As far as critics are concerned, Solana is mortally wounded – first from the FTX bloodbath and then the recurrent downtimes. Apparently, Solana is living on borrowed time.

However, paraphrasing Mark Twain, “Rumours of Solana’s death are greatly exaggerated”.

Rather than die, Solana might have just set a new record that speaks to its potential to outperform competitors and put some serious gains in your wallets.

TLDR 📃

- Solana has “only” been down for ~19 hours throughout 2023, compared to a whipping 108 hours in 2022.

- Phantom has launched a new product that allows users to sell NFTs within the wallet.

- Solana TVL is approaching the $1 billion mark, just 40% away from the pre-FTX figures.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

Solana's uptime exceeds 99.6% for the year 🆙

Outages have been a major pain point for Solana in the past. Throughout 2022, Solana mainnet spent 108.23 hours (yes, we added it up) completely or partially out of action. That’s 4 ½ days (most of a working week) where users' funds were locked, and DeFi protocols could not function - you get the point.Mission-critical infrastructure that power applications in healthcare, defence, and financial services can’t afford downtimes.

For a blockchain to maintain confidence and for users and protocols to deposit capital and keep it there, it is simply unacceptable to have it down over any period. Let alone an entire week.

Thankfully, data says Solana’s getting better.

Throughout 2023, Solana mainnet has only been down for 18.8 hours. And all of that happened on one day in February.

Solana has maintained a 99.65% uptime over the last 7 ½ months, with no major incidents (or any incidents) for 6 of those months. This reliability is a huge confidence-booster for users and protocols built on Solana.

User experience is a huge part of what made Solana attractive in the first place. It nailed transaction times and costs, unfortunately to the detriment of reliability.

Now, the trifecta is complete.

We’re not saying that Solana will never break down again.

But there’s a decent chance it will make it through the rest of the year without any incidents.

Phantom enhances the Solana user experience further 👻

At the centre of any blockchain user experience lies the wallet. Solana’s original main wallet was a nightmare - does anyone remember sollet?We do, and we’d like to forget it.

Then, along came Phantom, with its user-friendly and comprehensive interface.

Since its launch, Phantom has undergone many new updates and added many new features.

With Phantom, you can execute even the most complex of transactions with a few clicks, thanks to an abstraction layer that simplifies and automates the process. For most people, Phantom might sound like a nothing burger, but for those who regularly use Solana, it’s a massive time saver and a huge quality-of-life update.

But wait, there’s more.

For NFT lovers, Phantom recently introduced a 2-click NFT sales feature within the wallet.

This new feature is essentially an NFT marketplace aggregator. So now, within your wallet, you have all of Solana’s top marketplaces in one place and on demand.

So, has Solana been attracting capital with all these new and shiny features?

Solana DeFi TVL approaches $1B milestone 🤑

For the first time since the FTX collapse, Solana TVL is a hair away from $1 billion. This is a huge milestone on the road to recovery. Before the FTX collapse wreaked havoc on the Solana ecosystem, its TVL was about $1.4 billion.And now, it is nearly back there.

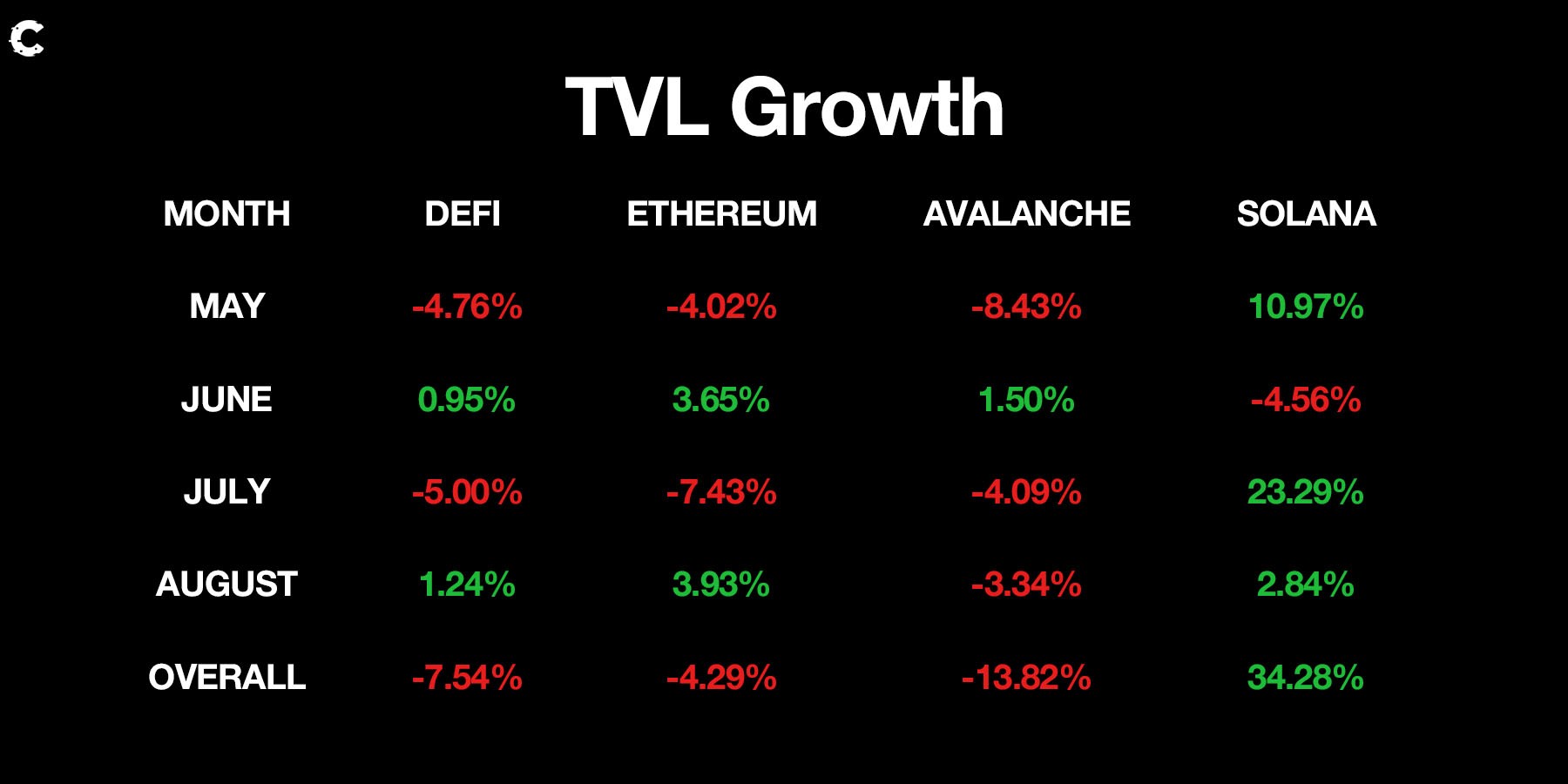

Solana’s TVL continues to outperform the market. In fact, in the last 3 ½ months, Solana has only registered one negative print.

The TVL move came from increased staking participation through Liquid Staking protocols.

A relative newcomer to the Solana liquid staking scene, Jito Labs, which offers MEV-boosted liquid staking, has seen a 190%+ TVL increase since the end of June.

The top liquid staking protocols remain Marinade Finance and Lido Finance.

With Solana DeFi taking off on a moon mission, where does that leave SOL?

Price analysis 📈

SOL, 1W

When there's clarity, technical analysis works like a charm.

After testing $15 in June, SOL had a great run to the upside, reaching $30 and topping around that level.

Since then, we saw a slight decline back to support at $22, but you might wonder what's next.

We view the $22 - $19 region as the ideal accumulation area for SOL. Not just because it respects the market structure and trend but also because it's in confluence with the current market conditions. We expect an upside across the board, so SOL breaking out is inevitable.

Based on last week's green candle, we might see a direct surge to $30 again, so make sure you are not out of the game.

Still, you should keep some capital aside to buy the dip if SOL drops inside the $22 - $19 region.

After all, that is where the ideal entry sits. Accumulating at that point reduces the risk and increases the reward.

Our only invalidation would be a loss of $19, but the chances of that happening are quite slim now.

Cryptonary’s take 🧠

Stability is key to the success of any blockchain, and Solana is no different. Uptime contributes massively to user experience - no one wants to risk their funds being locked because a chain isn’t working properly.The recent uptime figures represent a huge step forward for Solana. Coupled with the new front-facing features of Solana that complement the back-end performance improvements, the Solana picture is becoming much brighter.

The bounceback we see in TVL after SBF’s huge shitshow is impressive - it’s happening much sooner than we expected.

As an investment, SOL looks pretty tempting.

On Friday, we bring you another edition of Cryptonary’s smart money. Is the smart money taking up a position in Solana? Are there better plays out there? Don’t miss the opportunity to know what is happening in the portfolios of the biggest winners in crypto.

As always, thanks for reading! 🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms