Bitcoin and Ethereum both showed their age. Transaction times stretched out and fees skyrocketed.

L2 chains were created to make transactions fast and affordable when low-bandwidth mainchains can’t keep up. But for counter-intuitive reasons (see below), some of the strongest L2s saw their fees rise even higher than Ethereum’s.

When the dust cleared, one L2 emerged as king: faster and cheaper than Bitcoin, Ethereum, and the Layer 2 usual suspects.

TLDR 📃

- When mainchain fees rise into the stratosphere, we look to L2 for relief.

- But zkSync Era and Polygon’s zkEVM suffered from high fees too – even higher than Ethereum’s!

- PEPE mania exposed weaknesses in L2s with great reputations and left one L2 standing head and shoulders above the rest.

- This L2 could have what it takes to be the next Solana. Or – dare we say it? – the next Ethereum.

- But there are a lot of twists along that road, and no one can see all of them.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

Layer 2 struggles with high gas fees ⛽

For the past week, Ethereum has experienced high gas fees, leading many people to consider switching to Layer 2 networks like zkSync Era.Many were surprised to learn that zkSync is facing similar issues.

One Cryptonary community member shared the experience of paying $11 to complete a transaction on zkSync, which raises questions about using Layer 2 solutions when the fees rival those on the main Ethereum network.

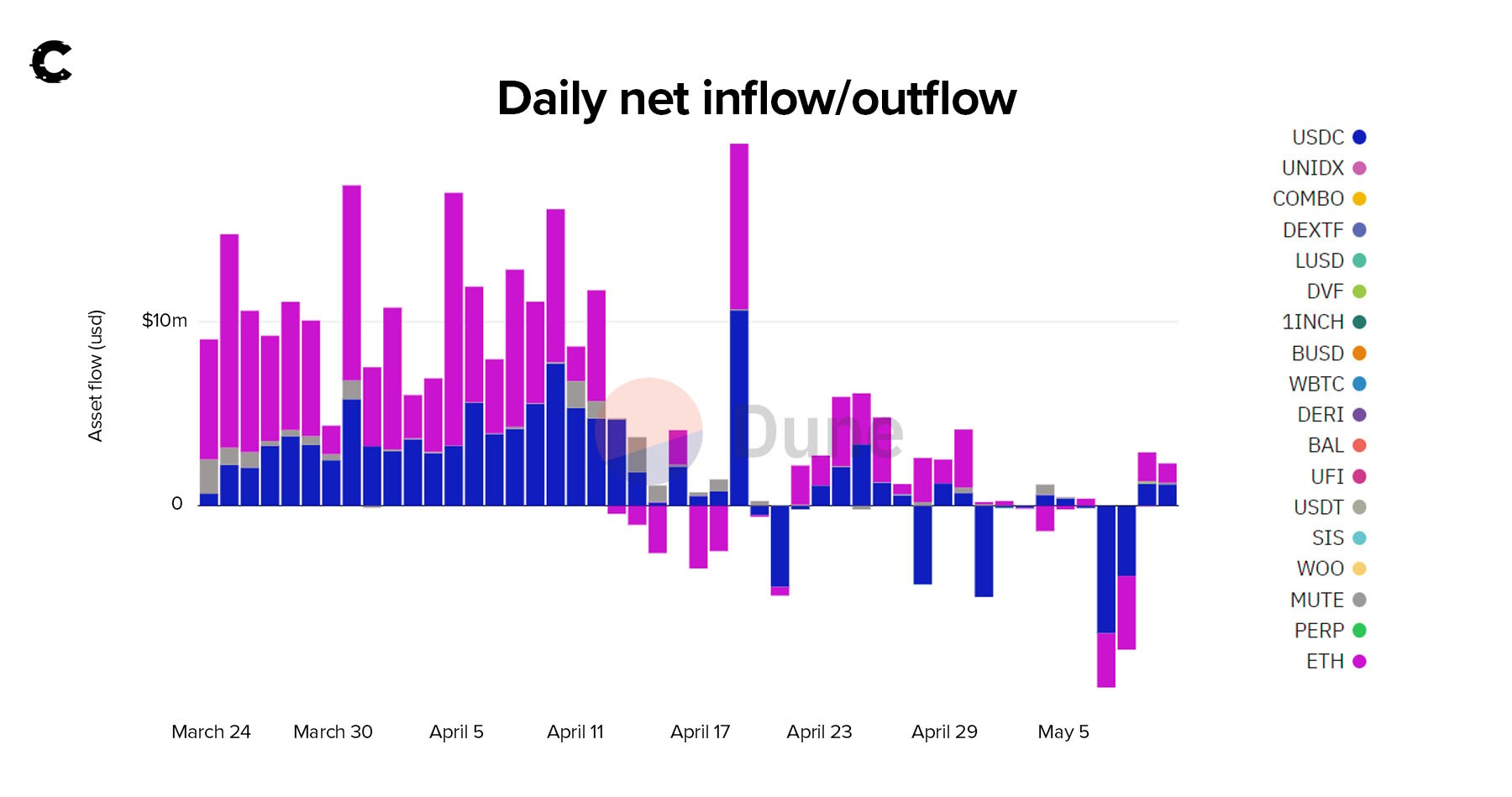

You can see how these fees are affecting zkSync users when you look at the data. The fees are actually driving people away. On May 7th and 8th alone, users withdrew $17.64M from the ecosystem.

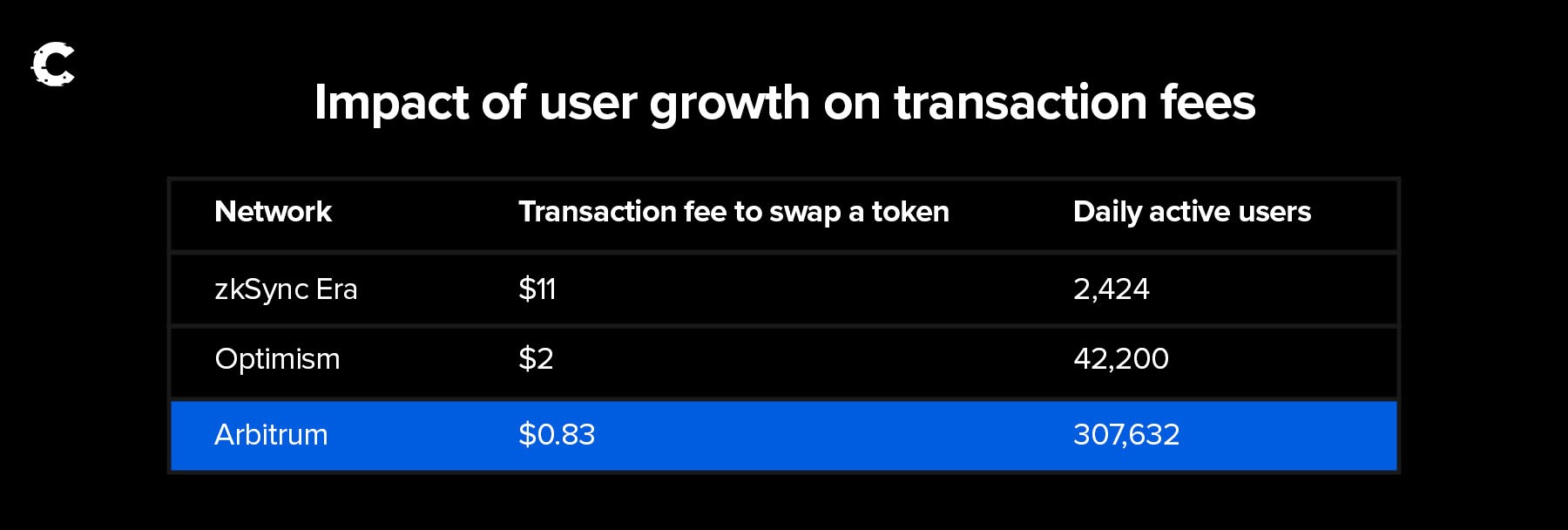

Why are the fees so high? Although it may seem counterintuitive, zkSync's high fees are a result of its low user count. Unlike networks such as Ethereum or Bitcoin, Layer 2 solutions like zkSync experience lower fees as more users are onboarded.

This is because zkSync settles its transactions on the Ethereum network by processing them in batches. The cost of these batches is divided among the users involved, making the fees lower as the number of users increases.

It’s like shipping goods via a containership. If you are the only person using a ship to send something from China to the United States, you’ll bear the entire cost. If thousands of people are sending packages, shipping costs are much lower because the expenses get divided among them all.

That’s why zkSync is feeling the impact of soaring Ethereum gas prices so acutely. It has a small user base.

High fees are common for Layer 2 networks in their early stages. Even Optimism faced similar challenges in the early days – so this doesn't make zkSync a bad project.

zkSync is the long-term winner 🐂

zkSync remains worthwhile, especially with an airdrop expected. To avoid high gas fees, you can check this page to see the current fees on zkSync. With clever scheduling you can avoid using the network when the fees are high and still farm the airdrop.We're bullish on zkSync's long-term potential, as zk-rollups are expected to outperform optimistic rollups like Arbitrum and Optimism in the long run. Even Vitalik Buterin has said zk-rollups are long-term winners.

zkSync is still new. It’s natural for it to face growing pains like the ones we’re seeing now.

A temporary problem ⏳

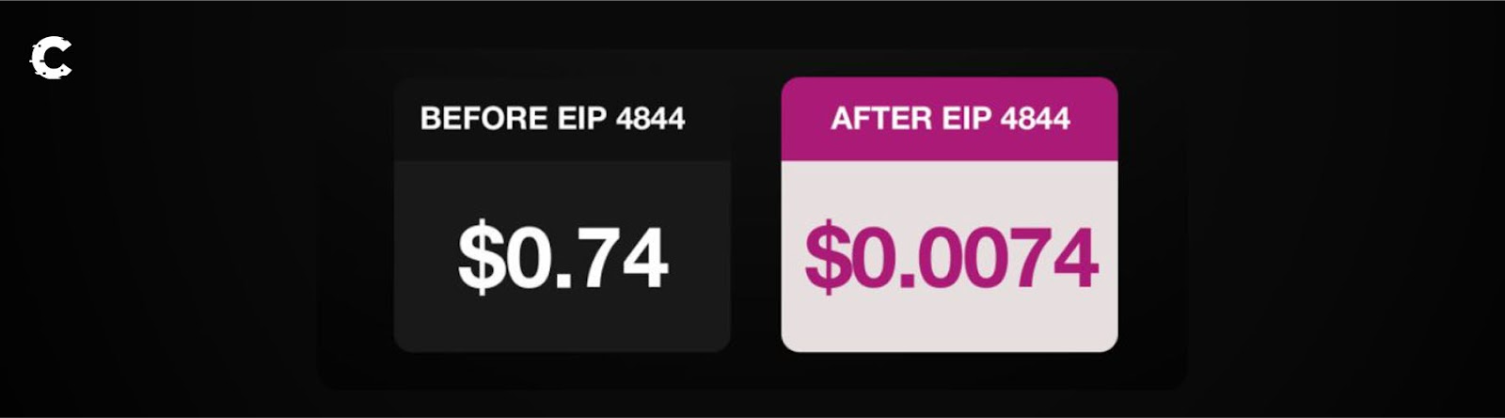

Fortunately, the current situation is not permanent. Ethereum's core developers are actively working to tackle the challenges posed by high gas fees on Layer 2 solutions.One promising approach is embodied in EIP-4844, which is set to be implemented in the next Ethereum upgrade later this year. With EIP-4844, L2 networks will operate on a dedicated highway, separated from congestion on the Ethereum network.

By separating themselves from mainchains and their high-traffic users – we’re looking at you, degen memecoin speculators – Layer 2 chains can drive down transaction fees.

This will allow these solutions to finally become rivals to Solana and possible successors to the Ethereum main chain.

Who’s the short-term winner? 👑

Despite the lower costs EIP-4844 may bring, the chain with the most users is likely to offer the most affordable transactions and thus emerge as the winning chain.Currently, Arbitrum holds this position. It has a significant advantage in daily active users. It’s no wonder it can offer such low fees.

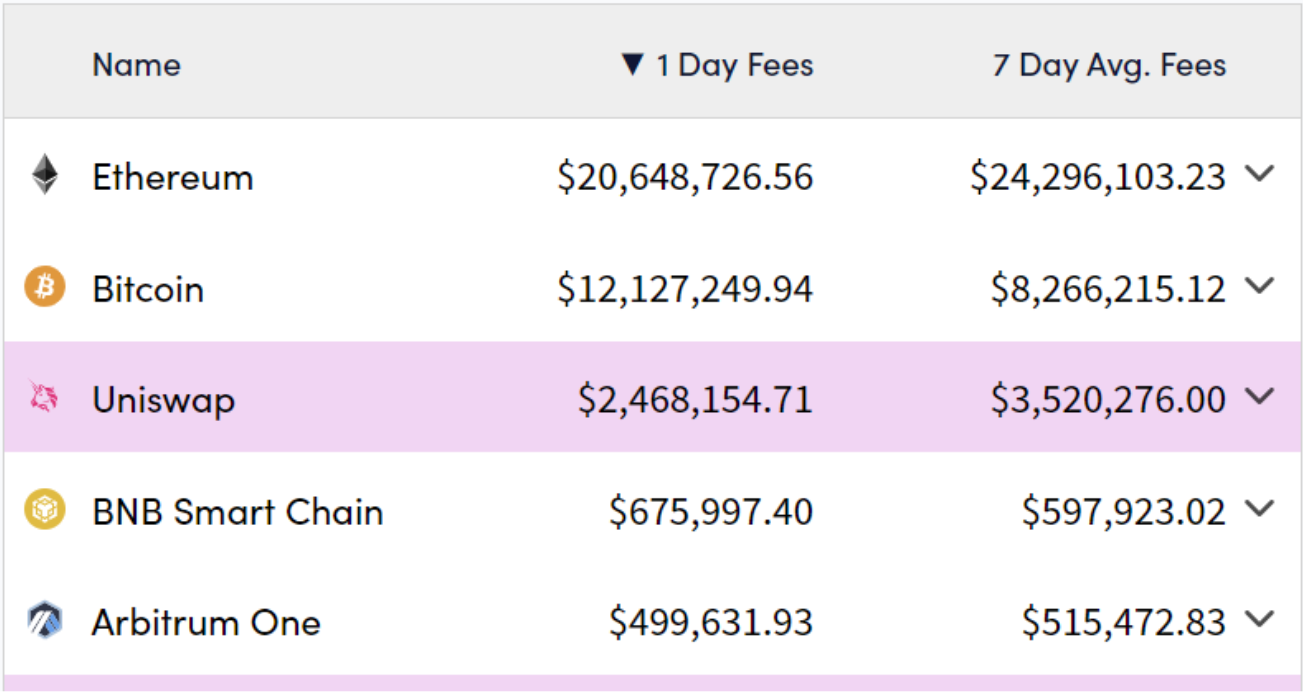

Arbitrum is also the highest-earning Layer 2 network. Its ability to make a considerable amount of money from user fees places it in the top five right behind BNB Chain, whose native BNB token has a valuation about six times that of ARB even though both networks earn about the same amount of fee revenue.

Arbitrum's top position is also reinforced by its healthy treasury. The Arbitrum Foundation holds $3.9B in ARB tokens that it can use to incentivize network usage and attract new users.

This huge war chest is in addition to the $124 million that was recently distributed to Arbitrum-based protocols via airdrop. These incentives are expected to increase the number of users on Arbitrum even more in the coming months.

What does this mean for the price of ARB? 💵

Arbitrum has clearly emerged as the dominant player in the market, and we don’t expect anyone to snatch the crown away anytime soon. We anticipate a bright future for ARB, which could reach a target of $6.5 in the long term, as we expect it to be the SOL of the next cycle.Despite the optimistic long-term outlook for ARB, the short term appears bleak. The price of ARB follows the movements of BTC, which has been bearish lately. As a result, it’s possible that ARB could break below $1 soon.

Cryptonary’s take🧠

While we believe zkSync will win the L2 race in the long term, its high gas prices place it at a significant disadvantage right now, which will likely be an issue for the network until EIP-4844 is implemented.With Optimism also not seeing widespread adoption, it’s clear that Arbitrum is the short-term winner. Price may not reflect that today but that’s because the market as a whole is going down - this will change soon.

Other L2 news📰

- Optimism to use Ethereum attestation service to promote user trust: The attestation service will allow any Optimism user to create digital sign-offs on all kinds of information involving the blockchain’s activities and users. AttestationStation has been upgraded to the EAS standard, which means developers can target a single standard for decentralised-identity projects.

- South Korean publisher Neowiz launches $10M Polygon game accelerator: The purpose of this grant program is to expand and drive the mass adoption of Web3 in the gaming industry.

- Arbitrum-based exchange Chronos reaches $230M TVL just two weeks after launch: This achievement has propelled Chronos to the third-largest protocol on Arbitrum based on TVL.

- Aave DAO passes proposal to deploy on Metis Network: Aave’s deployment on Ethereum L2 Metis is intended to increase market liquidity for both ecosystems while allowing Metis users to benefit from the borrowing and lending features of Aave.

Continue reading by joining Cryptonary Pro

$997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.