TLDR 📃

- Ethereum's price pattern shows bearish signs, with an upcoming drop to $1,400.

- Notably rich “whales” are also selling ETH, adding to the bearishness.

- Ethereum experienced two transaction finality halts, raising stability concerns.

- On the bullish side, over 20 million ETH are now staked, showing increased confidence in the Ethereum network.

- The DPIWETH chart suggests that for now, holding ETH may yield better results than holding DeFi tokens.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make is your full responsibility.

The bearish news 🐻

What's a Monday without a sprinkle of bearish news, right? We’re joking, of course! We're just trying to lighten things up a bit. But, when it comes to the "bearish" bit, we're dead serious.Price analysis 📉

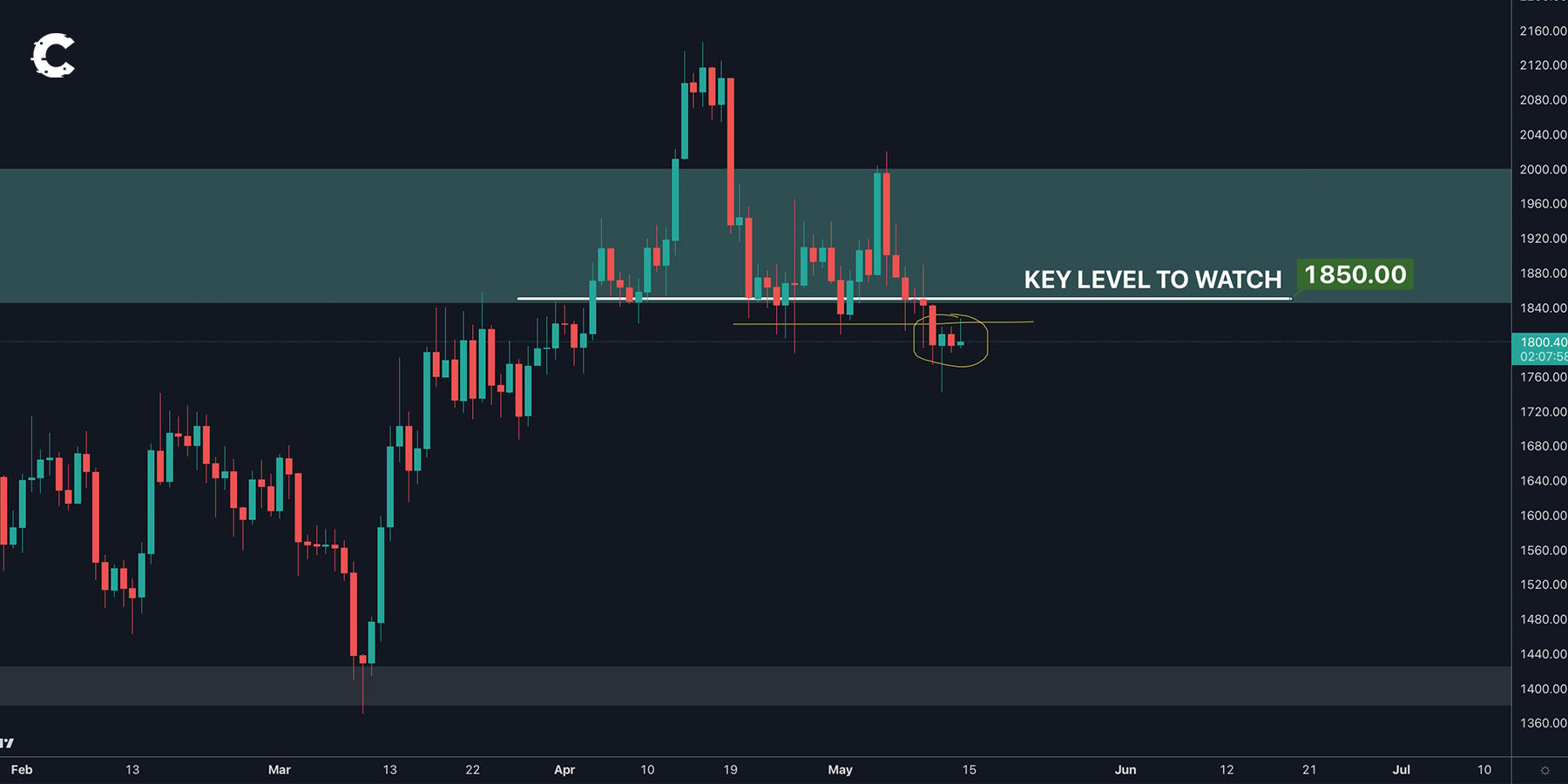

Remember when we pointed out how crucial the $1,850 mark was for ETH? We warned if it broke through, it could mean trouble. And guess what? That's exactly what happened.

To put it simply, ETH is now constantly hitting lower lows and lower highs, which is a telltale sign of a bearish market - yep, it's not looking good. The price continues to tumble, turning previous supports into resistance. You can easily spot this pattern - we've highlighted the most recent one in yellow.

We totally get it if you're feeling a bit lost right now. With the price not moving much and the market seeming unsure, it's easy to feel confused. But here's a secret: The market often drops clues before making a big move. This shift in market structure is one such clue.

So, unless ETH recoups $1,850 and turns that into support we’re going to call it: $1,400 is coming.

The “smartest” money is selling 🏦

When we talk about the smartest, we're actually referring to the richest. You see, most of these mega-rich “whales” reached their lofty heights thanks to their super-smart moves.

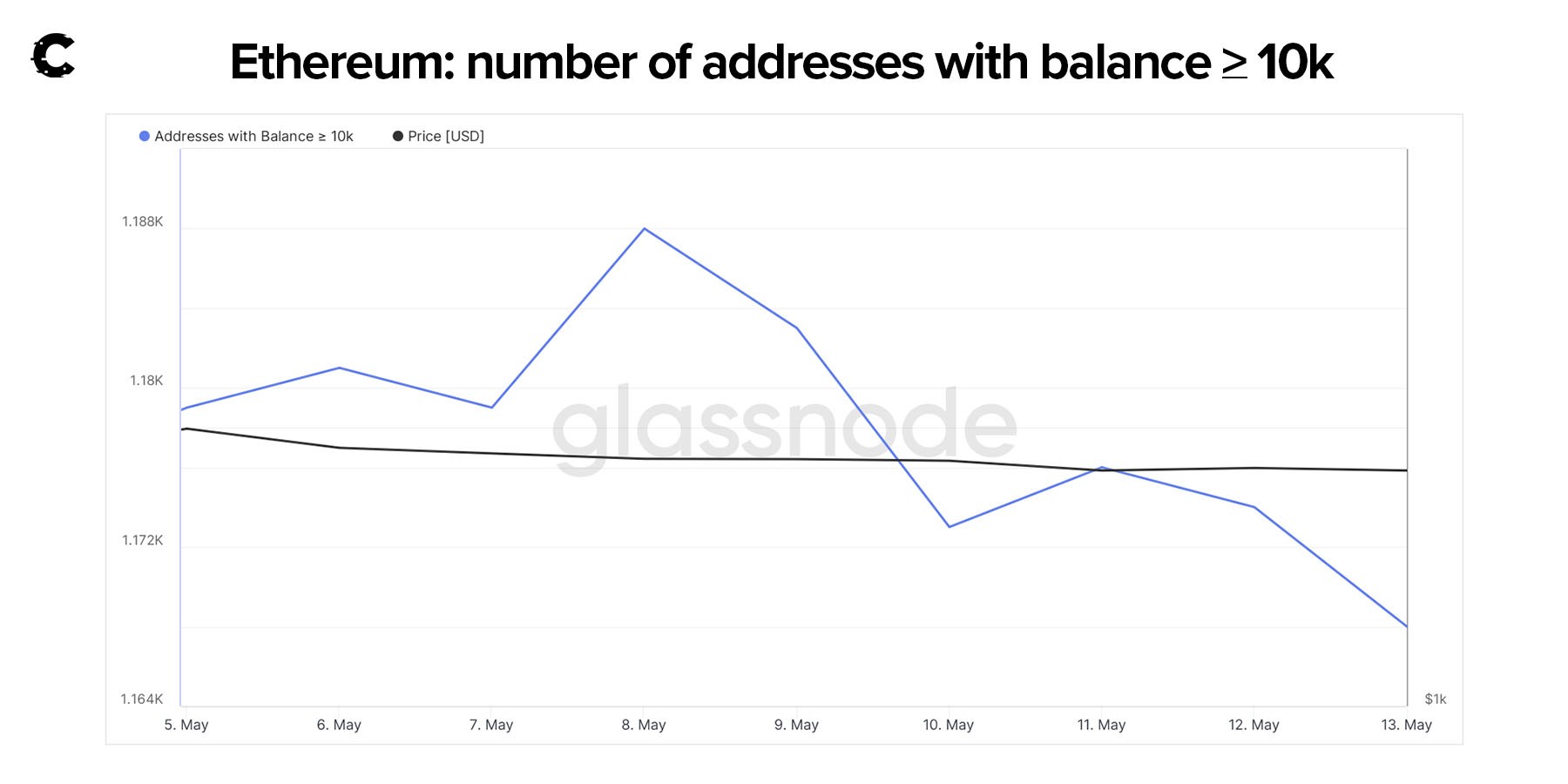

Just consider this: There are fewer than 1,200 whales with over 10,000 ETH in their wallets. But in the past week, we saw 20 of them exit this elite club.

Now, this isn't a huge percentage - not enough to have us screaming "the sky is falling!" But it's definitely unusual. Just to give you a sense of the scale, usually this number fluctuates by around 4-5 whales in either direction in a typical week.

Ethereum chain halts, twice ⛓️

Don't get us wrong – we’re huge fans of Ethereum and we're not looking to spread fear here. But, it's our job to share all the facts, even if they're not exactly fun.So, here's the scoop: On May 11th, 2023, Ethereum had a bit of a hiccup and couldn't finalise transactions for about 25 minutes. The next day, it happened again, for over an hour…

Imagine "Simon Says" (with Simon being Ethereum) suddenly going quiet mid-game. That's what we call a halt in "finality" – no more transactions getting confirmed.

Why does it matter? Well, when finality stops, transactions could potentially be dropped or shuffled around. That's a no-go for Ethereum because people rely on its stability.

But hey, let's give credit where it's due. Despite these blips, Ethereum bounced back each time, getting back to finalising transactions. It shows resilience, sure, but it's not exactly the smooth sailing we'd hope for.

Enough bearishness for a Monday, now let’s get into some bullish elements.

The bullish news 🐂

All these updates and stats are giving us big-time positive vibes for ETH's future. ⬇️They're like a giant arrow pointing to a bright outlook for ETH in the coming years. But remember, this doesn't mean we'll see immediate changes in the price. Keep calm and HODL on!

20M staked ETH 🚀

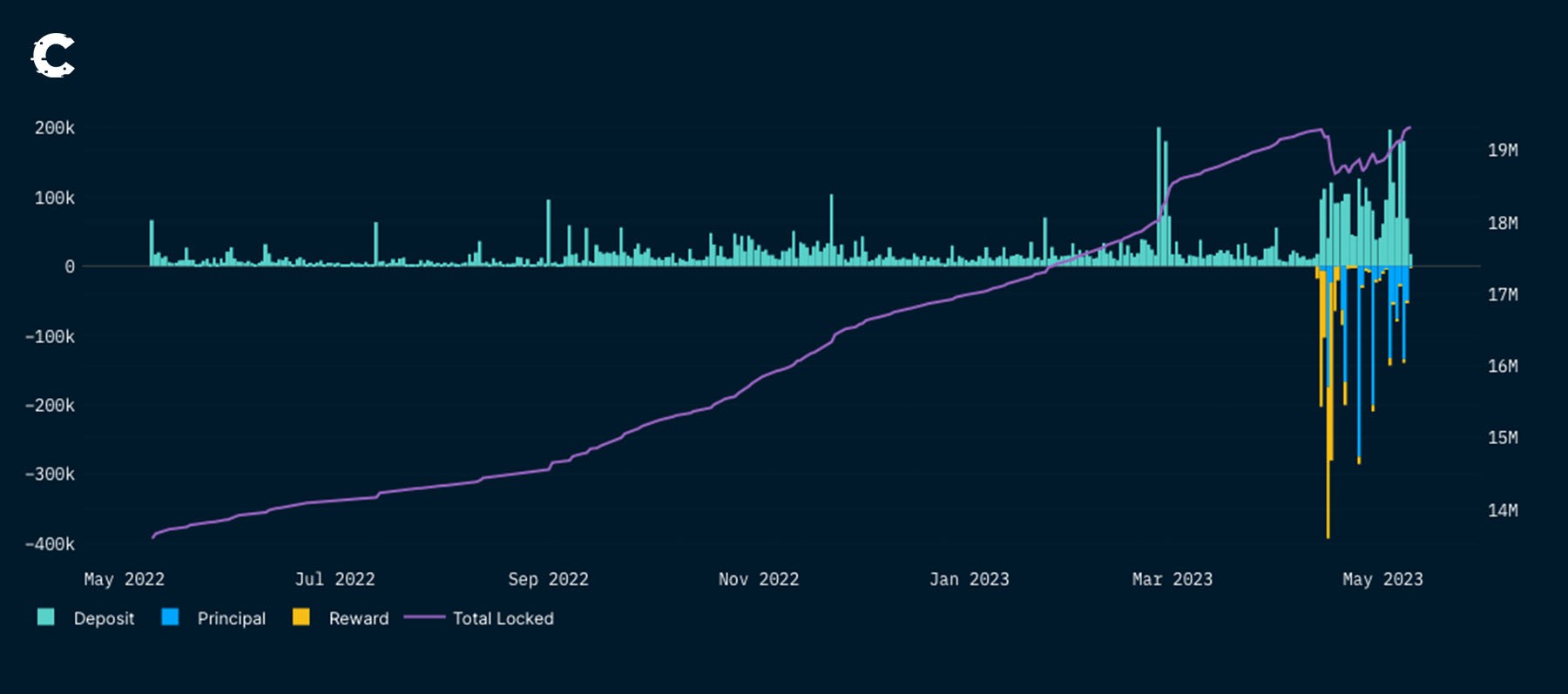

We've just hit a historic milestone – over 20 million ETH are now staked!

Just think, at the start of the year, we were looking at 17 million staked ETH. The growth kicked off after the Shanghai upgrade. It seems like folks are getting more confident now that they know the withdrawal system is rock solid.

We've predicted that this number will jump by 30% in the next two years, and we're sticking to it!

And here's another cool fact: now, only a tiny 0.22% of the staked ETH supply is waiting to be withdrawn. That's practically zero! Just a few weeks ago, this figure was over 2.5%. How about that for progress?

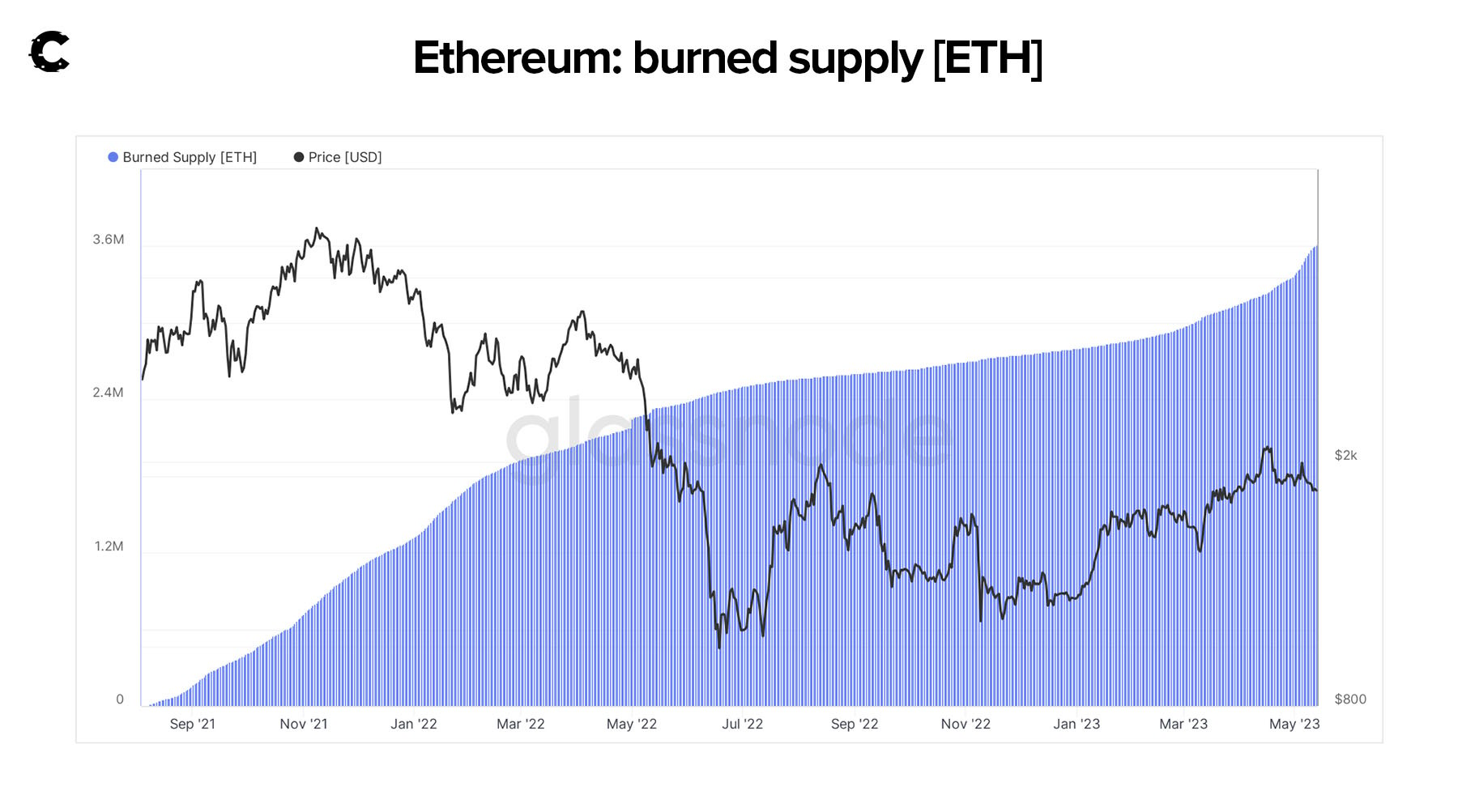

Ethereum is become scarcer by the day

Thanks to EIP-1559, a portion of every transaction fee gets burned. The rate at which ETH is being burned made it shed 3.5M ETH from its supply – making it much scarcer and even deflationary.

Some buying is still happening

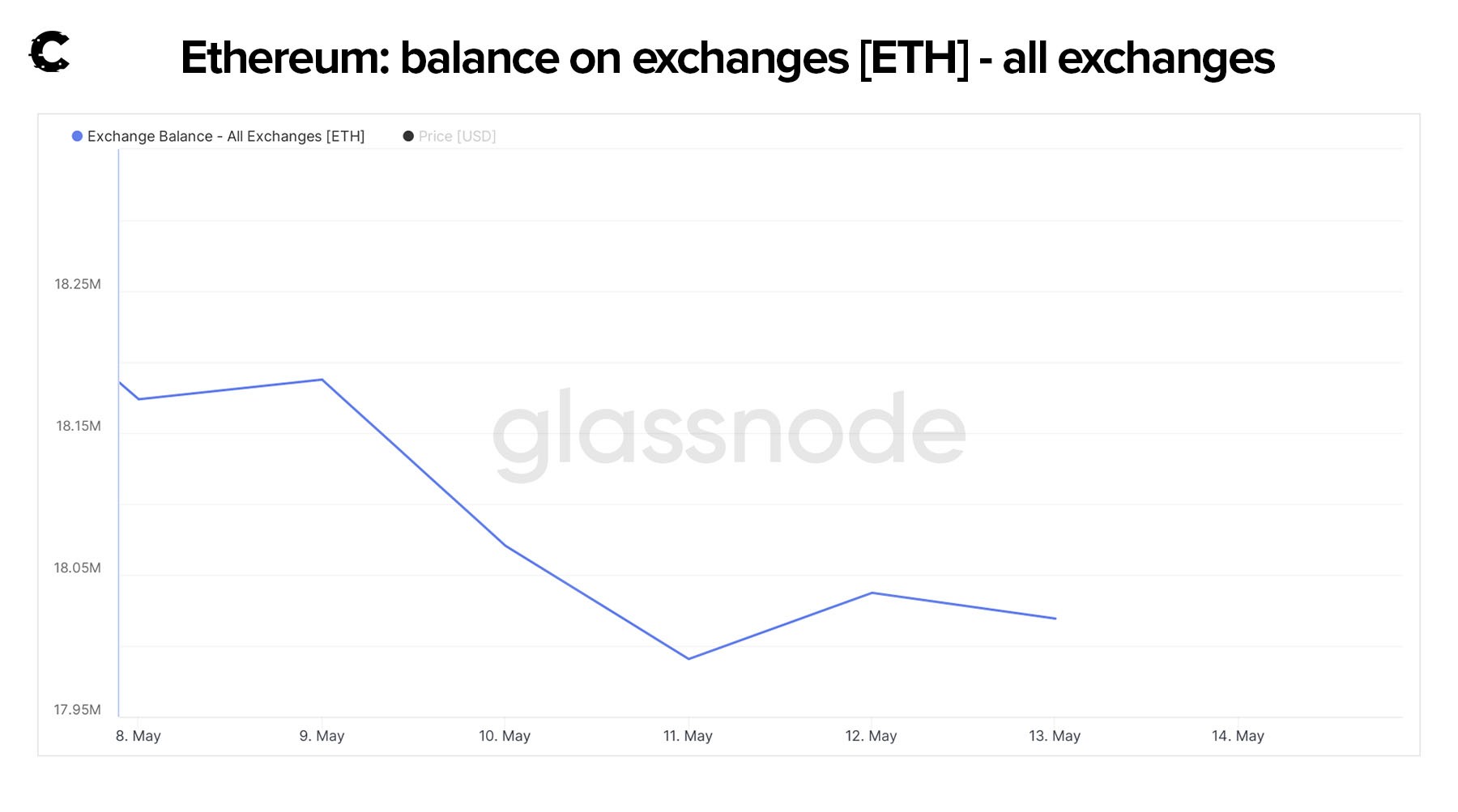

Even with ETH prices looking gloomy, some folks are still buying and moving it off centralised exchanges. In just the last week, 154,000 ETH, or over $275 million, left these platforms.

Why should we care? Well, this "balance on exchanges" info shows us how much ETH is up for grabs for selling. The less there is, the better for prices. Sure, with Ethereum's DeFi and decentralised exchanges (DEXs), the picture gets a bit fuzzier. But hey, DEXs only make up about 6% of total exchange volumes, so let's keep our eyes on the big chunk – the 94%.

Speaking of DeFi…

Better to hold ETH or DeFi tokens? 🗯️

Interesting question. One metric to consider is the DPIWETH chart. This is an index of DeFi assets measured in price performance against ETH. Simply put:

- If this chart is bullish, then holding DeFi tokens will likely lead to better results than holding ETH.

- If this chart is bearish, then holding ETH will likely lead to better results than holding DeFi tokens.

If you’re looking for a more in-depth dive into DeFi, read our latest dedicated piece on that sector here.

Cryptonary’s take 🧠

All right, folks. Let's get real. Ethereum's having a bit of a wild ride, isn't it? Sure, there are some bearish vibes out there. The price dip, the whale sell-offs, and those two hiccups in transaction finality – they've got some eyebrows raised, including ours.But let's not get lost in the storm. We've got to remember the sunlight peeking through those clouds. Millions of ETH are being staked – that's a whole lot of folks betting on Ethereum's future. And thanks to our friend EIP-1559, Ethereum's becoming a rare find – and we all know what scarcity can do to value. Plus, there are still a good number of people buying up ETH, even with the price looking a bit under the weather. That's got to count for something, right?

So, what's the bottom line? ETH and $1,400 have a rendez-vous pretty soon, but in the meantime the fundamentals are getting a lot better, which means (for long term believers) that dips are for buying.

As always, thank you for reading.

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms