These terms could've been used to describe Solana's status over the past eight months.

But all of that is changing. Signs of life are emerging. Much like a patient miraculously waking from a long coma.

We find ourselves asking: Is Solana back from the dead, or should we sell while the going is good?

Are we witnessing a true recovery, or is this a reprieve?

Let's scrub in and find out.

TLDR 📃

- Solana shows signs of a comeback, with a 16.5% increase in Total Value Locked (TVL) over the past month.

- The rapid growth in Solana's Liquid Staking DeFi (LSD) sector has been a crucial driver of this resurgence, with significant participation in Marinade Finance.

- Solana's AI integration promises exciting prospects, with projects like Hivemapper and MarginFi pushing the boundaries.

- If market conditions remain favourable, Solana's liquid staking could serve as the catalyst that reinvigorates its ecosystem.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

Pulse check: Solana’s TVL shows promising vitality 🏥

Solana seemed to be tucked away in a deep, unyielding slumber for the last eight months. Now, subtle movements stir beneath the surface, hinting at a potential awakening.

Remember previous Solana digests? Where we banged on about the fundamentally sound state of the ecosystem? Well, those fundamentals are finally bearing fruit.

Solana TVL, a key indicator of health, has risen over the last four weeks from the 12th of June, increasing from $724 million to $867 million, a ~16.5% increase. Comparing this to overall DeFi TVL gains of 9%, it's clear that Solana is not just rousing but also beginning to stretch its limbs and outperform the market.

This YTD all-time high reflects Solana’s growing base and market participants' confidence in the ecosystem. This performance is especially promising considering the lag most altcoins have suffered as Bitcoin dominance continues to rise.

Yet, the engine powering Solana’s TVL resurgence isn't surprising for those who have been keeping pace with our DeFi digests...…

Microdosing on Solana LSD 💉

Ethereum liquid staking has been the talk of the town in recent weeks. But Ethereum, step aside - Solana has a blossoming liquid staking sector that has driven recent growth.

At the heart of this blossoming sector is Marinade Finance, Solana's largest liquid staking provider, boasting an impressive 51% TVL growth in just the last month.

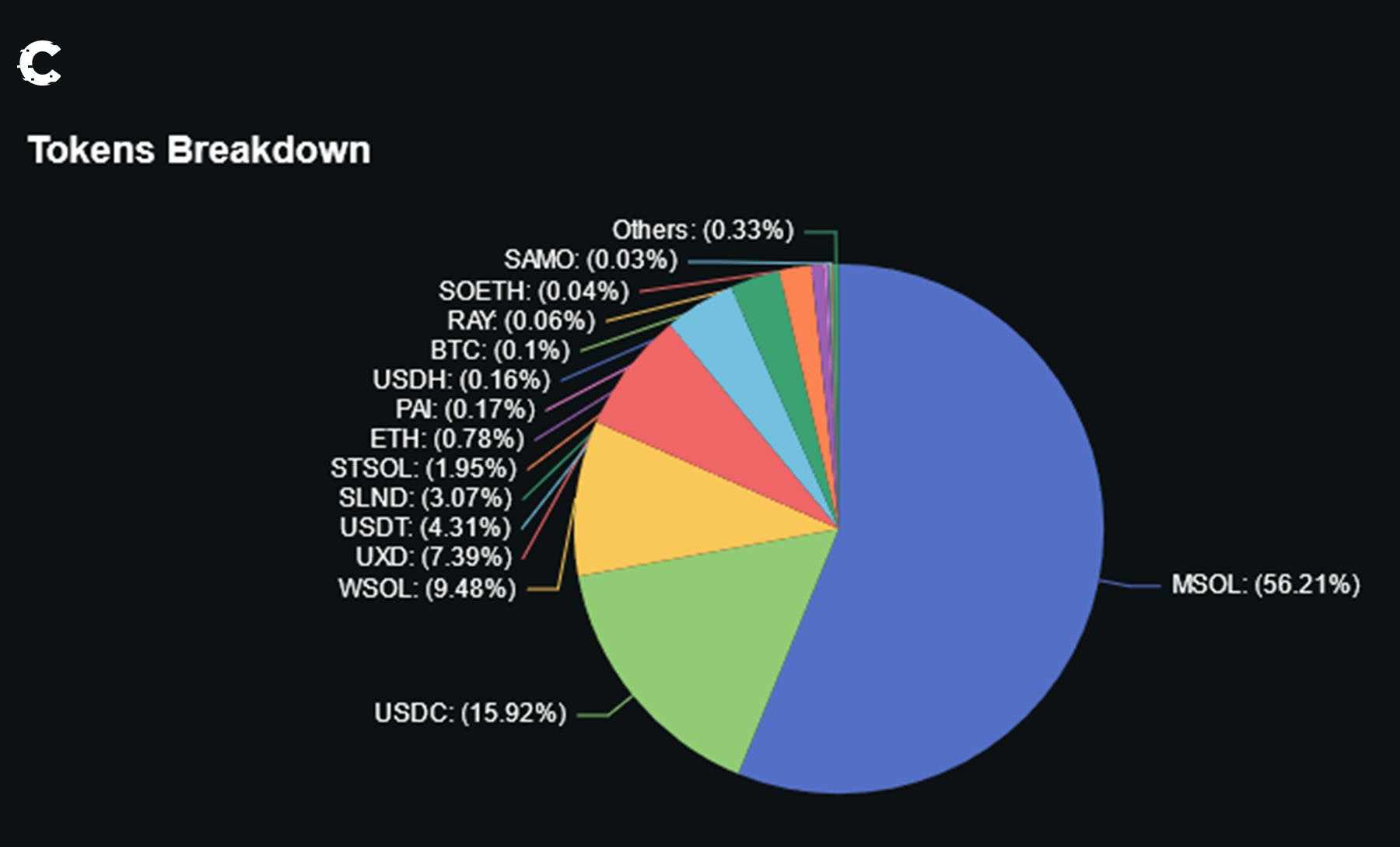

Marinade Finance issued an LST token, mSOL. This is equivalent to stETH issued by Lido on Ethereum. Interestingly, Lido has been dipping its toes within the Solana LSD sector too. However, diving into the utilisation of Solana LSTs within protocols, it’s clear that mSOL is the winner over stSOL.

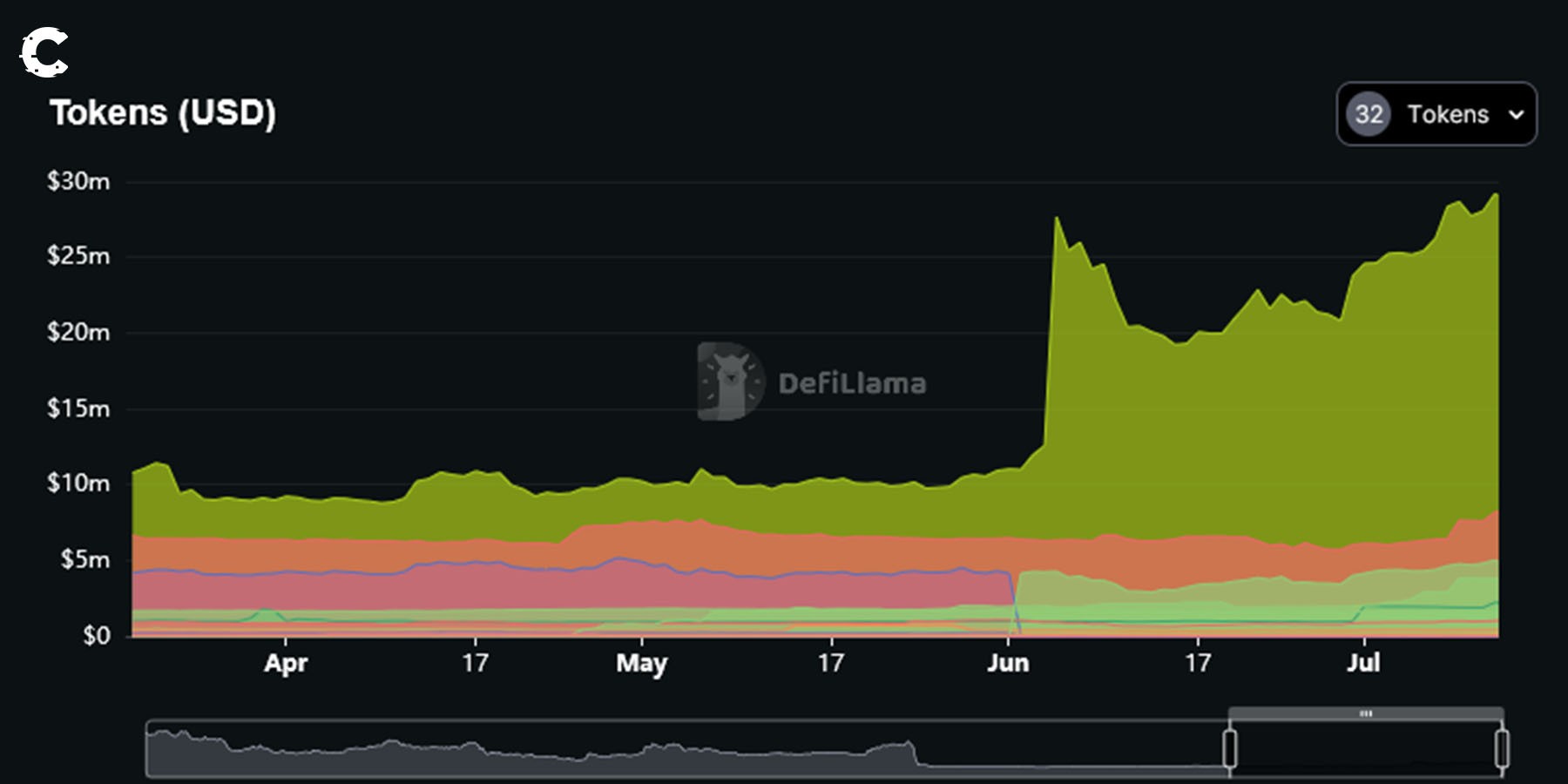

Walking in the footsteps of its competitor, Solana has witnessed significant growth in the LSD-Fi sector. Solend, a lending protocol resting on Solana's platform, has seen explosive growth in mSOL participation since the onset of June (light green area).

mSOL TVL has grown from $11 million to $29 million in just one month, a whopping 163% increase.

mSOL for the win!

Today, mSOL accounts for over 56% of the collateral within Solend, with stSOL lagging at just under 2%. These numbers suggest a marked preference for Solana-native Marinade over Lido, at least for now. The most likely explanation is that Solana-maxis and whales, rather than users from other ecosystems like Ethereum, are likely driving TVL growth.

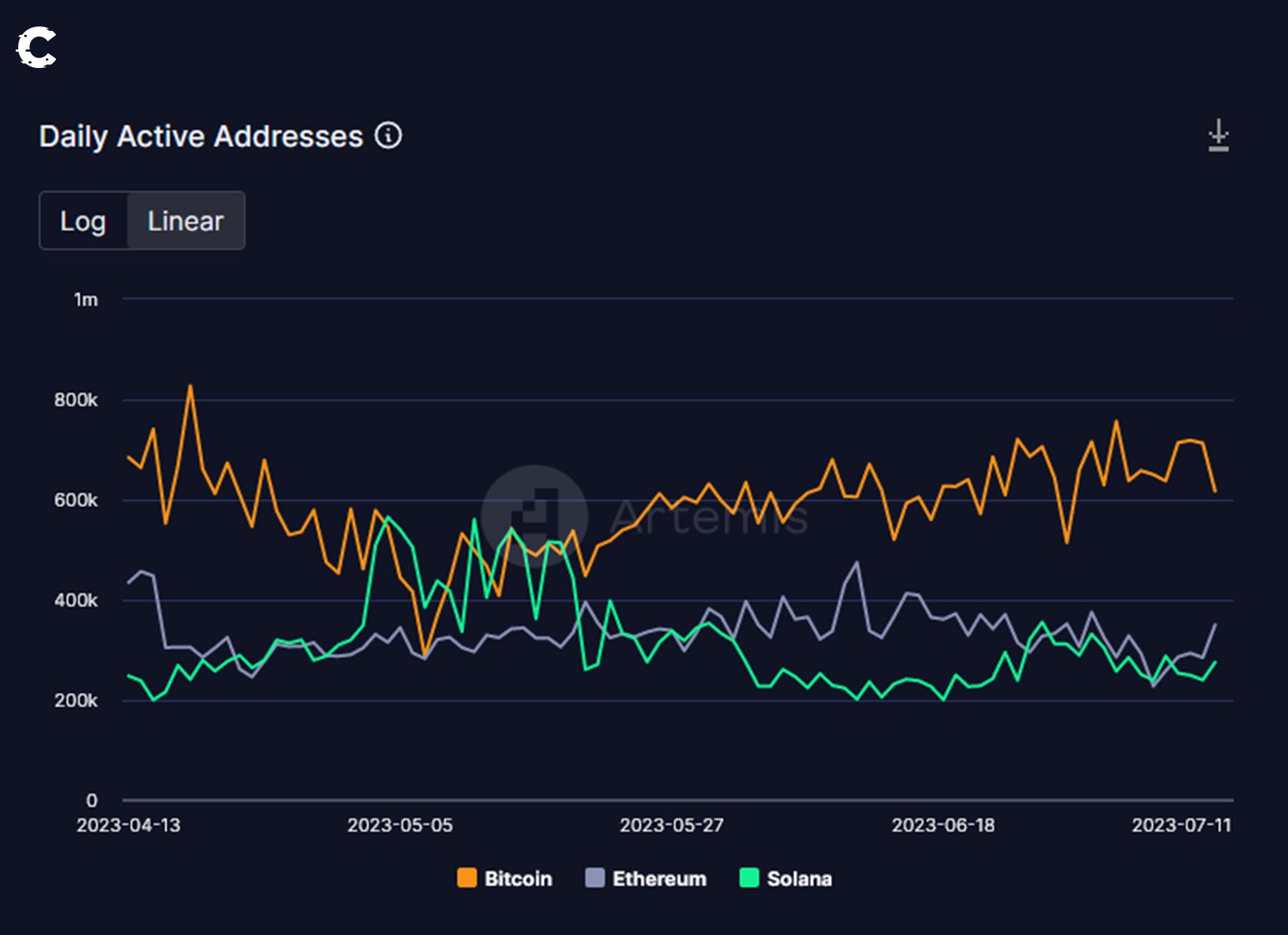

This is backed up by the fact that Solana DAUs remain relatively low compared to the highs in May, mirroring Ethereum.

LSDs and LSD-Fi on Solana are proving to be the defibrillator reviving the ecosystem's pulse. As participation in Solana's liquid staking grows, we expect LST tokens like mSOL to continue flowing into Solana's ecosystem protocols. This circulation will spur on-chain activity and open up more channels for liquidity usage on Solana.

Liquid staking is indeed driving TVL growth.

But what about AI, a topic we've extensively explored in the past?

Continued interest in AI 🤖

The integration of AI within Solana was a huge milestone. However, we’re still in the early stages of understanding the full potential of AI-driven innovation within Solana.

Hivemapper (HONEY), a project that uses driver’s dashcams to create and document street views (like a decentralised Google Maps), has been experimenting with Solana AI.

Hivemapper already deploys AI to merge collected data and create maps. However, the project is yet to utilise Solana's AI directly. The vision for the future is one where users can access Hivemapper data and information about its HONEY token (including rewards and balances) via the interface, and earnings from uploaded dashcam data will be automated through Solana's AI.

MarginFi, another protocol, is eyeing Solana's AI capabilities to enhance its Omni chatbot. This ambitious chatbot seeks to deliver accurate, real-time data direct from the Solana blockchain and field questions unrelated to Solana. Despite being nascent, Omni is primed to secure a healthy utilisation rate for Solana chatbots.

With TVL numbers rising and AI projects in full swing, what’s the future hold for SOL?

SOl price analysis 📊

SOL is on a winning streak. After consolidating $15 as support, the token has seen a remarkable ~50% surge, hitting a resistance level in the $19 - $22 range.

But Cryptonary, what's next?

We came up with two possible scenarios that SOL may encounter in the upcoming weeks or months:

Worst case scenario

The crypto market suffers a widespread downturn triggered by regulatory or macro reasons. SOL could face rejection at the resistance level ($19 - $22) and retreat to $15, $12.25. It could go down to $8 in a worst-case scenario. The lower the target, the more impactful event needs to push its price.

Best case scenario

On a more optimistic note, SOL could flip the $22 level into support and propel towards the $30 mark, shifting its weekly market structure from bearish to bullish. For this scenario to materialise, Bitcoin must surpass its own resistance level at $32,000 - our sole external confirmation indicating that SOL could see an upward trajectory.

Cryptonary’s take 🧠

In terms of outlook, Solana is still in accumulation despite the rally. This is not the time to sell, and we’re happy to continue accumulating in any dips.

The LSD craze has spread to other chains, and Solana has been a key beneficiary of the trend.

From historical observations (at least, post the FTX turbulence in November '22), Solana enthusiasts predominantly retain SOL while often overlooking Solana DeFi. The fact that they are now using SOL as the base for DeFi expansion through utilisation in liquid staking frees up otherwise wasted capital.

This is liquid staking working as intended.

But the paradigm shift towards using liquid staking as a springboard for adding liquidity to other protocols has merely scratched the surface. mSOL deposits have driven the promising TVL growth figures across the board.

We are witnessing the dawn of a revival in Solana's DeFi activity.

Just as Ethereum staking is holding the fort for Ethereum DeFi, Solana staking is the defibrillator that will get the heart of Solana pumping again.

As always, thanks for reading. 🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms