The fall of Signature Bank: A targeted attack on crypto banking?

On a Sunday evening, the financial world was rocked by the news that New York regulators had taken control of Signature Bank, a crypto-friendly institution. A week later, New York Community Bancorp picked up some of the bank's assets through its subsidiary but did not touch any of its crypto assets. The news was a surprise to many, including the bank's own employees.

On the surface, Signature appeared to be doing well. So how, in such a short amount of time, did the bank collapse?

Well, some theorise that the bank was a victim of a targeted attack by regulators. The reason? Its friendly relationship with crypto.

Now, we know this might sound crazy. So permit us to take an objective look at the events leading up to the collapse to see if this theory holds any weight.

Spoiler: this will shock you.

TLDR

- Signature Bank had a unique approach to banking, with unparalleled customer service. It was renowned for its crypto exposure through its digital payments platform, Signet. The bank faced challenges as the market weakened, but it was expected to weather the storm better than other banks.

- On March 12, 2023, Signature was abruptly shut down by New York state regulators due to liquidity issues caused by a surge in withdrawals, resulting in a loss of $17.8B in deposits.

- The closure sparked speculation that authorities used its collapse to send a message to the banking sector that banks involved in crypto will not be rescued.

- The future of Signet, a critical piece of infrastructure for the 24/7 crypto industry, is uncertain following the closure of both Signature and Silvergate (the only two banks offering real-time payments around the clock to the crypto industry).

Signature Bank's signature

Founded in 2001 by a group of daring former Republic National Bank of New York executives, Signature Bank is anything but your typical bank. Renowned for its unparalleled customer service and its focus on private banking and commercial lending, Signature Bank caught the attention of high-net-worth clients and The Wall Street Journal, which described it as “one of the country's quirkiest and fastest-growing banks” in 2015.

In 2018, Signature made a bold move and announced its venture into the world of crypto. The decision resulted in the 2019 creation of Signet, a digital payments platform that uses blockchain technology to enable customers to instantly transfer funds without intermediaries.

The main selling point of this service is its ability to process transactions outside of regular banking hours, which is essential for the 24/7 crypto market. Additionally, there are no transaction fees incurred by using this service.

Signet grew quickly alongside the crypto sector as it gained traction. Its larger equivalent SEN, launched by Silvergate, also saw tremendous growth in 2020 and 2021 as crypto exchanges and market makers used these platforms to conduct transactions during non-banking hours.

In 2022, Signature and Silvergate faced challenges as the market weakened, with the fall of FTX being the ultimate blow. Silvergate declared an orderly wind-down of its operations on March 9 due to the loss of billions of dollars in deposits from digital asset clients as a result of the crypto crash. However, Signature was expected to weather the storm better due to its lower exposure to crypto, and its more diversified operations.

Despite this setback, Signature emerged as a strong contender during the turmoil. Many expected that Signet could potentially fill the gap created by Silvergate shutting down SEN.

Many significant crypto firms, including Circle (The company behind $USDC) and Coinbase, considered transferring their funds to a new banking partner, which could potentially benefit Signature Bank as Silvergate - its main competitor - had just shut down. However, little did anyone know what the future held for the bank.

Signing off

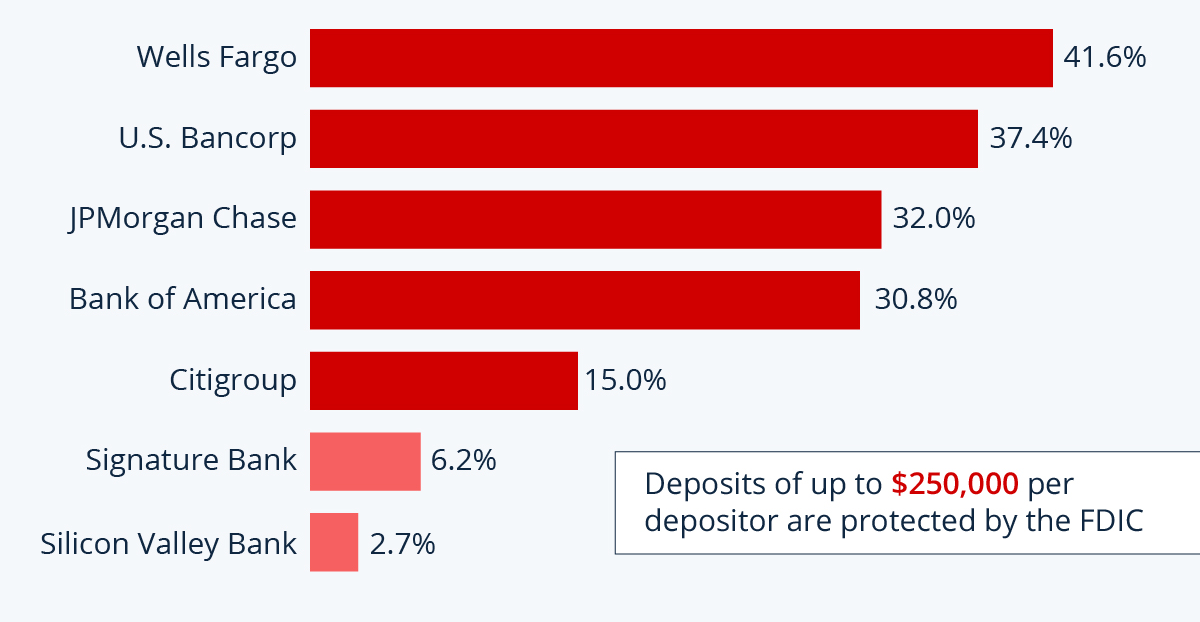

On Friday, March 10, 2023, Silicon Valley Bank (SVB) collapsed, sending shockwaves throughout the financial industry. Two days later, on Sunday, March 12, Signature Bank was abruptly shut down by New York regulators, adding to the growing anxiety. Now, Flagstar Bank, a subsidiary of New York Community Bancorp, has signed a takeover agreement with U.S. regulators for some of Signature Bank's assets and loans.The bank was facing liquidity issues due to a surge in withdrawals, resulting in a loss of $17.8 billion in deposits. Around the same time, rumors emerged that Silicon Valley Bank was experiencing a bank run. It's worth noting that Signature Bank had a lower exposure to long-maturity US Treasuries than SVB, which faced similar challenges. However, both lenders had a high concentration of uninsured depositors. Nearly 90% of deposit balances at Signature Bank belonged to uninsured business accounts with balances exceeding the standard limit of FDIC deposit insurance, which is $250,000. This lack of insurance likely prompted depositors to seek safety by moving their money to larger banks, rather than risking their funds at a bank that was not "too big to fail.”

Despite this, Signature remained technically solvent, reporting $4.54 billion in cash and $26.4 billion in marketable liquid securities. Additionally, the bank had $25.3 billion in borrowing capacity as of Friday before the weekend closure. However, the bank faced liquidity issues due to the panic caused by the high volume of withdrawals from uninsured depositors that day.

In an unusual turn of events, just as Signature was struggling with liquidity, the Federal Reserve established an emergency lending facility on Sunday night to provide additional funds to banks facing liquidity problems. This program was precisely what Signature would have needed to stay afloat during the challenges it ended up facing on Monday. Unfortunately, the bank was closed down before it had a chance to take advantage of the opportunity, leaving many puzzled by the timing of the closure.

Political motivations or sound reasoning?

The bank's unusual closure, just before the launch of a program that could have saved it - combined with the fact that it was technically solvent - fueled dark speculation. Some whisper that the authorities used its demise to send a message to the banking sector: Banks in bed with crypto will not be rescued. This effectively ends the crypto industry's access to the banking sector.The treatment of First Republic, a bank with seemingly larger issues, further supports this theory. First Republic did not face closure but instead received a $30B deposit injection from big banks to prevent its collapse. It could be argued that regulators were more willing to intervene and prevent the collapse of a traditional bank than one more heavily involved in crypto-related activities.

New York officials have denied that the closure of Signature was related to this. Nevertheless, the state’s Department of Financial Services (the entity responsible for the bank's shutdown) has not presented a clear rationale for the dramatic response, other than alleging a lack of reliable and consistent data. Many argue this is not a sufficient explanation to justify a shutdown like this.

Will Signet survive?

A Reuters report revealed that any buyer of Signature Bank must give up all crypto business at the bank, further fueling the theory that the closure of Signature Bank was a political attack rather than a move to protect depositors. The FDIC initially denied this report, but on Sunday, March 19th, it was announced that Flagstar Bank, a subsidiary of New York Community Bancorp, had signed a takeover agreement with U.S. regulators for some of Signature Bank's assets.However, Flagstar Bank's bid did not include approximately $4 billion of deposits related to Signature Bank's former digital-assets banking business. This is concerning because the FDIC estimates that the failure of Signature Bank will cost its Deposit Insurance Fund approximately $2.5 billion. If Flagstar had assumed crypto deposits, there would be no need for the insurance fund to guarantee them.

Flagstar Bank has confirmed that their recent acquisition of certain assets and liabilities of Signature Bridge Bank from the FDIC does not include Signet. This is concerning because, despite Signature Bank being acquired, the fate of Signet remains uncertain to this day. While the service itself is still running, the acquisition has not allowed it to find a new home. Whether this was intentional or not is unclear, but it is certainly not ideal. Coinbase has already announced that it won't support Signet anymore until further notice.

Cryptonary’s take

Signature's shutdown is concerning, particularly due to the lack of clear reasons from regulators as to why the bank could not continue to operate and use the tools offered by the Fed starting on Sunday.While regulators deny that crypto had a role in the bank's closure, the lack of openness in the decision-making process raises questions about how regulators treat crypto-related firms. There may be another explanation, but authorities have yet to offer it.

Based on the facts available right now, it appears that authorities permitted the bank to fail because they viewed its clients and infrastructure to be toxic. The move looks to be more political than anything else.

Action points

- If you haven't already, be sure to read our analysis of Silvergate's collapse.

- The current events in the banking industry may have an impact on the macroeconomic environment in the United States. To view our macro analysis, become a Cryptonary Pro member

- With the high-level hostility towards crypto in the US right now, if you are a developer working on a project or an entrepreneur intending to start a crypto company, it may be wise to consider going off-shore to have greater opportunities for experimentation, and more easily find banking partners.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms