From setbacks to success: Is our 50x underdog back on track?

Last year, we laid out an exciting 50x thesis on a project in the cross-chain sector of the Web3 industry.

This project teased the idea of a cross-chain native ecosystem full of hope and wonder – and if it delivered on the promise, one of us would be close to owning a yellow Lambo.

However, it’s mostly been a story of delay after delay, with no end in sight for the best part of two years.

Until now, that is!

Finally, the project has taken a massive step towards that end goal with the launch of testnet.

It's a long time coming - but what does it mean for the 50x thesis? Is a Yellow Lambo still on the books?

Let’s dive into these recent developments and understand what it all means for this ecosystem and it’s token.

TLDR 📃

- Synapse faced a major setback when a partner unexpectedly sold a massive token allocation.

- Despite the debacle, Synapse launched a long-awaited testnet of new chain infrastructure.

- Key details are still unclear about token economics in the new system.

- Synapse shows resilience, but the outlook for SYN remains uncertain until specifics emerge.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

State of Synapse 🔋

Synapse has had a tough year.

Its TVL has flatlined for most of 2023; it gets worse, the project got hit with a liquidity crisis a few weeks ago.

But let’s dial back a bit. On the 19th of March 2023, Synapse’s governance DAO passed SIP-21, a Synapse Improvement Proposal spearheaded by a VC called Nima Capital. In this proposal, Nima would provide $40 million in bridge liquidity for 12 months in exchange for a token grant from the DAO.

Fast forward to the 6th of September 2023, inexplicably, Nima Capital removed all its stablecoin liquidity from the bridge. And then, MARKET SOLD the ENTIRE allocation of 9 million SYN tokens that the DAO assigned to it.

It’s been three weeks since, and we still don’t have many details regarding what happened with the funds. But several questions need to be answered:

-

How was Nima Capital allowed to sell those tokens? The tokens should have been locked up for the duration of the contract.

-

Was there a legal contract in place? If you aren’t forcing them to adhere to the proposal via smart contract, then there should have at least been a legal document in place.

-

Where does this leave the bridge in terms of liquidity? $40 million is not a small amount - there’s only $108 million in TVL left in Synapse, and you can see the exact moment they withdrew liquidity on the above chart (after Sept).

Radio silence from the team

Again, there has been nothing from the team to quell investors' anxiety about the situation, and we are totally in the dark here. One clear thing is that - something has gone horribly wrong either from a competency or a development perspective.

It’s literally wild that this liquidity disruption happened because a couple of lines of code could have prevented it.

But no worries, you’ll be the first to hear about it when we find out more details.

Oddly, the timing of this liquidity crisis has coincided with one of the most bullish developments for Synapse…

Synapse Chain in testnet - what do we know? 📖

Synapse has announced its long-anticipated Synapse Chain. We did tell you it was coming!

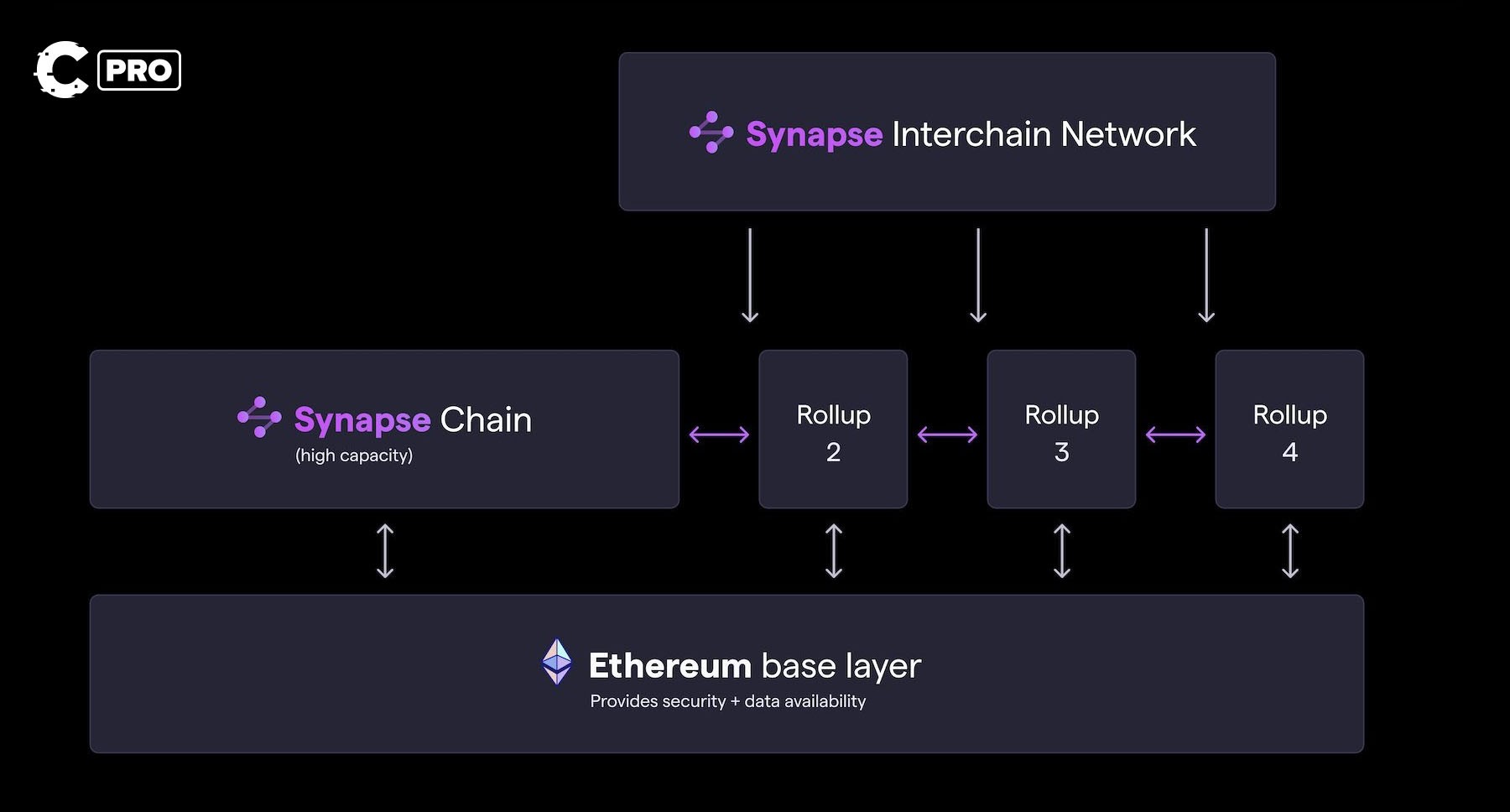

Synapse will become an Ethereum L2 Optimistic rollup-based network. The architecture is as follows:

Two key components will make up the new Synapse:

-

Synapse Interchain Network (SIN): A Proof-of-Stake multi-chain network similar to LayerZero’s highly utilised communications network. The SIN aggregates all incoming data across all chains so it can be validated on the Synapse Chain and finally “rolled up” and secured on Ethereum.

-

Synapse Chain: the actual Ethereum L2 Optimistic rollup chain, where all the staking, validation of transactions, fraud proofs, and cross-chain native dApps will live.

In our original thesis, we envisioned Synapse as becoming a cross-chain native ecosystem providing developers with instant access to all chains connected to Synapse. This milestone is a huge step towards realising that thesis and realising all the gains that we expect to come with it.

However, don’t throw your life savings at SYN just yet. We have yet to get a complete specification for the chain, the relationship between SYN and the chain, and how long the testnet phase will take.

These questions will presumably be answered over the coming weeks.

Yet, the information we have today is enough to say that Synapse’s infrastructure is significantly safer than other cross-chain solutions, like bridges.

We have always stated that bridging and wrapping tokens is mostly unsafe. The majority of the largest DeFi exploits have come from bridge protocols.

Synapse’s evolution towards a cross-chain communications network, rather than a bridge can only be a positive development.

In terms of economics, here’s what we do know…

Synapse’s new economy 🏛️

The SIN will have its own transaction fees, and there’ll also be transaction fees from activities on the Synapse Chain:

-

“Agents” (basically SIN validators) will stake to confirm SIN transactions.

-

There is a fee paid for each tx sent, split amongst Agents.

-

Stake is slashed for dishonesty (remember, Optimistic validation assumes all validations are honest until proven otherwise).

You might be forced to ask at this point - “wtf is the function of Synapse Chain then?”

And that’s a very valid question.

The Synapse Chain will become the hub for the interchain network. Where SIN will have smaller hubs on each supported L1 chain, Synapse Chain will aggregate all data incoming from those chains and essentially become the central database for all that info.

Ethereum becomes the ultimate security layer for the entire Synapse network through Synapse Chain.

Synapse Chain consists of several parts:

-

L2 Bridge: Synapse’s current offering will continue operating normally and be integrated within the new framework.

-

Interchain Data Layer: SIN agents also stake on Synapse Chain, maintaining the state of the whole network across all chains in sync.

-

Syn OP Stack: derived from Optimism’s tech stack but with modifications to integrate SIN infrastructure.

So far, SYN is absent

Currently, transaction fees for the testnet phase of the new infrastructure are paid in ETH. This is obviously not ideal from a SYN holder's perspective; at the very least, you want some indication that transaction fees will be paid in SYN on the mainnet. However, the team has remained somewhat vague regarding SYN’s place within the new Synapse.

Yet, for the 50x SYN thesis to continue to be valid, it is absolutely essential that the token is used within the ecosystem. There must be some mechanism for SYN staking and, subsequently, SYN’s use as a transaction token.

We know this, investors know this, and the market knows this.

Nowhere is the lack of clarity around SYN’s role in the new infrastructure more apparent than SYN’s price action…

Price analysis 📈

SYN, 1W

While comparing SYN to other tokens in the current market gives us scary results, all hope isn't lost for the token yet.

Five weeks ago, Synapse fell under its all-time low and entered downside price discovery. There was too much selling pressure to endure even though we were sitting in a major support region, which saw demand twice in the past.

So, what's next for SYN?

The general market experienced a surge recently. This led to SYN potentially bottoming out on the weekly timeframe. Put simply, its short-term trajectory has changed.

We're now looking at a retest of the previous all-time low ($0.4250), which we expect to be tested in the coming week. Given that this level was critical in the past, we should expect a rejection at first touch.

For SYN to escape downside price discovery, we'd have to see a change in market structures on the weekly timeframe or for $0.4250 to be flipped into support. Unfortunately, this will take several weeks, maybe even months, to happen, which makes SYN as a trade unreliable.

As an investment? Well, its price is at a discount, and if your conviction in the project is as high as ours, then you'd be missing out on all future gains if you ignore the token.

But again, SYN must be involved in the new architecture for significant upside.

NOTE: Bitcoin's price action will heavily influence the trajectory of SYN. Brush up on our expectations for it here.

Cryptonary’s take 🧠

The sale of Nima’s SYN tokens remains a mystery. Clearly, something illegal has happened as the proposal was in writing and should technically be legally binding. Nima has broken a contract. However, we do know that legal battles can take more than a year to be decisively resolved.

If criminality is involved, some of the value lost may be recovered.

But for all intents and purposes, we consider the tokens written off.

But the launch of Synapse Chain and the SIN testnet is a huge step in the right direction.

What we need now is a definitive stance from the team surrounding SYN’s role within the new Synapse ecosystem.

If SYN is not the token for securing the network and paying transaction fees, we will most certainly have to revise our relationship with SYN as an investment.

But until we get clarity on SYN’s utility, the jury’s still out if this underdog can rebound.

Once we know more, we will update this report with the confirmed economics!

Stay tuned…

As always, thank you for reading. 🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms