US government pumping funds into DeFi?

As the SEC makes sweeping moves to sue centralised exchanges in an unprecedented attack on crypto, the US government 🇺🇸 has been funding DeFi through the back door.

Isn't it funny that while they claim to be 'protecting US investors,' they're juggling near-default issues, sky-high interest rates, and wild inflation caused by a total economic mismanagement in the last three years?

But, enough of that. Let's chat DeFi.

The connections between traditional finance and DeFi can't be avoided. Replacing the old system in a snap? Nah, not happening. No 'quick fixes' here.

Still, it doesn't mean they can't mix and mingle while shifting gears.

Here's a thing - DeFi is increasingly tapping into treasury yield for extra revenue.

Think about it - the US government funnelling funds into DeFi... Crazy, right?

TLDR 📃

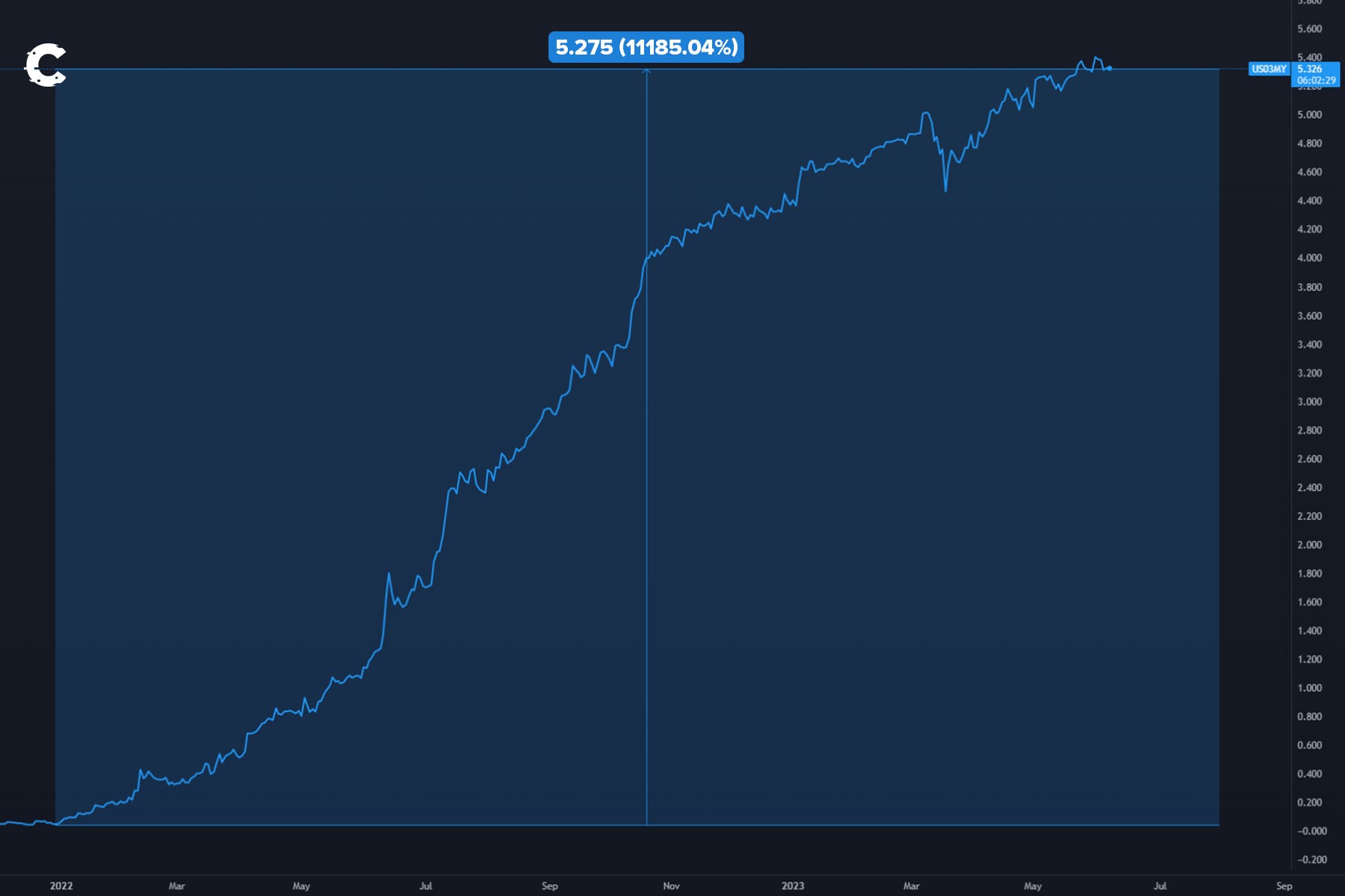

- US treasury yields are reaching degen levels - 5.3% on 3-month bonds. So much so that DeFi protocols are actively investing.

- Ironically, the opportunity for this kind of yield will likely cause a resurgence in DeFi growth.

- MakerDAO, the issuer of the largest decentralised stablecoin DAI, has created a new portfolio with a $1.28 billion ceiling to invest in US treasuries.

- They’ve also set their interest rate to 3.49%, offering a more competitive yield on DAI than anywhere else.

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your responsibility and yours only.

Dollar “staking” beats DeFi yields 💵

US 3-month treasury yields are at 5.3%. You’d struggle to find a better yield in DeFi that isn’t a scam or rug at the moment. For perspective, the DeFi equivalent - ETH staking yield - is around ~4%.

And that’s with the risk of ETH volatility against the dollar.

It’s no wonder many protocols and key infrastructures are moving in to capitalise, particularly stablecoin providers…

Exhibit A: MakerDAO buys in 🏦

The US government is dangling high yields, and MakerDAO is jumping on it. They've got this new idea for a vault called BlockTower Andromeda, planning to stuff it with up to $1.28 billion to buy US treasuries.

The game plan? Mix up the stuff backing the DAI stablecoin to rake in more bucks. Right now, Real World Assets (RWAs) make up only 20.7% of the DAI backing, but they're generating a whopping 34.9% of the yield.

Wait, there's more! MakerDAO announced the DAI Savings Rate (DSR) is getting a boost to 3.49%. Think of it like the Fed bumping up interest rates, except it's for DAI. Last time when they nudged the DSR to 1%, DAI deposits shot up by 35 million in a month. With this new rate, the DAI yield triples.

The net result? More DAI locked up and a DeFi revival.

Basically,

- For lending protocols like Aave/Compound, unused DAI deposits can be allocated into the DSR, increasing lender yield and reducing borrowing costs.

- For DeFi protocol treasuries, the DSR can offer increased revenue. An important point here is bridges with idle DAI - the increase in revenue for these protocols could be huge.

But Cryptonary, does this mean only DeFi protocols will benefit? How can I get in on the action?

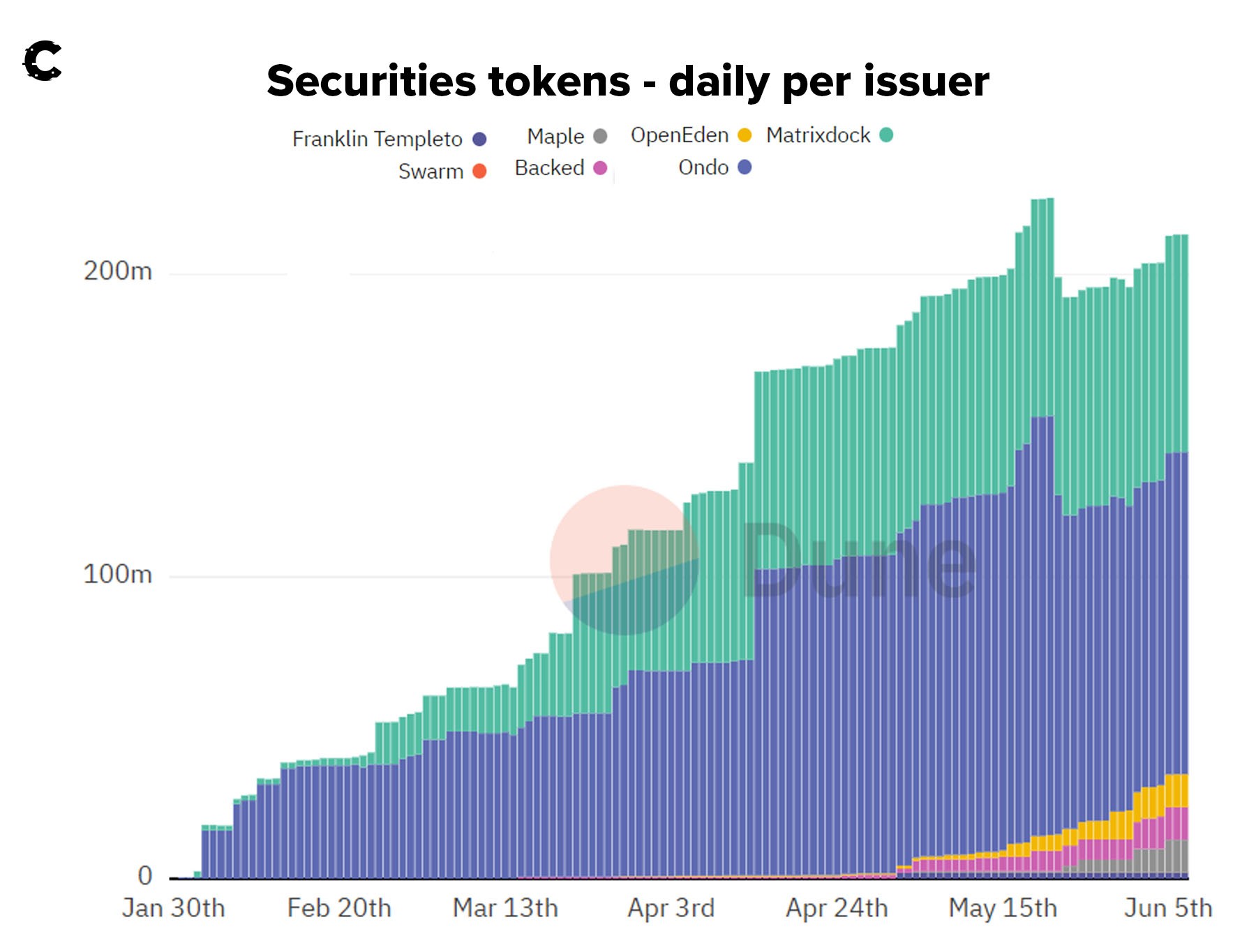

You’re in luck. There’s an entire sector growing to facilitate just that.

Everyone loves yield, even if it’s from TradFi sources…

The up-and-coming DeFi sector 📈

From nothing to something, Maple launched their treasuries product on the 19th of April. It's a newbie but investors are already all over it. Thanks to restored confidence in US bonds, Maple’s been offering ~5% yields and saw its TVL balloon from $2.3M to $11.3M in just a fortnight. That’s an incredible 400% growth!

Still, it's just the tip of the iceberg.

Wouldn't it be ideal if MakerDAO didn't need centralised money managers for their treasuries and instead tapped into protocols like Maple? With $1.28 billion going into treasuries from MakerDAO alone, you can see the potential here, right?

And guess what? Maple’s token, MPL, has been outperforming BTC and ETH since its product launch. With the Fed planning to keep interest rates high and treasury yields on the rise, Maple's growth might just speed up.

Sure, Maple's product is for the big boys (DAOs, crypto firms), but that doesn't mean we can't join the party. We expect Maple to bring more clients onboard and hike up the TVL, because let's face it, everyone's hunting for yield. So, how do we get in? We’re eyeing MPL to make a move in this budding sector.

But enough of the free alpha; what does it all mean for DeFi?

Cryptonary’s take 🧠

Alright, let's simplify this. Diversifying assets backing stablecoins like DAI is vital. Big centralised stablecoin providers like Circle and Tether have been using US treasuries as collateral for ages. Holding centralised assets doesn't mean more centralisation of stablecoins. The main hurdle has been tapping into centralised assets in decentralised ways.Sure, these high US treasury yields won't stick around forever, but DeFi can certainly seize the opportunity right now.

Decentralised stablecoin issuers like MakerDAO are pushing the yield from traditional finance sources to the DeFi world. This cash injection benefits nearly everyone in DeFi, from DAOs to bridges to lending protocols. Any protocol with spare stablecoins or a treasury can create "free" income courtesy of the US government.

The cherry on top? These short-term treasuries are super liquid, meaning they can be bought and sold regularly, providing extra income with little risk.

The future is decentralised. But for now, we’re happy to take the yield wherever we can get it.

Other news 📰

- We've got $100m worth of token unlocks this week. Expect IMX, DYDX, HOP, and APT to potentially face more selling pressure as more tokens enter circulation.

- Polygon is teaming up with Injective! After successfully joining forces with Solana, Injective is now partnering with Polygon, expanding the Cosmos connected protocols.

- Stargate is making waves! It became the most popular DApp in May, boasting 2M+ Unique Active Wallets. Users are all about that LayerZero airdrop.

- Aave is inching closer to launching their GHO decentralised stablecoin. As crypto's largest lending protocol, this is big news.

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms