The reason is simple, banks hold $200+ trillion in assets - even a simple trickle-down of that money can mean exponential gains… and we’re here for it. Are you?

Let’s jump down that rabbit hole together and find out how Chainlink plans to make us all rich.

TLDR 📃

- Chainlink's CCIP launches, offering seamless cross-chain operations and attracting interest from major financial institutions.

- CCIP has the potential to disrupt traditional banking systems, potentially replacing SWIFT.

- The news of CCIP's launch has already caused a significant increase in the price LINK.

- The revenue potential of CCIP, coupled with Chainlink's updated economic model, makes LINK a promising investment.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

SWIFT and why it’s a big deal 👀

Unless you’ve been living under a rock for the last 50 years, you know that SWIFT runs the banks. Literally, no bank can transfer funds internationally without SWIFT. The West disconnected Russia from this system when it wanted to impose sanctions on the Kremlin.

The Society for Worldwide Interbank Financial Telecommunication is basically a messaging system, imagine THORChain or Synapse but for banks. In 2020, the network processed over 7 billion transfers; now multiply that by the fee you pay for international transfers and imagine the pile of cash they sit on.

Ripple initially planned on replacing that system with their newer, cheaper, faster alternative, with XRP as the middleman. Now, that hasn’t really worked out for them. So Chainlink, learning from Ripple’s mistakes, decided to go another route and partner up with the old money instead.

How Chainlink beat Ripple at their own game 🎮

On the 17th of July, Chainlink’s CCIP (Cross-Chain Interoperability Protocol) launched on mainnet and is currently in the early access phase. Today, it has become available to all developers across five testnets, which is one step away from full mainnet.

What's so cool about this? Well, it's a game-changer.

It's like having a universal charger for all your devices. Suddenly, you can seamlessly connect, operate, and transfer digital goodies (tokens, NFTs) between blockchains. No more communication breakdowns, just smooth and secure operations.

The tech gurus are loving it too. Big players in the DeFi world, like Synthetix and Aave, are already using it. And guess what? Even the big financial institutions are catching the bug. Names like SWIFT, BNP Paribas, BNY Mellon and Citi are exploring how to use CCIP.

In a nutshell, Chainlink's CCIP is cutting through the multi-chain madness. One example – you’ll be able to ask the network to send USDT from Avalanche to Ethereum, swap that for ETH, and you’ll receive ETH on the other end.

Now the thing you all care about – price 📊

“Amazing news, Cryptonary! Now talk to me; what does this mean for LINK’s price?”

The news alone sent LINK up by +25% this week when most of the market hasn’t flinched.

So far, it is being well received, but is it good or big enough to cause a breakout from this dreadful accumulation zone [$5.25-$9.50]?

Is it big enough news to send it to $18 and beyond?

First off, this will depend on two factors:

- Bitcoin and what it does (looks positive)

- Whether CCIP causes an important shift in LINK’s fundamentals

So really, your answer is outside of these charts and in another data lane: revenue.

Has LINK become a better investment? 🤑

The news is excellent, usage is great, and billions of SWIFT messages sent through the system are also important, but none of it matters to us if LINK doesn’t capture that progress. So, does it?

Short answer: Yes.

Long answer: CCIP charges a small fee per transfer that must be paid in LINK or another asset with a 10% premium added. Naturally, most people will choose LINK to pay less in fees (especially institutions).

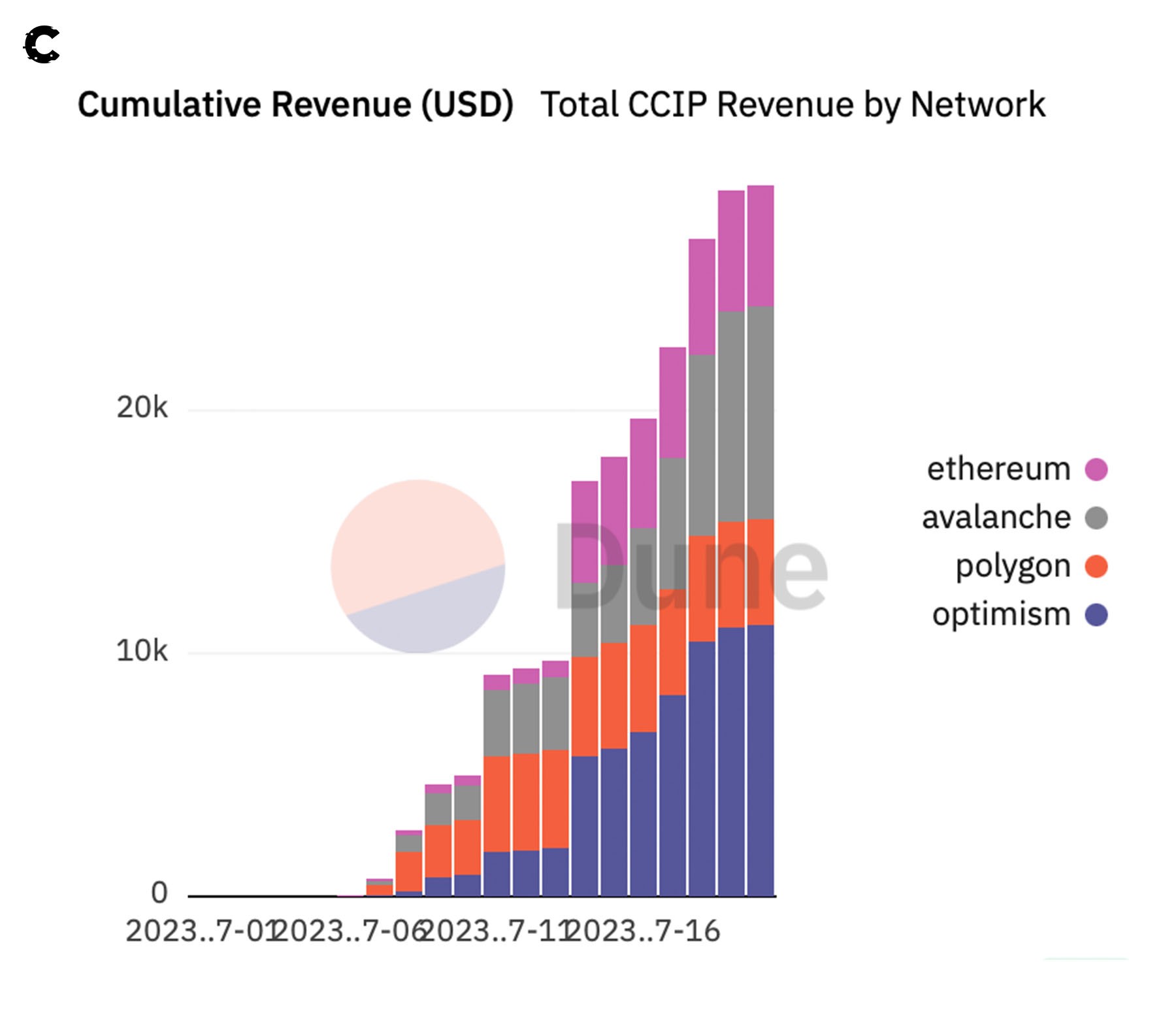

With limited access, complete novelty and a bear market, Chainlink was able to pull in $30,000 in the past few days.

We predict this number will grow to multi-millions by EOY; you can keep track of it here.

Add to this the fact that Chainlink updated its economic model to include staking, and all of a sudden; LINK is as sound as an investment as ETH is.

But since it’ll connect multiple chains, can it even be bigger?

Well, determine whether SWIFT or banks are larger than ETH, and you’ll have your answer on whether LINK or ETH is poised to become bigger over the years.

TLDR: CCIP actually adds more usage and revenue to Chainlink, which LINK itself also captures in terms of value. So yes, a breakout is something we’re betting on. LINK just got a whole lot better overnight.

Cyptonary’s take 🧠

Chainlink's Cross-Chain Interoperability Protocol (CCIP) is a game-changer set to add more usage and revenue to Chainlink’s ecosystem.

CCIP has gained traction among DeFi projects and even big financial institutions like SWIFT, BNP Paribas, BNY Mellon, and Citi by enabling seamless and secure operations between different blockchains.

The 25% bump in LINK after CCIP's launch is a good omen. And we foresee a breakout from the current accumulation zone potentially pushing LINK towards $18 or higher if Bitcoin's performance remains positive and CCIP brings about a significant shift in Chainlink's fundamentals.

The future is always uncertain, but CCIP’s launch is a significant development for Chainlink, and the future just got brighter for LINK.

As always, thanks for reading.🙏

Cryptonary, out!

Other news

- Polkadot 1.0 has been completed, fulfilling the whitepaper. Now, Polkadot 2.0 is in the works.

- Polygon 2.0 upgrade will change the face of that Polygon; a new token, POL, will replace MATIC.

- Avalanche continues to gain users at an astounding rate, reaching 1.76 million in the first 2 weeks of July.

- GMX votes to direct 10% of revenue to its treasury.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms