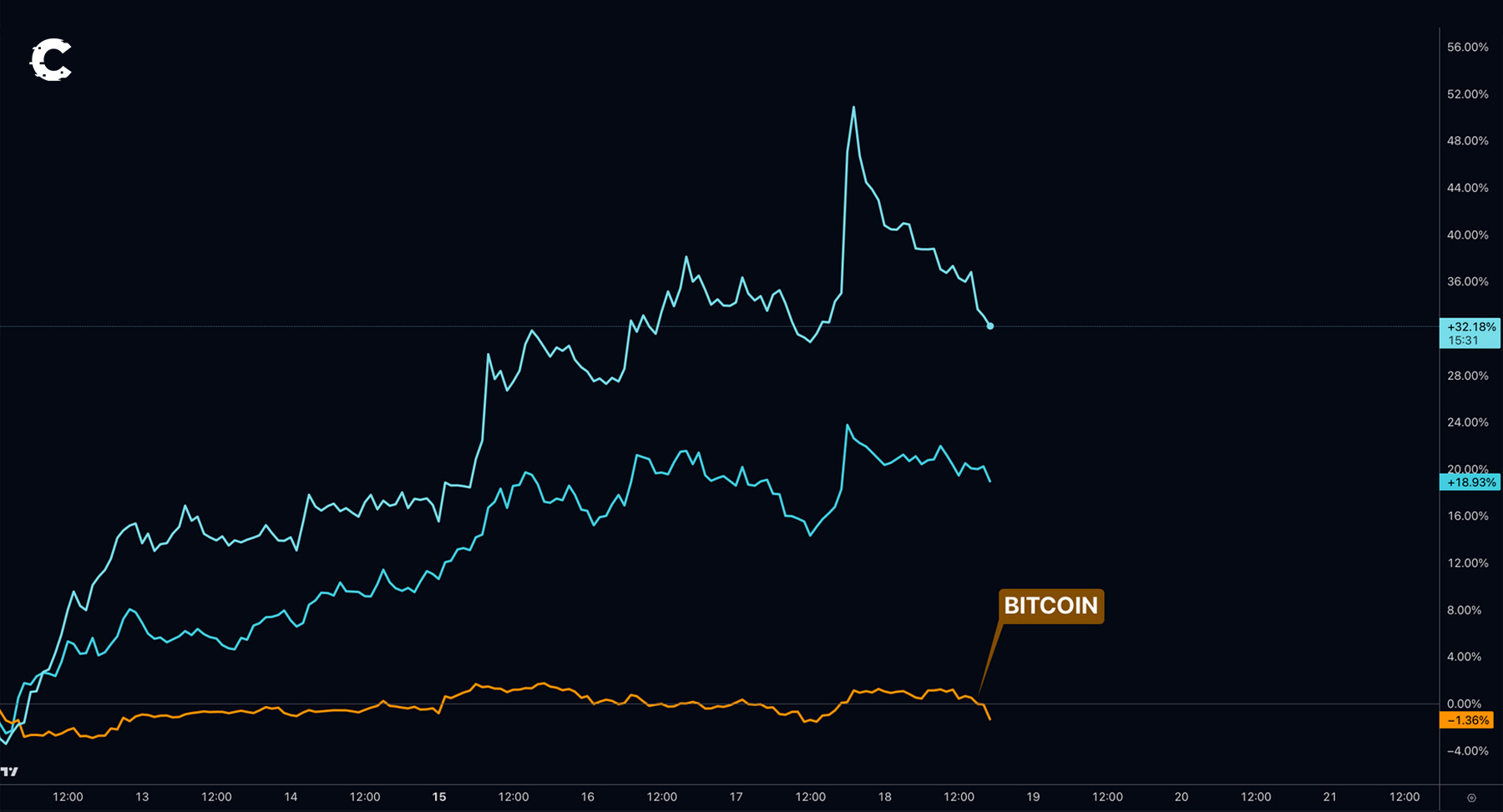

Outperformance isn’t random. It's the market shouting "Opportunity!".

These winning streaks often ride on powerful narratives in the crypto world, stories born out of solving urgent problems.

Today, one of crypto’s biggest problems is the complexity of staking. LSDs (liquid staking derivatives) make it a hell of a lot easier. You not only stake with a single click but you also stay liquid - no lock-ups.

Hello again, LSDs! We've talked about them before, and even predicted their return. But the shifts happening now are just too significant to overlook. So let’s dive in.

TLDR 📃

- Lido has proposed to introduce revenue-sharing with LDO stakers. Its token is set to advance especially if it closes over $1.98 this Sunday.

- RocketPool is starting to pick up steam with increases in market share and users. Token model remains weak.

- MetaMask's recent move to support in-wallet staking will open up the market to a larger user base.

- We’re betting on a third winner in this LSD race, but we’ve kept that to an exclusive CPro report 👀

Disclaimer: Not financial or investment advice. Any capital-related decisions you make is your full responsibility.

The changes you need to know about ✅

LidoDAO

Hot off the press, there’s a Lido DAO proposal to introduce LDO staking. The proposal outlines a few key points:- Protocol revenue will be shared with LDO stakers. The projected yield is between 4-6% APY, or around $0.13 per LDO staked per year (at current prices).

- Stakers will be subject to a 14-day cooldown before they can unstake. The insurance fund will be set to a 6k stETH minimum. LDO stakers will be liable to lose up to 30% of their stake if a major slashing event occurs.

The proposal is currently in discussion and is set to move to vote next week.

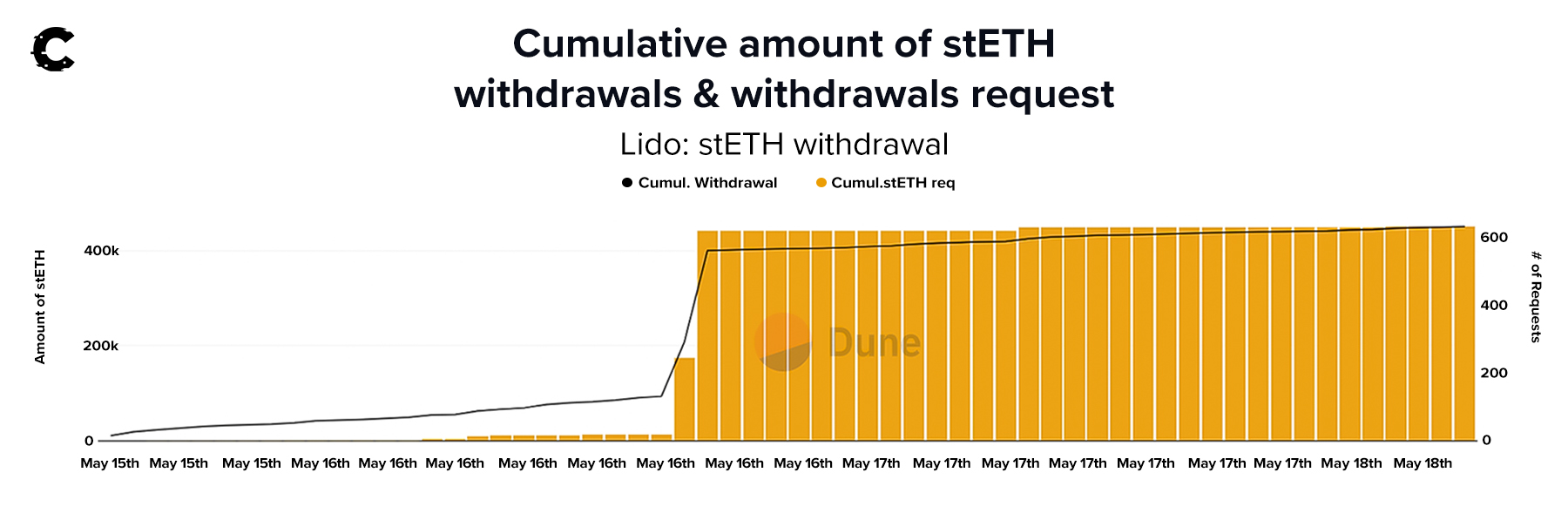

In other news, on the 15th of May unstaking was activated with the Lido V2 upgrade.

450k ETH is on the move. It's about $821 million, or 7.1% of all ETH staked with Lido. But hold on, Celsius is responsible for 98% of that.

So, as much as people FUDed Lido for being on the brink of losing market share and dealing with major withdrawals - that hasn't happened.

No major withdrawals beyond Celsius.

What about LDO's price? Will it follow in the footsteps of the positive fundamentals?

Last week, buyers made their move, and we saw LDO smash through the $1.85 - $1.9775 resistance zone. That's a bullish sign!

We're keeping our eyes peeled for the next couple of days. If this week's candle closes above $1.9775, it's goodbye to those pesky lows and hello to a potential $3.10.

Despite a bear-filled market, LDO could be the dark horse to watch. But what's the word on its rivals?

RocketPool

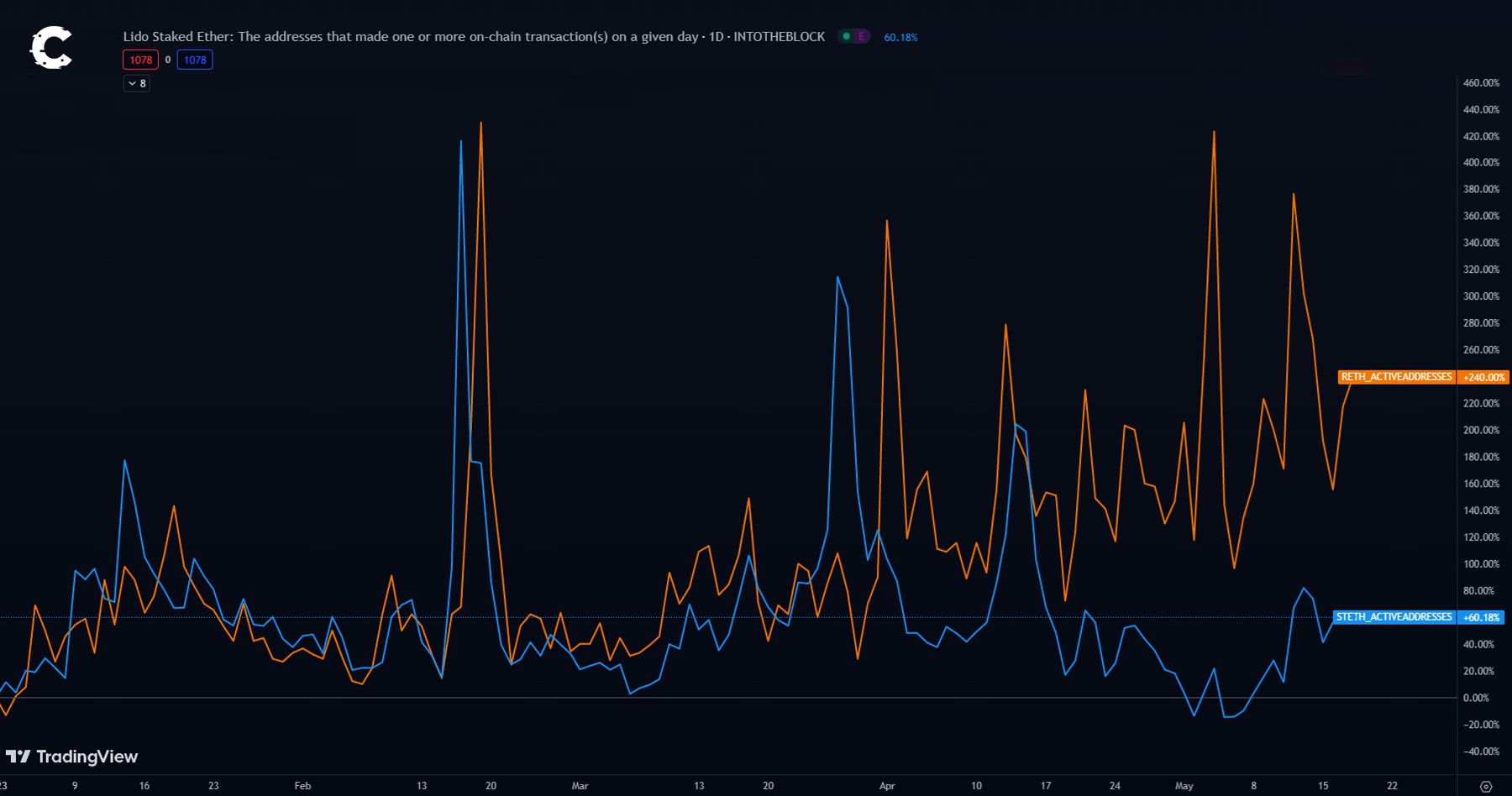

RocketPool is on a roll, scooping up market share and users like nobody's business in April/May. Just compare the daily active addresses for stETH (that's Lido) and rETH (that's RocketPool) – RocketPool's user base is on the up and up.

Their Atlas upgrade gave a nice boost to the daily user numbers. How? It's easier to get in – you just need 8 ETH to run a node, compared to 32 ETH in other places. That said, not everyone's a fan of how RPL's tokenomics work.

Here's the issue: For node operators to turn a profit, they're banking on their RPL position staying profitable. Why? Because they need an RPL deposit as insurance to run a node. But that means they're at the mercy of RPL's market performance. A bit of a head-scratcher, right?

For an 8 ETH node through RocketPool to make sense, the cash has to flow to RPL. Lido's picked up on this - they know a token can't just rely on governance for its worth. That's part of why we're seeing the LidoDAO proposal now.

But, despite the criticism, the fact that RPL's a must-have to run a lite node has given it a leg up this year.

RPL seems to shrug off market swings because it's got more use cases and node operators keep it locked up in the protocol. That's helped it hold its value better than LDO. But, to really tap into its potential and bring more node operators on board, RPL needs a system where it gains directly from protocol revenue. So far, though, there's nothing like that in sight.

So, where's RPL headed next?

Right now, RPL is bumping up against the $52 resistance. We need to turn this hurdle into a stepping stone for the upward trend to continue.

Due to a shortage of data, we're on the lookout for psychological price points that might act as resistance. Keep an eye on numbers like $75, $100, $150, where we might see more sellers jumping ship.

If RPL can't breach the $52 barrier, it might retreat to find support in the $39 - $35.50 range.

Next up, we're diving into CPro X-tra. We've talked about the two big names in decentralised liquid staking, but there's a tasty morsel of alpha only for Cryptonary Pro subscribers. This protocol has a wide reach, extending beyond just Ethereum liquid staking...

Staking is a multi-billion dollar industry 🏦

You may be surprised to hear us say; ETH staking is not that popular. Only around 17% of circulating ETH is currently staked. This is up from 13.4% at the start of the year - but still low. Compare this with other L1s:- ADA - 71.6%.

- SOL - 85.4%.

- AVAX - 62%.

The total Ethereum staking market is worth around $36.7 billion.

And that’s just Ethereum.

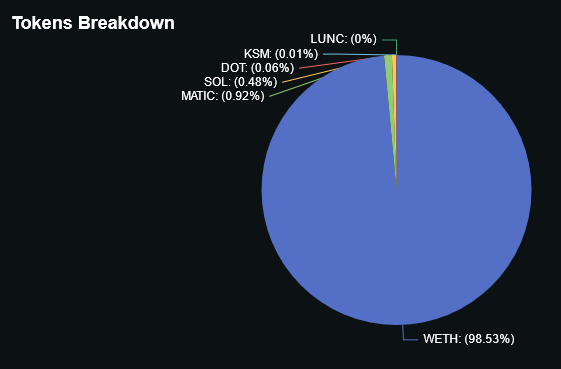

Although liquid staking on other chains is negligible at the moment compared to Ethereum, as the LidoDAO TVL breakdown clearly shows:

But the fact remains - there is significant room for expansion.

One way to attract more users is to make liquid staking more accessible…

MetaMask is opening up liquid staking to the masses 🦊

Even for us crypto veterans, using liquid staking derivatives (LSDs) can be a bit tricky for some. MetaMask is stepping up to solve that issue, potentially unlocking a wave of new capital.Joining the campaign to pull in more ETH stakers, MetaMask recently revealed they'll support in-wallet staking. It's no surprise that Lido and RocketPool got the nod as providers. MetaMask is the top Ethereum wallet out there, and this change will make staking Ethereum a breeze for your everyday user.

Cryptonary’s take 🧠

As Ethereum staking gets more popular, liquid staking protocols have been snapping up users left, right, and centre. But with their market caps now soaring into the billions, fine-tuning the tokenomics has taken centre stage.Sharing revenue with users is the crux of decentralisation. Beyond that, sweetening the pot with extra economic incentives to buy and hold tokens has a double payoff:

- Boosting the capital in liquid staking protocols ultimately bolsters Ethereum's security. For instance, if Lido's proposal gets the green light, the stake will provide additional insurance by bumping up the token's value.

- Getting more people involved in governance by spreading risk among token holders gives stakers a reason to vote on proposals.

The framework's in place. Now it's time to share the success with users

Other news 📰

- GMX V2 is now live on Avalanche Fuji testnet. The derivatives platform is about to get a major facelift. They're introducing market, limit, and stop orders. And that's not all. They're also tweaking their funding fees to ensure a balance between long and short positions.

- Uniswap V3 to launch on Polkadot. Uniswap, the top DEX by volume, is launching on Moonbeam next month, to serve the Polkadot ecosystem. Cool, huh?

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms