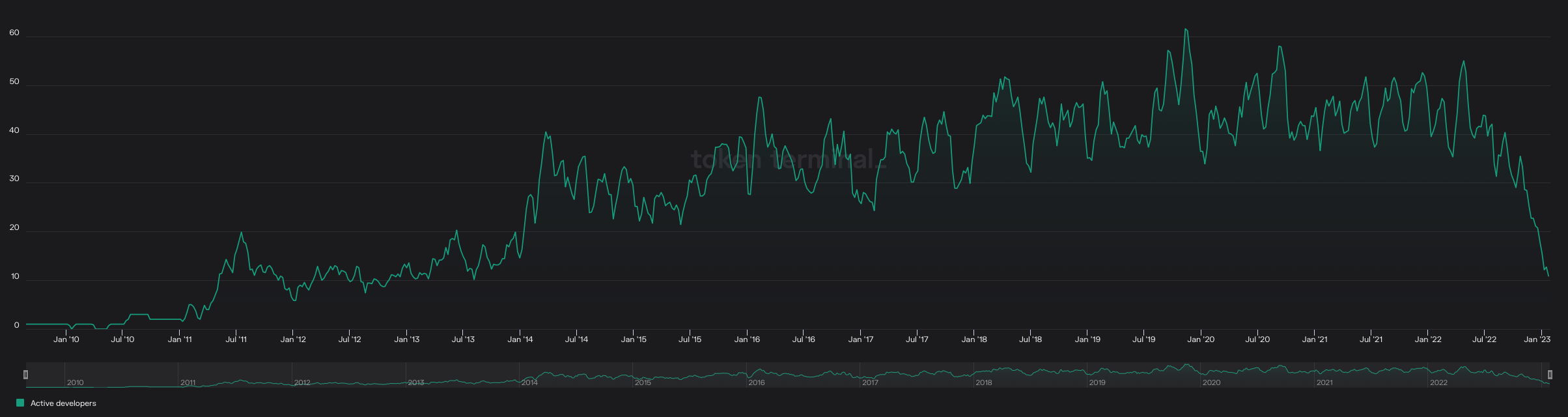

Bitcoin Devs

Weekly Average Active Developers Since Launch[caption id="attachment_261264" align="aligncenter" width="2408"] Source: TokenTerminal[/caption]

Source: TokenTerminal[/caption]

This one is largely self-explanatory (“devs” are developers). You can’t help but notice that this metric, in contrast to some others, is going down. The typical gut reaction when we see such a line is to hit the sell button. That may be true for a lot of assets, but that certainly is not the case with Bitcoin.

Yes, the average number of devs has fallen from a peak of 53 to 11 (-79%) in less than 10 months but – really! - that’s not a bad dynamic. Bitcoin is a store of value in today’s society, it’s gold 2.0. Thus it is not an asset or system that requires constant upkeep and upgrades. You don’t see scientists actively working on changing the chemical composition of gold, right?

You may see that negative feeling much discussed by crypto investors – fear, uncertainty, and doubt (FUD) - around this number once it gets disseminated by the masses, but don’t FUD change your mind – now or ever. We should buy and hold based on what the data and the trends are telling us, not on emotion.

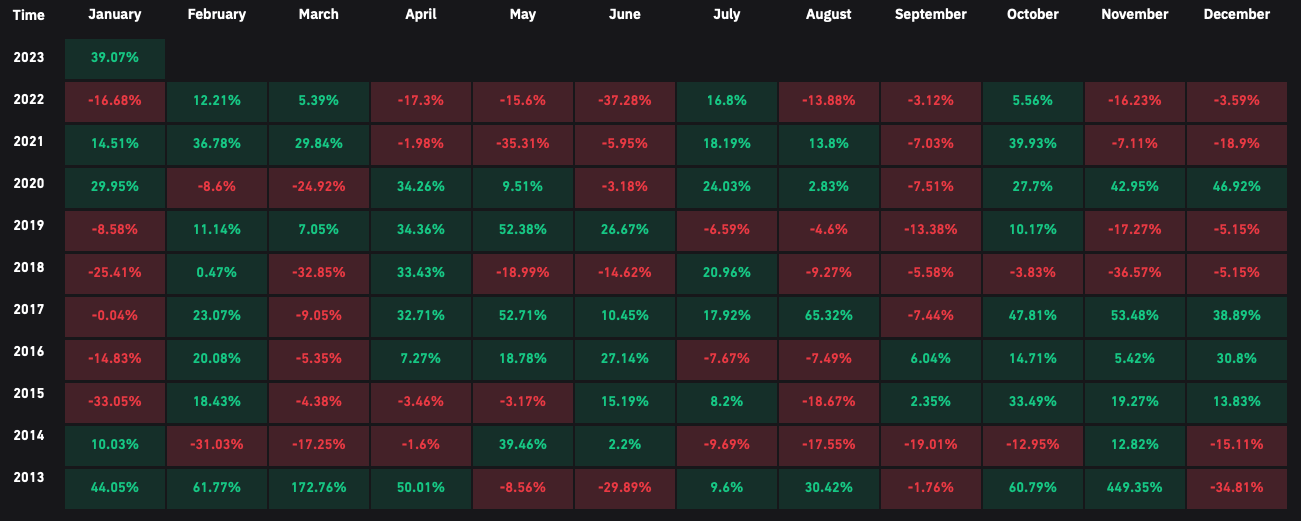

Bitcoin Monthly Returns

Finally, we have a more trivial set of statistics that is nevertheless worth a glance. This graph represents the monthly returns of BTC since 2013.

Historically, the most lucrative month for BTC has been… that’s right, February! The shortest month on the calendar has had only two down years out of 10 (80% up) with an average rise of +23% on green years. No one should transact anything based purely on what day/month/year/lunar phase it happens to be, but it’s worth keeping in the back of our minds that an 80% success rate for February is unusually high.

Cryptonary’s Take | Conclusion

So what have we got? Whales are holding onto their recent buys, more miners are continuing to enter the scene, adoption and acceptance is growing, volatility is hinting towards a big move, and the price dynamic is indicating a shift from a bearish to bullish market structure. With all that in our pocket, we’re happy to say that we remain confident in our thesis that BTC will soon hit $30,000. And that is only a first step up the price ladder.Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms