Turning $100 into $1.7M again?

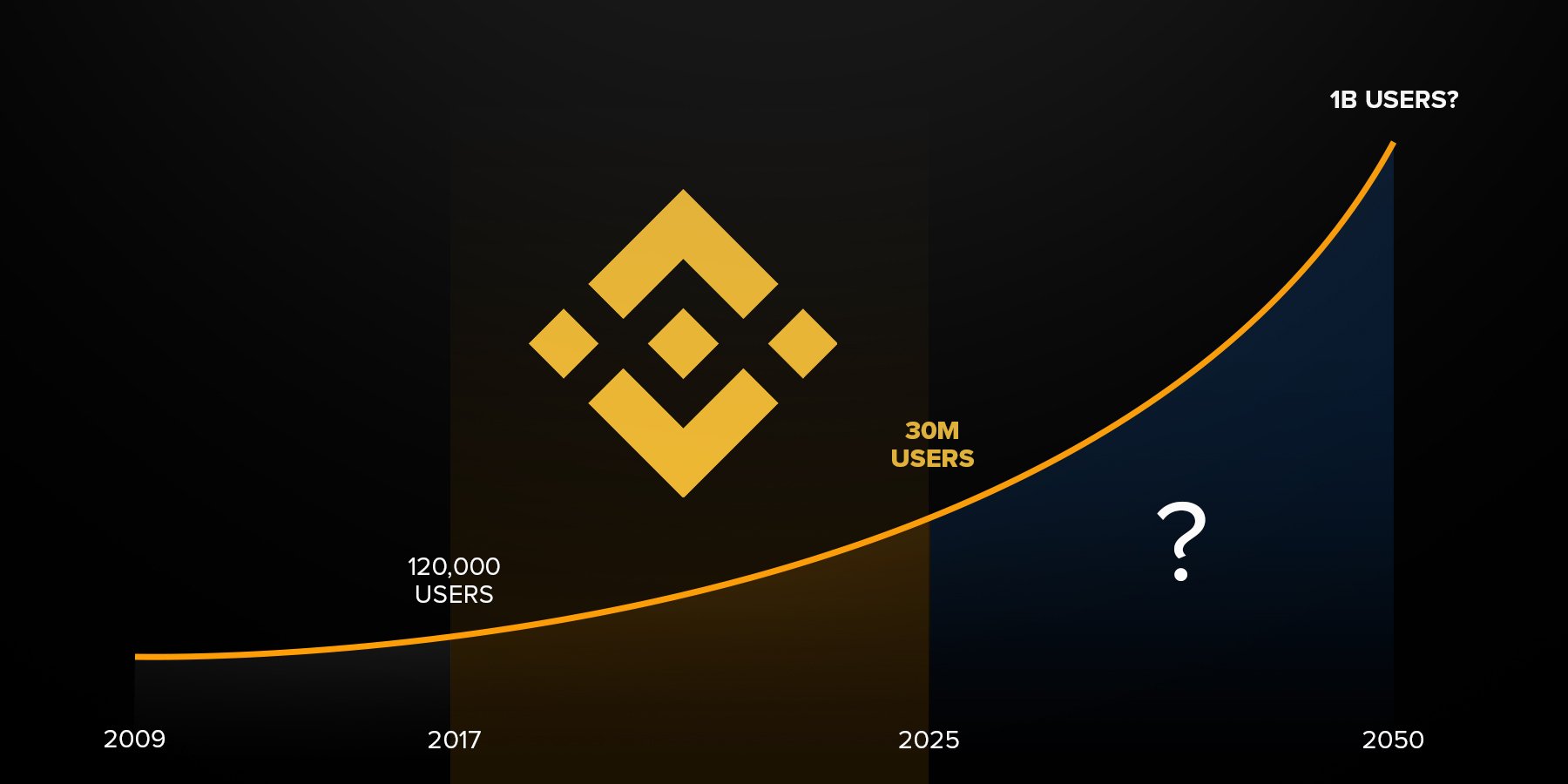

Crypto exchanges like Binance have been skyrocketing, with Binance boasting a 250x user growth since 2017 and its crypto, BNB, growing an astronomical 1,723,530% from bottom to top. That means a $100 investment could have turned into a whopping $1.7M+!

But here's the kicker. We're closing in on the end of this old exchange world. Centralised crypto exchanges are losing their lustre. They're missing out on what makes crypto so attractive in the first place - they're not trustless, transparent, or resistant to censorship. Plus, they're not getting the love from traditional finance due to regulatory hurdles and exclusion.

But fear not. This might seem like a bump in the road for crypto, but it's actually a green light for DeFi to take the lead. As centralised exchanges become more of a hassle and less secure, people are bound to look elsewhere. Think of it like a second chance to get in early on Binance in 2017.

And let us tell you, these “next exchanges” are being built on Ethereum L2s 👀

TLDR 📃

- Despite Binance’s issues, we have to remember that it had an incredible 250x user growth since 2017, and BNB outperformed it, turning a $100 investment into $1.7M+ in four years.

- Centralised exchanges are coming to their end, though, and now it is time to look at the “next Binance” in DeFi. The key will be to look for exchanges that offer leverage (Perp-DEXs), which made Binance a star.

- Layer-2s are taking a lot of the attention, with even exchanges like Coinbase choosing to go on there, so the next Binance is likely being built on there. GMX and Kwenta are two prime candidates.

- If you want to avoid trying to pick the Perp-DEX winner, owning Layer 2 tokens like ARB and OP could be like owning the 'land' on which these trading venues are built, especially with a potential increase in revenue.

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your responsibility and yours only.

First, the type of exchange that captures the most growth 📊

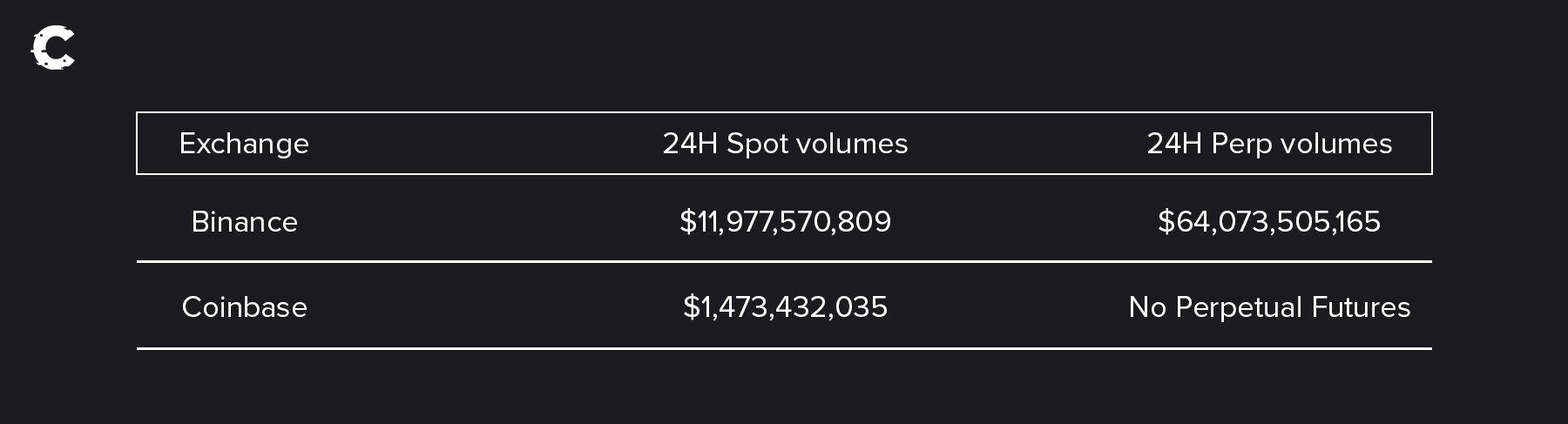

What really drew users to Binance, the biggest centralized exchange? Not the higher spot volume than Coinbase, but the juicy derivatives trading volumes. It’s miles ahead of Coinbase, which doesn't even offer leverage.

In fact, Binance boasts six times more volumes on its derivatives than its spot market and a whopping 60 times more than what Coinbase has on its spot exchange.

So, users will want that sweet leverage in their new trading spot. And while we adore Uniswap and other DEXes, the average Joe won't find what he's looking for there, as they simply don’t offer leverage.

That narrows our options down to one: perpetual DEXes, which provide that crucial ability to trade with leverage in a decentralized way.

But where will these new-favourite DEXes be built? On Solana, Avalanche, or Ethereum? Or…?

Second, the networks to look at ⛓️

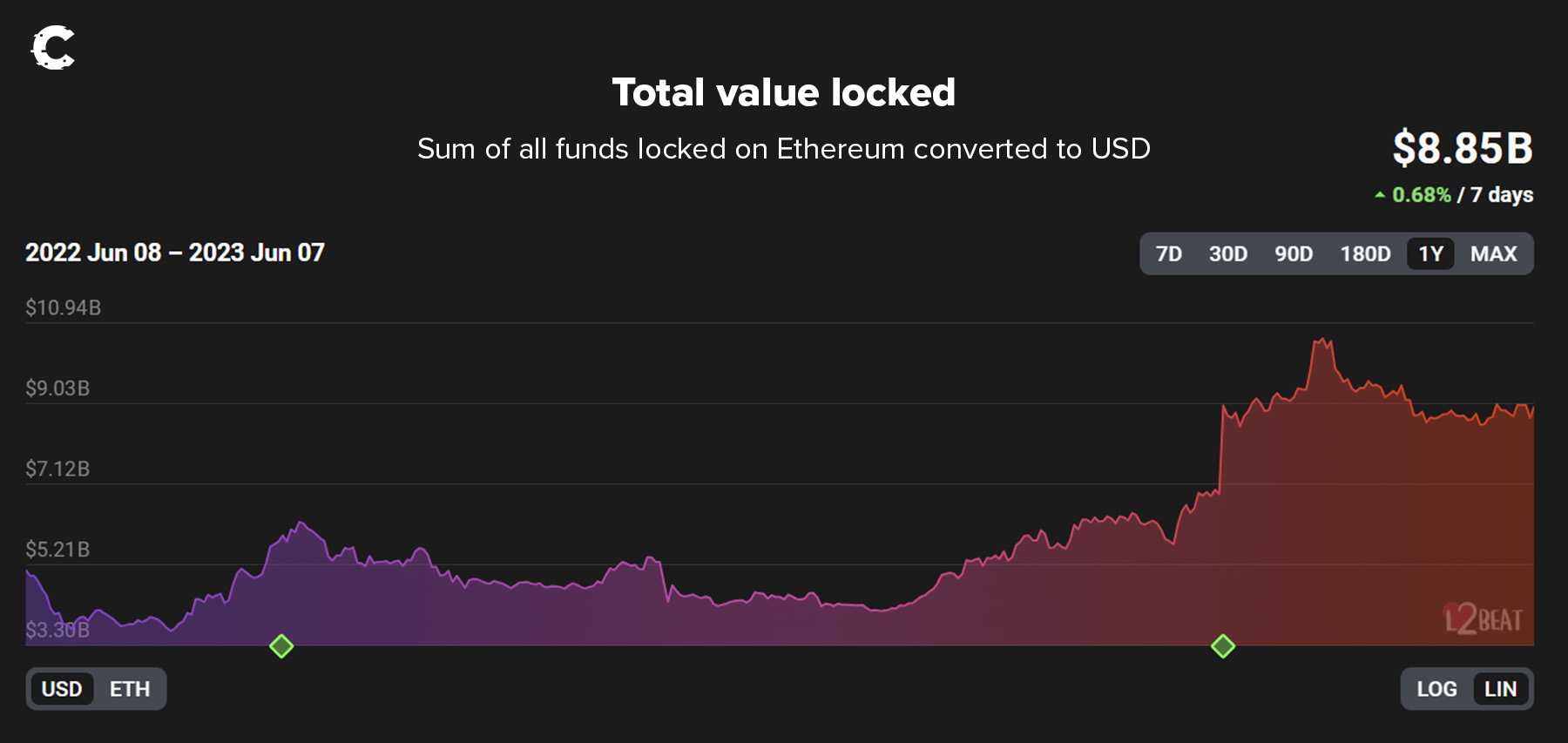

One ecosystem is outshining the rest in terms of growth and potential: Layer 2. The total value locked (TVL) in Layer 2s has been skyrocketing since 2022.

With all the momentum they already have, an upcoming game-changer called the EIP-4844 upgrade is set to make Layer 2s even more attractive by drastically reducing fees. They'll be as cost-effective as Solana.

We're not the only ones seeing the writing on the wall. Even centralized exchanges are getting in on the Layer 2 action, signalling a shift away from their own platforms.

Take Coinbase, which is working on a Layer 2 solution named Base that'll live on Optimism. Bybit is also cooking up its own Layer 2 called Mantle.

This move by Coinbase and Bybit is akin to radio stations admitting their model is outdated and embracing the digital shift. It's like a radio station making the jump to create Spotify, acknowledging that the transition to DeFi is inevitable.

So, if these billion-dollar powerhouses are betting big on Layer 2s, it's pretty clear that's where the users are headed.

But the million-dollar question is: which perpetual DEXes will they flock to?

Third, the future “Binances” 💱

There are multiple competitors in the Perp DEXs arena, including dYdX, but that one is moving onto its own chain soon. So, let’s discover which ones, built on L2s, are most likely to capture market share.There are two main players on L2s: one on Arbitrum (GMX) and one on Optimism (Kwenta).

To date, GMX has been the top perpetual DEX on Arbitrum and the go-to for leverage trading, but it recently started seeing a slowdown in growth. All while, Kwenta continues its upward trajectory with increased volumes.

Despite those volumes, though, GMX still generates more revenue, but that’s a strategic decision Kwenta made by keeping their fees low to attract more users. GMX has its V2 coming up, this can give it the boost it needs to come back ahead of Kwenta, but the latter isn’t just a sitting duck.

It’s coming to take over GMX’s territory: Arbitrum.

One of the weaknesses of Kwenta has been its decision to remain on Optimism despite Arbitrum being the bustling ecosystem - and now, rumour has it that it is about to change 👀

Don’t get us wrong, we think multiple Perp DEXs will win, including GMX, Kwenta and dYdX, but today we’re going after which one grows the quickest, and Kwenta is a prime candidate with its recent moves.

Note: Kwenta is built on Synthetix, which gives SNX stakers more yield and SNX itself more value.

But… what about ARB & OP? Where do they fit into all of this? 🔵🔴

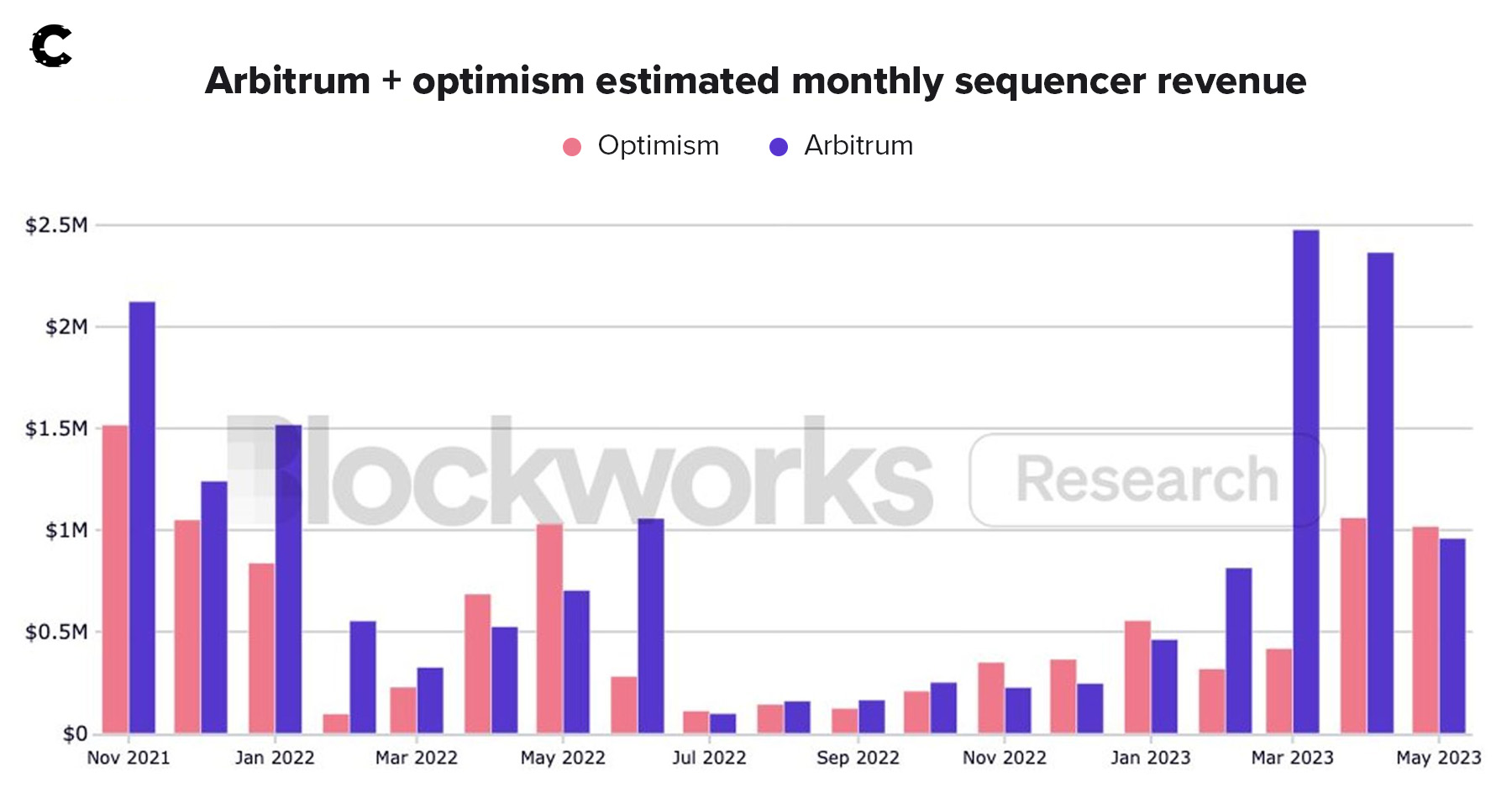

Owning an exchange is great but imagine owning the land where all the trading hubs stand. Think of it as being the landlord for networks like Optimism and Arbitrum, which are raking in significant fees from network usage.As of now, these Layer 2 solutions (L2s) are barely making revenue. They make just as much as Kwenta earns from its users.

This isn't much since they have to pay a portion to Ethereum to settle their transactions.

However, an upcoming upgrade will significantly cut down the settlement cost to Ethereum. They could then potentially make as much as five times more revenue by not reducing fees at the same rate.

Next, to make ARB or OP token holders part of the action, they need to change the revenue-sharing system. Instead of sharing it with a central sequencer, that revenue can be distributed amongst stakers just like on the Ethereum L1. This is something we’re really hoping they implement.

Cryptonary’s take 🧠

The Binance controversy is a mess, but it's not all bad news. Even though it feels like the US is messing with crypto to protect the faltering US dollar 💵, we're sure crypto will win.The failure of FTX and the troubles at Binance and Coinbase (let's hope those last two weather the storm) simply remind us of how important DeFi is as a solution to these issues.

But hey, “history doesn’t repeat itself, but it often rhymes,” so what we learned from Binance’s stupendous growth is that it’ll happen again somewhere in DeFi - specifically on Perp DEXs. And from all of the pointers, it seems highly probable that that “next Binance” actually lives on a Layer-2.

One way to avoid trying to pick the winning Perp DEX is to bet on Layer-2s in and of themselves, such as ARB, OP and soon zkSync’s own token (which you should be farming an airdrop for).

Other news 📰

- **Optimism successfully completes ‘Bedrock’ upgrade. The Optimism network completed its "Bedrock" upgrade on June 7. This upgrade reduces deposit times, offers users lower fees, and introduces additional security features, as announced by OP Labs.

- Arbitrum distributes 4 million additional $ARB tokens from airdrop allocation to DAOs: Arbitrum has deposited $6M worth of $ARB tokens this week to the DAOs that were part of the $ARB airdrop. We can expect activity from the DAOs soon regarding these tokens.

- Polygon to onboard Deutsche Telekom as validator: Germany's Deutsche Telekom is set to become one of the 100 validators for Polygon. This partnership will allow Deutsche Telekom to provide staking and validation services for the network and Polygon's Supernets solution.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms