Things are not looking good for Binance

Ever wondered what it's like to weather a storm in the wild, wild world of crypto? Well, today we're diving headfirst into the swirling tempest surrounding Binance and its digital sibling, BNB. With a cocktail of tough regulations, sliding market share, and a token value acting like a yo-yo, there's an epic saga of resilience and adaptation that you wouldn't want to miss. Intrigued?

Buckle up, because we're about to embark on a roller-coaster journey that might just change the way you look at the crypto universe!

TLDR 📃

- Binance is feeling the heat from U.S. regulators, who're digging into potential rule breaches related to their Russian clientele.

- The exit from Canada adds another chapter to Binance's tale of regulatory woe, particularly in the Western markets.

- Holding its place as a top exchange, Binance has still shed a hefty 20% of its market share to Asian competitors.

- These hurdles have taken their toll on Binance's token, BNB, which hasn't kept pace with the wider crypto market.

- Yet, amidst these trials, the BNB ecosystem has been thriving, smashing its own record with a trading volume of $5.1 billion on May 7.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

Binance is under increasing pressure ⚖️

Binance is hitting some serious turbulence! The CFTC threw a lawsuit their way on March 27th, and it's been a bumpy ride since then. They had their sights set on soaring heights in 2023, especially after FTX's meltdown last year. But alas, regulators have been tightening their grip, causing quite a few stumbling blocks.Regulators aren't exactly new visitors in Binance's backyard. The CFTC's lawsuit was the alarm bell that made it clear things were getting real for the exchange.

But wait, it gets worse! A recent Bloomberg report suggests that the US Department of Justice is poking around Binance. They're checking whether Binance gave Russian customers a free pass to their exchange - a big no-no under US rules.

In a chat with the Financial Times, Eun Young Choi, the big boss of the agency's national crypto enforcement team, gave us a peek into their plan. It seems the department is gearing up to flex its muscles on a host of crypto exchanges in the US.

She didn't call out Binance by name, but she made it crystal clear - size doesn't matter when it comes to flouting US laws. No company, no matter how large its market share, can dodge the consequences if it's been playing fast and loose with US criminal laws.

Will this force Binance out of the United States? 🦅

Binance is under a gloomy cloud of uncertainty - can it keep its doors open in the U.S.? With multiple agencies nosing around its business, operating smoothly stateside is becoming a tough nut to crack.The plot thickens with Binance packing up its bags in Canada. This move is a stark reminder of the hurdles it's facing. Binance didn't hide its disappointment, pointing to new stablecoin guidelines and investor limits as the culprits making Canada a no-go zone for them right now.

Binance may be in a pickle in the Western market but don't expect them to throw in the towel just yet, especially given the pull of the U.S. market. Still, their Canadian exit is a clear sign of the rough seas they're sailing.

20% market share loss to Asian rivals 🐻

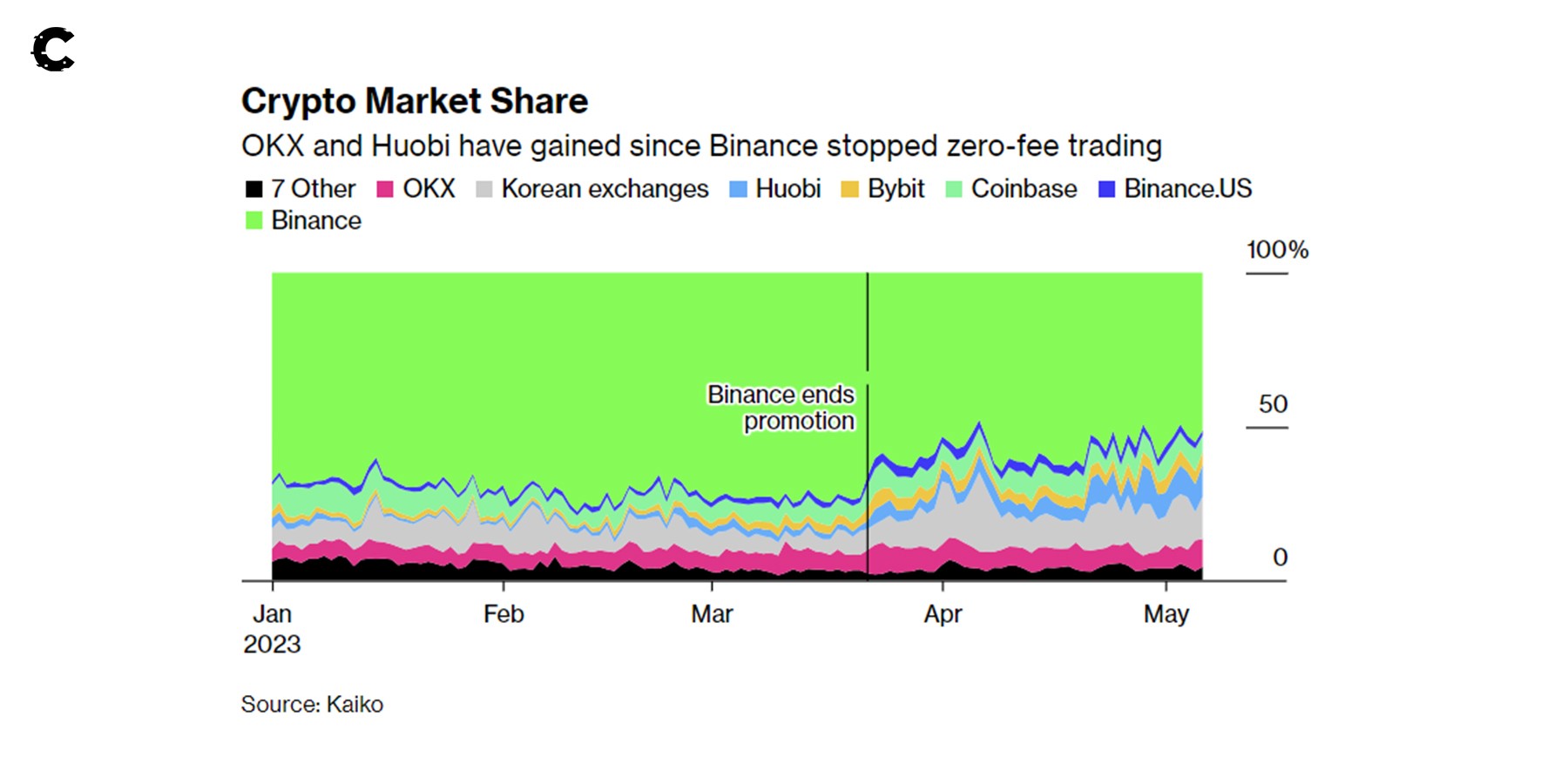

Binance, despite regulatory headaches, holds its ground as a leading exchange. Yet, regulator pressures have put a brake on its growth and customer retention throughout the year.A game-changer was when Binance pulled the plug on a wildly popular zero-fee promotion on March 22. This move sent ripples through the exchange, pushing its spot-trading volume dominance down from a hefty 73% to its ~50% baseline by May 6. This suggests Binance's recent surge owed much to the promotion, but the customers it wooed have proven fickle.

Binance, despite regulatory headaches, holds its ground as a leading exchange. Yet, regulator pressures have put a brake on its growth and customer retention throughout the year.

A game-changer was when Binance pulled the plug on a wildly popular zero-fee promotion on March 22. This move sent ripples through the exchange, pushing its spot-trading volume dominance down from a hefty 73% to its ~50% baseline by May 6. This suggests Binance's recent surge owed much to the promotion, but the customers it wooed have proven fickle.

Meanwhile, Asian exchanges like Huobi and OKX are on the upswing. Huobi's market share shot up from 2% to 10%, and OKX's rose from 5% to 9%.

Interestingly, Binance's market share decline coincided with the CFTC lawsuit, which may have thrown fuel on the fire.

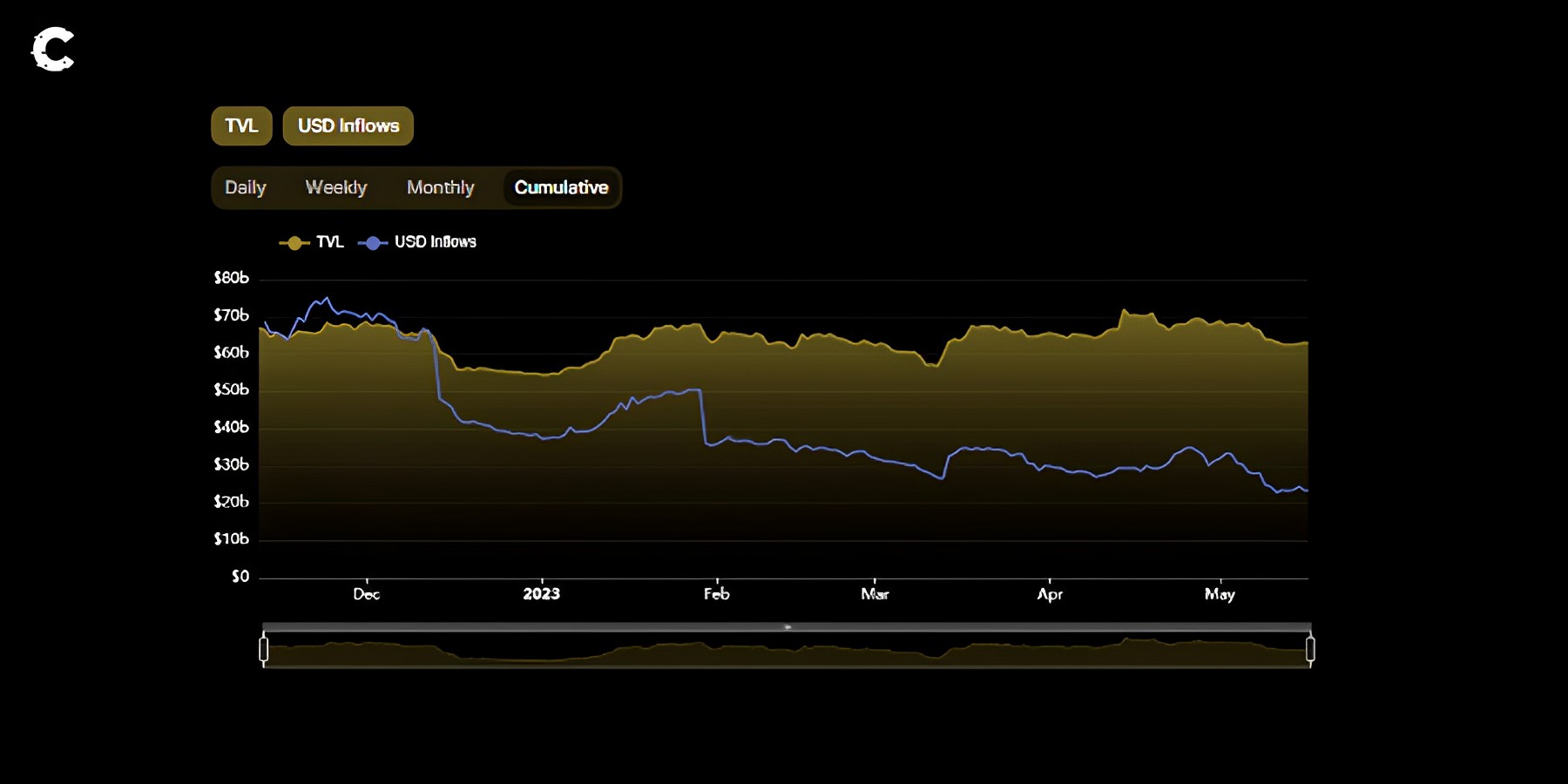

Even though crypto's dollar value saw an overall uptick this year, Binance's held assets haven't budged much. This is mainly due to regular outflows from the exchange seen month on month.

Right now, there's no easy fix for Binance's woes. U.S. regulators' ongoing investigations have cast a long shadow of doubt over the exchange.

Given the circumstances, it's pretty likely that Binance will keep seeing its Western market share shrink as long as these regulatory storms keep brewing.

So what does this mean for BNB? 📉

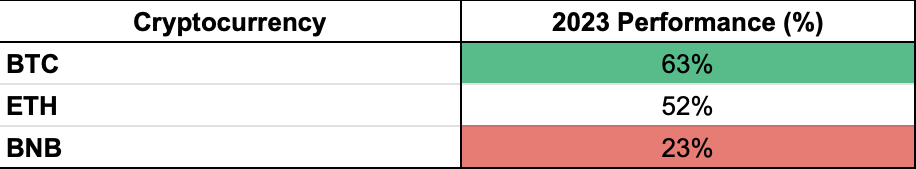

Binance's stormy weather has left its mark on BNB, which has been lagging behind the broader market.

So, where's BNB heading next? Let's take a deep dive 👇🏼

The thing with market analysis - it's always binary. Any asset, including BNB today, can take one of two paths:

- Continue its downhill journey to $268.

- Pull a rabbit out of a hat, bounce back to $350, and kickstart a rally towards $660+.

A positive note in this chaos: BNB ecosystem 🌐

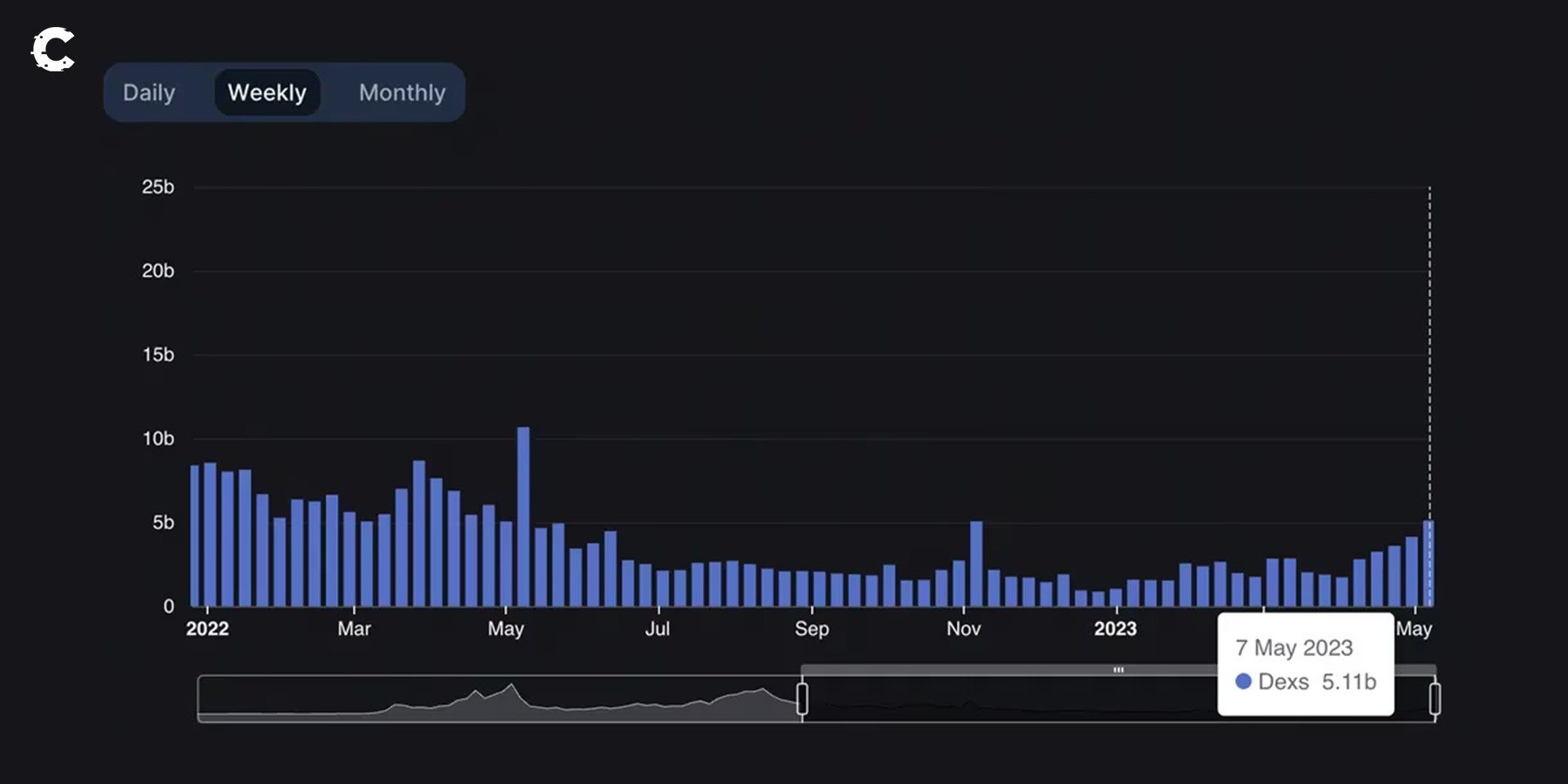

Even with Binance and BNB feeling the heat, the BNB ecosystem is blossoming. It hit a yearly high on May 7, with a booming trading volume of $5B+.

This uptick can be chalked up to Ethereum's rocketing gas fees and, ironically, the regulatory squeeze on centralized exchanges by U.S. authorities.

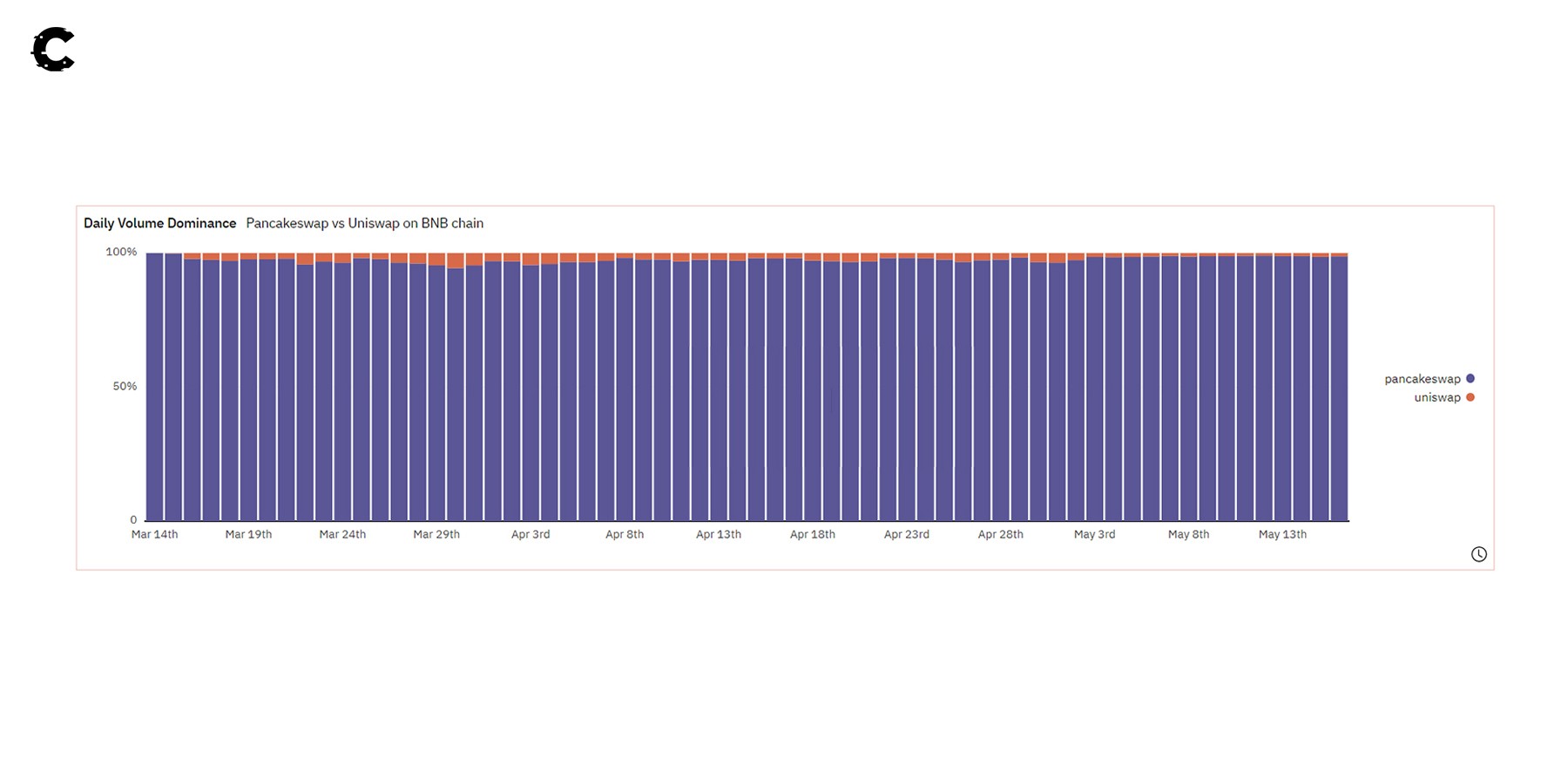

PancakeSwap is ruling the roost as the top DEX on the BNB Chain, despite Uniswap V3's splash earlier this year. It flexed its muscle with an eye-popping 17.3% week-on-week trading volume increase, hitting a whopping $4.46B.

Once more, this underscores the power of being first off the block. While Uniswap is the big cheese on the Ethereum network, it's struggled to gain a foothold on the BNB Chain. Right now, its weekly trading volume is a more humble $49M.

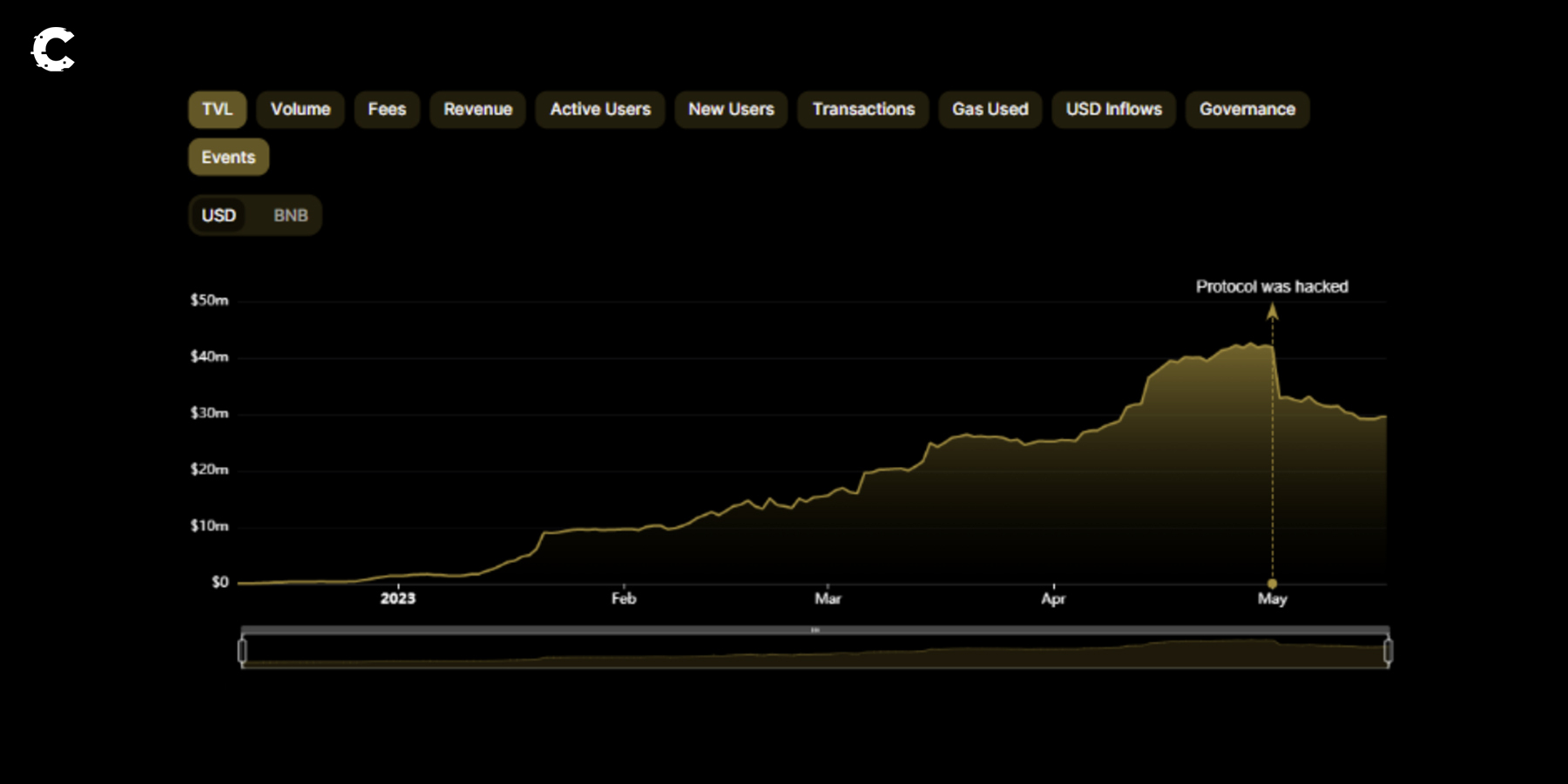

Switching gears to perpetual DeXs, it seems capital is shifting. Level Finance has seen its total value locked (TVL) shrink since its May 1 hack, dropping from $42M to $30M.

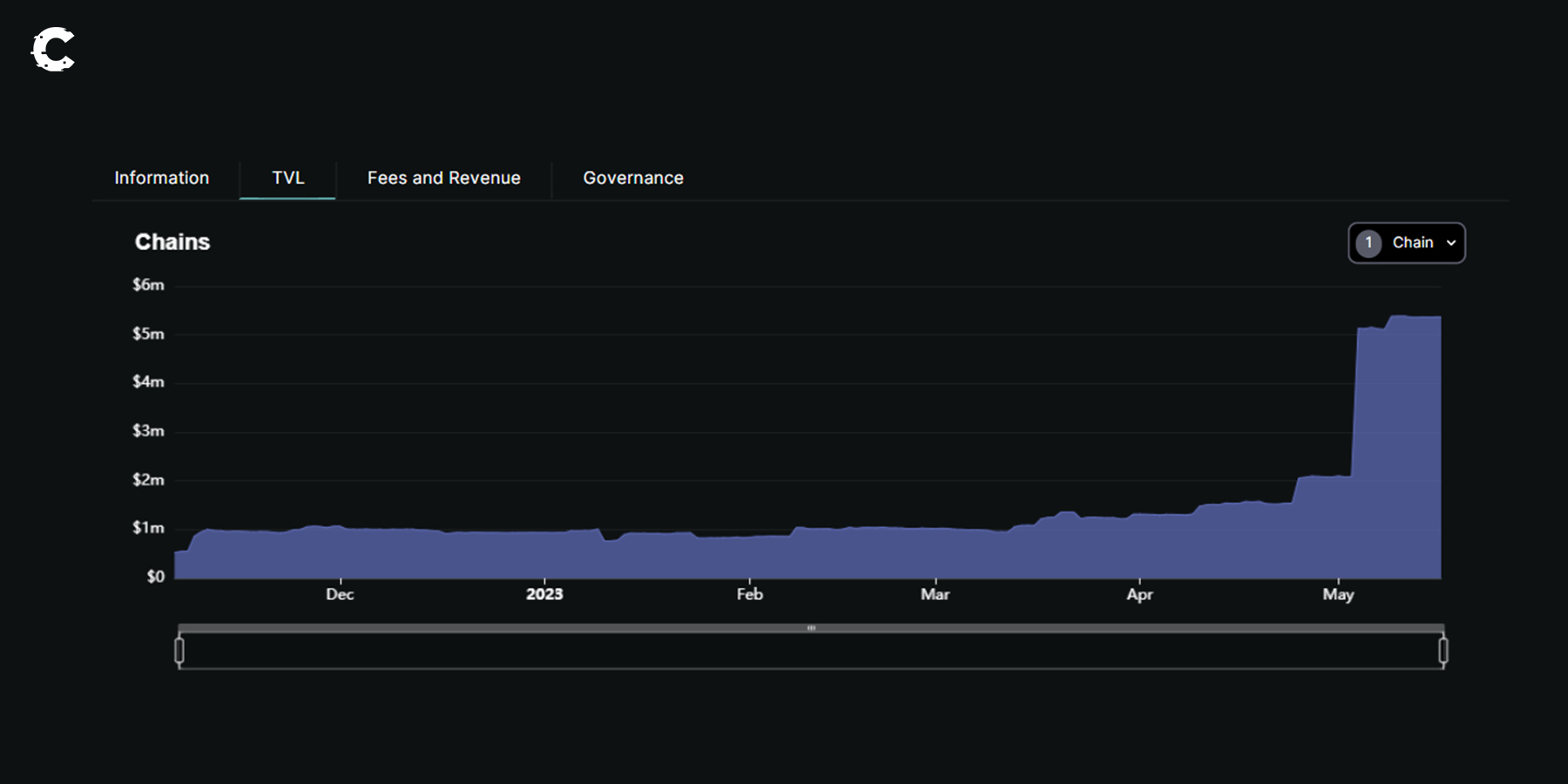

It looks like some of this capital has found a new home in Mux Protocol, another leverage trading protocol on the BNB Chain. Mux Protocol has seen its TVL rise from $2M on May 1 to $5.3M today.

It'll be interesting to see if this growth holds up and if Mux Protocol can keep nibbling away at Level Finance's market leadership, or if Level Finance can hold onto its crown.

Cryptonary’s take 🧠

Alright, let's tie it all together!We foresee the regulatory scrutiny on Binance to continue, brewing a tough storm for the platform to navigate.

Given this, we predict BNB to lag behind solid stalwarts like BTC and ETH as investors gravitate towards safer and more dependable choices and that it reaches $268.

Yet, the BNB Chain ecosystem stands firm amidst the chaos, boasting robust volumes and ongoing buzz. It's important to note though, that Binance's shadow, once a favourable ally, is now casting a gloomy effect on BNB itself and its ecosystem.

As always, thank you for reading.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms